NBER Summer Institute Econometrics Methods Lecture: GMM and Consumption-Based Asset Pricing

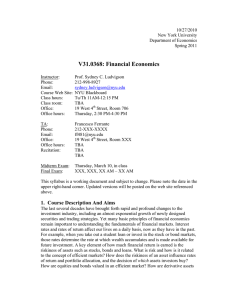

advertisement

NBER Summer Institute Econometrics

Methods Lecture:

GMM and Consumption-Based Asset Pricing

Sydney C. Ludvigson, NYU and NBER

July 14, 2010

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

...emphasize here: all models are misspecified, and macro

variables often measured with error. Therefore:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

...emphasize here: all models are misspecified, and macro

variables often measured with error. Therefore:

1

move away from specification tests of perfect fit (given

sampling error),

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

...emphasize here: all models are misspecified, and macro

variables often measured with error. Therefore:

1

move away from specification tests of perfect fit (given

sampling error),

2

toward estimation and testing that recognize all models are

misspecified,

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

...emphasize here: all models are misspecified, and macro

variables often measured with error. Therefore:

1

move away from specification tests of perfect fit (given

sampling error),

2

toward estimation and testing that recognize all models are

misspecified,

3

toward methods permit comparison of magnitude of

misspecification among multiple, competing macro models.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Themes

Why care about consumption-based models?

True systematic risk factors are macroeconomic in

nature–derived from IMRS over consumption–asset

prices are derived endogenously from these.

Some cons-based models work better than others, but...

...emphasize here: all models are misspecified, and macro

variables often measured with error. Therefore:

1

move away from specification tests of perfect fit (given

sampling error),

2

toward estimation and testing that recognize all models are

misspecified,

3

toward methods permit comparison of magnitude of

misspecification among multiple, competing macro models.

Themes are important in choosing which methods to use.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Incorporating conditioning information: scaled

consumption-based models

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Incorporating conditioning information: scaled

consumption-based models

Generalizations of CRRA utility: recursive utility

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Incorporating conditioning information: scaled

consumption-based models

Generalizations of CRRA utility: recursive utility

Semi-nonparametric minimum distance estimators:

unrestricted LOM for data

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Incorporating conditioning information: scaled

consumption-based models

Generalizations of CRRA utility: recursive utility

Semi-nonparametric minimum distance estimators:

unrestricted LOM for data

Simulation methods: restricted LOM

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM and Consumption-Based Models: Outline

GMM estimation of classic representative agent, CRRA

utility model

Incorporating conditioning information: scaled

consumption-based models

Generalizations of CRRA utility: recursive utility

Semi-nonparametric minimum distance estimators:

unrestricted LOM for data

Simulation methods: restricted LOM

Consumption-based asset pricing: concluding thoughts

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Economic model implies set of r population moment

restrictions

E{h (θ, wt )} = 0

| {z }

(r × 1 )

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Economic model implies set of r population moment

restrictions

E{h (θ, wt )} = 0

| {z }

(r × 1 )

wt is an h × 1 vector of variables known at t

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Economic model implies set of r population moment

restrictions

E{h (θ, wt )} = 0

| {z }

(r × 1 )

wt is an h × 1 vector of variables known at t

θ is an a × 1 vector of coefficients

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Economic model implies set of r population moment

restrictions

E{h (θ, wt )} = 0

| {z }

(r × 1 )

wt is an h × 1 vector of variables known at t

θ is an a × 1 vector of coefficients

Idea: choose θ to make the sample moment as close as

possible to the population moment.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Sample moments:

T

g(θ; yT )≡ (1/T ) ∑ h (θ, wt ) ,

| {z }

t= 1

(r × 1 )

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Sample moments:

T

g(θ; yT )≡ (1/T ) ∑ h (θ, wt ) ,

| {z }

t= 1

(r × 1 )

yT ≡ wT′ , wT′ −1 , ...w1′

Sydney C. Ludvigson

′

is a T · h × 1 vector of observations.

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Sample moments:

T

g(θ; yT )≡ (1/T ) ∑ h (θ, wt ) ,

| {z }

t= 1

(r × 1 )

yT ≡ wT′ , wT′ −1 , ...w1′

′

is a T · h × 1 vector of observations.

b minimizes the scalar

The GMM estimator θ

′

Q (θ; yT ) = [g(θ; yT )] WT [g(θ; yT )],

( 1× r )

(r×r)

(1)

( r × 1)

{WT }T∞=1 a sequence of r × r positive definite matrices

which may be a function of the data, yT .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Sample moments:

T

g(θ; yT )≡ (1/T ) ∑ h (θ, wt ) ,

| {z }

t= 1

(r × 1 )

yT ≡ wT′ , wT′ −1 , ...w1′

′

is a T · h × 1 vector of observations.

b minimizes the scalar

The GMM estimator θ

′

Q (θ; yT ) = [g(θ; yT )] WT [g(θ; yT )],

( 1× r )

(r×r)

(1)

( r × 1)

{WT }T∞=1 a sequence of r × r positive definite matrices

which may be a function of the data, yT .

If r = a, θ estimated by setting each g(θ; yT ) to zero.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Sample moments:

T

g(θ; yT )≡ (1/T ) ∑ h (θ, wt ) ,

| {z }

t= 1

(r × 1 )

yT ≡ wT′ , wT′ −1 , ...w1′

′

is a T · h × 1 vector of observations.

b minimizes the scalar

The GMM estimator θ

′

Q (θ; yT ) = [g(θ; yT )] WT [g(θ; yT )],

( 1× r )

(r×r)

(1)

( r × 1)

{WT }T∞=1 a sequence of r × r positive definite matrices

which may be a function of the data, yT .

If r = a, θ estimated by setting each g(θ; yT ) to zero.

GMM refers to use of (1) to estimate θ when r > a.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Asym. properties (Hansen 1982): b

θ consistent, asym.

normal.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Asym. properties (Hansen 1982): b

θ consistent, asym.

normal.

Optimal weighting WT = S−1

∞

S =

r×r

∑

E

j=− ∞

Sydney C. Ludvigson

′

.

[h (θo , wt )] h θo , wt−j

{z

}

| {z } |

r×1

1× r

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

Asym. properties (Hansen 1982): b

θ consistent, asym.

normal.

Optimal weighting WT = S−1

∞

S =

r×r

∑

E

j=− ∞

′

.

[h (θo , wt )] h θo , wt−j

{z

}

| {z } |

r×1

1× r

In many asset pricing applications, it is inappropriate to

use WT = S−1 (see below).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

b T . Employ an

b T depends on b

θT which depends on S

S

iterative procedure:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Review (Hansen, 1982)

b T . Employ an

b T depends on b

θT which depends on S

S

iterative procedure:

1

2

3

4

(1)

Obtain an initial estimate of θ = b

θT , by minimizing

Q (θ; yT ) subject to arbitrary weighting matrix, e.g., W = I.

