business associations outlin

advertisement

Business Associations Outline:

Professor Post

(Exam: one very long hypo, which covers everything we do over the semester and has 20

or so questions attached to it; there will be an extra credit question on Corporate Responsibility)

I. Intro:

A. Business Associations: the study of the means and devices by which business id conducted by either

a single individual or cooperatively by a few or many individuals. The subject is broken down into

unincorporated associations – such as agency and partnership, and corporations.

The Statutes:

1. The Uniform Partnership Act (1914) – UPA*

2. The Uniform Partnership Act (1997 – RUPA*

3. The Uniform Limited Liability Company Act (1996)

4. The Model Business Corporation Act (1969) – particularly the financial provisions – MBCA

5. The Model Business Corporation Act (1984) - RMBCA

*The Uniform Partnership Act (UPA) and the Revised Uniform Partnership Act (RUPA) are uniform acts model statutes proposed by the National Conference of Commissioners on Uniform State Laws ("NCCUSL") for the

governance of business partnerships by U.S. States. Several versions of each have been promulgated, the earliest

having been put forth in 1914, and the most recent in 1997. The 1914 version of the UPA was subsequently enacted

into law in every state except Louisiana. The most recent revision has been enacted into law by more than 40

states.Both the UPA and the RUPA attempt to cover every conceivable detail of the business partnership, including

formation, the ownership of partnership assets, the assessment of fiduciary duties, the settlement of partnership

disputes, and termination.

In NJ, we have UPA 1997 (with some variations in numbering), and the statutory provision on

this is tile 42 section 10

Ownership vs. Control in a Corp.

The corp form allows for separation between beneficial economic interests and control.

Day-to-day operations and long term strategy are typically handled by management, officers, directors

and sometimes dominant shareholder(s).

The division between ownership and control can be merely formal and in reality overlap a lot, as in the

case of a closely held corps (but, closely held corp form is being replaced with LLCs).

A Shareholder can pretty much have complete control w/o owning 100% of the shares (ie Ford-60%,

Microsoft 40%)

Since the shareholders have a riskier investment than bondholders, they usually get some sort of voting

power, whereas bondholders don’t. But bondholders can exercise negative control though

indentures/covenants that prevent the corp from making risky investments for the sole benefit of the

shareholders.

Risk and return is better organized under the corp form.

Suppliers of corporate capital:

Investors, providers of equity (shareholders)

Lenders (bondholders, banks)

Labor/Human capital (employees, contractors)

Coordinators (managers) fiduciaries, like owner’s quasi-agents, they are employees closely aligned

w/investors (ie officers and directors)

Carmen Corral

1

Spring ’06

Business Organization Choices:

INSERT CHART FROM 180 OF THE CASE BOOK HERE

Carmen Corral

2

Spring ’06

Agency problem: irreducible divergence of interest between managers and owners (i.e. aligning with other

employees on an issue, opposing a merger, level of compensation, sometimes less risk averse); solutions:

stock options, other profit sharing schemes.

Core questions turn on corporate governance. Who gets what? Who bears which risk? How is control

exercised and transferred?

Sole Proprietorship – Owner of the business carries on the business as an individual.

Debt – Owner directly liable for all debts of the proprietorship.

Tax – Owner reports the tax as his own.

Partnerships –

General Partnership – UPA definition: “an association of two or more persons to carry on as co-owners

a business for profit”

Creation By operation of law – Partnership can come into existence by operation of

the law, without any filing of papers.

Creation by ‘estoppel’– If two people represent to the outside world that

they are in partnership. See UPA §16.

1. Limited scope – Applies only where 3d party extends credit to the

partnership. Other forms of reliance inapplicable.

Life Span – Dissolution: Dissolves upon death, bankruptcy, or withdrawal of any partner.

Absent an agreement, any partner may withdraw and demand liquidation.

Liability to Outsiders – Partners have unlimited liability, personal assets at risk for partnership

obligations.

Under some statutes liability of partnership contracts is joint, so

partnership assets must first be exhausted.

LLP Statutes – Limit liability of partners for partnership debts and

obligation, unless partner supervised another partner or agent engaged in

wrongful conduct.

Financial Rights – Partners share equally in profits and losses, which are divided on dissolution.

No statutory right to profits.

No statutory right to compensation for services.

Firm Governance –

Binding the firm: Each partner is an agent of all other partners and can

bind the partnership, either by transacting business as agreed by the

partners (actual authority) or by appearing in the eyes of 3d parties to

carry on partnership business (apparent authority).

Control of firm – Unless otherwise agreed, majority vote needed to decide

ordinary partnership matters.

1. Extraordinary matters or those contravening agreement – require

unanimity.

Transferability of Ownership Interests – Partner cannot transfer interest unless all remaining

partners agree or partnership agreement permits it.

Partner may transfer his financial interest in profits and distribution,

entitling the transferee to a charging order.

Limited Partnership –

Formation – Must be created with written agreement among the partners and certificate filed

with state official. RULPA §201.

Carmen Corral

3

Spring ’06

Dissolution – Limited partnership lasts as long as the partners agree or,

absent agreement, until a general partner withdraws.

Nature – 2 kinds of partners

General – Each liable for all debts of the partnership;

1. Corporate general partner – General partners may be corporations.

Limited – Not liable for debts of partnership beyond their proportional

share of contributions.

1. No mgmt. participation –

Liability to Outsiders –

General Partner – Must be at least one unlimited liability

Limited Partners – Liable only to the extent of their investment.

1. No participation in control

Firm Governance –

Binding firm: General partners have authority to bind the partnership to

ordinary matters.

1. Limited partners have voting authority over specified matters, but

cannot bind the partnership.

Transferability of Ownership Interests –

General Partner – Cannot transfer interest unless all remaining partners

agree or partnership agreement permits it.

Limited Partner – Interests freely assignable.

Both – can assign their rights to profits and distributions.

Limited Liability Company (LLC) – Hybrid entity between corporation and partnership; Partnership

aspects – Members of LLC provide capital and manage the business according to their agreement;

Interests are not freely transferable; Corporation aspects – Members not personally liable for the debts

of the LLC entity.

Life Span – LLC arises with the filing of a certificate or articles of organization with a state

official.

i) Many LLC statutes require at least two members.

ii) Duration – Not limited by statutes.

Liability to Outsiders – LLC members, both as capital contributors and managers, are not liable

for LLC obligations.

i) Veil-piercing – Some LLC statutes suggest that members can become

individually liable if equity or justice requires.

