Bai Al-Arboon

advertisement

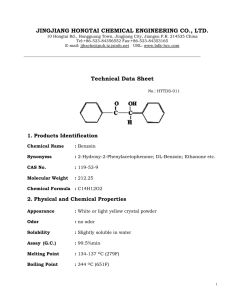

The Global University in Islamic Finance INCEIF CIFP part 1 SH1002 Shariah rules in financial transactions Bai Al-Arboon Semester September 2010 Name: Abdirahman Sh. Mohamed Omer Dirir Matric No: 1000366 Kuala Lumpur, Malaysia. 1 Table of content: Introduction ………………………………………………………………………… 3 The definition of bail al-urbun………………………………………………………4-5 View of the scholars on the application …………………………………………….6-9 The basic shari’ah ruling …………………………………………………………10-11 bai al-urbun and other contract………………………………………………….12-15 The current practice of the application in Islamic finance……………………..16-17 Comparing Features of the Short Sale and Arboon Sales…………………………18 Conclusion …………………………………………………………………………….19 References …………………………………………………………………………….20 2 Introduction Islam is not only a religion in the ordinary sense of the word, but a complete system of life. While other religious codes provide guidance only for the relation between man and his Creator, Islam guides man in his relationship with God, and gives him the norms which govern his temporal existence, since Islam is concerned with the spiritual, political, social economic, moral and all other material aspects of the human being. On the other hand, Shariah Law encourages Muslims to perform activities known as Muamalat or transaction, which is confine to Muslims and it is open to practice by non Muslims. There are more different types of Islamic transactions which basically allowed from the Shariah law, at same time there are certain business transactions which considered unlawful in Islam and cannot be carried out in an Islamic bank. For example trading in alcohol, intoxicating drugs, gambling or producing pornography are contrary to Islam. Bai-al-urbun is a one of the sale that argued between scholars, some of them they allowed while others are prohibited, and each of the scholar have a evidence to proof their idea. It refers to a sort of transaction through which a person who wants to purchase commodity in future, will pay percentage of cost at present time and at determined date if he purchase the commodity he pays the remaining cost at the time of settlement. If he does not purchase the commodity, he cannot get back the initial payment because he did not fulfill his promise. 3 Concept There are types of sales which are suspected for most of the people, because of some scholars they allowed while others are prohibited. And bai urbun is one of them. Bai Urbun is sale contract which a small part of the price is paid as down payment/deposit, by the buyer, which the main objective for remaining price is to exchange in a future date. In the case the buyer perform the contract, that means the amount of urbun will be a part of the price, but if the buyer did not execute the sale , he will loss the down payment, which is considered a gift to the seller. The definition of Bai Al- Urbun The literal meaning: there are more than sex different ways for the Arabic word which is similar to the down payment like urbun, Al- arboon, urban, arbun, arban, but the most usefully and practicable are (urbun, Al- arboon) which is also nearly the linguistic of Arabic language. As a technical term: Urbun has defined into more than one definition from different schools of thought and even classical and present scholars. In the beginning we choose the definition of urbun in a view of four Islamic juristic scholars. What they mentioned in their books, also I will discuss some definitions of group scholars according at present time. (1) First: the definition of Hanifa The man has to buy the commodity and pay darahim to the seller, so if he accepts to take the commodity the darahim will be part of the price. But if he didn‟t perform the sale the darahim will be recover from him 1 ) bia al-urbun in the light of Islamic law, abu hissam al-din al-darfawi, p (3-5). 4 Second: the definition of malikia Imam Maalik said (the man has to buy slave or fledgling then he says to the one he bought from him, I will give you a dinar or a dirham or more or less if I took the good, and the one I gave you is a part of the price‟s item. But if I left the commodity the amount I gave you is yours. Third: the definition of shafia To buy a good (buyer), and to give him (seller) darahim to be part of the price if the buyer satisfy the commodity otherwise it will be gift. Fourth: the definition of hanabila To pay after the contract a small amount and to say if I took the commodity I complete the price of the item, if not the amount is yours. Contemporary definition Islamic Fiqh Council defined (selling the good to the buyer with paying a sum of money to the seller, that if he takes the item will be calculated the amount of the price, but if he left the amount will belongs to the seller). Dr.abdirsaq Al- Sanhuri defined Urbun is the price of using the right to change a contract for the purchase or lease, where by the two parties agreed to appoint this price, So to have right to abandon his commitment to such contract. Sheik Sadi Abu Geab said: It is what the buyer accelerates with the price, and if he agrees it will be calculated among the part of sale, otherwise the seller will deserve it. The definition where by transmitted from our classical scholars actually it is definition by example, and it gives us a form of forms of urbun, also that is suitable for their great works. I can say to have the full and complete definition may included on three attributes: 1- being inclusive. 