(1)

(1)

b .

Use b

θT to obtain initial estimate of S = S

T

(1 )

b ; obtain

Re-minimize Q (θ; yT ) using initial estimate S

T

(2)

b

new estimate θT .

Continue iterating until convergence, or stop. (Estimators

have same asym. dist. but finite sample properties differ.)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Classic Example: Hansen and Singleton (1982)

Investors maximize utility

max Et

Ct

Sydney C. Ludvigson

"

∞

∑ β i u (C t + i )

i= 0

#

Methods Lecture: GMM and Consumption-Based Models

Classic Example: Hansen and Singleton (1982)

Investors maximize utility

max Et

Ct

"

∞

∑ β i u (C t + i )

i= 0

#

Power (isoelastic) utility

u (C t ) =

1− γ

Ct

1− γ

γ>0

(2)

u (Ct ) = ln(Ct ) γ = 1

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Classic Example: Hansen and Singleton (1982)

Investors maximize utility

max Et

Ct

"

∞

∑ β i u (C t + i )

i= 0

#

Power (isoelastic) utility

u (C t ) =

1− γ

Ct

1− γ

γ>0

(2)

u (Ct ) = ln(Ct ) γ = 1

N assets => N first-order conditions

n

o

−γ

−γ

Ct = βEt (1 + ℜi,t+1 ) Ct+1

Sydney C. Ludvigson

i = 1, ..., N.

(3)

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Re-write moment conditions

(

"

0 = Et

1 − β (1 + ℜi,t+1 )

Sydney C. Ludvigson

−γ

Ct + 1

−γ

Ct

#)

.

(4)

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Re-write moment conditions

(

"

0 = Et

1 − β (1 + ℜi,t+1 )

−γ

Ct + 1

−γ

Ct

#)

.

(4)

2 params to estimate: β and γ, so θ = ( β, γ) ′ .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Re-write moment conditions

(

"

0 = Et

1 − β (1 + ℜi,t+1 )

−γ

Ct + 1

−γ

Ct

#)

.

(4)

2 params to estimate: β and γ, so θ = ( β, γ) ′ .

xt∗ denotes info set of investors

0=E

nh

n

oi o

−γ

−γ

1 − β (1 + ℜi,t+1 ) Ct+1 /Ct

|xt∗

Sydney C. Ludvigson

i = 1, ...N

(5)

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Re-write moment conditions

(

"

0 = Et

1 − β (1 + ℜi,t+1 )

−γ

Ct + 1

−γ

Ct

#)

.

(4)

2 params to estimate: β and γ, so θ = ( β, γ) ′ .

xt∗ denotes info set of investors

0=E

nh

n

oi o

−γ

−γ

1 − β (1 + ℜi,t+1 ) Ct+1 /Ct

|xt∗

i = 1, ...N

(5)

∗

xt ⊂ xt . Conditional model (5) => unconditional model:

0=E

("

1−

(

β (1 + ℜi,t+1 )

−γ

Ct + 1

−γ

Ct

)# )

xt

i = 1, ...N

(6)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Let xt be M × 1. Then r = N · M and,

−γ

Ct+1

xt

1 − β (1 + ℜ1,t+1 ) Ct−γ

−

γ

1 − β (1 + ℜ2,t+1 ) Ct−+γ1

xt

Ct

·

h (θ, wt ) =

r×1

·

·

−γ

Ct+1

1 − β (1 + ℜN,t+1 ) −γ

xt

Ct

Sydney C. Ludvigson

(7)

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Let xt be M × 1. Then r = N · M and,

−γ

Ct+1

xt

1 − β (1 + ℜ1,t+1 ) Ct−γ

−

γ

1 − β (1 + ℜ2,t+1 ) Ct−+γ1

xt

Ct

·

h (θ, wt ) =

r×1

·

·

−γ

Ct+1

1 − β (1 + ℜN,t+1 ) −γ

xt

Ct

(7)

Model can be estimated, tested as long as r ≥ 2.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Let xt be M × 1. Then r = N · M and,

−γ

Ct+1

xt

1 − β (1 + ℜ1,t+1 ) Ct−γ

−

γ

1 − β (1 + ℜ2,t+1 ) Ct−+γ1

xt

Ct

·

h (θ, wt ) =

r×1

·

·

−γ

Ct+1

1 − β (1 + ℜN,t+1 ) −γ

xt

Ct

(7)

Model can be estimated, tested as long as r ≥ 2.

Take sample mean of (7) to get g(θ; yT ), minimize

′

min Q (θ; yT ) = [g(θ; yT )] WT [g(θ; yT )]

θ

| {z } r×r | {z }

1× r

Sydney C. Ludvigson

r×1

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

HS use lags of cons growth and returns in xt ; index and

industry returns, NDS expenditures.

Estimates of β ≈ .99, RRA low = .35 to .999. No equity

premium puzzle! But....

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

HS use lags of cons growth and returns in xt ; index and

industry returns, NDS expenditures.

Estimates of β ≈ .99, RRA low = .35 to .999. No equity

premium puzzle! But....

...model is strongly rejected according to OID test.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

HS use lags of cons growth and returns in xt ; index and

industry returns, NDS expenditures.

Estimates of β ≈ .99, RRA low = .35 to .999. No equity

premium puzzle! But....

...model is strongly rejected according to OID test.

Campbell, Lo, MacKinlay (1997): OID rejections stronger

whenever stock returns and commercial paper are

included as test returns. Why?

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

HS use lags of cons growth and returns in xt ; index and

industry returns, NDS expenditures.

Estimates of β ≈ .99, RRA low = .35 to .999. No equity

premium puzzle! But....

...model is strongly rejected according to OID test.

Campbell, Lo, MacKinlay (1997): OID rejections stronger

whenever stock returns and commercial paper are

included as test returns. Why?

Model cannot capture predictable variation in excess

returns over commercial paper ⇒

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Example: Hansen and Singleton (1982)

Test of Over-identifying (OID) restrictions:

a

TQ b

θ; yT ∼ χ2 (r − a)

HS use lags of cons growth and returns in xt ; index and

industry returns, NDS expenditures.

Estimates of β ≈ .99, RRA low = .35 to .999. No equity

premium puzzle! But....

...model is strongly rejected according to OID test.

Campbell, Lo, MacKinlay (1997): OID rejections stronger

whenever stock returns and commercial paper are

included as test returns. Why?

Model cannot capture predictable variation in excess

returns over commercial paper ⇒

Researchers have turned to other models of preferences.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Results in HS use conditioning info xt –scaled returns.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Results in HS use conditioning info xt –scaled returns.

Another limitation with classic CCAPM: large

unconditional Euler equation (pricing) errors even when

params freely chosen.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Results in HS use conditioning info xt –scaled returns.

Another limitation with classic CCAPM: large

unconditional Euler equation (pricing) errors even when

params freely chosen.