Firm Governance –

i) Two Possibilities: (1) Member-managed; (2) Manager-Managed.

Member-Managed – Members have broad authority to bind LLC in much

the same way as partners;

Manager-Managed – Members have no authority to bind.

ii) Voting – Generally in proportion to members’ capital contribution.

Transferability of Ownership Interests – Most LLC statutes provide that members cannot transfer

LLC interests without all other members’ consent.

i)

Standing Consent – Some LLC statutes permit the articles of organization to

provide standing consent for new members.

(ii)

Transfer of financial rights – Many LLC statutes permit transfer of financial

rights to creditors, who can obtain charging orders against the members’

interest.

Carmen Corral

4

Spring ’06

Avoiding Double Taxation:

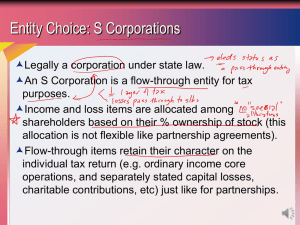

S-Corporation – What is it? Incorporated under state law and retains all its corporate attribute,

including limited liability. But it is not subject to an entity tax. All corporate income, losses,

deductions, and credits flow through to shareholders.

Eligibility:

Domestic – S-Corp. must be domestic;

75 Shareholders – No more than 75 indiv. shareholders;

Certain tax-exempt entities can be shareholders, e.g. stock ownership

plans, pension plans, charities.

Aliens – No shareholder can be a nonresident alien;

One class of stock – There can only be one class of stock.

Limitation

When heavy losses are anticipated, the S-Corp. may be less desirable than a

partnership; S-Corp. shareholders can only write off losses up to the amount of

capital they invested.

Loss can be carried forward and recognized in future years.

Rules on deductibility of passive losses may limit deductions for S-Corp.

shareholders, just like partners in a partnership.

Limited Partnership with a Corporate General Partner Combination – Flow-through tax treatment + Limited liability

Limited partner investors – have limited liability.

Participants – Shareholders, directors, or officers of the corporation have limited

corporate liability.

Uncertainty – When limited partners take on roles in corporate management “participate

in control” by virtue of their corporate positions some courts interpreted early limited

partnership statutes to make limited partners liable if they acted as directors and officers

of a corporate general partner.

Payment to shareholders of deductible compensation or interest – Corporate tax in a small,

closely held C-corporation can be zeroed out by paying shareholders deductible compensation or

interest.

Deductible compensation – Shareholders-employees can receive salaries, bonuses, and

contributions to profit-sharing plans, as long as they are “reasonable.”

Constructive dividends – If compensation is not related to the value of services,

IRS can treat excess compensation as “constructive dividends” and the

corporation loses its deduction, e.g. secretary gets $200K per year.

Deductible interest – Shareholder-lenders can receive deductible interest, rather

than non-deductible dividends.

Accumulating corporate earnings – If corporate earnings are reinvested in the business and not

distributed to shareholders, no federal income tax.

Under current tax law, any gains from selling assets that have increased in value

are taxed at the corporate level before the proceeds are distributed to shareholders,

Carmen Corral

5

Spring ’06

where they are taxed again. Nonetheless, it may be advantageous to let earnings

accumulate in a business, at sometimes lower corporate tax rates.

B. Agency (See also the Restatement on p. 4-6 of the Casebook)

1. Introduction: Agency is a legal relationship that is crucial to any common law legal system because

most of the work in the world is done by agents working for their principal. The law of agency covers

both personal activities and business activities. You don’t need the formalities of a contract or

consideration in order to have an agency relationship, though they are very often present. Agency is a

conductor of liability. Agency is an agreement by one person (an agent) to act for a principal at the

principal’s direction and control. Either the principal or the agent can terminate the agency at any time –

in no event can the agency continue over the objection of one of the parties. 3 subdivisions of agency:

the servant-agent

the non-servant agent, and

the non-agent

Consequences of agency: One of the most crucial consequences is that any agency relationship creates

heavy fiduciary duties running both ways.

From the agent to the principal: is a duty to promptly and accurately account and disclose, the

fiduciary duty of loyalty, which includes a duty not to compete with her principle, also anything

the agent obtains as a result of her employment belongs to the principal, thus effectively a

barring the retention of secret profits, advantages, and benefits absent the principal’s consent .

From the principal to the agent: is a duty to compensate the agent, including reimbursing her

for out of pocket costs, unless the parties contract otherwise. The principal also has a duty to

cooperate with the agent and aid her in the performance of her duties.

Remedies Available to the Principal:

Damages: in tort for breach of fiduciary duty

Action for secret profits: the actual profits recovered from them

Rescission: any transaction that violates the agent’s fiduciary duty is voidable by the

principal

Other: include an accounting, or imposition of a constructive trust on property the agent

obtained in violation of his fiduciary duties

Remedies Available to the Agent:

The agent’s lien: A lien is a charge upon, or interest in, property. It’s a rough form of coownership. For example, your attorney is your non-servant agent. You can’t tell her how to

do her job. You can control the result, but not the exact process. A general rule is that an

agent not paid what the principal promises to pay him may (emphasis on may) have a lien on

property of the principal in his possession. Agents liens are crucial and attorney’s liens are

one of the most important.

Who is an agent?: the manifestation of consent requirement is objective – it doesn’t matter what

the principal truly intended, but rather, the agency relationship depends on what the agent

believed the principal intended. Thus an agency relationship can arise even where the principal

subjectively intended no such relationship. Moreover, agency power to bind the principle can

arise even absent true mutual consent. Ways for an actual agency relationship to be formed:

Carmen Corral

6

Spring ’06

By agreement

By ratification: occurs when the principal accepts the benefits or otherwise affirms the

conduct of someone purporting to act for the principal, even though no actual agency

agreement exists

Agency by Estoppel: a principal may act in suach a way that a 3rd party reasonably believes

that someone is the principal’s agent/ this is called agency by estoppel

2. Liability of Principal to 3rd Parties in Contract: after establishing that an agency relationship

exists, a 3rd party wanting to hold the principal liable must demonstrate the scope of the agent’s authority

to act for the principal. There are several sources of authority:

i)

Actual Authority: may be expressly conferred on the agent, or reasonably implies by

custom, usage, or by the conduct of the principal to the agent. Such authority may be

either expressed or implied. The principal is bound.

a. Express Authority: is actual authority contained within the agency agreement (i.e.

expressly granted by the principal); i.e. “ I want you to do/be responsible for tasks x,

y, and z

b. Implied Authority: comes from the words or conduct between the principal and the

agent. It is often labeled to signify how it has arisen: a) incidental to express

authority; b) implied from conduct; c) implied from custom/usage/habit; and d)

implied because of emergency

ii)

Apparent Authority: results when a principal manifests to a 3rd party that an agent is

authorized, and the 3rd party reasonably relies on the manifestation. There must be some

holding out by the principal that causes a 3rd party to reasonably rely on the

principal’s manifestation; suit by 3rd parties against the agent will disappear if the

principal expressly, implicitly, or by conduct ratifies or adopts the contract. This

action will make it as if there was actual authority from the beginning. But if the board

of directors does not ratify, 3rd party has a cause of action in restitution against agent.

