One single instance GDL Consolidation EN-US

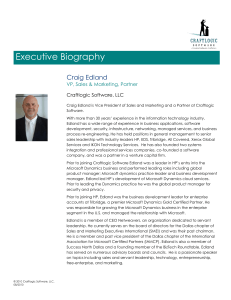

advertisement