Contracts Outline

advertisement

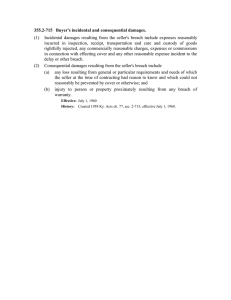

Contracts Outline I. Summary a. Common Law or UCC b. Contract Formation in General c. Offer d. Rejection and Counter-Offer e. Acceptance f. Agency and Contract g. Tricky Terminology h. Consideration i. Promissory Estoppel j. Statute of Frauds k. Terms of the Contract l. Performance m. Excuses and Defenses n. Is There a Breach? o. When Can You Sue for Breach of Contract? p. 3rd Party Issues q. Remedies II. Common Law or UCC? a. Common Law Governs i. For land, employment, services, construction b. UCC Governs i. For “goods” - Sale of movable objects (also crops to be severed); OR ii. Predominant Factor Test 1. When goods and services are combined and the value of goods “predominate” UCC controls c. Maryland: UCC i. Gravamen Test: When goods and services are combined in a contract where the services “predominate” If the “gravamen” (heart of the complaint) involves the goods, UCC still controls ii. Example: 1. Buy in-ground pool with diving board 2. There is an accident on diving board 3. The value of construction “predominates” over the value of the goods 4. But, accident occurs on the diving board 5. Diving board retains its character as a good (its detachable) and the gravamen of the complaint concerns something that would be a “good” if sold separately 6. So, UCC with implied warranties applies d. For UCC You do not need a merchant, BUT… i. The UCC applies to transactions in goods whether or not a merchant (expert in the trade) is involved ii. However, a FEW UCC provisions apply only to merchants, so always note if the seller or buyer is a merchant III. Contract Formation in General a. Generally: i. For a contract you need: 1. Mutual Assent (offer and acceptance), PLUS 2. Consideration or Promissory Estoppel b. Mutual Assent = Agree to Contract i. Scenarios 1. Two corporations “agree” to merge a. Shake hands and say, “Writing will follow” 2. Two parties sign a document (perhaps called a letter of intent) that contains some contractual language/terms and says, “Contract to follow” ii. Is there a contract at the handshake/”preliminary agreement” OR not until the follow-up writing? 1. It does not matter if you can’t tell which is the “offeror” 2. To tell if there is a contract at the handshake/”preliminary agreement,” ask “What did the parties intend?” a. Language of the agreement is paramount b. If many terms are left to the follow-up There is no K until that writing is completed iii. Intent is always determined objectively 1. What would a reasonable viewer (listener, reader) believe? 2. If A says, “I want to sell,” but whispers to another, “I’m joking” A wants to sell IV. Offer a. Offer: Permits specific offeree to create contract by assent b. NOT an Offer i. Statement of General Intent 1. “I’d like to sell. Are you interested? NOT offer ii. Advertisements NOT offers, UNLESS: 1. Language of specific promise: 1st come, 1st served 2. Rewards iii. Form Letters (Same letter to many recipients) Not offers, UNLESS: 1. Recipient not able to tell it’s a form letter 2. Multiple performances possible a. i.e. Pay if could remedy does not work iv. Statements in OBVIOUS Jest or Anger NOT offers c. How long to offers last? NOT Forever i. If NOTHING else happens Offer ends either: 1. By its own terms, a. i.e. You have until 6 pm 2. If no stated limitation After a reasonable time (under the circumstances), OR 3. Oral offer ends with conversation, unless stated otherwise ii. Offer ends IMMEDIATELY if: 1. Revocation a. By offeror 2. Rejection or Counter-Offer a. By offeree d. Revocation (of an Offer) i. Death 1. Offer dies if offeror dies ii. Revocation 1. Offer dies if offeror revokes iii. Key Rule Revocability of Offers: An offer can be revoked any time prior to acceptance, EVEN if offeror promises to keep offer open 1. i.e. A offers to mow B’s lawn for $100 and says, “I promise to keep offer open until Friday.” a. A can revoke on Thursday 2. *LIAR WINS iv. Revocation only effective when Received 1. Example: a. Day 1: A offers to sell land to B, “open for a week” b. Day 2: A sells same land to C c. Day 3: B learns of sale 2. Note: a. B could still accept on Day 2 b. Revocation only at Day 3 B learns A doesn’t want to contract anymore v. 3 Ways to make an Offer IRREVOCABLE 1. Option Contract a. Essentially, paying for time to think b. Example: i. A offers land to B for $1 million ii. B says, “I will pay $100 to you to keep offer open until Friday” iii. A agrees, and B pays $100 iv. A must keep offer open v. B can, but need not, buy land for $1 million 2. Reasonable Reliance on an Offer a. Bid by Subcontractor i. City wants school built, will award to the lowestbidding general contractor ii. General contractor gets bids from subcontractors (electricians, carpenters, etc.) iii. General contractor calculates bid to City by adding lowest electrician + lowest carpenter + … iv. If City awards K to general contractor, reliance on subcontractor’s bid makes a kind of “option contract” 1. Lowest subcontractor can’t revoke bid 2. General contractor can, but need not, choose lowest subcontractor b. Part Performance of Unilateral Contract i. “I will pay you $100 if you walk to Camden Yards” 1. If you begin walking, I cannot withdraw the offer 3. *UCC ONLY Firm Offer a. Signed written promise by a merchant to keep offer open i. Enforceable up to 90 days b. Note: Firm offer does NOT apply to: i. Common law, OR ii. UCC transactions involving ONLY non-merchants V. Rejection and Counter-Offer a. General Rule: Rejection and counter-offer destroy (terminate) an offer b. Rejection Destroys an Offer i. Example: 1. A offers car for $10,000 2. B says, “No” 3. B says, “OK I accept for $10,000” 4. NO CONTRACT Rejection kills offer ii. Hint: Revocation and Rejection are effective when Received c. Counter-Offer Kills Original Offer i. Offeree makes new offer for substituted bargain ii. Example: 1. A offers car for $10,000 2. B says, “I’ll take it for $9,000” 3. A says, “No” 4. B says, “OK I accept for $10,000” 5. NO CONTRACT A’s offer was destroyed by B’s counter-offer iii. *Note: Mere “INQUIRY” is NOT a counter-offer 1. A offers car for $10,000 2. B says, “That’s a high price. Could you lower it to $9,000?” 