Current approach in the courts: they stretch and strain to protect the expectations

of 3rd parties even when the principal’s manifestations of consent were illusory at

best.

a. Rationale: it is easier/more efficient to make the principal responsible for keeping

track of her agents as opposed to having the court do it

iii)

Inherent Agency Power: not well defined, but is thought to be analogous to the doctrine

or respondeat superior in torts. Recognizes that it is inevitable that in the course of

performing her duties, either by mistake, negligence, or misinterpretation of her

instruction, an agent may harm a 3rd party or deal with one in an unauthorized manner. It

is an agency power that raises even in the absence of actual or apparent authority or by

estoppel. It arises from the designation by the principal of a kind of agent who ordinarily

possesses certain powers. The doctrine is based on a reasonable foreseeability rationale.

The test is whether the principal could reasonably foresee that an agent would take

the action she did; often based on the agent’s title (i.e. if you’re a ‘Buyer’, you can be

expected to have the power to buy stuff)

iv)

Ratification: A person may affirm of ratify a prior act supposedly done on his behalf by

another by another that was not authorized at the time it was performed. Ratification

causes the agent’s act to be treated as if the principal had authorized it at the outset.

v)

Authority by Estoppel: When a principal negligently or intentionally causes a 3rd party to

believe that his agent has authority to do an act that is actually beyond his authority, and

the 3rd party detrimentally relies on the principal’s conduct, the principal is estopped

from denying the agent’s authority. Estoppel is different from apparent authority in that

apparent authority makes the principal a contracting party with the 3rd party with

rights and liabilities on both sides. In contrast, estoppel only compensates the 3rd party for

Carmen Corral

7

Spring ’06

losses arising from the 3rd party’s reliance; it creates no enforcement rights in the

principal against the 3rd party.

3. Agent’s Liability on the Contract: an agent’s liability on a contract depends on the statue of his

principal

i)

ii)

Disclosed Principal: an agent who purports to contract for a disclosed principal is not

personally liable on the contract. In such a case, the agent negotiates the contract in the

name of the principal, and the agent is not a party to the contract. The parties’ intent is

that the principal be bound.

Undisclosed or Partially Disclosed Principal: both the fact of agency and the principal’s

identity are not disclosed. In the partially disclosed principal cases, the 3rd party knows

that the agent is acting as an agent, but does not know the identity of the principal. An

agent acting on behalf of an undisclosed principal is personally liable on the contract

itself. Courts generally apply the same rule in partially disclosed principal cases. If the

agent has signed or described himself as an agent for an undisclosed person, he is

personally liable on the contract unless otherwise agreed.

4. Liability of Principal to 3rd Parties in Tort: issue is a question of fact

i)

Master-Servant: involves a servant, who, under the control of her master, renders some

sort of service. The master- servant relationship is precisely the same thing as “common

law employee”. This relationship is more commonly referred to as Employer-Employee

now. Control is the essential feature of this relationship. The employer retains control

over the manner in which the employee performs services. If the principal has legal

power to control the agent’s time allocation as well as how and when the agent works,

then the person is a servant-agent. This comes up in tax and other statutes that refer to the

word “employee”. Notice to a sufficiently important agent of a principal is notice to the

principal itself at common law

a. Respondeat superior: Respondeat superior – “Let the master answer.” What is this

doctrine? If you have (1) a servant-agent, (2) acting within the scope of employment,

(3) who commits a tort, the actor is liable, but, in addition, the master (the principal)

is liable even if the master is without fault. The related tort doctrine says that if the

principal was negligent in hiring, training, or failing to fire the agent, then you can

sue the principal in tort.

b. Application to Corporate Board Members: If a person is a director and only a

director, then that person is not any type of agent because an agent is one who agrees

to act for the principal and at the principal’s control and direction. This definition

doesn’t fit a director, because they are the ones who determine the principal’s

policies! This has practical ramifications: there is no wage withholding from the pay

of directors. They get a check from the company and they have to pay by declaration

of estimated tax. Furthermore, in almost all states, a person who is a director and only

a director is not covered by Workers’ Compensation or Equal Employment statutes.

Is the top officer of a corporation a servant-agent? Yes. If you carefully go through

the definition, you’ll find that the principal is the board of directors in this case. They

have the legal power to allocate the time of the president. The president of a

corporation is a servant-agent. The president’s salary is withheld, and the president is

covered by Workers’ Comp and Equal Employment statutes.

c. Application to General Partnerships: The partners, acting together, determine the

partnership policy. Thus, a partner of a partnership is not an employee of the

partnership and has no wage withholding.

Carmen Corral

8

Spring ’06

ii)

Independent Contractors aka Non-Agent Servants: arises when a principal retains

someone to do a certain job or achieve a specific objective. The principal retains no right

of control over the independent contractor as to how the work is performed. The

independent contractor determines for herself how she will achieve the end goal.

a. Respondeat superior: is built upon the premise that where there is a servant-agent

over whom the principal has the legal power over their physical activities, the

principal is liable whether or not he is negligent in hiring and training that agent. On

the other hand, respondeat superior doesn’t apply to a non-servant agent, though some

other theory like negligent hiring may apply. Officers of corporations are servantagents, but directors or outside law firms are not servant-agents.

b. Defining servant versus independent contractor: Restatement

1. The extent of control to which, by the agreement, the master may exercise over the

details of the work.

2. Whether or not the one employed is engaged in a distinct occupation or business.

3. The kind of occupation, with reference to whether, in the locality, the work is

usually done under the direction of the employer or by a specialist without

supervision.

4. The skill required in the particular occupation.

5. Whether the workman or the employer supplies the instrumentalities, tools, and

place of work for the person doing the work.

6. The length of time for which the person is employed.

7. The method of payment, whether by time or for the job.

8. Whether or not the work is part of the regular business of the employer.

9. Whether or not the parties believe they are creating the relationship of master and

servant.

