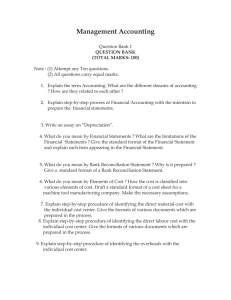

Costing notes

advertisement