3. A says, “No” 4. B says, “OK, I accept for $10,000” 5. Valid acceptance because B only made an inquiry, not a counteroffer VI. Acceptance a. Generally i. *Exam Tip: Bad acceptance usually becomes a counter-offer ii. Only those addressed by offeror can accept offer iii. Usually can accept either by performing or promising to perform, UNLESS the offeror specifies only one way to accept b. UNILATERAL Contracts i. Accept by Performing 1. Reward 2. Real Estate Broker 3. “Success” Contracts a. “I’ll pay if you make Dean’s list” b. “I’ll pay if you win MVP” ii. Must Know Offer before Acceptance by Performance 1. If accept by performing, offeree must know of offer before performance is complete to accept unilateral offer 2. Must know of reward offer before capture c. BILATERAL Contracts i. Accept by Promising Future Performance 1. “I will give you a car, if you promise to give me $5,000” 2. Especially if BOTH parties sign d. Mailbox Rule i. Acceptance of bilateral K is effective WHEN MAILED (before received) e. What if acceptance is not identical to the offer? i. AKA Battle of the Forms ii. Example: 1. A makes offer with terms 1,2, and 3 2. B responds, “I accept with terms 1, 2, and 4” 3. Is there a contract? If so, what are the terms? iii. Common Law 1. Mirror Image Rule: Acceptance must be exactly the same as the offer a. If terms of the acceptance change EVEN ONE TERM, the “acceptance” will be viewed as a “counter-offer” iv. Special UCC Rule 2-207 1. An acceptance with clear language of agreement creates a contract, even with additional or different terms a. Contract consists of terms in the original offer and new terms are deemed proposals for addition to the contract 2. When BOTH PARTIES = MERCHANTS Contract terms include: a. Terms in original offer, AND b. New terms from acceptance IF: i. Not objected to, and ii. Do not “materially alter” (make a big change in) the contract (different terms usually materially alter the contract) 3. EXCEPTION: If acceptance says, “THIS ACCEPTANCE IS EXPRESSLY CONDITIONED ON THE OFFEROR AGREEING TO MY DIFFERENT TERMS” (MAGIC WORDS) there is NO contract, UNLESS the offeror expressly agrees to those terms a. EXCEPTION TO EXCEPTION (“Knockout Rule”): If the parties both then act like they have a contract - paying and delivering - a contract will be created by their conduct. The terms of this contract are where the 2 parties agreed, plus “UCC gap-fillers” for all other terms VII. Agency and Contract a. *MD Favorite i. Most common fact pattern is ER/EE b. Generally i. Principal is liable in contract when agent enters into a contract on principal’s behalf with AUTHORITY ii. Principal can enforce a contract against a 3rd party when the agent enters into a contract on the principal’s behalf with AUTHORITY c. Types of Authority i. Actual Authority 1. Express or implied ii. Apparent Authority iii. Ratification 1. Not really authority, but the result is the same d. Type of Principal/Liability for Agent i. Disclosed Principal 1. 3rd party knows there is a principal and knows the ID of the principal 2. Agent is NOT personally liable on the contract ii. Partially Disclosed Principal 1. 3rd party knows there is a principal, BUT does NOT know the ID of the principal 2. Agent IS personally liable on the contract iii. Undisclosed Principal 1. 3rd party does NOT know there is a principal 2. Agent IS personally liable on the contract e. Agency Related Damages i. Indemnification 1. Between principal and agent 2. Wrongdoer pays other’s entire damages ii. Contribution 1. Both principal and agent were wrongdoers 2. Each pays fair share VIII. IX. Tricky Terminology a. Express Contract i. Formed with words - oral or written ii. i.e. “I will sell you my car for $500” b. Implied (In Fact) Contract i. Formed by conduct - mutual conduct shows mutual assent ii. i.e. Sitting silently in a barber chair c. Recovery if No Enforceable Contract i. Available ONLY if there is NO enforceable contract ii. *EXAM TIP: It’s IMPOSSIBLE to NOT AGREE that quasi-contract is a MINOR issue 1. Unenforceable contract because of impossibility 2. No agreement means no contract a. i.e. Doctor saves an unconscious person. Court orders payment to avoid unjust enrichment. 3. Unenforceable contract (voidable) because of minority iii. Quasi-Contract 1. 1 concept with 4 names In essay, try to include all of these terms a. Quasi-Contract = Implied in Law Contract b. Unjust Enrichment = Purpose of Contract c. Quantum Meruit = Remedy Afforded iv. Measure of Damages for Quasi-Contract Restitution for Unjust Enrichment 1. Unjust gain to Defendant 2. i.e. Painter works 5 hours, usual rate $30/hour ($150); increased value to homeowner because paint job is $100 a. If implied-in-fact contract Recover $150 b. If quasi-contract Recover $100 Consideration a. Generally i. Consideration = Legal Detriment that is Bargained For ii. Contract needs more than agreement iii. KEY RULE (*LIAR WINS) “A gift promise without reliance is unenforceable” b. Legal Detriment i. Generally, either: 1. Do what you do not have to do, OR a. No matter how small, even if give a “peppercorn” 2. Refrain from doing what you are permitted to do a. Note: Not filing a law suit is valid consideration, if good faith belief that suit might succeed ii. Pre-Existing Duty Rule (*LIAR WINS): Not consideration if only do what already bound to do 1. Police officer captures a bank robber in jurisdiction NO REWARD 2. “A will pay $100 if B stops walking across A’s yard” a. B supplies no consideration because there is a