Econ 334 Writing Assignment (1)

advertisement

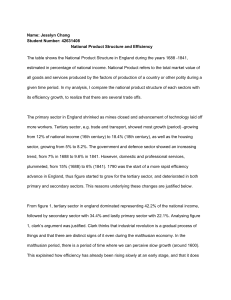

Name: Jesslyn Chang Student Number: 42631408 National Product Structure and Efficiency The table shows the National Product Structure in England during the years 1688 -1841, estimated in percentage of national income. National Product refers to the total market value of all goods and services produced by the factors of production of a country or other polity during a given time period. In my analysis, I compare the national product structure of each sectors with its efficiency growth, to realize that there are several trade offs. The primary sector in England shrinked as mines closed and advancement of technology laid off more workers. Tertiary sector, e.g. trade and transport, showed most growth (period) -growing from 12% of national income (16th century) to 18.4% (18th century), as well as the housing sector, growing from 5% to 8.2%. The government and defence sector showed an increasing trend, from 7% in 1688 to 9.6% in 1841. However, domestic and professional services, plummeted, from 15% (1688) to 6% (1841). 1790 was the start of a more rapid efficiency advance in England, thus figure started to grow for the tertiary sector, and deteriorated in both primary and secondary sectors. This reasons underlying these changes are justified below. From figure 1, tertiary sector in england dominated representing 42.2% of the national income, followed by secondary sector with 34.4% and lastly primary sector with 22.1%. Analysing figure 1, clark’s argument was justified. Clark thinks that industrial revolution is a gradual process of things and that there are distinct signs of it even during the malthusian economy. In the malthusian period, there is a period of time where we can perceive slow growth (around 1600). This explained how efficiency has already been rising slowly at an early stage, and that it does not only start to grow from 1800 (clark, 2007). Productivity has also been increasing for many sectors from 1688. Textiles showed enormous efficiency gains – productivity increased by 2.4% per year, and 1.40% for iron and steel, and 0.30% for agriculture (Clark, 2007). This means that would be inefficient to stay in the agriculture sector lesser output for a unit of input is generated, incurring higher costs per unit. Combining both figures: national product structure in 1688- 1841 and industrial revolution in numbers from 1760s to 1860s, we can see that 1790 was the start of a more rapid efficiency advances. This implies that eventually agriculture will no longer represent a huge portion in the share of national income, and the manufacturing sector of textiles will start to increase. In addition, the tertiary sector will continue to grow since trains, railways, ships are the main transportations in industrial revolution, thus efficiency growth rate will continue to propel beyond 1.20%. Clarks argument also justified the lag in the textile, Iron and steel (secondary sectors): that rewards to innovators cannot explain the increased rate of innovation. Many innovators only reaped normal profit rates and can hardly compete with rates of return in the primary sectors. Clark also analysed the wills and concluded that only a handful of textile innovators became really wealthy, only 4% of innovators received higher rewards. This is why the textile in 1760 only accounted for 11% of GNP, while Iron and steel accounted for 1%, as compared to that of agriculture, representing 30% of GNP. Same goes to coal and railroads, where the engineers (industrialists) who were responsible for making railroads made moderate comfortable livings, and the patent system designed in 1689 did not protect the rents of innovators in the time of slow technological growth. Industrial revolution causes prices of energy, textiles, transportations to drop in price, figure 12.3 (Clark, 2007) thus labour and customers can reap in the benefits. Since the old patent system in england offered little protection, competitions are increasing and there is an increasing supply of innovation. In every sector, there are more innovators experimenting new stuffs with the productivity growth rate for innovation was 0.27%. People are investing new ideas and resources to produce more, better and faster with the least costs. Only this is when the textiles started to grow in GNP. They contributed most to the national efficiency growth rate. We can see that those sectors with low efficiency gain such as agriculture would depart from the malthusian period as entrepreneurs were seeking for sectors that yields higher efficiency to cut costs. Observing figure 12.4: wheat yields in england, medieval agriculture remained stagnant (Clark, 2007). This is because of the switch of organic (agriculture) to inorganic technologies. Clark agrees that organic techs are limited because all inputs have to come within the system. the natural rate of productivity advance is negative - bugs become more resistant, stocks of nutrients got depleted. There is a switch into inorganic technologies from agriculture during the industrial revolution, where the agriculture sector showed a downward trend from 45% to 32.5% of GNP. Between 1420 and 1720, book production multiplied its efficiency by a factor of 25. This represents an increase in the manufacturing (secondary sector). Paper, glass, spectacles, spices were devoted by the rich and it represents only a small share in the english economy. The increase in manufacturing sector during 1688- 1770 from table 1 might be attributed to the production of luxury items. In conclusion, although the primary sector was the least efficient, it made up the largest percentage of GNP before industrial revolution. Contrary to this, sectors with higher efficiency gains e.g. secondary and tertiary sectors made up the least in terms of percentage of GNP. Although efficiency gains have started to increase from an early stage, the start of industrial revolution means that consumers and producers are more cost efficient. Increasing competition to be more efficient meant that sectors with higher efficiency (secondary and tertiary) started to grow, while the primary sector shrink. References: Clark (2007), A Farewell to Alms, Chapter 11. Clark (2007), A Farewell to Alms, Chapter 12. [1000 words]