Who wins ?: OTT Cache vs. Operator Cache

April 14, 2013 | By Harryson (tech@netmanias.com) | Netmanias Tech-Blog | www.netmanias.com

Sandvine has recently reported that, in the second half of 2012, Netflix and YouTube accounted for 48% (33%

and 15% respectively) of the total Internet traffic in North America, making telecom operators' IP network

look like a video transport network rather the Internet.

With an ever-increasing number of users and higher-resolution videos, the traffic of these two (and hence the

delivery costs thereof) are consistently increasing. Telecom operators and OTTs have had different strategies

to minimize these costs. Here, we will discuss the strategies used by OTTs (Over-The-Top: Internet video

streaming service providers) first.

CDN Strategy • GOOGLE

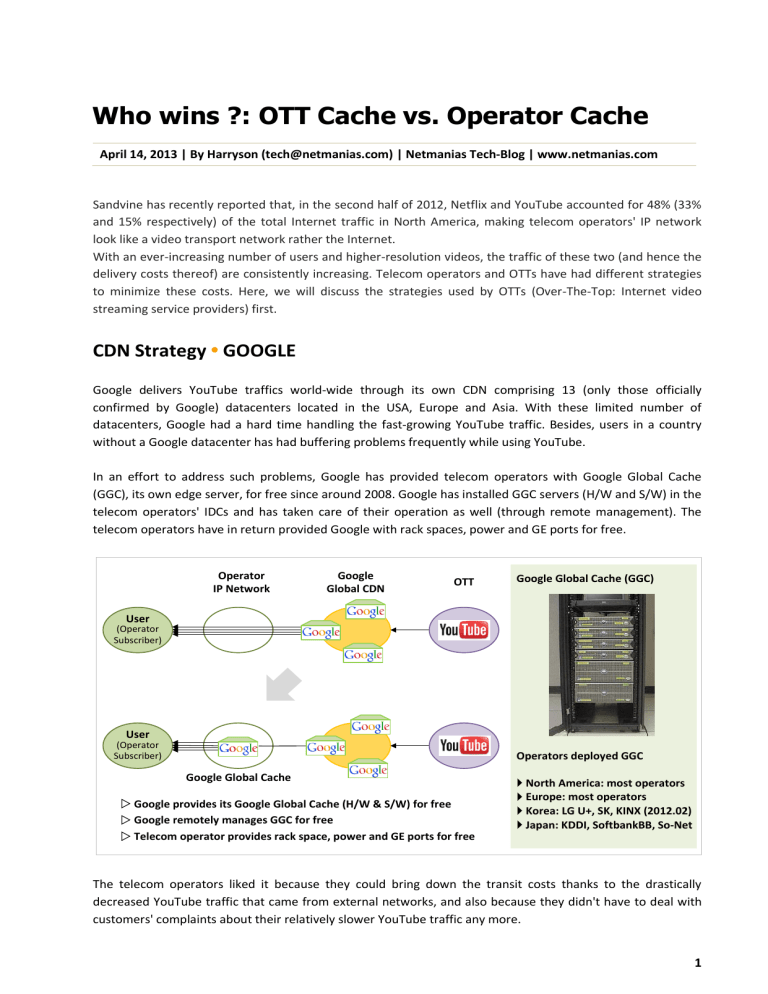

Google delivers YouTube traffics world-wide through its own CDN comprising 13 (only those officially

confirmed by Google) datacenters located in the USA, Europe and Asia. With these limited number of

datacenters, Google had a hard time handling the fast-growing YouTube traffic. Besides, users in a country

without a Google datacenter has had buffering problems frequently while using YouTube.

In an effort to address such problems, Google has provided telecom operators with Google Global Cache

(GGC), its own edge server, for free since around 2008. Google has installed GGC servers (H/W and S/W) in the

telecom operators' IDCs and has taken care of their operation as well (through remote management). The

telecom operators have in return provided Google with rack spaces, power and GE ports for free.

Operator

IP Network

Google

Global CDN

OTT

Google Global Cache (GGC)

User

(Operator

Subscriber)

User

(Operator

Subscriber)

Operators deployed GGC

Google Global Cache

w Google provides its Google Global Cache (H/W & S/W) for free

w Google remotely manages GGC for free

w Telecom operator provides rack space, power and GE ports for free

} North America: most operators

} Europe: most operators

} Korea: LG U+, SK, KINX (2012.02)

} Japan: KDDI, SoftbankBB, So-Net

The telecom operators liked it because they could bring down the transit costs thanks to the drastically

decreased YouTube traffic that came from external networks, and also because they didn't have to deal with

customers' complaints about their relatively slower YouTube traffic any more.

1

Also, Google liked it because it could provide YouTube users with improved QoE and higher-resolution video

services without burden of IDC fees. Since such strategy by Google was beneficial to both of them (Google

itself and telecom operators), neither of them needed to pay. GGCs have already been used by most telecom

operators in North America and Europe, and by SK, LG U+ and KINX in Korea in February 2012.

