Microeconomics Elasticity Problem Set - College Level

advertisement

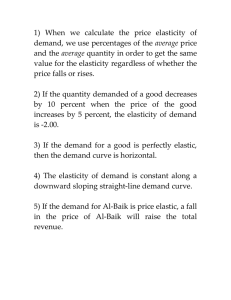

ASB-1112 INTRODUCTION TO ECONOMICS SEMESTER 1 – MICROECONOMICS PROBLEM SET 3 – Elasticity 1. For each of the following pairs of goods, which good would you expect to have the more elastic demand, and why? a. Required textbooks or novels. b. Vodka or alcoholic drinks in general. c. Heating oil during the next six months or heating oil during the next ten years. d. Lemonade or water. a. Novels have more elastic demand than required textbooks, because novels have close substitutes and are a luxury good, while required textbooks are a necessity with no close substitutes. If the price of novels were to rise, readers could substitute other types of novels, or buy fewer novels. But if the price of required textbooks were to rise, students would have little choice but to pay the higher price. Thus, the quantity demanded of required textbooks is less responsive to price than the quantity demanded of novels. b. Vodka has more elastic demand than alcoholic drinks in general. Vodka is a narrower market than alcoholic drinks in general, so it is easier to find a close substitute for it. If the price of vodka were to rise, people could substitute drinks, like gin. But if the price of all alcohol were to rise, substitution would be more difficult. Thus, the quantity demanded of alcoholic drinks in general is less responsive to price than the quantity demanded of vodka. c. Heating oil during the next five years has more elastic demand than heating oil during the next six months. Goods have a more elastic demand over longer time horizons. If the price of heating oil were to rise temporarily, consumers could not switch to other forms of heating without replacing their boiler, which involves significant expense and inconvenience. But if the price of heating oil were to remain high for a long time, people would gradually switch to alternative forms of heating as the natural life of their existing boiler comes to an end. As a result, the quantity demanded of heating oil during the next six months will be less responsive to changes in the price than the quantity demanded during the next five years. d. Lemonade has more elastic demand than water. Lemonade is a luxury with close substitutes, while water is a necessity with no close substitutes. If the price of water were to rise, consumers have little choice but to pay the higher price. But if the price of lemonade were to rise, consumers could easily switch to other soft drinks. So the quantity demanded of lemonade is more responsive to changes in price than the quantity demanded of water. 2. Suppose that business travellers and holidaymakers have the following demand for airline tickets from Liverpool to Geneva: Price Quantity demanded Quantity demanded (business travellers) (holidaymakers) 50 2,000 1,000 100 1,900 800 150 1,800 600 200 1,700 400 a. As the price of tickets rises from £100 to £150, what is the arc PED for (i) business travellers and (ii) holidaymakers? b. Why might holidaymakers have a different PED to business travellers? a. i. ii. PED= %ΔQd %ΔP Using midpoint method: %ΔP = [ (150-100) / 125 ] x 100% = 40% %ΔQd = [ (1800-1900) / 1850 ] x 100% = -5.4% Therefore: Arc PED = 5.4/40 = 0.135 Using midpoint method: %ΔP = [ (150-100) / 125 ] x 100% = 40% %ΔQd = [ (600-800) / 700 ] x 100% = -28.6% Therefore: Arc PED = 28.6/40 = 0.714 b. The price elasticity of demand for holidaymakers is higher than the elasticity for business travellers because holidaymakers can more easily choose a different mode of transportation (like driving or taking the train) or a different destination. Business travellers are less likely to do so because time is more important to them and their schedules are less adaptable. 3. Why does the price elasticity of demand fall as you go down a straight-line demand curve? The price elasticity of demand is equal to the ratio of the percentage change in quantity demanded to the percentage change in price: PED = %ΔQd = ΔQd x P (1) %ΔP ΔP Qd The slope of the demand curve, on the other hand, is simply equal to the ratio of the change in quantity demanded to the change in price: Slope = ΔQd ΔP Along a straight-line demand curve, the slope is constant. However, as you go down the straight-line demand curve, price falls and quantity increases. In other words, as you go down the straight-line demand curve, the first term in equation (1) is constant, but the second term decreases. Hence, the PED decreases. 4. Empirical studies of automobile demand have been made yielding the following estimates of income and price elasticities: Study IED PED Chow +3.0 (-)1.2 Alkinson +2.5 (-)1.4 Roos and Von Szeliski +2.5 (-)1.5 Assume that you can treat the income and price effects separately. Assume also that the car companies intend to increase the average price of an automobile by about 6 percent in the next year and that next year’s disposable personal income is expected to be 4 percent higher than this year’s. If this year’s car sales were 11 million units, how many would you expect to be sold under each pair of price and income demand elasticity estimates? Chow: A 4% increase in incomes will increase the quantity of cars demanded by 12% (%ΔQd = IED x %ΔI = 3 x 4%). A 6% increase in price will decrease the quantity of cars demanded by 7.2% (%ΔQd = PED x %ΔP = -1.2 x 6%). Overall, quantity demanded will rise by 4.8%. In other words, sales will go up from 11 million units to 11,528,000. Alkinson: A 4% increase in incomes will increase the quantity of cars demanded by 10% (%ΔQd = IED x %ΔI = 2.5 x 4%). A 6% increase in price will decrease the quantity of cars demanded by 8.4% (%ΔQd = PED x %ΔP = -1.4 x 6%). Overall, quantity demanded will rise by 1.6%. In other words, sales will go up from 11 million units to 11,176,000. Roos and Von Szeliski: A 4% increase in incomes will increase the quantity of cars demanded by 10% (%ΔQd = IED x %ΔI = 2.5 x 4%). A 6% increase in price will decrease the quantity of cars demanded by 9% (%ΔQd = PED x %ΔP = -1.5 x 6%). Overall, quantity demanded will rise by 1%. In other words, sales will go up from 11 million units to 11,110,000. 