Let Mt+1 = β(Ct+1 /Ct )−γ . Define Euler equation errors:

j

j

eR ≡ E[Mt+1 Rt+1 ] − 1

j

j

f

eX ≡ E[Mt+1 (Rt+1 − Rt+1 )]

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Results in HS use conditioning info xt –scaled returns.

Another limitation with classic CCAPM: large

unconditional Euler equation (pricing) errors even when

params freely chosen.

Let Mt+1 = β(Ct+1 /Ct )−γ . Define Euler equation errors:

j

j

eR ≡ E[Mt+1 Rt+1 ] − 1

j

j

f

eX ≡ E[Mt+1 (Rt+1 − Rt+1 )]

Choose params: min β,γ gT′ WT gT where jth element of gT

gj,t (γ, β) =

gj,t (γ) =

Sydney C. Ludvigson

1

T

1

T

j

∑Tt=1 eR,t

j

∑Tt=1 eX,t

Methods Lecture: GMM and Consumption-Based Models

Unconditional Euler Equation Errors, Excess Returns

j

j

f

eX ≡ E[ β(Ct+1 /Ct )−γ (Rt+1 − Rt+1 )]

RMSE =

q

1

N

j

2

∑N

j=1 [eX ] ,

RMSR =

q

j = 1, ..., N

1

N

j

f

2

∑N

j=1 [E(Rt+1 − Rt+1 )]

Source: Lettau and Ludvigson (2009). Rs is the excess return on CRSP-VW index over 3-Mo T-bill rate. Rs & 6 FF

refers to this return plus 6 size and book-market sorted portfolios provided by Fama and French. For each value of

γ, β is chosen to minimize the Euler equation error for the T-bill rate. U.S. quarterly data, 1954:1-2002:1.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Magnitude of errors large, even when parameters are

freely chosen to minimize errors.

Unlike the equity premium puzzle of Mehra and Prescott

(1985), large Euler eq. errors cannot be resolved with high

risk aversion.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Magnitude of errors large, even when parameters are

freely chosen to minimize errors.

Unlike the equity premium puzzle of Mehra and Prescott

(1985), large Euler eq. errors cannot be resolved with high

risk aversion.

Lettau and Ludvigson (2009): Leading consumption-based

asset pricing theories fail to explain the mispricing of

classic CCAPM.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Magnitude of errors large, even when parameters are

freely chosen to minimize errors.

Unlike the equity premium puzzle of Mehra and Prescott

(1985), large Euler eq. errors cannot be resolved with high

risk aversion.

Lettau and Ludvigson (2009): Leading consumption-based

asset pricing theories fail to explain the mispricing of

classic CCAPM.

Anomaly is striking b/c early evidence (e.g., Hansen &

Singleton) that the classic model’s Euler equations were

violated provided the impetus for developing these newer

models.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More GMM results: Euler Equation Errors

Magnitude of errors large, even when parameters are

freely chosen to minimize errors.

Unlike the equity premium puzzle of Mehra and Prescott

(1985), large Euler eq. errors cannot be resolved with high

risk aversion.

Lettau and Ludvigson (2009): Leading consumption-based

asset pricing theories fail to explain the mispricing of

classic CCAPM.

Anomaly is striking b/c early evidence (e.g., Hansen &

Singleton) that the classic model’s Euler equations were

violated provided the impetus for developing these newer

models.

Results imply data on consumption and asset returns not

jointly lognormal!

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

One reason: assessing specification error, comparing

models.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

One reason: assessing specification error, comparing

models.

Consider two estimated models of SDF, e.g.,

(1)

1

CCAPM: Mt+1 = β(Ct+1 /Ct )−γ , OID restricts not rejected

2

CAPM: Mt+1 = a + bRm,t+1 , OID restricts rejected

(2)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

One reason: assessing specification error, comparing

models.

Consider two estimated models of SDF, e.g.,

(1)

1

CCAPM: Mt+1 = β(Ct+1 /Ct )−γ , OID restricts not rejected

2

CAPM: Mt+1 = a + bRm,t+1 , OID restricts rejected

(2)

May we conclude Model 1 is superior?

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

One reason: assessing specification error, comparing

models.

Consider two estimated models of SDF, e.g.,

(1)

1

CCAPM: Mt+1 = β(Ct+1 /Ct )−γ , OID restricts not rejected

2

CAPM: Mt+1 = a + bRm,t+1 , OID restricts rejected

(2)

May we conclude Model 1 is superior?

No. Hansen’s J-test of OID restricts depends on model

specific S: J = gT′ S−1 gT .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Asset pricing applications often require WT , S−1 . Why?

One reason: assessing specification error, comparing

models.

Consider two estimated models of SDF, e.g.,

(1)

1

CCAPM: Mt+1 = β(Ct+1 /Ct )−γ , OID restricts not rejected

2

CAPM: Mt+1 = a + bRm,t+1 , OID restricts rejected

(2)

May we conclude Model 1 is superior?

No. Hansen’s J-test of OID restricts depends on model

specific S: J = gT′ S−1 gT .

Model 1 can look better simply b/c the SDF and pricing

errors gT are more volatile, not b/c pricing errors are lower.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

HJ: compare models Mt (θ) using distance metric:

DistT (θ) =

r

mingT (θ)′ GT−1 gT (θ),

θ

1

gT (θ) ≡

T

Sydney C. Ludvigson

T

GT ≡

∑ [Mt (θ)Rt − 1N ]

1

T

T

′

t Rt

∑ R|{z}

t= 1

N ×N

t= 1

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

HJ: compare models Mt (θ) using distance metric:

DistT (θ) =

r

mingT (θ)′ GT−1 gT (θ),

θ

1

gT (θ) ≡

T

T

GT ≡

∑ [Mt (θ)Rt − 1N ]

1

T

T

′

t Rt

∑ R|{z}

t= 1

N ×N

t= 1

DistT does not reward SDF volatility => suitable for

model comparison.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

HJ: compare models Mt (θ) using distance metric:

DistT (θ) =

r

mingT (θ)′ GT−1 gT (θ),

θ

1

gT (θ) ≡

T

GT ≡

T

∑ [Mt (θ)Rt − 1N ]

1

T

T

′

t Rt

∑ R|{z}

t= 1

N ×N

t= 1

DistT does not reward SDF volatility => suitable for

model comparison.

DistT is a measure of model misspecification:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

HJ: compare models Mt (θ) using distance metric:

DistT (θ) =

r

mingT (θ)′ GT−1 gT (θ),

θ

1

gT (θ) ≡

T

GT ≡

T

∑ [Mt (θ)Rt − 1N ]

1

T

T

′

t Rt

∑ R|{z}

t= 1

N ×N

t= 1

DistT does not reward SDF volatility => suitable for

model comparison.

