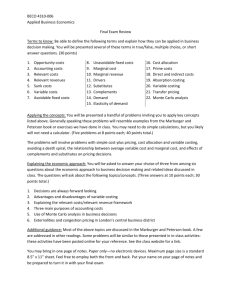

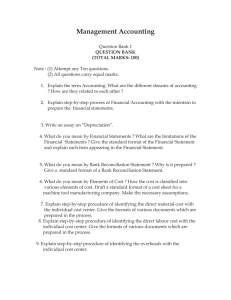

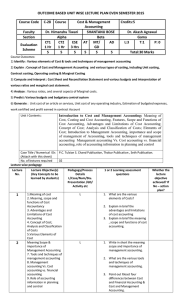

Costing notes

advertisement