Sanyco Project Selection: NPV, ROR, Payback Analysis

advertisement

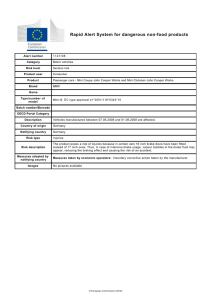

LIST OF TABLES Table 1: Data of NPV for three projects……………...................................................8 Table 2: Value of ROR for three projects.……………………………………….…...9 Table 3: Data of payback period for three projects……………...……………….….11 Table 4: Responsible matrix for Brake Duplex Assembly project …………….…...18 Table 5: Project resource allocation for Brake Duplex Assembly project………….19 Table 6: List of activities in Brake Duplex Assembly project ………………..........23 Table 7: Cost-Duration table for Brake Duplex Assembly project…………………25 Table 8: Summary of cost-duration network for Brake Duplex Assembly project...31 LIST OF FIGURES Figure 1: Product range of brake and clutch components produced by Sanyco…........3 Figure 2: Sanyco’s Logo .……………………………………………………………..3 Figure 3: The organization chart of Sanyco’s…………………………..……..………4 Figure 4: List of the Sanyco’s customers……………………………………………...4 Figure 5: Three options of project for selection………………………..……………...6 Figure 6: Formula to calculate NPV…………………………………………..............7 Figure 7: Bar graph of NPV for three projects…….…..……...…………………..…...8 Figure 8: Formula to calculate ROR………………………………………….…….....9 Figure 9: Bar graph of ROR for three projects……….……………...……………….10 Figure 10: Formula to calculate payback period……………………………………..10 Figure 11: Bar graph of payback period for three projects…………….…....…….....11 Figure 12: Project screening matrix for three projects……….………...…………….13 Figure 13: Project portfolio matrix for three projects………………………………..14 Figure 14: Work Breakdown Structure (WBS) of brake duplex assembly project.….17 Figure 15: Fraction of total budget allocation for main deliverables………………...20 Figure 16: Project schedule of brake duplex assembly………………...………….....21 Figure 17: The critical path of brake duplex assembly project………...…………….22 Figure 18: AON network of brake duplex assembly project………..………….…....24 Figure 19: Project cost-duration graph of brake duplex assembly project…..…........31 1|Page Chapter 1 1.0 Introduction Sanyco is Malaysia's leading manufacturer and assembler for a wide range of automotive brake master cylinders, clutch master cylinder, proportioning valves, wheel cylinders and ABS units. Over 5 million cars on the road globally rely on brake components built with Sanyco's technology. Supported by strong knowledge and technology, they continue to reach for a greater height of achievements in developing and producing superior products to meet customer satisfaction. Therefore, they have to ensure their planning and implementations were successfully in the right way towards achieving the company's goals. All the projects must be analysed, selected, planned, scheduled and implemented accordingly. 1.1 Company Background Sanyco Grand is a subsidiary of SMIS Corp. Berhad, a holding company listed in KLSE main board Malaysia. Incorporated in 1991, Sanyco Grand Industries Sdn Bhd started as an OEM automotive hydraulic brake & clutch components manufacturer. It is located at Hicom Glenmarie Industrial Park, Shah Alam With the 25 years of manufacturing experience, Sanyco Grand is now the leading manufacturer of hydraulic brake and clutch components in Malaysia. Today, with the experiences of producing precision and high safety requirement components, the company had also diversified her business into aerospace as well as oil & gas industries. 1.2 Product Range The core business of Sanyco is manufacturing of original hydraulic brake and clutch components to automaker such as PROTON, PERODUA and TOYOTA. List of the products that produced by Sanyco are shown in Figure 1. Most of the products are produced for PROTON. The Duplex Brake Assy and Proportioning Valve are manufactured for PERODUA meanwhile the Wheel Cylinder Assy is manufactured for TOTOYA as Tier-2 vendor. The product range has indicated that Sanyco is one of the leading company in its line of business. 2|Page Figure 1: Product range of brake and clutch components produced by Sanyco. 1.3 Vision & Mission Vision To be the Top 3 braking & transmission system manufacturer and solution provider in ASEAN and preferred precision machining in global niche market. Mission • Provide quality and cost effective products and solution through lean manufacturing process, reliable design, latest technologies and strategic partnership. 