DistT is a measure of model misspecification:

Gives distance between Mt (θ) and nearest point in space of

all SDFs that price assets correctly.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

HJ: compare models Mt (θ) using distance metric:

DistT (θ) =

r

mingT (θ)′ GT−1 gT (θ),

θ

1

gT (θ) ≡

T

GT ≡

T

∑ [Mt (θ)Rt − 1N ]

1

T

T

′

t Rt

∑ R|{z}

t= 1

N ×N

t= 1

DistT does not reward SDF volatility => suitable for

model comparison.

DistT is a measure of model misspecification:

Gives distance between Mt (θ) and nearest point in space of

all SDFs that price assets correctly.

Gives maximum pricing error of any portfolio formed from

the N assets.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Appeal of HJ Distance metric:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Appeal of HJ Distance metric:

Recognizes all models are misspecified.

Provides method for comparing models by assessing which

is least misspecified.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Appeal of HJ Distance metric:

Recognizes all models are misspecified.

Provides method for comparing models by assessing which

is least misspecified.

Important problem: how to compare HJ distances

statistically?

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Comparing specification error: Hansen and Jagannathan, 1997

Appeal of HJ Distance metric:

Recognizes all models are misspecified.

Provides method for comparing models by assessing which

is least misspecified.

Important problem: how to compare HJ distances

statistically?

One possibility developed in Chen and Ludvigson (2009):

White’s reality check method.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Chen and Ludvigson (2009) compare HJ distances among

K competing models using White’s reality check method.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Chen and Ludvigson (2009) compare HJ distances among

K competing models using White’s reality check method.

1

2

3

4

5

Take benchmark model, e.g., model with smallest squared

distance d21,T ≡ min{d2j,T }K

j =1 .

Null: d21,T − d22,T ≤ 0, where d22,T is competing model with

the next smallest squared distance.

√

Test statistic T W = T (d21,T − d22,T ).

If null is true, test statistic should not be unusually large,

given sampling error.

Given distribution for T W , reject null if historical value Tb W

is > 95th percentile.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Chen and Ludvigson (2009) compare HJ distances among

K competing models using White’s reality check method.

1

2

3

4

5

Take benchmark model, e.g., model with smallest squared

distance d21,T ≡ min{d2j,T }K

j =1 .

Null: d21,T − d22,T ≤ 0, where d22,T is competing model with

the next smallest squared distance.

√

Test statistic T W = T (d21,T − d22,T ).

If null is true, test statistic should not be unusually large,

given sampling error.

Given distribution for T W , reject null if historical value Tb W

is > 95th percentile.

Method applies generally to any stationary law of motion

for data, multiple competing possibly nonlinear, SDF

models.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Distribution of T W is computed via block bootstrap.

T W has complicated limiting distribution.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Distribution of T W is computed via block bootstrap.

T W has complicated limiting distribution.

Bootstrap works only if have a multivariate, joint,

continuous, limiting distribution under null.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Distribution of T W is computed via block bootstrap.

T W has complicated limiting distribution.

Bootstrap works only if have a multivariate, joint,

continuous, limiting distribution under null.

Proof of limiting distributions exists for applications to

most asset pricing models:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Statistical comparison of HJ distance: Chen and Ludvigson, 2009

Distribution of T W is computed via block bootstrap.

T W has complicated limiting distribution.

Bootstrap works only if have a multivariate, joint,

continuous, limiting distribution under null.

Proof of limiting distributions exists for applications to

most asset pricing models:

For parametric models (Hansen, Heaton, Luttmer ’95)

For semiparametric models (Ai and Chen ’07).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons to use identity matrix: econometric problems

Econometric problems: near singular ST−1 or GT−1 .

Asset returns are highly correlated.

We have large N and modest T.

If T < N covariance matrix for N asset returns is singular.

Unless T >> N, matrix can be near-singular.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons to use identity matrix: economically interesting portfolios

Original test assets may have economically meaningful

characteristics (e.g., size, value).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons to use identity matrix: economically interesting portfolios

Original test assets may have economically meaningful

characteristics (e.g., size, value).

Using WT = ST−1 or GT−1 same as using WT = I and doing

GMM on re-weighted portfolios of original test assets.

Triangular factorization S−1 = (P′ P), P lower triangular

min gT′ S−1 gT ⇔ (gT′ P′ )I(PgT )

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons to use identity matrix: economically interesting portfolios

Original test assets may have economically meaningful

characteristics (e.g., size, value).

Using WT = ST−1 or GT−1 same as using WT = I and doing

GMM on re-weighted portfolios of original test assets.

Triangular factorization S−1 = (P′ P), P lower triangular

min gT′ S−1 gT ⇔ (gT′ P′ )I(PgT )

Re-weighted portfolios may not provide large spread in

average returns.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons to use identity matrix: economically interesting portfolios

Original test assets may have economically meaningful

characteristics (e.g., size, value).

Using WT = ST−1 or GT−1 same as using WT = I and doing

GMM on re-weighted portfolios of original test assets.

Triangular factorization S−1 = (P′ P), P lower triangular

min gT′ S−1 gT ⇔ (gT′ P′ )I(PgT )

Re-weighted portfolios may not provide large spread in

average returns.

May imply implausible long and short positions in test

assets.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons not to use WT = I: objective function dependence on test asset choice

Using WT = [ET (R′ R)]−1 , GMM objective function is

invariant to initial choice of test assets.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons not to use WT = I: objective function dependence on test asset choice

Using WT = [ET (R′ R)]−1 , GMM objective function is

invariant to initial choice of test assets.

Form a portfolio, AR from initial returns R. (Note,

portfolio weights sum to 1 so A1N = 1N ).

[E (MR) − 1N ]′ E RR′

−1

[E (MR − 1N )]

−1

= [E (MAR) − A1N ] E ARR′ A

[E (MAR − A1N )] .

′

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

GMM Asset Pricing With Non-Optimal Weighting

Reasons not to use WT = I: objective function dependence on test asset choice

Using WT = [ET (R′ R)]−1 , GMM objective function is

invariant to initial choice of test assets.

Form a portfolio, AR from initial returns R. (Note,

portfolio weights sum to 1 so A1N = 1N ).

[E (MR) − 1N ]′ E RR′

−1

[E (MR − 1N )]

−1

= [E (MAR) − A1N ] E ARR′ A

[E (MAR − A1N )] .