5. Two goods have a cross-price elasticity of + 1.2. a. Would you describe these goods as substitutes or complements? b. If the price of one of the goods increases by 5 percent, what will happen to the demand for the other product, holding constant the effects of all other factors? a. Substitutes - an increase in the price of one good causes an increase in demand for the other b. Demand will increase by 5% x 1.2 = 6% [%ΔQdA = XED x %ΔPB] 6. Fuel prices are much more volatile than car prices. How might the respective price elasticities of demand for the two products explain this phenomenon? Use demand and supply diagrams to illustrate your answer. For given fluctuations in supply (e.g. supply fluctuating between SL and SH in the diagrams below), prices fluctuate much more in markets with inelastic demand (first diagram) than in those with elastic demand (second diagram). Therefore, if the demand for fuel is less elastic than the demand for cars, then this would explain some of the extra volatility in fuel prices. 7. The owner of a football club has access to the following information about elasticities of demand for tickets: Own price elasticity 1.4 Income elasticity 1.8 Cross-elasticity with respect to meat pies -1.1 at half time a. What does this information tell us about demand for tickets? b. If the club were making losses how could the owner make use of this information to increase profitability? c. Why might the club offer reduced ticket prices for pensioners and students? a. The demand for tickets is price elastic. In other words, fans are sensitive to price changes. The income elasticity is also high. Tickets are a luxury good (IED>1). Unsurprisingly, tickets and half-time pies are complimentary goods, they tend to be consumed together. b. Given that the costs of a football club (players wages, training facilities, upkeep of the ground etc) do not vary much in response to the size of the crowd, maximising ticket revenues is likely to be the best way to improve profitability. Given that demand is price elastic, the owner could increase ticket revenues by reducing the price of tickets. The percentage increase in tickets sold would be greater than the percentage fall in the price. The increase in tickets sold would also have the added bonus of increasing demand for half-time pies, allowing the club to profit more from the sale of pies. c. The income elasticity of demand for tickets is high. This means that the demand for tickets is much higher among those who have high incomes, than those on low incomes. If the club can differentiate between those on high and low incomes, then it may be able to charge low prices to those on low incomes who would otherwise not buy tickets, whilst continuing to charge high prices to those who have high incomes and a high demand. Generally, pensioners and students tend to have much lower incomes than working people. 8. Pharmaceutical drugs have an inelastic demand, and computers have an elastic demand. Suppose that technological advance doubles the supply of both products (i.e. quantity supplied at each price is twice what it was). Use supply and demand diagrams to answer the following questions: a. What happens to the equilibrium price and quantity in each market? b. Which product experiences a larger change in price? c. Which product experiences a larger change in quantity? d. What happens to total consumer spending on each product? a. As the diagram below shows, the increase in supply reduces the equilibrium price and increases the equilibrium quantity in both markets: b. Pharmaceutical drugs (with inelastic demand). c. Computers (with elastic demand). d. Because demand is inelastic in the market for pharmaceutical drugs, the percentage increase in quantity will be lower than the percentage decrease in price; thus, total consumer spending will decline. Because demand is elastic in the market for computers, the percentage increase in quantity will be greater than the percentage decrease in price, so total consumer spending will increase. 9. The demand for cocaine is highly inelastic. The supply of cocaine is highly elastic. Why might this be? The government has two policy options: (i) Constrain supply through tougher policing. (ii) Reduce demand by educating people about the consequences of taking cocaine. Which of these policies is likely to be more effective at: a. increasing the price of cocaine. b. reducing the quantity of cocaine consumed. c. reducing the revenues of drug dealers. Use demand and supply diagrams to illustrate your answers. Cocaine is an addictive drug for which users have few close substitutes. It therefore has a low price elasticity of demand. Cocaine suppliers are much more sensitive to price because they can switch relatively easily to producing other things. Farmers can switch from growing coca to other crops if the price of coca falls, and dealers can switch to supplying other drugs if the street price falls. The elasticity of supply is, therefore, reasonably high. These demand and supply curves are illustrated in the diagrams below. i. The first diagram shows the effect of constraining supply through tougher policing. It has the effect of: a. increasing the price of cocaine. b. reducing the quantity of cocaine consumed. c. increasing the revenues of drug dealers (revenue = price x quantity). ii. The second diagram shows the effect of reducing demand by educating people about the consequences of taking cocaine. It has the effect of: a. reducing the price of cocaine. b. reducing the quantity of cocaine consumed to a greater extent than option (i). c. reducing the revenues of drug dealers.