1.4 • Generate reasonable return to stakeholder by business expansion, • Effective cost management and broad base export. • Value our associate by developing and growing them. Logo SANYCO GRAND INDUSTRIES Figure 2: Sanyco’s Logo 3|Page 1.5 Organizational Chart At Sanyco, a project is managed by Research and Development (R&D) department by adopting strong matrix structure. The project manager controls most aspects of the project, including assignment of functional personnel. The project manager also controls when and what specialists do and has final say on major project decisions. The functional manager has title over her people and is consulted on a need basis and sometimes serve as a ‘subcontractor’ for the project. The advantages of matrix structure of project management are efficient, strong project focus, easier post-project transition and flexible. Figure 3: The organization chart of Sanyco 1.6 List of Customers Figure 4: List of the Sanyco’s customers. 4|Page Since incorporated in 1991, there several automakers being a loyal clients of Sanyco such as Proton, Toyota and Perodua. Basically, most of the Proton’s cars are using brake and clutch components developed by using Sanyco’s technology. Others client likes PEPSJv, EPMB, TRW Automotive and Sapura Industrial are the 1st tier vendor whereby Sanyco supply the components to the automakers via these companies. They are ordering some parts from Sanyco to completely assemble their final product. 5|Page Chapter 2 2.0 Project Selection Project selection is important to prioritize project proposals across a common set of criteria, rather than on politics or emotion as well as balances risk across all projects. Besides that, by conducting project selection, the organisation manage to allocates resources to projects that align with their strategic direction and justifies killing projects that do not support strategy and organisation's goals. There are two criteria of project selection as following:- 2.1 Financial : Payback, Net Present Value (NPV), internal rate of return (IRR) Non-financial : Projects of strategic importance to the firm List of project Figure 5: Three options of project for selection. As stated in the Figure 5, there are three types of projects has been suggested to the company. The projects are involving different customer namely Perodua, Toyota and Proton. In order to select the best project that suits certain goals and capabilities of the company, all the projects should be analysed through both criteria of project selection as earlier mentioned. 6|Page 2.2 Financial Analysis First of all, in order for a project engineer to be able to select the best project to be conducted, he should conduct the financial analysis. This is because the primary objective for a company is the maximisation of profit. It is a business-oriented culture to ensure a project engineer should prioritise a project that can bring maximum monetary profit to the organisation. Thus, implementing this financial analysis is essential to aid the objective to be achieved. Usually, there are three basic analysis that can be done to help us making a decision, namely: Net Present Value (NPV) Rate of Return (RoR) Payback Period (PP) These three method may give us a different outcome so it is important to do all three and compare. More importantly, a project engineer should be well-informed regarding the current direction of the company so that every decision is in line with the organisation’s direction. 2.2.1 Net Present Value Figure 6: Formula to calculate NPV. The formula as shown in Figure 6 is used to generate the value of NPV for all three project choices. Assuming all the data are complete and accurate, a tabulation data as shown in Table 1 can be obtained. NPV model uses management minimum desired rate of return to compute the present value of all net cash inflows. So, if the final value turns out to be positive, it is qualified to be considered. Negative results will completely rejecting that project from any further consideration. As result, the higher the NPV, the better the project. 7|Page Table 1: Data of NPV for three projects. Based on the figures of NPV in Table 1, a bar graph as shown in Figure 7 is generated to make a clear comparison. By doing this, the visualisation is better and everyone can actually be able to see the differences. A project engineer must always remember that the top management is usually consisting of non-engineering managers thus it may have a barrier when we are discussing this kind of matter. Net Present Value, NPV 4,000,000.00 3,701,740.27 3,500,000.00 3,000,000.00 2,500,000.00 2,000,000.00 1,680,271.44 1,500,000.00 1,000,000.00 390,862.48 500,000.00 Brake Duplex Assy Wheel Cylinder Assy Brake Master Cylinder Assy Figure 7: Bar graph of NPV for three projects The chart in Figure 7 has indicated that Brake Duplex Assembly is suited the best to be run by the company with the total NPV of RM 3,701, 740.27. However, another two projects are also 8|Page exhibiting the positive value of NPV but smaller than the Brake Duplex Assembly. In order to further verify about the selected project, we calculate the Rate of Return (ROR) of al projects. 