5 2 - as a deterrent. 3 - Being a short in words, devoid of padding. Perhaps the nearest definition for the ex-scholars is what Bahooti defined urbun saying: «to pay after the contract something by saying: if I took the good I complete the price, otherwise it is yours » The selected definition: Bai al-arboon: the buyer has to pay sum amount to the seller after the contract, if he took the good it considered as part of the price, but if he didn‟t take the amount will belongs to seller.(2) View of the scholars on the application Jurists differed in opinion regarding this type of sale, so there are two main opinions:First: the team forbids this sale Classical jurists differed over the legal status of this contract, most of them forbidding it based on a Prophetic tradition (which referred to the transaction under the name bay ˘ al-urban). Although that tradition was deemed no authoritative, because of missing links in its chain of narration, most classical jurists still deemed the contract forbidden, because of two thing:1- In this sale there is a gharar, because since the seller does not know whether or not the buyer will conclude the sale. Moreover, they argued, 2- the potential seller gives the potential buyer in this contract an option (in contemporary parlance: a call option), but if the buyer proceeds to exercise that option, the down payment counts toward the price, and the seller would thus not have been compensated forth option. 2 ) bai al- urbun and the current application, Ali bin Muhammad bin Hassan Al-Zayli, (P 10, 11, 12). 6 3- Some classical jurists have clarified that included option for the case of urbun should be properly compensated. It is in this regard that they ruled that the seller is compensated only if the buyer did not exercise his right, and even that may not be sufficient compensation for the time he had to wait, during which he was not able to sell the property and benefit from its price. Evidences of this group: Most of jurists said the bai al-urbun is prohibited like shafi, malik, abu hunifa, ishaq ibnu rawia, ibnu Abas (Allah blesses him), al – Hassan and others. The evidences or proofs of this group are from the Quran Al- Karim and Sunah Al- Sharif. Here on below explanation of their evidences:1- from the Quran Al- Karim Al- Qurtubi said in his Tafseer (5/150): it is consuming people‟s property with illegal and bai al irban considered as a part of this action. This does not work and not allowed for scholars in Alhijaz and Al- Iraq , because it is a matter of selling gambling, ambiguity, risk, and eat the money unlawfully without compensation or gift and that is invalid unanimously. Abu hayyan said :( unlawful is every way which Shariah not allowed, so bai al-arboon include 2- from Al- Sunah: The hadeeth which Amar ibnu Shui‟ab narrated from his father and from his grandfather, that our prophet peace and blessing be upon him (prohibit bai al- irban). Also the prophet peace and blessing be upon him said: (it is not allowed for salve in sale and two conditions in a one sale) narrated by five scholars. 3 (3) ) bai al-urbun, Dr. Afiif Hamad, University of al-qudus, 2007, p (4, 5,6). 7 Second: the team allowed this sale Islamic past jurists are allowed bai al-arboon, like Saidina Omar Al-Khattab, Abdilah ibnu Omar Al-Khataab, and some from tabi‟in like Mujahid, Ibnu Sirin, Nafi bin Haris, Zaid bin Aslam and the Hanbali school . They considered it permissible based on the practice of Saidina Omar AlKhattab. Also Imam Ahmed has mentioned that there is no problem in bai al- urbun because of Khalifa Omar has practiced and allowed it. Evidence of this group 1- from the Quran Al- Karim: In surah Al-Baqarah: verse (275), Allah says: (Allah has permitted trade and prohibited interestriba-). This verse is general for all different kinds of sale, either there is clear evidence from Quran and Sunah which prohibit the sale. For the case of bai al-urbun we don‟t have correct and strong evidence which prohibit bai al-urbun, so the sale will stay under permissibility. 