ECONOMICS PROJECT(data)

advertisement

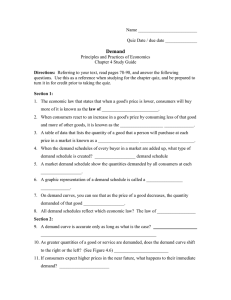

ELASTICITY Elasticity of demand refers to price elasticity of demand. It is the degree of responsiveness of quantity demanded of a commodity due to change in price, other things remaining the same. Price Elasticity of Demand The price elasticity of demand is defined as the percentage change in quantity demanded due to certain percentage change in price. Where, E = Price elasticity of demand q= Original quantity demanded ∆q = Change in quantity demanded p= Original price ∆p = Change in price Types or degrees of price elasticity of demand Relatively Elastic Demand (E > 1) The demand is said to be relatively elastic if the percentage change in demand is greater than the percentage change in price i.e. if there is a greater change in demand there is a small change in price. It is also called highly elastic demand or simply elastic demand. For example: If the price falls by 5% and the demand rises by more than 5% (say 10%), then it is a case of elastic demand. The demand for luxurious goods such as car, television, furniture, etc. is considered to be elastic. Relatively Inelastic Demand (E < 1 ) The demand is said to be relatively inelastic if the percentage change in quantity demanded is less than the percentage change in price i.e. if there is a small change in demand with a greater change in price. It is also called less elastic or simply inelastic demand. For example: when the price falls by 10% and the demand rises by less than 10% (say 5%), then it is the case of inelastic demand. The demand for goods of daily consumption such as rice, salt, kerosene, etc. is said to be inelastic. In the given }gure, price and quantity demanded are measured along the Y-axis and X-axis respectively. The demand curve DD is steeper, which shows that the demand is less elastic.The greater fall in price from OP to OP has led to small increase in demand from OM to OM . Likewise, greater increase in price leads to small fall in demand. Unitary Elastic Demand ( E = 1) The demand is said to be unitary elastic if the percentage change in quantity demanded is equal to the percentage change in price. It is also called unitary elasticity. In such type of demand, 1% change in price leads to exactly 1% change in quantity demanded. This type of demand is an imaginary one as it is rarely applicable in our practical life In the given Figure, price and quantity demanded are measured along Y-axis and X-axis respectively. The demand curve DD is a rectangular hyperbola, which shows that the demand is unitary elastic. The fall in price from OP to OP hascaused equal proportionate increase in demand from OM to OM . Likewise, when price increases, the demand decreases in the same proportion. Perfectly Inelastic Demand, (PED = 0) With a perfectly inelastic demand, there is no change in the demand for a product with a change in its price. This means that the demand remains constant for any value of price. The demand curve is represented as a straight vertical line. It is practically impossible to find a product that has perfectly inelastic demand. The closest thing could be essentials like water or certain food products. This is the effect on total revenue with a change in price: Price ↑ → Total Revenue ↑ Price ↓ → Total Revenue ↓ Perfectly Elastic Demand, (PED = ∞) In Perfectly Elastic Demand, a small rise in price will result in a fall in demand to zero, while a small fall in price will result in the demand to become infinite. Consumers will buy all available at some price, but none at any other price. This is a theoretical concept because it requires perfect competition where the slightest price increase results in zero demand. In a perfectly elastic demand, the demand curve is represented as a horizontal straight line. This is the effect on total revenue with a change in price: Price ↑ → 0 Total Revenue Price ↓ → 0 Total Revenue Factors That Cause a Demand Curve to Shift A demand curve shifts when a determinant other than prices changes. If the price changes, then the demand curve will tell you how many units will be sold. But if the price remains the same, and the income changes, then that changes the amount purchased at every price point. People can buy more of what they want when they have more income The curve shifts to the left if the determinant causes demand to drop. That means less of the good or service is demanded at every price. The curve shifts to the right if the determinant causes demand to rise. That means more of the good or service is demanded at every price. income Say we have an initial demand curve for a certain kind of car. Now imagine that the economy expands in a way that raises the incomes of many people, making cars more affordable. This will cause the demand curve to shift. Shifts in demand: a car example Normal and inferior goods A product whose demand rises when income rises, and vice versa, is called a normal good. A few exceptions to this pattern do exist, though. As incomes rise, many people will buy fewer generic-brand groceries and more name-brand groceries. They are less likely to buy used cars and more likely to buy new cars. They will be less likely to rent an apartment and more likely to own a home, and so on. A product whose demand falls when income rises, and vice versa, is called an inferior good. In other words, when income increases, the demand curve shifts to the left. Changing tastes or preferences From 1980 to 2014, the per-person consumption of chicken by Americans rose from 48 pounds per year to 85 pounds per year, and consumption of beef fell from 77 pounds per year to 54 pounds per year, according to the U.S. Department of Agriculture (USDA). Changes like these are largely due to movements in taste, which change the quantity of a good demanded at every price—that is, they shift the demand curve for that good, rightward for chicken and leftward for beef. Changes in the composiƭon of the population The proporƭon of elderly ciƭzens in the United States populaƭon is rising. It rose from 9.8% in 1970 to 12.6% in 2000 and is projected by the U.S. Census Bureau to be 20% of the populaƭon by 2030. A society with relaƭvely more children, like the United States in the 1960s, will have greater demand for goods and services like tricycles and day care faciliƭes. A society with relaƭvely more elderly persons, as the United