2.2.2 Rate of Return (ROR) ROR is actually not a model of financial analysis, but its value still possesses a defining figure. It can be calculated by using formula as shown in Figure 8. Rate of Return (%) = Annual Estimated Savings / Project Investment Figure 8: Formula to calculate ROR. In simple, if the calculated value is exceeding the minimum ROR set by the company, the project can be taken into next discussions. For this case, the minimum ROR is at 15%. Table 2: Value of ROR for three projects. For better visualization of ROR value, a bar graph as shown in Figure 9 is generated. The value of ROR is in percentage. The value of rate of return for all proposed project are more than 15% which means above the desired ROR. 9|Page Rate of Return, (ROR) 70 58.4 PERCENTAGE, % 60 50 40.9 40 32.2 30 20 10 0 Brake Duplex Assy Wheel Cylinder Assy Brake Master Cylinder Assy Figure 9: Bar graph of ROR for three projects. Based on the result of ROR in Figure 9, the Brake Duplex Assembly is again shows a positive sign which turns out to have the highest value of rate of return with 58.4% followed by Wheel Cylinder Assembly and Brake Master Cylinder Assembly with the values of 40.9% and 32.2%, respectively. 2.2.3 Payback Period This model measures the time it will take to recover the project investment. This is the simplest thus most widely used model. The concept is, the shorter the time needed to recover the investments is better. However, this model does not take into account the issue of depreciation and the profit maximisation. The payback period can be calculated based on the formula as shown in Figure 10. Payback Period (years) = Project Investment / Annual Estimated Savings Figure 10: Formula to calculate payback period. The result of calculation for payback period is shown in Table 3. The result then visualised via a bar graph as for fast comparison purpose as shown in Figure 11. 10 | P a g e Table 3: Data of Payback Period for three projects. Payback Period 3.5 3.1 3 2.4 YEARS 2.5 2 1.7 1.5 1 0.5 0 Brake Duplex Assy Wheel Cylinder Assy Brake Master Cylinder Assy Figure 11: Bar graph of payback period for three projects From the Table 3 and Figure 11, the Brake Duplex Assembly is more desirable project to be chose due to shortest in payback duration. As a result, the project engineers now somehow at least have facts and figures to help him to make a decision. However, it is vital to remember that the result from financial analysis may have some errors and situations will be different when the project will actually takes place. 11 | P a g e As a conclusion, for financial analysis, the NPV model is more realistic because it considers the time value of money, cash flows and profitability. 2.3 Non-Financial Analysis Non-financial analysis is suggested in case any of strategic criteria of the projects as following is met. To capture larger market share To develop an enabler product, which by its introduction will increase sales in more profitable products To develop core technology that will be used in future products To reduce dependency on unreliable suppliers Meanwhile, the multi weighted scoring model also the most preferable tool in conducting the non-financial analysis. This multi-weighted scoring model helps the company to evaluate project proposals and allow for comparison of projects with other potential projects. By applying a selection model, the projects is focus closer with the organisation's strategic goals and deciding how well a strategic or operations project fits the organization's strategy. Other advantages of selection models are: Reduces the number of wasteful projects Helps identify proper goals for projects Helps everyone involved understand how and why a project is selected 2.3.1 Multi-Weighted Scoring Models A weighted scoring model typically uses several weighted selection criteria to evaluate project proposal. Weighted scoring models is generally include qualitative and/ or quantitative criteria. Each selection criterion is assigned a weight. Scores are assigned to each criterion for the project, based on its importance to the project being evaluated. The weights and scores are multiplied to get a total weighted score for the project. 12 | P a g e Competitor Complexity Risk 4 4 3 4 4 3 3 3 5 5 4 3 3 3 1 3 2 3 3 3 2 2 3 3 Weighted Total Market Penetration 4 4 3 4 Fund Availability Project Duration Brake Duplex Assy Wheel Cylinder Assy Brake Master Cylinder Assy Technical Expertise Weight Resource Availability Criteria 4 4 2 3 104 79 92 Figure 12: Project screening matrix for three projects Based on the project screening matrix as shown in Figure 12, selection of criteria is chosen based on the important and necessity to the project and company's goals includes resource availability, technical expertise, project duration, market penetration, competitor, complexity, risk and fund availability. Hence, project of Brake Duplex Assembly has displayed the highest weighted total (104) compared to other project listed. This weighted scoring model shows qualitative analysis instead of quantitative to explain why the project is selected. 