2- from the Sunah Al- Sharifah: The hadeeth which sahabi Hassan Said bin Aslam narrated from our prophet Mohamed peace and blessing be upon him said: (The Messenger of God was asked about down-payment sale (alurban), and permitted it. This hadeeth is sender (mursal Hassan), and it mursal to Hassan Zaid bin Aslam. The second proof is hadeeth which narrated Nafi‟ ibn „Abd Al-Harith: “That he bought for Umar the jailhouse building from Safwan ibn ‟Umayya for four thousand Dirhams, on the condition that if „Umar approves it, then the sale is executed, otherwise, Safwan may keep four hundred Dirhams.” (4) 4 ) bai al- urbun and the current application, Ali bin Muhammad bin Hassan Al-Zayli, p ( 16-17). 8 The third evidence is from some tabi‟in, among them Mujahid, Ibnu Sirin they don‟t see any problem with permissibility of bia al- urbun. For the view of Ibnu Sirin there is no problem if the buyer gives a down payment to other part. Ibnu Sirin says: to the man renting the house or ship, if you bring to me with such amount the good will is yours, otherwise it will be mine. So those are the senior of tabi‟n and jurists they allowed taking in bai al urbun and dealing in it. Ibn Al Qayem has found proof of the admissibility of this kind of contract in the statement of Al Bukhari who quoted Ibn Sirin when he said: "A man told the operator of a caravan I would like to join your passengers, but if I did not depart with you on a certain day you would be entitled to a sum of one hundred Dirhams. When he did not travel on the set date, he willingly agreed to comply with the condition." Such contract is deemed binding upon the seller who has no power to abstain from executing it. The buyer, however, has the option to buy within the mutually agreed period. in this sale Ahmad ibn Hanbal believed that the practice of bai al-urbun is permissible, also the majority of jurists of his time had different opinion, but he depend on the prophetic traditions. The scholars of tradition believe that hadeeth bin Aslam which premised bai al-urbun consider with a weak chain of narration, also this narration was further supported by another weak narration which Nafi‟ ibn „Abd Al-Harith narrated that Umar ibn Al- Khattab allowed down payment toward the purchase of a jailhouse. Ahmad deemed the narrated Hadeeth on urbun sales weak, however classical Hanbali and contemporary jurists of most schools that bai al- urbun ( down payment sales) have become general and essential for commercial transactions, it is also provides compensation towards the seller for waiting and delays, in case the buyer take a decision to not perform the bai al- urbun. 9 The basic shari’ah ruling As I mentioned above there are two views towards the ruling of bai- al urbun which from different jurists, some of them they don‟t allow bia al urbun like (shafi, malik, abu hunifa, ishaq ibnu rawia, ibnu abas). While others they allow like (Omar Al-Khattab, Abdilah ibnu Omar AlKhataab, Mujahid, Ibnu Sirin, Nafi bin Haris, Zaid bin Aslam). For the contemporary scholars like (Dr.Al- Qaradawi, Dr. Wahab Al- Zuhaily, Dr.Rafiq AlMasri, Dr. Al- Sanhoori) they allowed bai al- urbun regarding the condition that some of the Hanbalis have ruled which is determined for the waiting period, because we don‟t know how long the seller must wait. The view of Dr. Al- Qaradwai in his analysis and comparison of the evidence for and against the arboon sale, he has declared that he opponents of bia- al urbun have relied on a hadith which premised on a condition that involve appropriation by the seller of the buyer‟s property without any exchange. As for the reliability of hadith which reported by Nafis ibnu Harith, Al-Qaradawi has mentioned that this hadith is undependable, which this evidence was supported by other hadith recorded in Nayl al- Awtar, which in really express that (Our Prophet Mohamed - peace and blessing be upon him - was asked the ruling of bial al-urbun, and he declared it is permissible). But as I mentioned above this hadith was said to be mursal, because its chain of transmitters includes a weak narrator. Therefore Al- Qaradwai observes it must be determined on rational grounds. As I noted on pervious pages that Imam Ahmad Ibn Hanbal relied on the example of Saidna Umar ibn alKhattab and did not considered bai al-urbun to list into the category of unlawful appropriation. This ruling is similar the state of al- Qaradwai, because he adds that this is more suitable to our current times and in greater harmony with the spirit of the Shari‟ah, which seeks to remove hardship and facilitate the people‟s convenience. 