10. Whether the principal is or is not in business.

The Partnership statutes change the Agency relationship – every partner is an agent of the partnership

and of every other partner

Hypothecate: To pledge property as security for a debt without giving up possession or title. The pledged

property is said to be hypothecated. For example, a savings or trust account that is pledged or assigned as

collateral for a loan is called a hypothecated account.

II. Partnerships

Intro: A partnership is treated both as a separate entity from its partners (for some purposes) and as though

there is no separate entity but merely an aggregate of separate, individual partners. The partners are jointly

and severally liable for the obligations of the partnership per UPA §15. And for federal income tax purposes,

the income and losses of the partnership are attributed to the individual partner; the partnership itself does

not pay taxes. RUPA §201 expressly states that a partnerships is an entity, thus simplifying many partnership

rules such as those on property ownership and litigation.

Uniform Partnership Act: UPA §§6, 7, 9, 15, 16, 18

controlling law governing general partnerships

most states adopt UPA even though it is a matter of state law greater uniformity than corp law

you can’t avoid general partnership status just by labeling if you’re associated as joint owners;

statements that no partnership is intended are not conclusive

Carmen Corral

9

Spring ’06

UPA §6: Partnership Defined – an association of two or more personas to carry on a business as co-owners

for profit. A lawful partnership cannot be formed for nonprofit purposes.

Agreement to Form a Partnership:

Formalities: if the partnership is to continue beyond one year, the Statute of Frauds requires that the

agreement be written

Duration: If no term is specified, then the partnership is terminable at the will of any partner

Capacity to become a partner: persons must have the capacity to contract; some states hold that

corporations cannot be partners

Consent of the parties: a prospective partner must have the consent of all of the other prospective

partners UPA §18(g)

Intent of the parties: where there is any question, the intent of the parties involved is determined

from all of the circumstances per UPA §7

UPA §7: Formation –

(1) Persons who are not partners as to each other are not partners as to 3rd parties

Receiving a share in the profits is prima facie evidence of a partnership

Contract can be either express or implied

No filing is necessary

Knowledge that you’re partners is not necessary

UPA §9: Relationship between partners and the partnership – every partner is an agent, which carries with it

a fiduciary duty to act fairly and honestly

UPA §15: Liability – Joint and severable unlimited personal liability; misconduct of one partner could result

in the financial ruin of fellow partners

UPA §18: starts with language “subject to any agreement between partners”

(a): Profit/Loss – evenly divided, equally allocated; each partner is a residual claimant; even where

one person is providing only capital and the other only services

(e): Ownership & Management – equal

(g): New Members – unanimous consent of all the partners is required

(h): Dispute Resolution – ordinary matters = majority decides; other matters = requires unanimity

UPA §31: Exit Right – at will dissolution (if no writing for the original agreement)

UPA §33: Exit Effect – dissolution terminates all authority of any partner to act for the partnership

RUPA §202 Formation of Partnership – requires only a statutorily specified mutual manifestation of consent

(a): The association of 2 or more persons to carry on as co-owners a business

for profit forms a partnership whether or not the persons intended to form a partnership

(b): An association formed under a statute other than this one, a predecessor statute, or a

comparable statute of another jurisdiction is not a partnership under this Act

(c): In determining whether a partnership is formed, the following rules apply

o (3) if you share profits, you are presumed to be a partner unless one of the

exceptions applies (exception= where profit sharing does not = partner) see second box

below

(d)(2): Sharing profits/returns does not by itself establish a partnership

Carmen Corral

10

Spring ’06

To establish partnership: 4 Part Test (all parts must be met)

1. an agreement to share profits

2. an agreement to share losses

3. a mutual right of control or management of the business; and

4. a community of interest in the venture

*Used in the absence of an agreement

Way to tackle the question of whether a partnership exists – move from UPA §7 to §6

1. Partnership is a matter of contract

2. And so it is a matter of objective intent of the parties

3. Is there a prima facie case of partnership; did they share risk like co-owners; did they share control the

way co-owners do? Set up all the facts that lead you to your conclusion

4. What are the possible other classifications/what’s the other side of your agrument finding a partnership

5. Talk about the defintion of a partnership

Problems with Partnership Law:

a partnership can be formed by conduct, rather than conscious decision

If you share risk and share control can be treated as a partner absent explicit

agreement outside of exceptions RUPA §202(c)(1)-(3)(i)-(vi)

o (i) as a debt by installments or otherwise,

o (ii) as wages of an employee or rent to a landlord,

o (iii) of rent

o (iv) as an annuity to a widow or representative of a deceased partner,

o (v) as interest on a loan, and

o (vi) as the consideration for the sale of a good-will of a business

Once a partnership is created, each partner shares losses with unlimited liability [ie

sued, all bear losses]

To avoid these problems, best to have a partnership agreement so that those who

are partners know it and those who aren’t also know

The Need for a Written Agreement: Although there is no requirement that a partnership agreement be in

writing, there are several advantages to doing so

It may avoid future disagreements

Can be readily proved in court

May point out potential trouble spots

Facilitates allocation of tax burdens among themselves

Resolves death and/or retirement issues

Clarifies whether investments are lent rather than contributed

Satisfies the Statute of Frauds where real estate is involved

Assumed name statutes: If you are doing business under an assumed name, you are supposed to file an

assumed name certificate. As to a partnership, the statute is especially demanding in that, if you are a

partnership and the firm name contains less than all of the names of all of the partners, the county recorder is

not to accept real estate documents unless there is an assumed name certificate filed. If the firm name is

Smith & Jones and there is only Smith and only Jones, you’re okay.

Sharing of Profits and Losses:

I. Profits of a business may be divided by agreement in numerous possible ways including:

Carmen Corral

11

Spring ’06

The partners may share on a flat percentage basis without regard to any other factor.

Profit sharing ratios for each partner may be established in the partnership agreement

itself. They may also be established by issuing “partnership units” to each partner and

determining the profit-or loss-sharing ratio for each partner by dividing the number of

units owned by that partner by the total number of units outstanding.

One or more partners may be entitled to a fixed weekly or monthly salary.

The partners may share on a percentage basis:

o with the percentages recomputed each year on the basis of the average amount

invested in the business during the year by each partner.

o with the percentages recomputed each year on the basis of total income, the sales

or billing by each partner, time devoted to the business, or on the basis of some

other factor.

In large partnerships, each partner may be entitled to a fixed percentage applied against

perhaps 80 percent of the income. The remaining 20 percent is allocated among the junior

partners as a form of incentive compensation etc.

