ACC 207 Final Project Case Study

advertisement

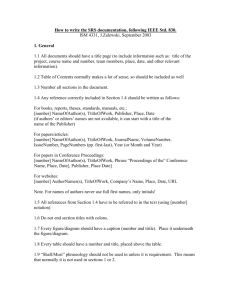

The following case study is adapted from: Samuels, J. A., & Sawers, K. M. (2017). “SRS Educational Supply Company: An instructional budget project.” Issues in Accounting Education: November 2017, Vol. 32, No. 4, pp. 51-59. Summative Case Study: SRS Educational Supply Company Part 1 – Job Order Costing / Process Costing SRS Educational Supply Company provides educational materials and supplies to educational institutions. The company provides educational supply needs that includes workbooks, classroom visual aids, instructor support materials, art supplies, lab supplies, and administrative office supplies. Since SRS Educational Supply Company consistently produces the same service to its customers, the company uses job order costing. The company’s processing units are assigned costs. For example, the company will determine all of the costs associated with the sales/marketing in a certain period and divide the costs by the number of customers that the company currently has. The cost per customer then becomes a part of the inputs and its used to determine the cost of sales/marketing and the cost of each customer. Service industries often do not match directly the normal costing systems, but the same concepts can still be used to determine the costs per customer. The SRS Educational Press is wholly owned by the Company. It performs the bulk of its work for the print materials that are sold to the customers. The press also publishes and maintains a stock of books for general sale. The press uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). The following data (in thousands) pertain to 2017: Direct materials and supplies purchased on credit: $800 Direct materials used: $710 Indirect materials issued to various production departments: $100 Direct manufacturing labor: $1,300 Indirect manufacturing labor incurred by various production departments: $900 Depreciation on building and manufacturing equipment: $400 Miscellaneous manufacturing overhead incurred by various production departments: $550 o (Ordinarily, this would be detailed as repairs, photocopying, utilities, etc.) Manufacturing overhead allocated at 160% of direct manufacturing labor costs: ? Cost of goods manufactured: $4,120 Revenues: $8,000 Cost of goods sold (before adjustment for under- or overallocated manufacturing overhead): $4,020 Inventories, December 31, 2016 (not 2017): o Materials control: $100 o Work-in-process control: $60 o Finished goods control: $500 Submission Requirements for Final Project I: As the accountant, the company has asked you to perform the following tasks: 1. Prepare an overview diagram of the job-costing system at the SRS Educational Press. 2. Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of the year-end under- or overallocated manufacturing overhead as a write-off to cost of goods sold. Number your entries. Explanations for each entry may be omitted. 3. Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated. 4. How did the SRS Educational Press perform in 2017? Should the company continue to have in-house press production? You will submit your answers/explanations for Final Project I in a memo-style format to the company’s leadership team. Use Microsoft Word and Excel. Part 2 – Departmental and Master Budgets SRS Educational Supply Company provides educational materials and supplies to educational institutions. The SRS business model is to be a one-stop provider of educational supply needs. For example, some of their product lines include educational workbooks, classroom visual aids, instructor support materials, art supplies, lab supplies, and administrative office supplies. While SRS serves all levels of educational institutions, the majority of their customers are K-12 schools. Sales can vary quite a bit from month-to-month as K-12 educational institutions have seasonal ordering patterns. Thus, budgeting is vital for planning and cash flow purposes. SRS has a June 30, fiscal year end. The company’s balance sheet at June 30 is given below: Assets Cash Accounts receivable Inventory Prepaid insurance Building & equip. (net) Total assets $ 40,000 340,000 50,000 18,000 860,000 $ 1,308,000 Liabilities & Stockholders’ Equity Accounts payable $ 130,000 Capital stock Retained earnings Total liabilities & stockholders’ equity The company’s income statement for the year ending June 30 is given below: Sales Cost of goods sold $ 5,523,000 2,541,000 420,000 758,000 $ 1,308,000 Gross margin Selling and administrative expenses Shipping Other Salaries and wages Advertising Insurance Depreciation Total operating expenses Net operating income Interest expense Net income $ 2,982,000 $ 249,000 511,000 1,104,000 685,000 27,000 228,000 2,804,000 178,000 25,000 $ 153,000 $ The following forecasts have been provided by the organization: Sales forecasts range July August September October November December $550,000 - $650,000 $900,000 - $980,000 $450,000 - $550,000 $360,000 - $420,000 $350,000 - $480,000 $350,000 - $480,000 Purchasing cost range (July – December) Cost of goods sold 42% - 50% Operating expense range (July – December) Shipping Other expenses Salaries and wages Advertising Insurance Depreciation 4% - 5% of sales 8% - 9.5% of sales $85,000 to $95,000 per month $45,000 - $58,000 per month $2,000 - $3,000 per month $25,000 per month General Instructions for Master Budget Assignment The company has four main departments: Sales, Purchasing, Operations and Finance. Based on the information provided about each department, you will create a master budget for the threemonth period beginning July 1 and ending September 30. You are responsible for creating a budget for each department that will become the master budget. The master budget must include the following detailed budgets: A sales budget by month and in total A schedule of expected cash collections from sales, by month and in total A merchandise purchase budget in dollars. Show the budget by month and in total A schedule of expected cash disbursements for merchandise purchases, by month and in total A selling and administrative budget, by month and in total A schedule