10 It was asked Ibnu Bas the formal mufti in Saudi Arabia (Allah mercy him) about bai al- urbun: he said in his opinion there is no problem with performing urbun sale - considering the correct view of our scholars- if the two parts agree to take urbun before they complete the sale. For the Wahab Al- Zuhaily, he said in my observation bai al-urbun is valid and permissible, we can perform urbun sale accordance with ur‟f (custom), because the al- ahadith contained on this matter (urbun sale) which each of the groups has bring as evidence , was not valid. In my humble observation it is valid and permissible to use the urbun sale considering and following the convention, since the Hadiths were used to argue on either side have all been shown to be weak. So this is the decision of the Islamic jurisprudence Council (Majma‟ Al-Fiqh Al-Islam) - the most prestigious international juristic body- in its eighth session in Brunei on the first of Muharram, 1414 A.H. In Malaysia, since there were two opposite views related to this method of trading. The Shariah Advisory Council has declared that the idea of bai‟ al- urbun is permissible and it can be progressed as an instrument in the Malaysia Islamic capital market. Actually it has been a general practice in any population to deal with down payment (deposit) for their business transactions, so the main concept is the two parties which involved the contract will not lose their rights within certain given period. This is not opposite to Shariah principles, because it is under urf sahih which means we have to ensure the level of a muamalah is running perfectly. In its 13th meeting on 19 March 1998, in a discussion on composite index futures contract, the Shariah Advisory Council passed a resolution permitting bai` `urbun from the Islamic jurisprudence perspective. So they concluded that bai al- arboon is permissible according the hadith of the prophet (peace and blessing be upon him) which show us the prohibition of bai al- urbun is weak. 5 (5) ) Islamic finance, law, economics and practice, Mahmoud A. El-Gamal-Rice University- ,p (91-96). 11 bai al-urbun and other contract Murabahah: Literal meaning of: Murabahah comes from the word ribh which means increase. Technically, Murabahah is the mark-up disclosed to the purchaser as per the seller‟s purchase price for a trust-sale of a certain specified asset, excluding monetary assets such as cash and receivables. Murabahah sale may be contracted on cash or credit basis The Bank shall provide funds for financing on the basis of an agreement for sale and purchase of goods. The term for payment of prices for goods by which provide the customer to the Bank shall be based on the terms agreed by the Bank and the customer. The bank my finance Murabahah contract in part or all of the purchase price for the goods at agreed quality specifications, if the bank delegates the purchase of the goods to customer as (wakalah), the Murabahah Agreement must be executed after the goods in principle have become the property of the Bank. Although the Bank my request the customer to make a down payment or urbun upon signature of the initial agreement for the customer order for the goods. When the bank requests from the customer to pay down payment or urbun, that means to ensure if the customer ready to perform the contract by purchasing the good, otherwise the bank does not need to be in a position where he has finished the purchasing of good, then the Bank will find the buyer has already changed his mind. In the case of down payment, if a customer refused or cancels to purchase the goods after making the down payment, the real costs of the Bank must be paid from the down payment and the Bank must return the surplus down payment to the customer. However, if the down payment is insufficient to cover the loss borne by the Bank, the Bank may demand further payment from the customer to cover the remaining loss. 12 Mudharabah Mudharabah is a contract which involves agreement between two parties, namely rabb mal (investor) which provides 100% of the fund, and mudharib (entrepreneur) who manages the project in accordance with Shariah principles. Any profit from this investment will be apportioned based on the pre-agreed ratio at the inception of the agreement. However, any losses will be fully borne by the rabb mal. In Mudharabah muqayyadah or (restricted Mudharabah), the Rabbul Mal who provided fund will have the right to choose specific investment or securities namely Discounted Islam Negotiable Instruments (INIs) for capital protection and a basket of stocks for yield enhancement. The Profit from Mudharabah investment is distributable between Rabbul Mal and Mudharib based on an agreed profit sharing ratio. The 90% of the capital provided by the customer who will get at least an amount that is equivalent to his/her initial capital 100%. The other part of the capital is invested in equity basket (Al- Baraka Islamic Population Index) through an agent using the Arbun mechanism. The Arbun represents initial payment amount for the purchase price of the index. Upon maturity, if the Bank has to pay the remainder of the purchase, the Bank will subsequently sell the index in the market and the profit derived from the sale will be shared accordingly with the customer. If the Bank revokes the purchase, the initial payment amount will be forfeited by the seller (through the agent). 