The agreement may remain silent on the division of profits, it being contemplated each

year that the partners will work out the division of profits by agreement on a mutually

acceptable basis.

RUPA §401(b) creates the presumption that profits are to be divided equally among

partners

Note: If no partnership agreement, look to the default rules. The default rule per

UPA §18(a) is: profits are shared equally. Losses are shared in the same

manner as profits.

II. Responsibility for losses

RUPA §401(b) provides that losses are divided according to each partners assigned share

of the profits

LLP: its unique feature is that by electing LLP status partners may avoid personal

liability for partnership claims that cannot be satisfied from partnership assets.

o Always some possibility that partners may become liable to third persons because

of their own conduct.

“Joint liability” requires joinder of all partners as defendants in litigation.

o Joint and several liability permits suit to be brought against one or more of

the partners without them all.

Judgment creditors/3rd parties are required to first exhaust partnership assets before

proceeding directly against the assets of one or more of the partners. RUPA §301-8

o There is liability for a 3rd party who enters into a contract with the partnership

when the contract is for something in the ordinary course of that partnership’s

business

o The partnership can contest and avoid liability if it can show there was, in

fact, no authority or there was notice that there was no authority

A partnership is an entity separate from the original partners (important for

procedural requirements)

In some cases, dealing with the partners not discussing the sharing of losses, the

courts have ruled that the absence of an express agreement to share losses indicated

that no partnership was ever created in the first place.

o However, some courts have recognized that an express agreement to share

losses is not essential for the existence of a partnership. {see UPA §7 and

RUPA §202(c)(3)).

Carmen Corral

12

Spring ’06

Richert v. Handly I (p. 30)

o Issue: Who bears the loss when a partnership enters into an agreement where

the partners agreed to share equally in the profits and the losses from a

venture, the venture suffers a loss and one of the partners sues for

reimbursement of his capital contribution?

o Rule: The cause must be remanded with directions to make findings regarding

the basis on which the parties agreed that the losses were to be shared and

whether the claims of one partner were to take priority over the claims of the

other.

Richert v. Handly III (p. 33)

o Issue: Should one party be compensated over the other party in a partnership

suffering a loss when there was no agreement between the parties to whether

the parties losses would be shared, whether one party’s losses were to take

priority over the other, whether one of the parties was to be compensated for

his services, or an agreement showing how the loss of capital by one party

was to be borne?

o Rule: Since the agreement did not specify how the losses would be shared or

whether one partner’s claims were to take priority over the claims of the other,

UPA §§18(a), 18(f) are controlling. UPA §18(a): Each partner shall be

repaid his contributions, whether by way of capital or advances to the

partnership property and share equal in the profits and surplus

remaining after all liabilities, including those to partners, are satisfied;

and must contribute towards the losses, whether of capital or otherwise,

sustained by the partnership according to his share in the profits. UPA

§18(f): No partner is entitled to remuneration for acting in the e partnership

business, except that a surviving partner is entitled to reasonable

compensation for his services in winding up the partnership affairs.

(service/capital ) Ct. screwed up the math. Should return capital, then force

contribution.

Class notes:

o Leasing remains the same in capital account

o Partnership law runs into problems when one person puts in capital and

the other partner puts in services.

Solution: you can put into the written agreement that capital

account will go up with services provided. (try to give credit for

labor in written agreement)

In Kessler v. Antinora, Agreement said will share profits 60/40

but silent on losses. Court allowed labor to contribute.

Employee or Partner?:

If there is confusion as to whether one is an employee, look to employment K

If no K, do analysis:

o Is employee sharing losses?

o Is employee sharing control?

Might be think about what actions they do contribute to business

o Policy: Cuts in favor of not making employee a partner unless explicit K because

people might otherwise avoid certain jobs if it means risking losses

Carmen Corral

13

Spring ’06

A. Fiduciary Obligations of Partners

Analysis-Fact Heavy

1. Make sure that one party is empowered to exercise discretion on behalf of another

party

2. Look at character and conduct of relationship and the business of legal entity

3. Look at facts and circumstances of the breach of duty

No Violation IF1. Solely because partner’s conduct furthers their own interest

2. Partner may lend money, provide collateral and transact with other

business

Winding Up- partnership business or affairs as the personal or legal representation of the last surviving partner

as if person of the partner.

1. Partnership agreement controls

MAY NOT1. Eliminate the implied covenant of good faith and fair dealing

2. Maximum effect of freedom of contract

The RUPA approaches the fiduciary duty issue very differently from the UPA; it attempts to diminish the

vague, broad statements and uncertainty of the latter.

i.

2 elements of Fiduciary Duty

1) Duty of Care: to promote the interest of the employer

2) Duty of Loyalty: to put the company’s interest above the

individual’s interest and not enrich him/herself at the cost of the

company.

Fiduciary Duties: UPA §§20-22; RUPA §§403-405; 603 (duties during dissolution)

The Duty of Care: not big in partnerships because the assumption is that all partners are actively

involved in the running of the business; The standard here is gross negligence rather than just

negligence; essentially the duty of care owed in corporate law applied to partnerships

o Business Judgment Rule: a presumption created that business judgment makers were doing

their best for the business; so, it is the P’s burden to rebut this presumption; good-faith, fully

informed, & acted in the best interest of the corporation

The Duty of Loyalty: RUPA §404(b) – a partner’s duty of loyalty to the partnership and the other

partners is limited to:

o (1): Can’t appropriate a partnership opportunity

o (2): Can’t act as or on behalf of an adverse party

o (3): Can’t compete with the partnership/partners

Bane v. Ferguson (p. 49): Issue is whether retired partner has claim against firm for loss of pension.

Firm merged into larger firm and went out of business. P first theory of recovery was under UPA

§9(3)(c) one or more partners can not commit act that would make it impossible to carry out

ordinary business of partnership. 2nd was violation of fiduciary duty to him. Held: Bane was no

Carmen Corral

14

Spring ’06

longer partner, therefore no fiduciary duty was owed to him. Business judgment rule: if judgment is

exercised within reasonable range of business judgment and turns out to be the wrong decision, there

is no liability; Rationale: no second guessing and allows people to make decisions.