2.3.2 Project Portfolio Matrix Next, the project portfolio matrix is designed in order to support the decision that has been showed through multi weighted selection model. The project portfolio matrix has four basic type of project but in our case, only three types of project involved as shown in Figure 13. Brake Duplex Assembly (considered as pearl type project) - Represent revolutionary commercial opportunities using proven technical advances Brake Master Cylinder Assembly (considered as bread and butter type project) - Involve evolutionary improvements to current products and services Wheel Cylinder Assembly (considered as oyster type project) - Involve technological breakthroughs, with high commercial payoffs White elephants type project is not applicable in this case study 13 | P a g e Brake Master Cylinder Assy Brake Duplex Assy Wheel Cylinder Assy Figure 13: Project portfolio matrix for three projects Findings from both financial and non-financial analysis on project selection is concluded as below: Based on financial and non-financial analysis, Brake Duplex Assembly project is selected to be developed and manufactured The justification of the selection are due to:i. Aligned with company’s mission to provide quality and cost effective products and generate reasonable return to stakeholder (maximize profit with minimum investment - financial analysis) ii. Most criteria in the non-financial analysis favor to Project 1 considering all contributing factors (4M – Man, Machine, Method and Money) iii. The company’s strategy to capture a larger market share in order to achieve company’s vision and causing difficulty for competitors to enter the market 14 | P a g e Chapter 3 3.0 Project Overview 3.1 Work Breakdown Structure A work breakdown structure (WBS) is a key project deliverable that organizes the team’s work into manageable sections. It helps to assure project manager that all products and work elements are identified, to integrate the project with the current organization and to establish a basis for control. Prior to establish the WBS, the scope of the project must be defined to ensure all the project requirements are fulfilled as for benefit to both parties. Clearly, project scope is the keystone interlocking all elements of a project plan. There are 6 project scope checklist as below: a) Project objective – the objective of the project is to develop, manufacture and supply the Brake Duplex Assembly to Perodua for D18D model with the total development cost of RM 3,700,000.00 within 2 years. b) Deliverables – product and process technical specification, samples trial run, product testing report and product samples. c) Milestones – the milestone of the project is the major deliverables of the project such as plan and define program, product design and development, process design and development, supplier development, pilot production, product testing and verification and product evaluation. d) Technical requirements – the major requirement of the product is as given by customer and design of the internal chamber of product to meet customer specification is undertake by vendor. In this case, there are 2 variant of product to be produced namely ABS type and NonABS type. e) Limit and exclusion – development of tier 2 supplier is under responsibility of tier 1 vendor, cost of sample preparation for testing and validation is bared by tier 1 vendor. f) Review with customer – the part and process approval (PPAp) activities will be conducted together with customer during audit session. This activity is conducted prior to mass production begins. 15 | P a g e The WBS of the Brake Duplex Assembly project is established based on deliverable oriented. The major deliverables are the highest or first level of structure that created from project’s scope definition, it is requires a full team participation to defined all the major deliverables. As shown in Figure 14, there are 7 major deliverables in this project which are; 1.1. Plan and define program 1.2. Product design and development 1.3. Process design and development 1.4. Supplier development 1.5. Pilot production 1.6. Product testing and verification 1.7. Product evaluation Normally, the major deliverables is organized according to the flow of the development steps as defined in Advanced Product Quality Planning (APQP). Each major deliverables has supporting deliverables which is considered as activities under the deliverable. For example, Product design and development has comprises of engineering drawing, engineering specifications and design failure mode and effect analysis (DFMEA). Leader will be assigned for 7 major deliverables and the supporting deliverables to responsible for the work product and complete the task. To ensure the entire task should be done within the allocated period, each leader for task structured at level 2 will report the progress to their leader structured at level 1and they will report the progress to the project manager. 