pre-existing duty not to trespass NO CONTRACT 3. Paying less amount of AGREED upon, CURRENTLY OWED debt is NOT CONSIDERATION a. Example: i. We agree: “You owe me $1,000 today” 1. I say: “I won’t sue for the rest if you pay $700” You agree and you pay 2. I can sue for the rest. There is no consideration for my promise because you ALREADY OWED me the $ ii. BUT, enforce Creditor’s promise not to sue for the rest (Accord and Satisfaction) IF: 1. Creditor cashes check and either: a. Good faith dispute over amount owed; OR b. Debtor pays earlier than required 2. “In Full Satisfaction” Promise of creditor to not sue for remaining balance c. Modification i. Modification: An agreement to change terms of an existing contract 1. Example: a. Contract: A works for B for 1 year for $1,000/week. After 2 months, B wants to give A a raise to $1,200/week b. Problem: Where’s consideration to support B’s new promise to pay the extra $200/week? ii. To be enforceable, a modification needs: 1. An agreement to modify; AND 2. Either (1 of these 4): a. Consideration, OR i. Pay more for more work b. Recission, OR i. Physically tear up first contract and replace with new one ii. On exam, NO recission unless torn up c. Common Law, OR i. Good faith response to unforeseen hardship d. UCC i. Good faith (no extortion) d. Consideration Twists i. Illusory Promise 1. Where promisor has 100% discretion whether to perform, so no consideration 2. i.e. “I will buy if I feel like it” does not require anything - not detrimental 3. BUT, courts imply good faith and best efforts a. “I will be your exclusive agent, and give you 50% of my sales, if any” b. Courts imply best efforts, so we have a valid contract ii. Alternate Promises 1. “Or” means “do either” 2. “You will pay. I will build a fence OR stop trespassing” 3. If one option is non-detrimental No Contract iii. Multiple Exchange 1. “And” means “do both” 2. “You will pay. I will build a fence AND stop trespassing.” 3. If one prerequisite is detrimental Valid Contract e. “Bargained For” i. Consideration means detriment that’s been BARGAINED FOR 1. Need true exchange ii. NOT hidden family gift (sham) 1. Dad promises Daughter a house when he dies 2. Daughter says, “Here’s a dollar to make it binding” 3. Not enforceable iii. NOT conditional gift 1. “IF you come to my office after class, I will let you borrow my book” 2. Not enforceable iv. NOT past consideration 1. Because you named your son Wilber, I will give you $100 2. Not enforceable because it already happened v. Special EXCEPTION 1. A debt barred by the Statute of Limitations can be revived by a new promise to pay a. I owed you $1,000, now time barred b. I say, “I will pay you $600” c. Enforceable to extent of the new promise: $600 X. Promissory Estoppel a. Usually a WRONG answer b. Needs: i. Promise, AND ii. Reasonable Reliance on Promise c. KEY TIP: Don’t use promissory estoppel as an answer if problem gives you consideration d. Examples: i. “If you study 3 hours a day, I will pay for trip to every big league ballpark” 1. Enforce fully because of consideration, NOT because of promissory estoppel ii. “Because you studied hard, I will pay for trip to every big league ballpark” 1. You go to 3 parks, and then I call to cancel 2. Enforce because of promissory estoppel, despite no consideration (only past consideration) 3. However, only get cost of reliance a. 3 parks and then come home…why? (see below) e. IMPORTANT: Only enforce “to extend necessary to avoid injustice” i. Frequently, does not enforce the total promise XI. Statute of Frauds a. When Applicable i. “SLY ME GOODS” 1. Need writing for contract to be enforceable if contract involves SLY ME GOODS a. Suretyship b. Land c. Not performable within one Year d. Marriage Contracts e. Estate Executor’s Contracts f. GOODS princes $500 or more ii. S = Suretyship 1. Guaranty debt of another a. Song of Suretyship = “If he doesn’t pay you back, then I will” b. 2 contracts with the same creditor primary debtor and surety - contingent debtor 2. Needs a writing (plus either consideration or reliance) to be enforceable 3. STRANGE EXCEPTION a. *MD = If the “main purpose” of the surety is to protect his own economic interest, its called an “original undertaking” and does not need a writing i. Example: One debtor, many creditors. Creditor A threatens to drive debtor into bankruptcy. Creditor B wants debtor to stay in business so tells Creditor A, “If the debtor doesn’t pay you back, then I will.” Since the main purpose is B’s own economic gain, this is an original undertaking and does not need a writing. b. *MULTISTATE = Same concept as above, but its called the “Main Purpose” Exception and does not need a writing as well iii. L = Land 1. Transferring any interest in land needs a writing 2. EXCEPTION - PART PERFORMANCE a. Pay, occupy, and improve i. i.e. Oral K to buy land; Buyer pays, moves on land, and builds fence; enforceable even though not written iv. Y = Contract Not Performable within One Year 1. If K has a time period requiring performance to extent beyond 1 year from the date of the making of the K, you need a writing for the K to be enforceable 2. TIP: Compare date when K is MADE with EARLIEST time when performance might POSSIBLE BE COMPLETED a. Contract: “Work for 2 years” i. NEEDS writing b. Contract Today: “Work for 1 year” i. Does NOT need a writing c. Contract Today: “Work for 1 year starting after the bar exam” i. NEEDS writing d. Contract Today: “Work for 1 day, July 4, 2020” i. NEEDS writing e. Contract Today: “Work for life” i. Does NOT need writing - could die tomorrow f. Contract Today: “Cut down all the trees in Alaska” i. Does NOT need a writing because K does not contain a time provision ii. It theoretically could be performed quickly 3. TRICK: Clock restarts if “restate terms” a. Oral 13 months contract (not enforceable) but… i. After 2 months, employer says, “You have 