Google, with the fascinating content that YouTube has, has successfully expanded its CDN throughout the

world, even into the networks of telecom operators, without paying a single penny.

Users

Operator IP Network

Transit/IX

Global CDN

OTT

L Operator: increased backbone cost

L Google: hard to deliver high resolution video without

Higher costs for transit and IP backbones due to YouTube traffic

buffering

Due to long RTT between its datacenter and users

L Operator: more complaints from its Internet subscribers

about buffering

Google

Datacenter

Google

Global CDN

Transit/IX

IP Edge

IP Backbone

Google

Datacenter

Operator

Datacenter

Google

Cache

Google

Global CDN

Transit/IX

IP Edge

IP Backbone

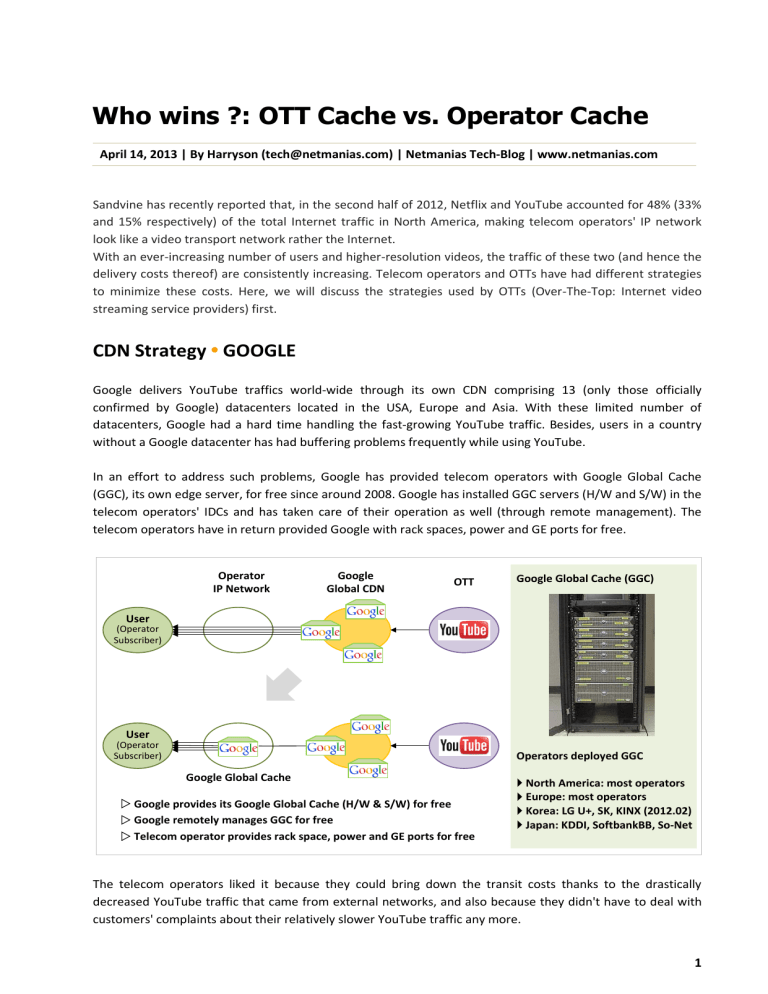

J Operator: reduced transit costs

J Operator: no costs for building or operating caching

solution (operator CDN or transparent cache)

J Google: improved YouTube video QoE for its user

YouTube traffic delivered from GGCs in the network of

operators, providing low RTT

J Google: expanded its CDN throughout the world,

J Operator: improved YouTube QoE for its Internet subscriber even into the networks of telecom operators at no IDC

cost

2

CDN Strategy • NETFLIX

Netflix, with over 30 million paid subscribers generating 33% of the Internet traffic in North America, applies

the same strategy as Google's as to be seen below. To serve its customers, Netflix uses fee-based CDN services

provided by Akamai, Limelight and Level3. Obviously, Netflix hasn't been happy with the CDN service fees it

has been paying to CDN providers. But, what was worse is that it has to pay even more to provide higherresolution video services (full HD level) in order to be able to attract more subscribers.

And Netflix noticed Google, once in a similar situation, had managed to have its GGCs deployed in telecom

operators' network somehow. That's when Netflix, also well-equipped with all the coolest content, decided to

apply the same strategy. And as a result, Netflix Cache was first introduced in June 2012.