′

With WT = I or other fixed weighting, GMM objective

depends on choice of test assets.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

More Complex Preferences: Scaled

Consumption-Based Models

Consumption-based models may be approximated:

Mt+1 ≈ at + bt ∆ct+1 ,

Sydney C. Ludvigson

ct+1 ≡ ln(Ct+1 )

Methods Lecture: GMM and Consumption-Based Models

More Complex Preferences: Scaled

Consumption-Based Models

Consumption-based models may be approximated:

Mt+1 ≈ at + bt ∆ct+1 ,

ct+1 ≡ ln(Ct+1 )

Example: Classic CCAPM with CRRA utility

u ( Ct ) =

1− γ

Ct

⇒ Mt+1 ≈ β − βγ ∆ct+1

1−γ

|{z} |{z}

at = a0

Sydney C. Ludvigson

bt = b0

Methods Lecture: GMM and Consumption-Based Models

More Complex Preferences: Scaled

Consumption-Based Models

Consumption-based models may be approximated:

Mt+1 ≈ at + bt ∆ct+1 ,

ct+1 ≡ ln(Ct+1 )

Example: Classic CCAPM with CRRA utility

u ( Ct ) =

1− γ

Ct

⇒ Mt+1 ≈ β − βγ ∆ct+1

1−γ

|{z} |{z}

at = a0

bt = b0

Model with habit and time-varying risk aversion: Campbell and

Cochrane ’99, Menzly et. al ’04

u ( Ct , S t ) =

( Ct S t ) 1 − γ

,

1−γ

St + 1 ≡

C t − Xt

Ct

⇒ Mt+1 ≈ β 1 − γ (φ − 1)(st − s) − γ (1 + ψ (st )) ∆ct+1

|

{z

} |

{z

}

at

Sydney C. Ludvigson

bt

Methods Lecture: GMM and Consumption-Based Models

More Complex Preferences: Scaled

Consumption-Based Models

Consumption-based models may be approximated:

Mt+1 ≈ at + bt ∆ct+1 ,

ct+1 ≡ ln(Ct+1 )

Example: Classic CCAPM with CRRA utility

u ( Ct ) =

1− γ

Ct

⇒ Mt+1 ≈ β − βγ ∆ct+1

1−γ

|{z} |{z}

at = a0

bt = b0

Model with habit and time-varying risk aversion: Campbell and

Cochrane ’99, Menzly et. al ’04

u ( Ct , S t ) =

( Ct S t ) 1 − γ

,

1−γ

St + 1 ≡

C t − Xt

Ct

⇒ Mt+1 ≈ β 1 − γ (φ − 1)(st − s) − γ (1 + ψ (st )) ∆ct+1

|

{z

} |

{z

}

at

bt

Proxies for time-varying risk-premia should be good proxies for

time-variation in at and bt .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Mt+1 ≈ at + bt ∆ct+1

Empirical specification: Lettau and Ludvigson (2001a, 2001b):

at = a0 + a1 zt , bt = b0 + b1 zt

zt = cayt ≡ ct − αa at − αy yt , (cointegrating residual)

cayt related to log consumption-(aggregate) wealth ratio.

cayt strong predictor of excess stock market returns

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Mt+1 ≈ at + bt ∆ct+1

Empirical specification: Lettau and Ludvigson (2001a, 2001b):

at = a0 + a1 zt , bt = b0 + b1 zt

zt = cayt ≡ ct − αa at − αy yt , (cointegrating residual)

cayt related to log consumption-(aggregate) wealth ratio.

cayt strong predictor of excess stock market returns

Other examples: including housing consumption

1

U(Ct , Ht ) =

e 1− σ

C

t

1−

1

σ

ε −1

ε

ε −1

ε −1

ε

ε

e

Ct = χCt + (1 − χ) Ht

,

⇒ ln Mt+1 ≈ at + bt ∆ ln Ct+1 + dt ∆ ln St+1 ,

St + 1 ≡

pC

t Ct

pC

t Ct

+ pH

t Ht

Lustig and Van Nieuwerburgh ’05 (incomplete markets):

at = a0 + a1 zt , bt = b0 + b1 zt , dt = d0 + d1 zt

zt = housing collateral ratio (measures quantity of risk

sharing)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Two kinds of conditioning are often confused.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Two kinds of conditioning are often confused.

Euler equation: E Mt+1 Rt+1 |zt = 1

Unconditional version: E Mt+1 Rt+1 = 1

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Two kinds of conditioning are often confused.

Euler equation: E Mt+1 Rt+1 |zt = 1

Unconditional version: E Mt+1 Rt+1 = 1

Two forms of conditionality:

1

2

scaling returns: E Mt+1 Ri,t+1 ⊗ (1 zt )′ = 1

scaling factors ft+1 , e.g., ft+1 = ∆ ln Ct+1 :

Mt+1

Sydney C. Ludvigson

= bt′ ft+1 with bt = b0 + b1 zt

= b′ ft+1 ⊗ (1 zt )′

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Two kinds of conditioning are often confused.

Euler equation: E Mt+1 Rt+1 |zt = 1

Unconditional version: E Mt+1 Rt+1 = 1

Two forms of conditionality:

1

2

scaling returns: E Mt+1 Ri,t+1 ⊗ (1 zt )′ = 1

scaling factors ft+1 , e.g., ft+1 = ∆ ln Ct+1 :

Mt+1

= bt′ ft+1 with bt = b0 + b1 zt

= b′ ft+1 ⊗ (1 zt )′

Scaled consumption-based models are conditional in sense

that Mt+1 is a state-dependent function of ∆ ln Ct+1

⇒ scaled factors

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Two kinds of conditioning are often confused.

Euler equation: E Mt+1 Rt+1 |zt = 1

Unconditional version: E Mt+1 Rt+1 = 1

Two forms of conditionality:

1

2

scaling returns: E Mt+1 Ri,t+1 ⊗ (1 zt )′ = 1

scaling factors ft+1 , e.g., ft+1 = ∆ ln Ct+1 :

Mt+1

= bt′ ft+1 with bt = b0 + b1 zt

= b′ ft+1 ⊗ (1 zt )′

Scaled consumption-based models are conditional in sense

that Mt+1 is a state-dependent function of ∆ ln Ct+1

⇒ scaled factors

Scaled consumption-basedmodels have

been tested on

unconditional moments, E Mt+1 Rt+1 = 1

⇒ NO scaled returns.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled CCAPM turns a single factor model with

state-dependent weights into multi-factor model ft with

constant weights:

Mt+1 = (a0 + a1 zt ) + (b0 + b1 zt ) ∆ ln Ct+1

= a0 + a1 zt +b0 ∆ ln Ct+1 +b1 (zt ∆ ln Ct+1 )

|{z}

| {z }

| {z }

f1,t+1

Sydney C. Ludvigson

f2,t+1

f3,t+1

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled CCAPM turns a single factor model with

state-dependent weights into multi-factor model ft with

constant weights:

Mt+1 = (a0 + a1 zt ) + (b0 + b1 zt ) ∆ ln Ct+1

= a0 + a1 zt +b0 ∆ ln Ct+1 +b1 (zt ∆ ln Ct+1 )

|{z}

| {z }

| {z }

f1,t+1

f2,t+1

f3,t+1

Multiple risk factors ft′ ≡ (zt , ∆ ln Ct+1 , zt ∆ ln Ct+1 ).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled CCAPM turns a single factor model with

state-dependent weights into multi-factor model ft with

constant weights:

Mt+1 = (a0 + a1 zt ) + (b0 + b1 zt ) ∆ ln Ct+1

= a0 + a1 zt +b0 ∆ ln Ct+1 +b1 (zt ∆ ln Ct+1 )

|{z}

| {z }

| {z }

f1,t+1

f2,t+1

f3,t+1

Multiple risk factors ft′ ≡ (zt , ∆ ln Ct+1 , zt ∆ ln Ct+1 ).