13 Bai al-urbun and call option Basically, contemporary jurists and Islamic financial practitioners they consider that the similarity of this arrangement to a call option, also it is binding on the seller not on the buyer. Really, some classical Hanbali jurists had even think that the option period should be determined or to be fixed, otherwise the seller may have to wait for the possible of the buyer to decide whether or not to perform his right. Some scholars have justified the permissibility to options by drawing a parallel with bai alurbun. Urbun refers to a sale in which the buyer deposits earnest money with the seller as a part payment of the price in advance but agrees that if he fails to ratify the contract he will forfeit the deposit money which the seller can keep The analysis of the difference between the down- payment sale (urbun) and the modern call option is concluded that the letter cannot be synthesized from the former. However, some of institutions have been performing call options under the name urbun, because they are ignoring some of the finer legal differences between the two contracts.(6) The comparison between the bai al-urbun and call option Bay al-Urbun is a sale involving urbun (the earnest money). The seller does not return the urbun in case the latter does not confirm the contract. We can say the call option may be considered near to Bai„al „Arbun:1- in the sense that the seller does not return the premium or advance payment to the buyer 2- If the latter does not exercise the purchase option and the buyer loses the option premium even if the option is exercised and the contract is confirmed. 6 ) Islamic finance, law, economics and practice, Mahmoud A. El-Gamal-Rice University- ,p (91-96). 14 3-In the case of Bai„al „Arbun, however, the option premium is adjusted in the sale price when the contract is confirmed. Bay al-tawrid The best definition of this contract is the definition of sheikh. Abdulla Al Mutlaq :( It is contract which one of the two contracting parties will undertake to hand over the other part to movable things, with a particular price). For the most common image of this contract is as following: 1- Each of the contractors must pay amount of money which calculated as basic of the proportion of the price, to ensure each parties have to obligate the contract and to implement it. The buyer must pay full amount to the third party, or to give the management of the market, to ensure the implementation of the contract, and the seller will return the down payment to the buyer. Finally the amount paid by the buyer will calculated as part of the total price. 2- To pay the price of the good with delayed until to delivered the good, or one part move to other for the delays, as stipulated in the contract. 3- The buyer has to pay insurance, or guarantee or urbun, which is calculated as the price of the item deferred delivery. Based on what we discussed on above with the permissibility of bia al-urbun, and what our contemporary jurists clarify that bai al-tawreed is allowed based on third image. Finally, we can say the bai al-urubn is allowed based on the last image which the buyer pays the urbun, and it considered as a part of the total price, if the deal is completed. 15 The current practice of the application in Islamic finance Bai Al-urbun stand for a mount which cannot be returned in case the buyer cancel to purchase the good, on the other hand the down payment show us the intention of the buyer to purchase the asset and is typically toward goods that will be delivered at a later date. The next table or form will indicates the basic structure of bai al urbun which is practiced in islam banks, although there are different practice which many banks use for bai al-urbun:- This is a simple Bai al-urbun structure 1- Make down payment BUYER 2- Deliver asset. SELLER 3- Pay remaining purchase price The urbun or down payment is part of the total price which agreed between the two parties (seller and buyer), but if the buyer does not take the delivery asset there is no refundable to him. let is simplify the steps which i mention in above :1- Buyer and seller agree on a price and the buyer pays a down payment or urbun, for example he has to pay 15% of the total purchase price. In this contract two things must be specified and agreed by each party (the asset and the delivery date). 16 2- In the time of agreed delivery date, the seller delivers the asset to the buyer, at same time the buyer collects it from the seller. 