11 months to go.” 1. Because can finish in less than a year after “restatement” - now enforceable v. M = Marriage 1. Promise to give consideration in exchange for marriage must be written vi. E = Estate Executor’s Contracts 1. Like the surety rule, where executor agrees to be personally liable for an estate obligation - must be written vii. G = Goods 1. Goods with price of $500 or more b. SOF Writing Requirement i. Writing that satisfies the Statute of Frauds “Written Memorandum” (anything written down) ii. Common Law (SLY ME) Needs: 1. All essential terms, PLUS a. Price, amount, time 2. Signature of party “being charged” (defendant) a. Example: Law firm writes you, offering 3 year job; you call to accept. They signed the writing and can be “charged” if they breached. You did not sign; you are NOT bound by the K b. STRANGE RULE 3. MD EXCEPTION a. In-court admission that K exists satisfies the statute iii. UCC (GOODS) Needs: 1. Only essential term is quantity 2. Need signature of party “being charged” BUT… a. Merchant’s Exception: If 2 merchants, one sends signed writing that satisfies SOF for both, UNLESS the other gives written objection in 10 days 3. UCC EXCEPTIONS TO SOF Do NOT need writing for UCC if: a. “Specially manufactured goods” b. In-court admission that K exists c. To the EXTENT that goods have been accepted and paid for XII. Terms of the Contract a. READ the Contract b. PAROL EVIDENCE RULE i. Generally 1. Parol evidence is Prior to a written contract 2. ISSUE: Is the jury allowed to consider what preceded a written contract to interpret its meaning? 3. How to analyze: a. Is the writing intended to be a final “contract” Intended to be integrated? i. If not, OR if oral K Use all evidence to interpret contract meaning b. If the writing was “intended to be final” Is the writing “fully” or “partially” integrated? ii. Partial v. Full Integration 1. FULL (TOTAL) Integration If not written, NOT part of K 2. PARTIAL Integration Use parol evidence to add terms, but can NOT contradict writing 3. PRESUME PARTIAL INTEGRATION OF WRITTEN K 4. Merger Clause aka Integration Clause: a. If there is a conspicuous “merger clause” stating, “This K is total and complete” Treat as FULL Integration 5. Example: a. Writing says, “Deliver Delicious Apples; $1 a bushel.” Seller ships Red Delicious Apples. Buyer claims oral agreement for Golden Delicious. i. If FULL integration Stick to writing, color not in K, NO breach ii. If PARTIAL integration Color “supplements” writing, part of K, breach b. Note: Cannot use oral evidence to say 90 cents a pound contradicts writing iii. WHEN do you ALWAYS allow in Parol Evidence? 1. Allow in evidence occurring AFTER the contract 2. Allow in order to clear up ambiguity a. 2 reasonable meanings for the same word or phrase 3. To show NO K at all a. i.e. Fraud 4. To show K’s existence was conditioned on some contingency 5. Example: a. Writing says, “A + B will swap stocks.” A wants to prove they had an oral agreement stating either: i. “Until we raise $1 million, K is NOT IN EFFECT.” 1. Without $ there is no K at all All evidence for parol evidence rule comes in ii. “Until we raise $1 million, this agreement is NOT BINDING.” 1. Without $ there is no K at all All evidence for parol evidence rule comes in 2. iii. “Until we raise $1 million, we don’t have to PERFORM.” 1. Don’t have to perform; K still exists b. Use parol evidence to show i and ii Showing no K at all exists c. If merger clause Can’t use parol evidence to show example iii above, because this does NOT deny the existence of a K, just do not need to perform 6. UCC: Use to supplement, but NOT contradict, the writing with (in order of preference): a. Course of Performance i. What these parties have done under this contract b. Course of Dealing i. What these parties have done in the past c. Trade Usage i. What those in the same business do c. Duties and Conditions i. Duty = Promise 1. Covenant, obligation, guaranty, I will, you shall, you must 2. Perform or pay damages, UNLESS excused 3. Excuses like “changed circumstances” or … failure of condition ii. Condition = Event that causes a duty to be owed 1. Express Condition a. Language of express condition: “If,” “When,” “Unless,” “On condition that…” b. Example: IF I have an accident (condition), Allstate will pay me (duty). c. Express Conditions must be literally fulfilled i. Example: K “If A wins 20 games, B will pay a bonus.” “If A wins 19 games, B does not have to pay a bonus.” 2. Constructive Condition a. 2 independent sounding duties without an express relationship b. Constructive conditions need only be substantially performed c. Example: K “A will clean 100 windows. B will pay.” If A substantially performs, B will have to pay something. (If A cleans 99 windows, B must pay K price MINUS harm caused by the breach.) 3. Who goes First in Constructive Conditions? a. If one long performance and one short Long (painting) goes first b. If both short (stock for stock, money for title) called “concurrent conditions” Whoever wants to go first, goes first. If no one does, then there is no breach. d. e. f. g. c. Contract can always give order of performance: “Pay Monday, paint Tuesday” Covenant Not to Compete i. Enforce to extent REASONABLE in 3 ways: 1. Time a. How long can’t you compete? 2. Geography a. Where can’t you compete? 