International Trade and Investment Law

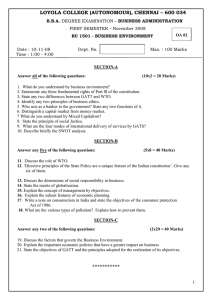

advertisement