3- When the buyer delivered the asset, after ensure and check the asset, the buyer must pay the remaining balance of the purchase price. For example if he pays 15% of the original purchase price as urbun or down payment, the amount he has to pay is 75%. Example of Bai al Arboon Mohammed agrees to buy a motorbike form Ahmed‟s Bahran, who have a special motorbike garage with specific amount 1,533RM. The motorbike that Mohammed wants and agreed with seller is not new, and it has been in the showroom for a few weeks. However the seller will check the motorbike if it is working before it is collected, and to ensure that it is roadworthy. Although the deal is done, the seller would like some sort of guarantee, because he does not want to be in a position where he has finished all the work only to find the buyer who has changed his mind. The seller requests from the buyer a down payment and the buyer will agree to pay sum amount on 533RM. When Mohammed goes to collect the motorbike, he has to pay the remaining amount which is 1,000RM. If Mohammed had pulled out of the purchase, the 533RM would have been forfeited by the seller to cover the cost of work he had done in getting the motorbike ready for sale. (7) 7 ) see Al-Zuhayli (2003, vol. 1, pp. (99–100). 17 Comparing Features of the Short Sale and Arboon Sales 1. In a Shariah-compliant Arboon Sale, stocks are purchased using an arboon contract so that the investor actually takes ownership of the stocks. By means of the arboon contract, no stocks are borrowed. In a conventional short sale, shares are borrowed under a “Master Securities Lending Agreement” and then sold into the market. The Arboon Sale employs a “Master Securities Arboon Sale Agreement” instead to ensure the investor‟s ownership of whatever stocks are later sold into the market. 2. In a classical arboon sale, the buyer agrees to purchase goods by paying earnest money against an agreed sale price. In the Arboon Sale, the prime broker agrees to sell stock to the investment manager at the quoted (and therefore agreed) market price. The investment manager makes an arboon down payment and assumes ownership of the stocks. 3. The Arboon Sale equivalent is structured with a specified “date of ultimate settlement of the purchase and sale” at which time the unpaid portion of the purchase price has to be paid (the “Closing Date”). This complies with the condition stipulated by the OIC Fiqh Academy that a time period for payment of the remaining purchase price must be specified. 4. In the classical arboon sale, if the buyer does not complete the purchase within the time period specified, he must return the goods and forfeit the down payment of earnest money. In the Arboon Sale, if the investment manager decides not to complete the sale, he returns the shares and forfeits the arboon earnest money. 5. In a classical arboon sale, once the purchaser has paid the arboon earnest money to the seller, he is free to dispose of whatever he purchased. In an Arboon Sale, once the investment manager has made a down payment equal to a margin account deposit, he may arrange through the prime broker to sell the stocks purchased by means of the Arboon Sale to a third party at the market price when the sale is concluded. 6. In order to close out the transaction in the Arboon Sale, the investment manager instructs the prime broker to purchase the required number of stocks from the market at the market price. 18 Using these securities, the investment manager terminates the Arboon and the Prime Broker retains the earnest money. The same process is used in a conventional short sale.(8) Conclusion Islamic banks are using a special variant of Arboon in which the client pays small part of the price up-front and payment of the price and the object of sale are both delayed, so different scholars has different idea about transaction of bia- al urbn is allowed or not allowed. But I mentioned above in Malaysia Shariah Advisory Council passed a resolution permitting bai` `urbun from the Islamic jurisprudence perspective. So they concluded that bai al- arboon is permissible according the hadith of the prophet (peace and blessing be upon him) which show us the prohibition of bai al- urbun is weak. That is similar what has been discussed by the Islamic jurisprudence Council (Majma‟ Al-Fiqh Al-Islami) - the most prestigious international juristic body- in its eighth session in Brunei on the first of Muharram, 1414 A.H. 8 ) bai al- urbun and the current application, Ali bin Muhammad bin Hassan Al-Zayli, p 28. 19 References Arabic references:- 1- bia al-urbun in the light of Islamic law, abu hissam al-din al-darfawi, p (3-5). 2- bai al- urbun and the current application, Ali bin Muhammad bin Hassan Al-Zayli, p ( 10, 11, 12). 3- bai al-urbun, Dr. Afiif Hamad, University of al-qudus , 2007, p ( 4,5,6). English references:- 1- Islamic finance, law, economics and practice, Mahmoud A. El-Gamal-Rice University- , p (91-96). 2- Financial Transactions in Islamic Jurisprudence Al-Zuhayli (2003, vol. 1, pp. (99–100). 20