MEINHARD V. SALMON

FACTS HOTEL LEASED TO SALMON FOR 20 YEARS. SALMON ENTERS INTO ARRANGEMENT WITH INVESTOR MEINHARD

TO FULFILL OBLIGATIONS AS LESSEE. S AND M AGREE TO SHARE EXPENSES AND PROFITS. S TO HAVE SOLE

MANAGEMENT POWER. CERTAIN BUYOUT RIGHTS ON DEATH OF EITHER PARTY. LESSOR APPROACHES M WITH 4

MONTHS LEFT ON LEASE - NEW LEASE TO S FOR 20 YRS + OPTION UP TO 80 YRS. S DOES NOT OFFER M OPPORTUNITY

TO PARTICIPATE. M SUES S FOR SHARE OF PROFITS IN NEW LEASE.

RULING COURT CONFIRMS APP DIV AWARD OF PROFITS INTEREST TO M.

REASONING JOINT ADVENTURERS, LIKE COPARTNERS, OWE TO ONE ANOTHER, WHILE THE ENTERPRISE CONTINUES,

THE DUTY OF THE FINEST LOYALTY. NOT HONESTY ALONE, BUT THE PUNCTILIO OF AN HONOR THE MOST SENSITIVE

IS THE STANDARD OF BEHAVIOR REQUIRED. LESSOR WOULD HAVE OFFERED OPPORTUNITY TO S AND M AS

PARTNERS IF HE HAD KNOWN OF PSHIP AS LESSEE.

Meinhard v. Salmon (p. 67): A person named Gerry leased Hotel Bristol to Salmon. Salmon needed

monies and asked Meinhard for funds. Meinhard agreed and Salmon was to pay him a portion of the

profits upon a time basis. The two were coadventurers. The majority of the duties fell upon Salmon.

They were not partners on paper. After the end of the lease of the Hotel, the new owner of the hotel

wanted to do some construction and the owner needed someone to help w/ his idea. Owner

approached Salmon and went ahead w/ a deal w/ Owner w/out informing Meinhard. Meinhard

found out after the fact about the deal and he sued Salmon for profits on the new deal.

Analysis:

Rule: Joint adventurers, like co-partners, owe to one another, while the enterprise continues,

the duty of loyalty.

Salmon owed a duty of loyalty to inform Meinhard of the deal to allow Meinhard to compete.

RUPA §404 (a & b1) General Standards of Partner’s Conduct

Holding/Rule:

Court found that Salmon breached his duty of loyalty to Meinhard, who the court looked at

as a partner. Meinhard recovers under fiduciary duty. Salmon had a heightened

duty/obligation to Meinhard b/c Salmon had the day to day dealings of the business or

control of the business.

Joint adventurers owe to one another, while their enterprise continues, the duty of

finest loyalty, a standard of behavior most sensitive

Dissent:

Disagrees on the basis that the arrangement between Meinhard and Salmon was a limited

arrangement, limited to the adventure and there was not duty.

b. Meinhard v. Salmon (80): Salmon and Meinhard are joint venturers. They enter

into a 20 year lease. 4 months before the lease is over Salmon is offered a

profitable lease which he accepts under his wholly owned subsidiary, Salmon

Corp.

i.

Meinhard sues Salmon for breach of fiduciary duty.

1) Duty of loyalty case.

ii.

Salmon had a duty of full and adequate disclosure of all the facts to

Meinhard.

1) Salmon can enter into an agreement with Gerry but he must

inform Meinhard of the opportunity.

iii. The breach of duty in this case came from the failure to disclose.

Carmen Corral

15

Spring ’06

iv.

v.

vi.

vii.

viii.

Cardozo’s point is that Salmon does not have to share the opportunity

Meinhard, but Salmon is obligated to notify Meinhard of the opportunity.

Meinhard gets the benefit of hindsight because if Salmon had made a loss,

Salmon would not be able to go after Meinhard to share in the losses.

1) Cardozo is creating incentives for partners to disclose.

Dissenting Opinion

1) The dissent says that fiduciary duty law is a gap filler when the

agreement is silent, but the gap is filled at the time of the

agreement.

2) The contract is the end all and be all.

Cardozo does not ignore the agreement, but looks to the duty of loyalty

which he states was breached by Salmon when he failed to disclose that he

had entered into an agreement with Gerry.

Salmon could have terminated the partnership and entered into the

agreement, but Salmon did so when the partnership was still in effect and

when it was continuing.

Should you be able to contract out of your fiduciary duty?

No, partnership is the one business agreement where the parties are totally vulnerable to each

other; to disallow contracting out would protect each from the other; to allow it would invite

unscrupulous behavior

There are certain relationships that carry legal fiduciary duties (lawyers & clients, trustees &

clients, and partnerships) mostly because of this issue of vulnerability

RUPA §103(b)(3) says that partners can’t agree to void fiduciary duties except:

They may identify specific types or categories of activities that do not violate the duty of

loyalty, if not manifestly unreasonable; or

All, a number, or a percentage of the partners may authorize or ratify, after full disclosure of

all material fact, a specific act or transaction that otherwise would violate the duty of loyalty

NJ Statue on fiduciary obligations:

Partners can’t restrict access to books and records unreasonably to other partners

Duty of Loyalty – can’t agree to let one partner intentionally harm the partnership; can’t be

reduced so as to allow a partner to do anything injurious to the other

Duty of Care – can’t unreasonably reduce the standard of care

B. Partnership Property - UPA §§24-28

A frequent issue involves whether property is partnership property of the individual property of a partner. All

property originally brought into the partnership or subsequently acquired, by purchase or otherwise, for the

partnership is partnership property per UPA §8(1). Where there is no clear intention expressed as to whether

property is partnership property, then courts consider all of the facts related to the acquisition and ownership

of the asset in question. Some of the factors considered are:

How title to the property is held

Whether partnership funds were used in the purchase of the property

Whether partnerships funds have been used to improve the property

How central the property is to the partnership’s purposes

Carmen Corral

16

Spring ’06

How frequent and extensive the partnership’s use is of the property; and

Whether the property is accounted for on the financial records of the partnership

Rights and Interests:

Individual partner’s interest in the partnership: the property rights of an individual partner in

the partnership property are 1) her rights in specific partnership property; 2) her interest in the

partnership; and 3) her right to participate in the management of the partnership UPA §24

o Rights in specific partnership property: each partner is a tenant-in-partnership with her

co-partners as to each asset of the partnership per UPA §25(1). The incidents of this

tenancy are as follows:

Each partner has an equal right to possession for partnership purposes

The right to possession is no assignable, except when done by all of the partners

individually or by the partnership as an entity

The right is not subject to attachment or execution except on a claim against the

partnership

The right is not community property, hence it is not subject to family allowances,

dower, etc.