Scaled consumption models have multiple, constant betas

for each factor, rather than a single time-varying beta for

∆ ln Ct+1 .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Deriving the “beta”-representation

Let F = (1 f′ )′ , M = b′ F, ignore time indices

= E[MRi ]

1

= E[Ri F′ ]b ⇒ unconditional moments

= E[Ri ]E[F′ ]b + Cov(Ri , F′ )b ⇒

E[Ri ]

=

1 − Cov(Ri , F′ )b

E [F′ ]b

=

1 − Cov(Ri , f′ )b

E [F′ ]b

=

1 − Cov(Ri , f′ )Cov(f, f′ )−1 Cov(f, f′ )b

E [F′ ]b

= R0 − R0 β′ Cov(f, f′ )b

= R0 − β′ λ ⇒ multiple, constant betas

Estimate cross-sectional model using Fama-MacBeth (see Brandt

lecture).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Fama-MacBeth Methodology: Preview–See Brandt

Step 1: Estimate β’s in time-series regression for each

portfolio i:

βi ≡ Cov(ft+1 , ft′ +1 )−1 Cov(ft+1 , Ri,t+1 )

Step 2: Cross-sectional regressions (T of them):

Ri,t+1 − R0,t = αi,t + βi′ λt

T

λ = 1/T ∑ λt ;

t= 1

T

σ2 (λ) = 1/T ∑ (λt − λ)2

t= 1

Note: report Shanken t-statistics (corrected for estimation error

of betas in first stage)

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled models: conditioning done in SDF:

Mt+1 = at + bt ∆ ln Ct+1 ,

not in Euler equation: E(MR) = 1N .

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled models: conditioning done in SDF:

Mt+1 = at + bt ∆ ln Ct+1 ,

not in Euler equation: E(MR) = 1N .

Gives rise to a restricted conditional consumption beta

model:

Rit = a + β ∆c ∆ct + β ∆c,z ∆ct zt−1 + βz zt−1

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled models: conditioning done in SDF:

Mt+1 = at + bt ∆ ln Ct+1 ,

not in Euler equation: E(MR) = 1N .

Gives rise to a restricted conditional consumption beta

model:

Rit = a + β ∆c ∆ct + β ∆c,z ∆ct zt−1 + βz zt−1

Rewrite as

Rit = a + ( βc + βc,z zt−1 ) ∆ct + βz zt−1

|

{z

}

time-varying beta

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Scaled models: conditioning done in SDF:

Mt+1 = at + bt ∆ ln Ct+1 ,

not in Euler equation: E(MR) = 1N .

Gives rise to a restricted conditional consumption beta

model:

Rit = a + β ∆c ∆ct + β ∆c,z ∆ct zt−1 + βz zt−1

Rewrite as

Rit = a + ( βc + βc,z zt−1 ) ∆ct + βz zt−1

|

{z

}

time-varying beta

Unlikely the same time-varying beta as obtained from

modeling conditional mean Et (Mt+1 Rt+1 ) = 1.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Conditioning in SDF: theory provides guidance:

typically a few variables that capture risk-premia.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Conditioning in SDF: theory provides guidance:

typically a few variables that capture risk-premia.

Conditioning in Euler eqn: model joint dist. (Mt+1 Rt+1 ).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Conditioning in SDF: theory provides guidance:

typically a few variables that capture risk-premia.

Conditioning in Euler eqn: model joint dist. (Mt+1 Rt+1 ).

Latter may require variables beyond a few that capture

risk-premia.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Conditioning in SDF: theory provides guidance:

typically a few variables that capture risk-premia.

Conditioning in Euler eqn: model joint dist. (Mt+1 Rt+1 ).

Latter may require variables beyond a few that capture

risk-premia.

Approximating condition mean well requires large

number of instruments (misspecified information sets)

Results sensitive to chosen conditioning variables, may fail

to span information sets of market participants.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Distinction is important.

Conditioning in SDF: theory provides guidance:

typically a few variables that capture risk-premia.

Conditioning in Euler eqn: model joint dist. (Mt+1 Rt+1 ).

Latter may require variables beyond a few that capture

risk-premia.

Approximating condition mean well requires large

number of instruments (misspecified information sets)

Results sensitive to chosen conditioning variables, may fail

to span information sets of market participants.

Partial solution: summarize information in large number

of time-series with few estimated dynamic factors (e.g.,

Ludvigson and Ng ’07, ’09).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Bottom lines:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Bottom lines:

1

Conditional moments of Mt+1 Rt+1 difficult to model ⇒

reason to focus on unconditional moments

E[Mt+1 Rt+1 ] = 1.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Bottom lines:

1

Conditional moments of Mt+1 Rt+1 difficult to model ⇒

reason to focus on unconditional moments

E[Mt+1 Rt+1 ] = 1.

2

Models are misspecified: interesting question is whether

state-dependence of Mt+1 on consumption growth ⇒ less

misspecification than standard, fixed-weight CCAPM.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Scaled Consumption-Based Models

Distinguishing two types of conditioning, or state dependence

Bottom lines:

1

Conditional moments of Mt+1 Rt+1 difficult to model ⇒

reason to focus on unconditional moments

E[Mt+1 Rt+1 ] = 1.

2

Models are misspecified: interesting question is whether

state-dependence of Mt+1 on consumption growth ⇒ less

misspecification than standard, fixed-weight CCAPM.

3

As before, can compare models on basis of HJ distances,

using White ”reality check” method to compare statistically.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Growing interest in asset pricing models with recursive

preferences, e.g., Epstein and Zin ’89, ’91, Weil ’89, (EZW).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Growing interest in asset pricing models with recursive

preferences, e.g., Epstein and Zin ’89, ’91, Weil ’89, (EZW).

Two reasons recursive utility is of interest:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Growing interest in asset pricing models with recursive

preferences, e.g., Epstein and Zin ’89, ’91, Weil ’89, (EZW).

Two reasons recursive utility is of interest:

More flexibility as regards attitudes toward risk and

intertemporal substitution.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Growing interest in asset pricing models with recursive

preferences, e.g., Epstein and Zin ’89, ’91, Weil ’89, (EZW).

Two reasons recursive utility is of interest:

More flexibility as regards attitudes toward risk and

intertemporal substitution.

Preferences deliver an added risk factor for explaining asset

returns.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Growing interest in asset pricing models with recursive

preferences, e.g., Epstein and Zin ’89, ’91, Weil ’89, (EZW).