of expected cash disbursements for selling and administration, by month and in total A cash budget. Show the budget by month and in total A budgeted income statement for the three-month period ending September 30 A budgeted balance sheet as of September 30 For grading purposes, you will be graded on the accuracy of the budgeted numbers. In addition, you will be graded on the accurate completion of the Budgeted Balance Sheet. Additional Financial Information for the Sales Department SRS has a large number of customers that are K-12 educational institutions. As a result, SRS receives large orders for educational supplies in July and August as schools get ready for the start of the academic year. This is also when educational budgets are still plentiful. Sales begin to decline in September and October and then monthly sales stabilize for the rest of the year (November – June) to a range between $350,000 and $480,000. Actual sales for June and your forecasted sales for the next four months are as follows: June (actual) $455,000 July Likely Range: $550,000 - $650,000 (most likely outcome is $600,000) August Likely Range: $900,000 - $980,000 (most likely outcome is $910,000) September Likely Range: $450,000 - $550,000 (most likely outcome is $475,000) October Likely Range: $360,000 - $420,000 (most likely outcome is $385,000) As the accountant, your specific responsibility is to prepare a sales budget and a schedule of expected cash collections from sales by month and in total (July – September). Additional Financial Information for the Purchasing Department Most of SRS’ clients expect a one to three-day turn-around time for orders. It typically takes a week for the company to get merchandise. As a result, the organization states that it has approximately a week’s worth of inventory on hand at all times. For budgeting purposes, the organization should plan to purchase enough merchandise during any one month to meet the sales projections for that month and to end the month with 20% of the next month’s cost of merchandise sold. The company’s cost of merchandise sold ranges from 42% – 50% of sales with the most likely outcome for next quarter (July – September) of 45% of sales. As the accountant, your responsibility is to prepare a merchandise purchase budget (in dollars) and a schedule of expected cash disbursements for merchandise purchases by month and in total (July – September). Additional Financial Information for the Operations Department The Operations and Logistics Department of SRS Educational Supply Company secures advertising that supports the sales efforts, coordinate shipping and delivery of merchandise to clients and provide general administrative support to the other departments. The organization has estimated the company’s monthly operating expenses for the next quarter (July – September) as follows: Variable: Shipping Other expenses 4.0% to 5.0% of sales with 5% of sales the most likely outcome 8.0% to 9.5% of sales with 8% of sales the most likely outcome Fixed: Salaries and wages Advertising Insurance Depreciation $85,000 to $95,000 with $85,000 the most likely outcome $45,000 to $58,000 with $50,000 the most likely outcome $2,000 to $3,000 with $3,000 the most likely outcome $25,000 As the accountant, you will prepare a selling and administrative budget and a schedule of expected cash disbursements by month and in total (July – September). Additional Financial Information for the Finance Department The Accounting and Finance Department of SRS Educational Supply Company manages the accounts receivable and collections, accounts payable, general ledger, and handles the cash management, borrowing and investing activities of the company. Historic collection data (cash collections of sales): ● All sales are on credit, with no discounts, and due in 15 days. ● The company has found, however, that only 30% of a month’s sales are collected by month-end and the remaining 70% is collected in the following month. Historic payment data: ● Purchases of inventory are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month. ● Other operating expenses are paid in cash during the month they are incurred. Other planned outlays of cash: ● During July, purchases of automated equipment totaling $200,000 for cash. ● New computers for the office will be purchased during August for $90,000 cash. ● The company plans on declaring and paying dividends of $50,000 during July. Cash management policies: ● Desired minimum ending cash balance each month: $35,000 ● The company has a line of credit with a bank. ● The company can borrow in increments of $1,000 at the beginning of each month. ● The interest rate on these loans is 1% per month and we assume a simple interest calculation (not compounded). ● At the end of each month, the company pays the bank as much of the loan as possible (increments of $1,000), while still retaining at least $35,000 in cash. ● For simplicity, the company pays the bank the interest related to the borrowing for one month at the beginning of the next month. For example, the interest on any borrowing in June is paid in July. As the accountant, you will prepare a cash budget by month and in total (July – September) and a Budgeted Income Statement for the quarter ending September 30. * Depreciation on newly acquired assets will be made as an adjustment at the end of the fiscal year. Submission Requirements for Final Project II: At this point, you should have a budget for each of the four departments. You will take the four departmental budgets and prepare the master budget. You will submit the four budgets and the master budget in one Excel file. Then, using the budget project you just completed, you will create a PowerPoint presentation that will serve as an executive brief to the organization’s leadership team. The presentation should include an overview of the budgets and the process for creating the budgets, and it should answer the questions listed below: 1. What were your goals for the master budget you created for July, August, and September? 2. What process did you use to create each of the four budgets? Did the budgeting process differ between different departments? Explain.