On the death of a partner, the right vests in the surviving partners

§25:

o (1): A partner is co-owner with his partners of specific partnership property holding as a

tenant in partnership

o (2): This means that

(a): Each partner, subject to this act and any agreement between the parties, has an

equal right to possessor specific partnership property for partnership purposes; but

he has no right to possess such property for any other purpose without the consent

of his partners

(b): The right of a partner as co-owner in specific partnership property is not

separately assignable

(c): Partnership property cannot be attached/executed towards the debts of an

individual partner; if the property is attached/executed towards the debts of the

partnership as a whole, it cannot be protected via the homestead or exemption

laws

(d): On the death of a partner, the other partners and not the executors of the

deceased partners will/estate can have a right to wind up the partnership affairs

except when the deceased partner was the last surviving one, when his right in

such property vest in his legal representative

Partner’s interest in the partnership: is her share of the profits and surplus, which is personal

property per UPA §26 even if it is real property that the firm owns

o Consequences of classification as personal property: the partner’s rights to any

individual property held by the partnership are equitable (the partnership holds title), and

this equitable interest is ‘converted’ into a personal property interest. This can be

important in the inheritance situations where real property may be given to one heir and

personal property to another

o Assignments: a partner may assign her interest in the partnership (unless there is a

provision in the partnership agreement to the contrary), and unless the agreement provides

otherwise, such and assignment will not dissolve the partnership per UPA §27(1)

The assignee has no right to participate in the management of the

partnership (i.e. he is not a partner )

Carmen Corral

17

Spring ’06

But the assignee is liable for partnership obligations

Creditor’s rights: a creditor of an individual partner may not attach partnership assets. He must get a

judgment against the partner and then proceed against the individual partner’s interests

Third party claims against partnership property:

UPA

§25(1) Partnership owned by partners as

“tenants in partnership.”

§25(2) Partner cannot possess or assign

rights in partnership property, partner’s heirs

cannot inherit it, and a partner’s creditors

cannot attach or execute upon it.

UPA

Contributors of equity capital do not “own” the

assets themselves but rather own the rights to

the net financial returns that these assets

generate, as well as certain governance or

management rights. §§26 and 27

Individual creditors of partners (e.g., banks that

have made personal loans to partners) are

permitted to obtain “charging orders” which

are liens on partner’s transferable interests that

are subject to foreclosure unless redeemed by

payment of debt. §28

RUPA

RUPA abandoned the transparent fiction of joint partner

ownership of property entirely in favor of straightforward

entity ownership in §§ 501 and 502.

§501 states that partners are not co-owners of partnership

property.

§502 states partner’s transferable interest in the

partnership.

RUPA

Contributors of equity capital do not “own” the assets

themselves but rather own the rights to the net financial

returns that these assets generate, as well as certain

governance or management rights. §§502 and 503

Individual creditors of partners (e.g., banks that have made

personal loans to partners) are permitted to obtain

“charging orders” which are liens on partner’s transferable

interests that are subject to foreclosure unless redeemed by

payment of debt. §504

A general partner’s personal assets are considered part of the general fund to which a bankruptcy estate may

look to satisfy partnership debts.

Jingle Rule (used by UPA)

Parity Rule (used by RUPA)

Partnership creditors have first priority in the

assets of the partnership.

Individual creditors have first priority in the

assets of the individual.

Partnership creditors have first priority in the assets of the

partnership.

Partnership creditors are placed on parity with individual

creditors in allocating assets of an individual partner when

a partnership is bankrupt.

C. Inadvertent Partnerships: There is no such thing as an inadvertent LLC or corporation.

Carmen Corral

A recurring issue in partnership law is whether an arrangement between persons may

unintentionally constitute a partnership so that a creditor who dealt with A may force B to pay its

claim.

At common law, a sharing of profits was often deemed conclusive of the existence of a

partnership.

UPA states that profit sharing is prima facie evidence of a partnership

RUPA states that a person who receives a share of the profits of a business is presumed to be a

partner

18

Spring ’06

UPA §16 (1)-(2)

Martin v. Peyton (p. 125): Facts: Peyton (D) and others (D) loaned a partnership money so that it could

carry on its brokerage business. Rule: While words are not determinative, where a transaction bears

all of the aspects of a loan, no partnership arrangement will be found.

Smith v. Kelly (p. 129): Facts: Smith (P) was hired by Kelly (D) and Galloway (D), partners in an

accounting firm. Smith later claimed to be a partner in the firm, with a right to share in its profits. Rule:

Unless the rights of third parties are involved, a partnership cannot exist in the absence of an

intention to create it.

Young v. Jones: Facts: Investors claim that they lost $550,000 in capital as a result of Price WaterhouseBahamas (D) negligent conducting of an audit and related documents upon which the investors (P) relied

to their detriment. Rule: Persons who represent themselves, or allow others to represent them to

third parties as a partner in either an existing partnership or with other parties who are not their

true partners, are liable to any third persons who relied to their detriment on the existence of that

apparent partnership.

UPA §7(1): Persons who are not partners as to each other are not partners as to third persons.

UPA §16(1): Partnership by Estoppel – One who holds herself out to be a partner, or who expressly or

impliedly consents to representations that she is such a partner, is liable to any 3rd person who extends credit

in good-faith reliance on such representations

Liability of partners who represent others to be partners:

if persons making above representations is part of an actual partnership, then she is an agent of

that partnership and binds the partnerships to contracts she makes

if there is no such partnership in existence, only agent is bound to the contract

D. Managing the Partnership

Absent an agreement to the contrary, partners in a partnership have equal rights to participate in the

management of the business.

The default rule is that if there is a vote taken on specific matters, each partner has one vote and the

majority decision controls in the absence of an agreement to the contrary.

The partnership agreement may create classes of partners with different voting and financial rights.

Partners have apparent and actual authority to bind the partnership to obligations relating to the

business of the partnership. Thus, a partner may bind the partnership on obligations he or she

was not authorized to create.

National Biscuit Company v. Stroud (p. 55): Here we have a 50-50 two-man partnership running a grocery

store. The first partner said: “Don’t buy from X.” The second partner continued to buy from X, who knew

about the dispute. There could be no apparent authority. Instead, it sounds like inherent authority. One

partner can bind the partnership since the other partner didn’t control the majority (even if they have

a 2 party partnership). If they’ve got a disagreement and a 3rd person has knowledge of it, the

partnership can, but usually won’t, be bound. If 3rd party didn’t know of the disagreement, it is clear

that it will be binding on the partnership. Rule: They read UPA §18(e) & (h), which says that when you

have a deadlock among partners on this particular issue, any partner has actual authority for any typical

transaction. Substantially the same result would have been reached under restitution. But the court upheld the

Carmen Corral

19

Spring ’06

contract. The acts of a partner, if performed on behalf of the partnership and within the scope of its

business, are binding upon all co-partners – UPA §15: all partners are jointly and severely liable for the

acts and obligations of the partnership.