Two reasons recursive utility is of interest:

More flexibility as regards attitudes toward risk and

intertemporal substitution.

Preferences deliver an added risk factor for explaining asset

returns.

But, only a small amount of econometric work on

recursive preferences ⇒ gap in the literature.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Here discuss two examples of estimating EZW models:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Here discuss two examples of estimating EZW models:

1

For general stationary, consumption growth and cash flow

dynamics: Chen, Favilukis, Ludvigson ’07.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Here discuss two examples of estimating EZW models:

1

For general stationary, consumption growth and cash flow

dynamics: Chen, Favilukis, Ludvigson ’07.

2

When restricting cash flow dynamics (e.g., “long-run risk”):

Bansal, Gallant, Tauchen ’07.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Here discuss two examples of estimating EZW models:

1

For general stationary, consumption growth and cash flow

dynamics: Chen, Favilukis, Ludvigson ’07.

2

When restricting cash flow dynamics (e.g., “long-run risk”):

Bansal, Gallant, Tauchen ’07.

In (1) DGP is left unrestricted, as is joint distribution of

consumption and returns (distribution-free estimation

procedure).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

Asset Pricing Models With Recursive Preferences

Here discuss two examples of estimating EZW models:

1

For general stationary, consumption growth and cash flow

dynamics: Chen, Favilukis, Ludvigson ’07.

2

When restricting cash flow dynamics (e.g., “long-run risk”):

Bansal, Gallant, Tauchen ’07.

In (1) DGP is left unrestricted, as is joint distribution of

consumption and returns (distribution-free estimation

procedure).

In (2) DGP and distribution of shocks explicitly modeled.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstein-Zin-Weil basics

Recursive utility (Epstein, Zin (’89, ’91) & Weil (’89)):

h

i 1−1 ρ

1− ρ

Vt = ( 1 − β ) Ct + β R t ( Vt + 1 ) 1 − ρ

h

i 1−1 θ

Rt (Vt+1 ) = E Vt1+−1θ |Ft

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstein-Zin-Weil basics

Recursive utility (Epstein, Zin (’89, ’91) & Weil (’89)):

h

i 1−1 ρ

1− ρ

Vt = ( 1 − β ) Ct + β R t ( Vt + 1 ) 1 − ρ

h

i 1−1 θ

Rt (Vt+1 ) = E Vt1+−1θ |Ft

Vt+1 is continuation value, θ is RRA, 1/ρ is EIS.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstein-Zin-Weil basics

Recursive utility (Epstein, Zin (’89, ’91) & Weil (’89)):

h

i 1−1 ρ

1− ρ

Vt = ( 1 − β ) Ct + β R t ( Vt + 1 ) 1 − ρ

h

i 1−1 θ

Rt (Vt+1 ) = E Vt1+−1θ |Ft

Vt+1 is continuation value, θ is RRA, 1/ρ is EIS.

Rescale utility function (Hansen, Heaton, Li ’05):

"

# 1−1 ρ

Vt

Vt + 1 Ct + 1 1 − ρ

= ( 1 − β ) + β Rt

Ct

Ct + 1 Ct

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstein-Zin-Weil basics

Recursive utility (Epstein, Zin (’89, ’91) & Weil (’89)):

h

i 1−1 ρ

1− ρ

Vt = ( 1 − β ) Ct + β R t ( Vt + 1 ) 1 − ρ

h

i 1−1 θ

Rt (Vt+1 ) = E Vt1+−1θ |Ft

Vt+1 is continuation value, θ is RRA, 1/ρ is EIS.

Rescale utility function (Hansen, Heaton, Li ’05):

"

# 1−1 ρ

Vt

Vt + 1 Ct + 1 1 − ρ

= ( 1 − β ) + β Rt

Ct

Ct + 1 Ct

C1−θ

t

Special case: ρ = θ ⇒ CRRA separable utility Vt = β 1−

θ.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

The MRS is pricing kernel (SDF) with added risk factor:

ρ−θ

Vt+1 Ct+1

Ct + 1 − ρ

C

C

t+1 t

Mt + 1 = β

Vt+1 Ct+1

Ct

R

t

Sydney C. Ludvigson

Ct+1 Ct

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

The MRS is pricing kernel (SDF) with added risk factor:

ρ−θ

Vt+1 Ct+1

Ct + 1 − ρ

C

C

t+1 t

Mt + 1 = β

Vt+1 Ct+1

Ct

R

t

Ct+1 Ct

Difficulty: MRS a function of V/C, unobservable, embeds

Rt (·).

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

The MRS is pricing kernel (SDF) with added risk factor:

ρ−θ

Vt+1 Ct+1

Ct + 1 − ρ

C

C

t+1 t

Mt + 1 = β

Vt+1 Ct+1

Ct

R

t

Ct+1 Ct

Difficulty: MRS a function of V/C, unobservable, embeds

Rt (·).

Epstein-Zin ’91 use alt. rep. of SDF, uses agg. wealth

return Rw,t :

( ) 11−−ρθ 1θ −−ρρ

1

Ct + 1 − ρ

Mt + 1 = β

Ct

Rw,t+1

where Rw,t proxied by stock market return.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

The MRS is pricing kernel (SDF) with added risk factor:

ρ−θ

Vt+1 Ct+1

Ct + 1 − ρ

C

C

t+1 t

Mt + 1 = β

Vt+1 Ct+1

Ct

R

t

Ct+1 Ct

Difficulty: MRS a function of V/C, unobservable, embeds

Rt (·).

Epstein-Zin ’91 use alt. rep. of SDF, uses agg. wealth

return Rw,t :

( ) 11−−ρθ 1θ −−ρρ

1

Ct + 1 − ρ

Mt + 1 = β

Ct

Rw,t+1

where Rw,t proxied by stock market return.

Problem: Rw,t+1 represents a claim to future Ct , itself

unobservable.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

2

If returns, Ct are jointly lognormal and homoscedastic, risk

premia are approx. log-linear functions of COV between

returns, and news about current and future Ct growth.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

2

If returns, Ct are jointly lognormal and homoscedastic, risk

premia are approx. log-linear functions of COV between

returns, and news about current and future Ct growth.

But....

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

2

If returns, Ct are jointly lognormal and homoscedastic, risk

premia are approx. log-linear functions of COV between

returns, and news about current and future Ct growth.

But....

EIS=1 ⇒ consumption-wealth ratio is constant,

contradicting statistical evidence.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

2

If returns, Ct are jointly lognormal and homoscedastic, risk

premia are approx. log-linear functions of COV between

returns, and news about current and future Ct growth.

But....

EIS=1 ⇒ consumption-wealth ratio is constant,

contradicting statistical evidence.

Joint lognormality strongly rejected in quarterly data.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Epstien-Zin-Weil basics

1

If EIS=1, and ∆ log Ct+1 follows a loglinear time-series

process, log(V/C) has an analytical solution.