3. Scope a. In what kinds of work can’t you compete? ii. Purpose of a covenant not to compete must be to prevent unfair competition (from using trade secrets or stealing clients due to inside information). It is not to be enforced if purpose is to limit competition in general. Good Faith i. In every aspect of contract performance ii. UCC Honesty 1. For merchants, honesty and “fair dealing” iii. Imply “best efforts” by exclusive agents iv. Non-Prevention: Can’t benefit by preventing the other from completing the task v. Condition of Satisfaction: Usually, must be subjective, good faith determination 1. Rejection allowed if dissatisfied with performance, NOT with COST 2. For 3rd party satisfaction (architect), parties bound by good faith decision (no fraud) Liquidated Damages i. Definition: A clause/statement in contract of remedy in case of breach ii. If provided for in K, can recover liquidated damages for breach iii. But, only recover liquidated damages if they are a “reasonable estimate” of the harm that could be anticipated iv. If liquidated damages are excessive, treat as unenforceable punitive damages UCC Warranties i. Promise of Quality: Can be express or implied 1. EXPRESS Warranties a. Fact statement (odometer) or Promise (repair for the next 30 days) b. NOT puffery or opinion i. i.e. “I Can’t Believe It’s Not Butter” c. Express warranty rules apply to common law contracts too i. Cannot (usually) be disclaimed 2. IMPLIED Warranties a. Generally i. Merchantability and Fitness for a Particular Purpose b. Merchantability - Must be a merchant i. Goods fit for “ordinary purpose” No defects 1. 3 typical defects: a. Manufacturing Defect b. Design Defect c. Insufficient Instructions ii. ONLY if sold by a MERCHANT iii. To disclaim Must use word “merchantability” and be conspicuous c. Fitness for Particular Purpose i. *MD Favorite ii. Goods fit for buyer’s special purpose iii. NEED: 1. Special (not ordinary) purpose for buying goods; 2. Seller knows purpose; AND 3. Buyer relies on seller a. Buyer NOT rely if ask for trade name iv. Fitness warranty can be given by ALL UCC SELLERS (MERCHANTS and NON-MERCHANTS) v. Disclaimed by conspicuous language - “as is” ii. Disclaimers of Implied Warranties 1. MBE a. Can disclaim both implied warranties with conspicuous language Use word “merchantability” in disclaimer b. Implied warranties disclaimed if sold “as is” or “junk” c. Cannot disclaim express warranties 2. *MD Difference a. Can NOT disclaim either implied warranty for consumer goods b. Manufacturer can NOT limit remedies for breach of express warranty for consumer goods, UNLESS the manufacturer provides easy means to perform express warranty obligations h. Express UCC Terms i. Output and Requirements Contracts 1. Output Contract a. Buyer promises to buy all seller produces b. “I will buy all the bread crumbs you bake” 2. Requirements Contract a. Seller promises to provide all the buyer needs b. “I will provide you all the gasoline you need” 3. What Amount is Due? a. “Not unreasonably disproportionate from estimates or past practice” b. Ask: Is there a good faith reason for large deviation? ii. Installment Contracts 1. K provides for multiple deliveries of goods iii. Places of “Delivery” 1. Legal Delivery: When legal ownership changes, not necessarily physical possession; can occur at 4 possible places: a. Seller’s place of business b. 3rd party holds goods (garage, repair shop) c. Shipment Contract: When seller gives to ship, truck, etc. d. Destination Contract: When goods actually reach buyer iv. Mercantile Symbols 1. Shorthand for when during transit, obligations and risks shift from seller to buyer 2. FOB = Free for Buyer until… a. “FOB NYC” Free for buyer until goods reach NYC; seller responsible until then, and buyer is responsible after b. “FOB Cars” Free for buyer until seller loads goods onto cards c. “FOB Shipment Point” Free for buyer until at dock; buyer pays to load and ship XIII. Performance a. Do the facts show that the duties discussed in the “terms” section were performed? b. Risk of Loss i. “Delivery” and Risk of Loss 1. KEY TIP: Which party loses when goods are destroyed depends on location of “delivery” ii. Who loses when goods are destroyed? 1. If delivery at seller’s place of business: a. If seller is a merchant Risk of loss stays on seller until pickup b. If seller is a non-merchant Risk to buyer a “reasonable time” after goods available 2. If goods move in transit: a. If Shipment K or “FOB Seller’s Place” Risk on buyer after the carrier gets goods b. If Delivery K or “FOB Buyer’s Place” Risk on seller until at delivery point 3. If train blows up and goods are destroyed: a. If risk on buyer Buyer pays price and gets nothing b. If risk on seller Seller replaces or is liable for nondelivery i. BUT - Identified Goods: 1. If a specific good is “identified” at time of K (and specific unique antique desk or buyer is told common goods “selected” for buyer), and destroyed, and risk on seller no breach - neither party has to perform 2. Basically: If goods have been identified and goods are destroyed K is now void because K is now impossible (no breach) a. But if goods are not identified, then seller still needs to perform by sending new goods 4. Special cases: a. If seller ships non-conforming goods Risk always on seller b. “Sale on Approval” Contract says buyer is purchasing goods for OWN use and can return even if they conform Return at seller’s risk c. “Sale or Return” Contract says buyer has right to return conforming goods that are not resold Return at buyer’s risk XIV. Excuses and Defenses a. Generally i. Some are defenses to contract formation, leading to a finding that no contract never existed OR that the contract is voidable ii. Some excuse performance where there was a valid contract b. Capacity i. Usually minors (under 18 years old) 1. If under 18, contract is VOIDABLE 2. ONLY the kid can get out, adult is bound 3. ONLY obligation for kid Return what they have, if anything 4. EXCEPTION FOR NECESSARIES (food, clothing, etc.) a. Then, enforce as a “quasi-K” Is it a fair price for kid to pay? 5. Kid can avoid (get out of K) any time while a kid 6. To RATIFY K (lose power to get out), kid becomes adult, AND a. Does a positive act indicating assent; OR b. Does nothing for “too long” after becoming an adult c. Illegality d. e. f. g. i. Usual Rule: Courts do not want to be involved AT ALL with illegal contracts ii. If