16 | P a g e Figure 14: Work Breakdown Structure (WBS) of brake duplex assembly project 17 | P a g e 3.2 Responsible Matrix Responsible Assignment Matrix also called as linear responsibility chart is one of practices of project management in Sanyco. The matrix summarizes the tasks to be accomplished and who is responsible for what on a project. In other words, it describes all the participation by all assigned staff in completing all the tasks included in matrix. The tasks will be including all major deliverables starting from plan and define program until product evaluation. The matrix uses the notation of R- responsible, S – support, C – consult, N- notification, and A – approval. Table 4: Responsible matrix for brake duplex assembly project Based on the responsible matrix as shown in Table 4, basically each department in Sanyco is involved during the project development. This scenario may facilitate the project handover because everybody are understand and familiar with the product processing method. For example during pilot production, most of the departments are responsible to each process scope in order to facilitate the activity. 18 | P a g e Chapter 4 4.0 Resource Allocation Time, cost and resources estimates must be accurate if the project planning, scheduling and controlling are to be affective. Poor estimates of those items are recognize as a major contributor to projects failure. Therefore, in Sanyco the estimation of the time, cost and resources is part of management commitment in order achieve the company’s vision. In Brake Duplex Assembly project, the allocation of project resources and investment cost as displayed in the Table 5. Table 5: Project resource allocation for brake duplex assembly project 19 | P a g e 1.14% 0.73% 0.54% 11.92% 37.33% Plan & Define Program Product Design & Development Process Design & Development Supplier Development Pilot Production 1.55% 46.80% Product Testing & Verification Product Evaluation Figure 15: Fraction of total budget allocation for main deliverables Summary of the total budget allocation for main deliverables as shown in Figure 15. Based on that figure, the allocation for pilot production is the highest which is 46.80% of the total budget. Budget allocated in this deliverable is including the cost of material, new tooling, new equipment and resources. Then it is followed by the cost of product evaluation whereby 37.33% of the total project cost will be spent on it. In this deliverable, 3.7% of the cost for product evaluation is used to purchase material and child parts for this activity. Allocation on supplier development also high which is 11.92% of the total allocation because a lot of child parts to be developed by to meet the technical requirement of the product. 20 | P a g e Chapter 5 5.0 Project Planning After completion of WBS, project deliverables and resources allocation, it is easy to schedule the project activities according to duration of each activity and priority. Then we can determine total time and final responsibilities. By using Microsoft Project, activities can be arranged and presented in “Gantt Chart” based on the WBS of the project and then each activity must include planned start and finished dates in order to determine the estimated final project duration as shown in Figure 16. Figure 16: Project schedule of brake duplex assembly After completion of key in step in Microsoft Project with the project activities parameters, the final timeline of the project will show the estimated finish time and the default sequence of flow. Then, we need to find the “Critical Path” which will guide us to the least slack (activities least priority and can be delayed). In our project we found the “critical path” as indicated in Figure 17 by the red bar. The critical path indicates 262 days is required to complete such project. 21 | P a g e Figure 17: The critical path of the brake duplex assembly project 22 | P a g e Chapter 6 6.0 Project Network 6.1 Activity on Node (AON) and Critical Path After finish designing our “Gantt Chart” then we can arrange a complete information on how the activates will flow and which one proceeding the other and for how long as shown in Table 6. Table 6: List of activities in brake duplex assembly project ID WBS P0 1.0 P1 Item/ Task Duration Predecessors Start 0 - 1.1.1 RFQ from Customer 1 P0 P2 1.1.2 Feasibility Study 10 P1 P3 1.1.3 LOA/LOI from Customer 30 P2 P4 1.1.4 Kick of Meeting 1 P3 P5 1.2 Product Design & Development 5 P4 P6 1.3 Process Design & Development 3 P4 P7 1.4 Supplier Development 60 P5,P6 P8 1.5.1 Setup of Trial Run 95 P7 P9 1.5.2 Production Trial Run 12 P8 P10 1.5.3 Quality Control System Evaluation 16 P8 P11 1.5.4 Product Storage 1 P9,P10 P12 1.6.1 Material Testing 5 P11 P13 1.6.2 Functional Testing 3 P11 P14 