2

If returns, Ct are jointly lognormal and homoscedastic, risk

premia are approx. log-linear functions of COV between

returns, and news about current and future Ct growth.

But....

EIS=1 ⇒ consumption-wealth ratio is constant,

contradicting statistical evidence.

Joint lognormality strongly rejected in quarterly data.

Points to need for estimation method feasible under less

restrictive assumptions.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Loglinearizing the model.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Loglinearizing the model.

Parametric restrictions on law of motion or joint dist. of Ct

and Ri,t , or on value of key preference parameters.

Obtain estimates of β, RRA θ, EIS ρ−1

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Loglinearizing the model.

Parametric restrictions on law of motion or joint dist. of Ct

and Ri,t , or on value of key preference parameters.

Obtain estimates of β, RRA θ, EIS ρ−1

Evaluate EZW model’s ability to fit asset return data

relative to competing model specifications.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Loglinearizing the model.

Parametric restrictions on law of motion or joint dist. of Ct

and Ri,t , or on value of key preference parameters.

Obtain estimates of β, RRA θ, EIS ρ−1

Evaluate EZW model’s ability to fit asset return data

relative to competing model specifications.

Investigate implications for Rw,t+1 and return to human

wealth.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

CFL: semiparametric approach to estimate EZW model

without:

Need to proxy Rw,t+1 with observable returns.

Loglinearizing the model.

Parametric restrictions on law of motion or joint dist. of Ct

and Ri,t , or on value of key preference parameters.

Obtain estimates of β, RRA θ, EIS ρ−1

Evaluate EZW model’s ability to fit asset return data

relative to competing model specifications.

Investigate implications for Rw,t+1 and return to human

wealth.

Semiparametric approach is sieve minimum distance

(SMD) procedure.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

First order conditions for optimal consumption choice:

ρ−θ

−ρ

Vt + 1 C t + 1

Ct + 1

Ct + 1 Ct

Et β

Ri,t+1 − 1 = 0

Vt + 1 C t + 1

Ct

R t Ct + 1 Ct

Sydney C. Ludvigson

(8)

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

First order conditions for optimal consumption choice:

ρ−θ

−ρ

Vt + 1 C t + 1

Ct + 1

Ct + 1 Ct

Et β

Ri,t+1 − 1 = 0

Vt + 1 C t + 1

Ct

R t Ct + 1 Ct

CFL: plug

Et

β

Ct+1

Ct

Vt

Ct

(8)

1−ρ 1−1 ρ

t + 1 Ct + 1

= ( 1 − β ) + β Rt V

into (8):

Ct + 1 Ct

− ρ

n h

1

β

ρ−θ

Vt+1 Ct+1

Ct+1 Ct

Vt 1 − ρ

Ct

Sydney C. Ludvigson

− (1 − β )

io 1−1 ρ

Ri,t+1 − 1

=0

i = 1, ..., N.

(9)

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

First order conditions for optimal consumption choice:

ρ−θ

−ρ

Vt + 1 C t + 1

Ct + 1

Ct + 1 Ct

Et β

Ri,t+1 − 1 = 0

Vt + 1 C t + 1

Ct

R t Ct + 1 Ct

CFL: plug

Et

β

Ct+1

Ct

Vt

Ct

(8)

1−ρ 1−1 ρ

t + 1 Ct + 1

= ( 1 − β ) + β Rt V

into (8):

Ct + 1 Ct

− ρ

n h

1

β

ρ−θ

Vt+1 Ct+1

Ct+1 Ct

Vt 1 − ρ

Ct

− (1 − β )

io 1−1 ρ

Ri,t+1 − 1

=0

i = 1, ..., N.

(9)

N test asset returns, {Ri,t+1 }N

i=1 . (9) is a x-sect asset pricing model.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

First order conditions for optimal consumption choice:

ρ−θ

−ρ

Vt + 1 C t + 1

Ct + 1

Ct + 1 Ct

Et β

Ri,t+1 − 1 = 0

Vt + 1 C t + 1

Ct

R t Ct + 1 Ct

CFL: plug

Et

β

Ct+1

Ct

Vt

Ct

(8)

1−ρ 1−1 ρ

t + 1 Ct + 1

= ( 1 − β ) + β Rt V

into (8):

Ct + 1 Ct

− ρ

n h

1

β

ρ−θ

Vt+1 Ct+1

Ct+1 Ct

Vt 1 − ρ

Ct

− (1 − β )

io 1−1 ρ

Ri,t+1 − 1

=0

i = 1, ..., N.

(9)

N test asset returns, {Ri,t+1 }N

i=1 . (9) is a x-sect asset pricing model.

Moment restrictions (9) form the basis of empirical investigation.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

First order conditions for optimal consumption choice:

ρ−θ

−ρ

Vt + 1 C t + 1

Ct + 1

Ct + 1 Ct

Et β

Ri,t+1 − 1 = 0

Vt + 1 C t + 1

Ct

R t Ct + 1 Ct

CFL: plug

Et

β

Ct+1

Ct

Vt

Ct

(8)

1−ρ 1−1 ρ

t + 1 Ct + 1

= ( 1 − β ) + β Rt V

into (8):

Ct + 1 Ct

− ρ

n h

1

β

ρ−θ

Vt+1 Ct+1

Ct+1 Ct

Vt 1 − ρ

Ct

− (1 − β )

io 1−1 ρ

Ri,t+1 − 1

=0

i = 1, ..., N.

(9)

N test asset returns, {Ri,t+1 }N

i=1 . (9) is a x-sect asset pricing model.

Moment restrictions (9) form the basis of empirical investigation.

Empirical model is semiparametric: δ ≡ ( β, θ, ρ)′ denote finite

dimensional parameter vector; Vt /Ct unknown function.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

Assume

Vt

Ct

an unknown function F: R2 → R of form

Vt

Vt − 1 Ct

=F

,

,

Ct

Ct − 1 Ct − 1

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

Assume

Vt

Ct

an unknown function F: R2 → R of form

Vt

Vt − 1 Ct

=F

,

,

Ct

Ct − 1 Ct − 1

Assume {Ct /Ct−1 : t = 1, ...} is strictly stationary ergodic;

and F(·) is such that the process{Vt /Ct : t = 1, ...} is

asymptotically stationary ergodic.

Sydney C. Ludvigson

Methods Lecture: GMM and Consumption-Based Models

EZW Recursive Preferences

Unrestricted Dynamics, Distribution-Free Estimation: Chen, Favilukis, Ludvigson ’07

Assume

Vt

Ct

an unknown function F: R2 → R of form

Vt

Vt − 1 Ct

=F

,

,

Ct

Ct − 1 Ct − 1

Assume {Ct /Ct−1 : t = 1, ...} is strictly stationary ergodic;

and F(·) is such that the process{Vt /Ct : t = 1, ...} is

asymptotically stationary ergodic.

Justified if, for example,

Sydney C. Ludvigson