one party is “less” at fault (debtor v. loan shark) Weaker party can sue iii. If K was legal, but performance became illegal 1. “Impossible” to perform; no one is bound iv. If only part of K is illegal Sever and enforce the rest Unconscionability i. So one-sided as to “shock the conscience” ii. Only if unfair when made, not later events iii. Unconscionability is a question of law (for judge) iv. Result: Court can strike out or limit unfairness 1. Contract NOT AVOIDABLE Fraud i. Makes K VOIDABLE ii. Known lie iii. No duty to give information, UNLESS need to: 1. Correct previous statement which has become inaccurate 2. Correct known arithmetic error 3. Correct “Basic Assumption” that other party could not discover on their own iv. Full disclosure if fiduciary (lawyer, broker) Duress i. Deprive of meaningful choice ii. Makes K VOIDABLE iii. NOT duress if take advantage of economic distress YOU DID NOT CAUSE iv. ONLY duress if “wrongful threat” (i.e. “You will lose custody of your kids if you don’t take pay cut.”) or physical threat Mistake i. Mistake of Material Fact at time of K - Makes K VOIDABLE 1. NOT bad prediction (“I thought stock would rise”) 2. NOT a “mistake” when assumed risk of error a. K says, “Pay even if wrong.” b. Conscious Uncertainty i. If you are aware you lacked sufficient knowledge and proceed anyway ii. “I have a rock and am not sure what it is. I think it’s only a topaz.” I sell it for $10. It turns out to be a diamond worth $50K. NOT VOIDABLE. ii. Mutual Mistake (LEGAL TERM) 1. Both parties wrong on material fact at time of K a. Sell land with trees. Unknown to both, prior to K, fire destroys all trees. VOIDABLE. iii. Unilateral Mistake 1. One party wrong (Usually contractor bids too low) 2. Only avoid K if non-mistaken party knew or should have known error OR if result is “unconscionable” a. Example: i. Four Bids: 3, 4, 5, and 6. Even if low bid is “error,” K NOT VOIDABLE ii. Four Bids: 3, 7, 7, and 7. Low bid is an “obvious error,” K VOIDABLE iv. Plain English Mistakes (Not legal mistakes) 1. Misunderstanding: 2 ships named Peerless, each party had different equally reasonable understanding of the same word No K 2. Mistake in Transmission: Fax received different than sent a. K as received UNLESS mistake “known or should have been known” 3. Reformation a. 3 part story i. Oral agreement ii. Intend to put specific term in writing iii. Writing omits or restates term b. Result i. Reform writing to include correct term ii. K NOT VOIDABLE h. Changed Circumstances - AFTER THE K IS MADE i. MIGHT excuse non-performance, if not assume risk ii. Types of Excuse by Changed Circumstances: 1. Impossibility 2. Frustration 3. Impracticability iii. General Format 1. Day 1, K. Day 2, something surprising happens. Day 3, performance due. i. Impossibility (LEGAL TERM) i. *BE CAREFUL: Bar examiners like to try and trick you by using impossibility in its plain English meaning ii. Requires OBJECTIVE Impossibility 1. No one could do it (i.e. port blockaded now illegal to do) 2. NOT “I’m out of money” iii. Personal Service K and promisor dies 1. “Picasso will paint picture” 2. BUT, if K to buy car and buyer dies, estate must pay iv. Destruction of SPECIFICALLY MENTIONED subject matter 1. K to rent Carnegie Hall, which burns down Performance excused 2. Farmer contracts to sell 100 bushels of potatoes from HIS FARM; and drought causes no potatoes to grown on his farm Performance excused a. TRICK: If Farmer contracts to just sell “potatoes” - NOT potatoes from HIS FARM - he can always go to market to buy other potatoes to perform K v. NOTE: IF impossibility happens after performance begins 1. K to fix roof, ½ is done, fire destroys HOUSE. Impossible to fix roof when house is gone; roofer is “excused.” a. Gets paid pro rata share (1/2) for work as “quasi-K” j. Frustration of Purpose i. K has NO value 1. Pay to watch parade, and parade is cancelled a. There is zero value in sitting in the room and watching an empty street k. Impracticability i. Unforeseen change fundamentally alters nature of performance 1. Prices double; work MUCH harder than expected 2. Mathematically, at least more than TWICE the amount of performance XV. Is There a Breach? a. Breach at Common Law i. 3 Types of Breaches Total, Material, and Partial 1. Total Breach a. A total breach is either: i. A repudiation, or 1. An unequivocal statement of nonperformance ii. A very, very serious breach, or iii. A material breach that has not been cured 2. Material Breach a. A material breach occurs when there is “no substantial performance” i. If promisor does less than 90-95% There is a material breach 1. i.e. Building only ¾ of a house is a material breach 3. Partial Breach a. Occurs when there is “substantial performance” but some (usually minor) breach i. i.e. Paints all of house, but missed the garage door ii. EFFECT of Different Types of Breaches 1. Total Breach a. Permits victim to: i. Rescind contract ii. Suspend own performance 1. i.e. Need not pay breacher iii. Sue for damages iv. Hire replacements 2. Material Breach a. Permits victim to: i. Suspend own performance 1. i.e. Need not pay breacher ii. Sue for damages iii. Can NOT hire replacements yet 3. Partial Breach a. Permits victim to: i. Can NOT suspend own performance 1. Must still perform a. i.e. Must pay breacher ii. Sue for damages iii. Late Performance 1. Brief delay in performance usually is NOT a material breach, UNLESS K says, “Time is of the essence.” b. Breach Under UCC i. Perfect Tender Rule 1. The buyer can reject the entire shipment if there is ANY defect, no matter how small ii. Right to Cure? 1. Can seller repair defect or try again? Usually NO, UNLESS: a. Time left on K to perform, OR i. To deliver car on May 15, but deliver on May 1 b. Seller in Good Faith believed foods were going to be acceptable, OR i. Ship different but “improved” version of product c. For