1.6.3 Durability Testing 10 P11 P15 1.7.1 Part and Process Approval (PPAp) 33 P12,P13,P14 23 | P a g e 6.2 Project Network A project network is a diagram that depicting the sequence in which a project's terminal elements are to be completed by showing terminal elements and their dependencies. It is always drawn from left to right to reflect project chronology. Figures 18 exhibiting the Active-on-Node (AON) diagram that obtained from the Microsoft project software. The red dotted line shows the critical path for our activity on node project network. Figure 18: AON network of brake duplex assembly project 24 | P a g e Chapter 7 7.0 Reducing Project Duration (Crash) 7.1 Cost-Duration Table Table 7: Cost-duration table for brake duplex assembly project Direct Cost) ID Item/ Task Normal Time Crash Cost (RM) Time Cost (RM) 0 - Max Crash Time Slope P0 Start 0 P1 RFQ from Customer 1 - 1 P2 Feasibility Study 10 20,000.00 9 P3 LOA/LOI from Customer 30 - 30 0 - P4 Kick of Meeting 1 - 1 0 - P5 Product Design & Development 5 27,000.00 3 52,500.00 2 12,750.00 P6 Process Design & Development 3 42,150.00 1 78,180.00 2 18,015.00 P7 Supplier Development 60 441,000.00 59 490,000.00 1 49,000.00 P8 Setup of Trial Run 95 1,085,850.00 93 1,700,000.00 2 307,075.00 25,000.00 0 - 0 - 1 5,000.00 P9 Production Trial Run 12 540,000.00 10 580,000.00 2 20,000.00 P10 Quallity Control System Evaluation 16 105,600.00 11 250,000.00 5 28,880.00 P11 Product Storage 1 150.00 1 150.00 0 P12 Material Testing 5 10,000.00 3 25,000.00 2 7,500.00 P13 Functional Testing 3 7,200.00 2 12,400.00 1 5,200.00 P14 Durability Testing 10 40,000.00 2 150,000.00 8 13,750.00 P15 Part and Process Approval (PPAp) 33 1,381,050.00 32 1,500,000.00 1 118,950.00 - Table 7 above shows the cost duration table of direct cost and maximum crash time and its slope. After this table being tabulated, the cost-duration reduction network is created according to data of maximum crash time and value of slope. To calculate maximum crash time and slope as below: i) Maximum crash time = Time (Normal) – Time (Crash) ii) Slope = (Crash Cost – Normal Cost) / (Normal Time – Crash Time) 25 | P a g e 7.2 Cost-Duration Network 26 | P a g e 27 | P a g e 28 | P a g e 29 | P a g e 30 | P a g e Table 8: Summary of cost-duration network for brake duplex assembly project Project Duration Direct Cost Indirect Cost Total Cost (Days) 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 (RM) 3,700,000 3,705,000 3,717,750 3,730,500 3,744,250 3,758,000 3,771,750 3,785,500 3,799,250 3,828,130 3,857,010 3,885,890 3,914,770 3,936,020 3,957,270 4,006,150 4,055,150 4,174,100 4,481,175 4,788,250 (RM) 4,300,000 4,250,000 4,200,000 4,150,000 4,100,000 4,050,000 4,000,000 3,950,000 3,900,000 3,850,000 3,800,000 3,750,000 3,700,000 3,650,000 3,600,000 3,550,000 3,500,000 3,450,000 3,400,000 3,350,000 (RM) 8,000,000 7,955,000 7,917,750 7,880,500 7,844,250 7,808,000 7,771,750 7,735,500 7,699,250 7,678,130 7,657,010 7,635,890 7,614,770 7,586,020 7,557,270 7,556,150 7,555,150 7,624,100 7,881,175 8,138,250 Optimum Cost Point Figure 19: Project cost-duration graph of brake duplex assembly project 31 | P a g e Cost-duration network visualizes the direct cost and duration reduction for certain project activity. From Table 8 it shows that the summary of cost reduction network and we have chosen to complete project from 262 days to 246 days with the total cost of RM 7,555,150. Plus, we also visualize our selection using project cost-reduction graph as displayed in Figure 19 which is showing our optimum cost point at 246 days. 32 | P a g e Chapter 8 8.0 Conclusion Sanyco is incorporated in 1991 and now has become the leading manufacturer of hydraulic brake and clutch components in Malaysia. There are several projects to be selected by Sanyco in this case study based on the following list: • Brake duplex assembly project • Wheel cylinder assembly project • Brake master cylinder assembly project Based on the results of financial and non-financial analyses, brake duplex assembly project is selected. Manpower allocation to implement the project is sufficient for each work package. Therefore, it is not a constraint to this project. According to the AON network planning shows that the project initially will take 262 days for completion. Based on the result of reducing project duration (crashing), the crash cost duration can be reduced up to 243 days (maximum). Nevertheless, the optimum total cost is RM 7,555,150.00 at 246 days. 33 | P a g e References: [1] Eric W. Larson and Clifford F. Gray (2014), Project Management – The Managerial Process, Sixth Edition, McGraw – Hill International Edition. [2] http://www.sgisb.com/. Retrieved on 1 April 2016 [3] Microsoft Project Tutorial; http://www.project-tutorial.com/. Retrieved on 1 April 2016 [4] Advanced Product Quality Planning (APQP); http://quality-one.com/apqp. Retrieved on 20 April 2016 34 | P a g e