Content service fee

Operator

IP Network

User

Netflix Cache

Global CDN

OTT

CDN fee

Akamai/

Limelight

(Operator

Subscriber)

Content service fee

Operator

IP Network

User

(Operator

Subscriber)

Netflix Cache

w Netflix provides its Netflix Cache (H/W & S/W) for free

w Netflix remotely manages servers for free

w Telecom operator provides rack space, power and GE ports for free

Telecom operators deployed

Netflix Caches as of Jan. 2013

} North America:

Cablevision (US), Clearwire

(US), Google Fiber (US),

Telus (Canada)

} Europe:

British Telecom (UK), Virgin

Media (UK), TDC (Denmark)

} Latin America:

Telmex, GVT

Just like GGC, Netflix Cache was developed, offered for telecom operators' uses at no charge, and operated by

Netflix, an OTT. Again, the telecom operators have supplied rack spaces, power and GE ports in their IDCs to

Netflix at no charge.

Currently, Netflix Cache has been deployed inside the network of telecom operators like Cablevision, Google

Fiber and Clearwire in the USA, Telus in Canada, BT and Virgin Media in the UK, TDC in Denmark, and Telmex

and GVT in Central America (countries where Netflix service is available). Especially in Europe, all the Netflix

traffic is now delivered to Netflix users through Netflix Cache, not through global CDNs.

3

Users

Global CDN

Public Internet

Operator IP Network

OTT

L Operator: increased transit costs

L Netflix: CDN cost

Higher costs for transit and IP backbones due

to Netflix traffic

CDN services currently provided by Akamai, Limelight and Level3

L Netflix: hard to deliver high resolution video without buffering

Average resolution in US – 2~3 Mbps

Operator

Datacenter

Akamai

Edge

IP Edge

Akamai Global CDN

Limelight

Datacenter

IP Backbone

Transit/IX

Limelight Global CDN

Operator

Datacenter

Netflix

Cache

IP Edge

IP Backbone

NB/eNB

Operator

Datacenter

Public Internet

Netflix

Cache

J Operator: reduced transit costs

J Operator: no costs for building or operating caching

solution (operator CDN or transparent cache)

J Netflix: improved Netflix video QoE for its user

YouTube traffic delivered from IP edge of operator IP

network, providing low RTT

Netflix: expanded its CDN throughout the world, even

J Operator: improved Netflix QoE for its Internet subscriber J

into the networks of telecom operators at no IDC cost

Neflix started full HD services (1920x1080, 5~7 Mbps) and 3D video services (12 mbps) in January 2013. Netflix

subscribers now can enjoy high resolution services at no extra charge. But, here the tricky thing is that these

high resolution services are only available to subscribers of the telecom operators who have Netflix Cache

placed in their network. Such restrictions are intended specifically to promote telecom operators' deployment

of Netflix Cache, thereby bringing down CDN costs and providing high-resolution services without paying IDC

fees to telecom operators.

When this service came up, Time Warner Cable protested that the full HD and 3D services should also be

4

available to the subscribers of telecom operators how have not deployed a Netflix Cache. What has long been

an issue was the network neutrality of telecom operators. But now, an issue of the neutrality of content that

OTTs should not discriminate among telecom operators in providing their contents has been raised.

I

Now it's not telecom operators, but OTTs who hold all the cards.

Anyway, it turned out Netflix could have more CDNs deployed across the networks of telecom operators in the

world without any cost just like Google did. YouTube and Netflix, the two top OTTs, have found a way to have

their Cache getting inside the network of telecom operators throughout the world by taking advantage of

their powerful content and huge user base. The market of telecom operator CDN and transparent Cache was

once formed to reduce network costs through caching OTTs' traffic in the network of telecom operators and

generate new profit sources. However, the market is now at risk of being significantly reduced.

Telecom operators' CDNs and Transparent Cache are developed by domestic or foreign vendors and provided

to telecom operators. So, the vendors may make some profits out of it. The telecom operators may also build

CDN in their network and collect CDN service fees from OTTs. However, if YouTube and Netflix have their own

Cache inside the network of telecom operators, no one except for OTTs can earn a penny.

5

LTE Identification I: UE and ME Identifier

Netmanias Research and Consulting Scope

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

eMBMS/Mobile IPTV

CDN/Mobile CDN

Transparent Caching

BSS/OSS

Services

Cable TPS

Voice/Video Quality

IMS

Policy Control/PCRF

IPTV/TPS

LTE

Mobile

Network

Mobile WiMAX

Carrier WiFi

LTE Backaul

Data Center Migration

Carrier Ethernet

FTTH

Wireline

Network

Data Center

Metro Ethernet

MPLS

IP Routing

Visit http://www.netmanias.com to view and download more technical documents.

About NMC Consulting Group (www.netmanias.com)

NMC Consulting Group is an advanced and professional network consulting company, specializing in IP network areas (e.g., FTTH, Metro Ethernet and IP/MPLS), service

areas (e.g., IPTV, IMS and CDN), and wireless network areas (e.g., Mobile WiMAX, LTE and Wi-Fi) since 2002.

Copyright © 2002-2013 NMC Consulting Group. All rights reserved.

6