Installment K (multiple deliveries), Seller always has right to cure c. Divisibility i. Look for UNIT PRICING 1. Paint 3 houses, $2,000 EACH ii. TRICK: Treat each unit like a separate contract iii. Employment Contract 1. Usually divisible by salary period (i.e. weekly) iv. Construction Contract 1. Usually not divisible d. Waiver and Ratification i. *MD Favorite ii. Waiver 1. Intentional relinquishment of known right 2. Say, “It’s OK if you deliver a few days late” a. Irrevocable upon reliance iii. Ratification 1. Proceeding after knowledge of mistake, etc. XVI. WHEN Can You Sue for Breach of Contract? a. Non-Performance i. Normally, only when it’s time for duty and duty actually not performed as promised b. Anticipatory Repudiation i. Sometimes can sue when TOLD performance won’t occur ii. Repudiation: 1. Clear and unequivocal statement or act, “I won’t perform” iii. EXAMPLE 1. K made on 1st for A to paint on the 15th and B to pay on the 15th. On the 10th, B says, “I won’t let you paint.” A can sue on the 10 th OR wait until the 15th when performance was due. iv. BAR TRICK 1. Plaintiff can’t sue early, but MUST WAIT for time when performance is due IF either: a. Good faith dispute over K i. Disagree over what’s required b. Plaintiff has finished performance i. Example: K says, “A paints on the 15th. B to pay on the 20th.” On the 16th, A is finished. B says, “I won’t pay.” Because A is done working, A can’t sue on the 16th. A must wait until the 20th to sue. BUT, if A was only partly done on the 16th, would be able to sue on the 16th. v. Retraction: 1. Repudiation can be retracted (“I changed my mind, I’ll let you paint.”) UNLESS the other party: a. Sues, b. Relies on repudiation, OR c. States, “I accept your repudiation” vi. UCC ONLY 1. “Demand assurances” if: a. Reasonable grounds for feeling insecure; and b. Make written demand for assurances (can suspend own performance while wait); and c. If not receive good assurances in 30 days, treat as repudiation and sue for breach i. Quicker assurance if performance is due soon XVII. 3rd Party Issues a. 3rd Party Beneficiary i. Example 1. A + B make a contract; A will paint B’s house, if B pays C 2. C is NOT a party to the contract, but may have rights ii. 3 Issues: 1. Who Has Rights? 2. Defenses During Litigation 3. Vesting iii. Who Has Rights? 1. INTENDED Beneficiaries a. ONLY intended beneficiaries have rights b. KEY: One party wants to help; the other knows of intent c. TIP: Look for 3rd party NAMED in contract and facts give some “reason” for helping him i. Example: Creditor or relative of one of the parties 2. INCIDENTAL Beneficiaries a. If no one really cares about 3rd party, he’s an incidental beneficiary b. Incidental beneficiaries have NO rights iv. Defenses During Litigation 1. EXAMPLE a. A and B make a contract b. A will paint B’s house, if B pays C c. After A paints, if B does not pay, either A (who is a party to the K) or C (intended 3rd party) can sue d. If A sues, B may have defenses i. Breach by A, limitations, etc. e. If 3rd party C sues, any defense B could have used against A, can be used against C v. Vesting 1. When A and B lose the right to change K, without C’s consent 2. Before vesting A and B can change K so that C gets nothing 3. After vesting A and B cannot change K without C’s approval 4. If K SILENT, vesting occurs when 3rd party either: a. Changes position in reliance; b. Sues to enforce; OR c. Says, “I assent to this arrangement” 5. TIP: If C does NOT know of K, can’t be vested. So A and B can change K to exclude C. b. Assignment and Delegation i. Generally 1. 2 different things Even though exam often uses “assignment” to refer to both 2. You assign RIGHTS to RECEIVE benefits 3. You DELEGATE DUTIES to DO something 4. It’s easy to assign rights, it’s difficult to delegate duties ii. Assignment 1. Presume allowed to assign rights, unless K specifically says, “Assignments are VOID” or “Assignment of Rights is Prohibited” a. *MAGIC WORDS b. CAN assign rights even if K says, “I will NOT assign this contract.” i. Still a breach, but damages are likely only nominal 2. Gift assignments are enforceable a. Like any other gift, NEED: i. Present donative intent (intend to give NOW), AND ii. Delivery 1. Of some physical thing - title, bank book, piece of paper 3. Defenses during litigation involving assignments - EXAMPLE: a. A sells TV on credit to B. A assigns right to receive payments to C. b. A is assignor; C is assignee; B is obligor (or debtor) c. If B does not pay, C stands in the shows of assignor A for lawsuit d. C can sue B, but i. Any defenses B could have used against A (i.e. breach of warranty, fraud) are usable against C ii. RULE: If B wouldn’t have had to pay A, not have to pay C 4. Duty to NOT Impair Value of Assignment a. Assignor (A) has responsibility to Assignee (C) Not impair value of assignment b. Example i. If Assignor (A) breaches warranty, Obligor (B) does not have to pay Assignee (C) ii. Assignor (A) then must pay Assignee (C) damages iii. Delegation 1. Delegation NOT allowed if: a. “No delegation” clause included in contract b. Even without “no delegation” clause in contract, do NOT allow delegation of “personal skill” - someone of especially high skill 2. If delegation is allowed, Delegator remains liable a. EXAMPLE: I agree to mow your lawn. I delegate my duty by hiring kid to mow your lawn. If kid does a bad job, I am still responsible, UNLESS… (Novation) 3. EXCEPTION Novation a. An express agreement to substitute and relieve the original promisor (delegator) of duty Delegator no longer liable b. HINT: NEVER IMPLY A NOVATION i. Only find a novation if there is an express statement that the original party is being replaced and relieved 4. TIP: Look for delegation of contract duty; original obligee (party owed duty in original K) is an intended beneficiary a. EXAMPLE: B contracts to mow A’s lawn; B delegates