States is projected to have by 2030, has a higher demand for nursing homes and hearing aids. Similarly, changes in the size of the populaƭon can affect the demand for housing and many other goods. Each of these changes in demand will be shown as a shiW in the demand curve. Related goods The demand for a product can also be affected by changes in the prices of related goods such as substitutes or complements. A substitute is a good or service that can be used in place of another good or service. As electronic resources, like this one, become more available, you would expect to see a decrease in demand for traditional printed books. A lower price for a substitute decreases demand for the other product. For example, in recent years as the price of tablet computers has fallen, the quantity demanded has increased because of the law of demand. Since people are purchasing tablets, there has been a decrease in demand for laptops, which can be shown graphically as a leftward shift in the demand curve for laptops. A higher price for a substitute good has the reverse effect. Other goods are complements for each other, meaning that the goods are often used together because consumption of one good tends to enhance consumption of the other. Examples include breakfast cereal and milk; notebooks and pens or pencils; golf balls and golf clubs; gasoline and sport utility vehicles; and the five-way combination of bacon, lettuce, tomato, mayonnaise, and bread. If the price of golf clubs rises, the quantity demanded of golf clubs falls because of the law of demand, and demand for a complement good like golf balls decreases along with it. Similarly, a higher price for skis would shift the demand curve for a complement good like ski resort trips to the left, while a lower price for a complement has the reverse effect. Changes in expectations about future prices or other factors that affect demand While it is clear that the price of a good affects the quantity demanded, it is also true that expectations about the future price—or expectations about tastes and preferences, income, and so on—can affect demand. For example, if people hear that a hurricane is coming, they may rush to the store to buy flashlight batteries and bottled water. If people learn that the price of a good like coffee is likely to rise in the future, they may head for the store to stock up on coffee now. These changes in demand are shown as shifts in the curve. Therefore, a shift in demand happens when a change in some economic factor other than price causes a different quantity to be demanded at every price. Summing up factors that change demand Six factors that can shift demand curves are summarized in the graph below. Notice that a change in the price of the good or service itself is not listed among the factors that can shift a demand curve. A change in the price of a good or service causes a movement along a specific demand curve, and it typically leads to some change in the quantity demanded, but it does not shift the demand curve. The graph on the left lists events that could lead to increased demand. The graph on the right lists events that could lead to decreased demand. When a demand curve shifts, it will then intersect with a given supply curve at a different equilibrium price and quantity. We are, however, getting ahead of our story. Before discussing how changes in demand can affect equilibrium price and quantity, we first need to discuss shifts in supply curves. Price Elasticity of Supply In Economics, elasticity is defined as the degree of change in demand and supply of consumers and producers with respect to the change in income or price of the commodity. Particularly, price elasticity of supply is a measure of the degree of change in the supplied amount of commodity in response to the change in the commodity’s price. In simple words, it can be de}ned as the rate of change in supply in response to a price change. It is denoted as PES or E . Mathematically, price elasticity of supply is expressed as Degrees or Types of Price Elasticity of Supply They are described below in brief with figure. Relatively elastic supply When percentage change in quantity supplied is greater than percentage change in price, the condition is known as relatively elastic supply. This situation when plotted in graph makes an upward slope which intersects positive Y-axis. we can see that ratio of change in quantity supplied is greater than the ratio of change in price. As a result,when we put their values in the above mathematical expression, we get PES>1. Elasticity tends to be greater than 1 in case of products which are not necessary to sustain our lives. Luxury goods such as expensive smart phone, gold, etc. show this kind of price elasticity. Relatively inelastic supply When the percentage change in quantity supplied is lesser than percentage change in price, the condition is known as relatively inelastic supply. This situation when plotted in graph makes highly inclined upward slope which intersects In the above figure, it is clearly shown that ratio of change in price is greater than ratio of change in quantity, whose value when substituted in the given expression, we get PES<1. Such kind of price elasticity can be observed in goods which are necessary in our day to day lives. Clothes, foods, etc.are good examples of these kinds of goods. Unitary elastic supply When percentage change in quantity supplied is exactly equal to percentage change in price, the situation is known as unitary elastic supply. This situation is graph is represented by an upward slope which intersects the origin Perfectly Inelastic Supply (PES = 0), The Quantity Supplied doesn’t change as the price changes Perfectly Elastic Supply (PES = ∞), Suppliers will be willing and able to supply any amount at a given price but none at a different price. Factors That Cause a Supply Curve to Shift How production costs affect supply A supply curve shows how quantity supplied will change as the price rises and falls, assuming ceteris paribus—no other economically relevant factors are changing. If other factors relevant to supply do change, then the entire supply curve will shift. A shift in supply means a change in the quantity supplied at every price. Say we have an initial supply curve for a certain kind of car. Now imagine that the price of steel—an important ingredient in manufacturing cars—rises so