duty to mow to C; A is an intended beneficiary of K between B and C and can sue C to enforce it. XVIII. Remedies a. UCC Obligations PRIOR TO RECOVERY i. Buyer options for delivery of NON-CONFORMING goods 1. Reject; Accept; or Revoke Acceptance 2. NOTE: Do NOT confuse this “acceptance” of goods with the “acceptance” of an offer that creates a contract 3. Rejection of Goods a. Buyer can reject goods for ANY defect (Perfect Tender Rule) b. Then, treat as if NEVER delivered 4. Acceptance of Goods a. NOTE: Do NOT confuse this “acceptance” of goods with the “acceptance” of an offer that creates a contract b. Buyer accepts goods by saying “OK” or failing to reject after time to inspect i. NOTE: Buyer can physically have goods and pay for them without accepting prior to time to inspect c. Buyer can accept and keep defective goods and sue for Warranty Damages: i. Value of Goods As Warranted MINUS Value of Goods As Delivered 1. Only if buyer GIVES NOTICE of defect/breach in REASONABLE TIME 5. Revocation of Acceptance a. *MD Favorite b. Buyer can revoke acceptance ONLY IF: i. Defection substantially impairs value (big problem), AND ii. EITHER 1. Buyer was told defect would be fixed and it wasn’t, OR 2. Defect was difficult to discover on reasonable inspection c. If allowed to revoke acceptance, treat as rejection b. Goal of Contract Remedies i. Usually the remedy is $$$$ ii. GOAL is to compensate victim, not punish breacher c. Expectancy Damages i. Generally 1. Put victim where would have been if K was performed 2. 3 Types of Damages (Can recover all 3): a. Direct Damages b. Consequential Damages c. Incidental Damages ii. Direct Damages 1. Difference between value of what you would have gotten if K performed and value of what you actually received 2. EXAMPLE: K to build $100,000 home a. If BUILDER breaches and buyer gets new builder for $115,000 i. Damages: NEW K - OLD K 1. 115,000 - 100,000 = 15,000 b. If BUYER repudiates BEFORE work begins, and labor plus supplies would cost $80,000 i. Damages: K PRICE - COST AVOIDED 1. 100,000 - 80,000 = 20,000 (or “expected profit”) c. If BUYER repudiates AFTER some work done, and builder already put in $10,000 i. Damages: AMOUNT PUT IN + LOST PROFIT 1. 10,000 + 20,000 = 30,000 d. UCC Damages i. Different remedies/damages for Buyer and Seller ii. EXAMPLE: K for $10,000 car iii. BUYER’S Remedies 1. If no delivery or there is a proper rejection OR revocation of acceptance, BUYER can sue for either: a. COVER DAMAGES Buy substitute goods, OR i. If get replacement car at good faith price of $10,500 1. DAMAGES: COVER PRICE - K PRICE a. 10,500 - 10,000 = 500 b. MARKET PRICE DAMAGES i. If market price of that car at time of breach has increased to $11,000 1. DAMAGES: MARKET PRICE - K PRICE a. 11,000 - 10,000 = 1,000 iv. SELLER’s Remedies 1. If buyer does not accept conforming goods, SELLER can sue for either: a. RESALE DAMAGES, OR i. If resell in commercially reasonable way for $8,000 1. DAMAGES: K PRICE - RESALE PRICE a. 10,000 - 8,000 = 2,000 b. MARKET PRICE DAMAGES i. If market price of that care at time and place of delivery has decreased to $9,000 1. DAMAGES: K PRICE - MARKET PRICE a. 10,000 - 9,000 = 1,000 2. 3 Special Remedies for Special Circumstances a. Resell Unfinished Goods i. If goods are being manufactured when buyer repudiates; ii. Seller either finishes and resells OR stops work and sells as junk 1. Whichever leads to the lowest damages b. Action for Lost Profits i. Lost Volume Seller: If seller had 10 boats, K with A to buy a boat, A repudiates, and seller sells same boat to B at same price ii. The remedy is Lost Profit 1. Seller would have sold 2 boats but for the breach c. Action for the Price i. Seller can sue for full K price ONLY if can’t resell: 1. NO Resale Market, or 2. Goods destroyed, or 3. Buyer wrongfully keeps goods e. Consequential Damages i. Generally 1. Flow FROM direct damages a. EXAMPLE: Bad construction of motel roof 2 types of damages i. Cost of repair of roof Direct Damage ii. Lost profit while being repaired Consequential Damage ii. 3 Limitations on Consequential Damages 1. Foreseeable a. Foreseeable at time of K b. Foreseeable means either: i. “Naturally occurring” - Natural and probable consequences of the breach, OR ii. Disclosed - Contemplated by the parties 2. Reasonably Certain a. Damages must be established with reasonably certainty b. Use business’s history to assess certainty of damages c. Note: Lost profit of a new business is not “reasonably certain,” UNLESS it replaced a similar business at the same location or same owner has other stores 3. Unavoidable - Duty to Mitigate a. KEY TIP: Never recover for losses you could HAVE PREVENTED b. Never recover for unnecessary payments (gratuity or tip) c. Note: Employee suing former employer need only take “similar job” to mitigate damages f. Incidental Damages i. Minor expenses resulting from breach 1. i.e. postage and handling; advertising and storage g. Summary - Example i. UCC K for $10K ice cream maker; no delivery; Buyer advertises for new machine in paper costing $100 (cost of ad); Buyer buys replacement machine for $12K and loses $500 profits while waiting for new machine 1. Buyer can recover: a. Direct Damages from “cover” 12,000 - 10,000 = 2,000 b. Consequential Damages Lost profits of 500 c. Incidental Damages Cost of ad 100 h. NO PUNITIVE DAMAGES i. Never penalize for breach ii. But, if provided in K, can recover Liquidated Damages if they are a “reasonable estimate” of the harm that could be anticipated i. SPECIFIC PERFORMANCE i. Equitable Remedy - Injunction to perform K promise ii. KEY TIP: Only get specific performance if “unique” iii. UCC 1. Unique goods (1940 Rolls Royce), or 2. Irreplaceable K (long-term K when no one else in the business is offering) iv. Land 1. All real estate v. Employment 1. Can’t force someone to work, but can stop from working elsewhere