that producing a car becomes more expensive. Shifts in supply: a car example . . Other factors that affect supply In the example above, we saw that changes in the prices of inputs in the production process will affect the cost of production and thus the supply. Several other factors affect the cost of production, too. Natural conditions In 2014, the Manchurian Plain in Northeastern China—which produces most of the country's wheat, corn, and soybeans—experienced its most severe drought in 50 years. A drought decreases the supply of agricultural products, which means that at any given price, a lower quantity will be supplied. Conversely, especially good weather would shift the supply curve to the right. New technology When a firm discovers a new technology that allows it to produce at a lower cost, the supply curve will shift to the right as well. For instance, in the 1960s, a major scientific effort nicknamed the Green Revolution focused on breeding improved seeds for basic crops like wheat and rice. By the early 1990s, more than two-thirds of the wheat and rice in low-income countries around the world was grown with these Green Revolution seeds—and the harvest was twice as high per acre. A technological improvement that reduces costs of production will shift supply to the right, causing a greater quantity to be produced at any given price. Input prices Firms use a number of different inputs to produce any kind of good or service (i.e. output). When the prices of those inputs increase, the firms face higher production costs. As a result, producing said good or service becomes less profitable and firms will reduce supply. That is, the supply curve shifts to the left (i.e. inward). By contrast, a decrease in input prices reduces production costs and therefore shifts the supply curve to the right (i.e. outward). For example, your favorite restaurant needs several ingredients to make a burger: buns, meat, lettuce, tomatoes, BBQ sauce, and so on. Now, imagine the price of meat increases. That means, the restaurant faces higher costs for every burger it produces. If the price of the burger remains the same, this results in a smaller profit for the restaurant. Because of this, the restaurant will produce less burgers and focus on other dishes that are more profitable. Therefore supply of burgers decreases, as the price of meat increases. If the price of meat increases a lot, some restaurants may even decide to shut down and go out of business, because they cannot earn profits anymore. This reduces supply even further. By contrast, if the price of meat decrease, it becomes more attractive to sell burgers, which results in an increase in supply. Hence, supply is negatively correlated to the price of the inputs used in production. Government policies Government policies can affect the cost of production and the supply curve through taxes, regulations, and subsidies. For example, the U.S. government imposes a tax on alcoholic beverages that collects about $8 billion per year from producers. Taxes are treated as costs by businesses. Higher costs decrease supply for the reasons discussed above. Another example of policy that can affect cost is the wide array of government regulations that require firms to spend money to provide a cleaner environment or a safer workplace; complying with regulations increases costs. A government subsidy, on the other hand, is the opposite of a tax. A subsidy occurs when the government pays a firm directly or reduces the firm’s taxes if the firm carries out certain actions. From the firm’s perspective, taxes or regulations are an additional cost of production that shifts supply to the left, leading the firm to produce a lower quantity at every given price. Government subsidies, however, reduce the cost of production and increase supply at every given price, shifting supply to the right. Summing up factors that change supply The graph below summarizes factors that change the supply of goods and services. Notice that a change in the price of the product itself is not among the factors that shift the supply curve. Although a change in price of a good or service typically causes a change in quantity supplied or a movement along the supply curve for that specific good or service, it does not cause the supply curve itself to shift. Factors that shift supply curves Two graphs—the graph on the left lists events that could lead to increased supply; the graph on the right lists events that could lead to decreased supply. Income elasticity of demand Income elasticity of demand (YED) is defned as a numerical measure of the responsiveness of the quantity demanded following a change in income. All other factors remain unchanged. Once again if demand is responsive, then it is classifed as elastic; if unresponsive, it is inelastic. It is important to recognise that the relationship between income and demand changes may not always be positive.If an increase in income leads to an increase in the quantity demanded (or a decrease in income leads to a decrease in the quantity demanded), then there is a positive relationship and the product is classifed as normal. Te YED has a positive value. However, there are some products, inferior goods, which exhibit a negative relationship between income and demand. An increase in income would cause a decrease in the quantity demanded(a decrease in income would cause an increase in the quantity demanded). Here, the YED has a negative value.So the sign that precedes the YED tells you the nature of the relationship between income and the quantity that is demanded; the numerical value tells you the strength of that relationship. Cross elasticity of demand Cross elasticity of demand (XED) is a numerical measure of the responsiveness of the quantity demanded for one product following a change in the price of another related product, ceteris paribus. Products that are substitutes for each other (e.g., different types of laptop computer) will have positive values for the XED. If the price of B goes up, then people will begin to turn to product A because of its more favourable relative price. If the price of B falls, then consumers will start to buy B instead of A. Products that are complements (e.g.,computers and printers or sofware) will have negative values of XED. If the price of B goes up, the quantity demanded of B will drop and so will the complementary demand for A.