Smith v. Dixon (p. 56): Under UPA §9, limits are imposed on partnership. Facts: Smith (D), manager of a

partnership consisting of his family members (D), agreed to sell land to Dixon (P). the other members of the

partnership later refused to convey the property. Rule: The acts of a partner are biding upon the

partnership if he acted within the scope, or apparent scope, of his authority only.

Rouse v. Pollard (p. 59): Facts: Here we had a very prestigious New Jersey firm. A partner, Fitzsimmons

(D), decided he wasn’t making enough from the firm alone. He started confidential conferences with rich

old ladies and told them he was running his own private investment operation on the side. D promised to

invest Mrs. Rouse’s (P) money for her but, in fact, converted it to his own use. P sues partnership. Rule:

Partners are liable for the acts of the co-partners only if those acts are within the scope of the

partnership’s business.

Roach v. Mead (p. 62): Facts: Berentson (D) contended he was not vicariously liable for the negligent acts

of his partner, Mead (D), because such acts were outside the scope of the partnerships’ business. Rule: Each

partner is responsible to 3rd parties for the acts of the other partners when such could reasonably have

been thought by the 3rd party to fall within the purpose of the partnership.

Partnership Accounting:

A capital account essentially sets forth the partner’s ownership interest in the partnership.

A partner’s capital account equals the capital contributed by the partner less the amount of any

distributions to the partner plus the partner’s share of the profits less the partner’s share of the

losses.

The standard set of accounting principles that forms the norm for financial reporting in the United

States is known as Generally Accepted Accounting Principles (GAAP).

o GAAP accounting is accrual accounting. If you sell something on credit, you take in the

income and you increase the capital account immediately. In other words, you accrue

immediately. For tax purposes, any business using an inventory must use the accrual

method. What does the Internal Revenue Code provide as to professionals? For service

professions, regardless of income, you can use the cash method, that is, accounts

receivable are neither an asset nor income until they are collected. The capital account

will not reflect unrealized receivables. If you are on the accrual method, the capital

account will reflect such receivables. Independent CPAs will certify statements on the

cash method, but they will put legends on the statements saying that a non-GAAP method

is being used. The pure cash method is not a traditional GAAP method.

These principles must also be followed by most publicly held corporations when publicly

reporting results

Accounting in large business involves two basic functions:

o The entering of records of transactions as they occur and

o The subsequent determination and reporting of results of operations on a periodic basis

(quarterly or annually)

Equity = Assets - Liabilities. This means that the net worth of a business is equal to its assets less

its liabilities.

There are four fundamental premises underlying financial accounting:

o Financial accounting assumes that the business that is the subject of the financial statements

is an entity

Carmen Corral

20

Spring ’06

o All entries have to be in terms of dollars

o A balance sheet has to balanced

o Every transaction entered into by a business must be recorded in at least two ways if the

balance sheet is to continue to balance.

The Balance Sheet:

Assets = Liabilities + Equity (Balance sheet equation.)

The asset side of a balance sheet is sometimes referred to as the left-hand side.

The liability/equity side is sometimes called the right-hand side.

A balance sheet must balance and must be in terms of dollars. Transactions must be recorded in

at least two ways.

Left hand side (assets) may be divided into two categories:

o Current assets: consist of cash plus other assets that normally may be expected to turn

into cash w/in a year, including cash (and cash equivalents, such as certificates of

deposit, Treasury bills, etc.), marketable securities, accounts receivable, and inventories

(raw materials, partially finished goods, finished goods); and

o Non-current assets: consist of all assets that are not classified as current and include a

variety of different items, including fixed assets (property, buildings, equipment).

Because these things depreciate, accumulated depreciation appears as an offset.

Right hand side (current liabilities) include: accounts payable, notes payable, accrued expenses

payable -Long-term liabilities include: mortgages and debentures

Stockholder’s equity is the balancing factor between assets and liabilities on the balancing sheet.

Balance sheets do not say much to the true value of the business - they do not include intangible

assets (i.e. any item of intellectual property is an intangible asset)

Accounting for Profits and Losses:

Income = Revenues – Expenses

Profit and loss items are reflected on the balance sheet as changes in owner’s equity.

Income Statement: measures what a company burns or gains from day to day over a period of

time.

Journal Entries:

Debit means left-hand; credit means right-hand.

Ledger or T Accounts:

All debits go on the left side, all credits go on the right side.

Usually there is a separate T account for each item on the balance sheet, and as entries are made

in the journal they are also entered on the appropriate T account.

Law Firm Partnerships: in recent years, possibly because of economic pressure, law firms have begun to

swing away from lock-step systems of partner compensation. Less emphasis is being place don tenure and

seniority, and more consideration is being given to merit performance and attraction of new business.

Among the various compensation schemes, several factors govern the size of individual allocations. The

following are perhaps the most common:

Productivity and billable hours: with special recognition of those who regularly contribute the

most billed and collected hours

New business: credit given for production of new business is usually a percentage of the total

fees generated by the new business and continues for a predetermined period of time

Client liaison: recognition given for efforts to retain the larger clients, although those efforts

don’t produce an discernable, tangible results

Carmen Corral

21

Spring ’06

Practice economics: recognition for prompt billing, client matter planning & control, accounts

receivable follow-up & cash collection, fees received from clients, other fees directly resulting

from partners’ work, profitability by type of law, avoiding write-offs, and overhead control

Management, administration, training, and supervision: recognition given to effective work

delegation, supervision and good staff relations

Marketing advancement: recognition for firm promotion, enhancement of the firm’s public and

professional image and the pursuit of specific marketing opportunities (i.e. figure head’s)

Leveraging: firms have thus had every incentive to grow rapidly by increasing the number of associates

relative to the number of partners, this process is known as leveraging

Two-Tiered Partnerships: caused by the downswing in the economy

Income Partners: are paid a salary that is not contingent on their firms’ profits; are entitled to

many of the same benefits as equity partners, but there are differences; they attain partnership

status without assuming any risk; their rights are many and can be found on p. 41 of the

casebook

Equity Partners: are owners of their firms and share in the profits

The Gunderson Effect: throwing more money at first year associates to attract and keep them which

spread across the country and into all areas of legal practice; the various effects of this phenomenon can

be found on p. 45 of the casebook

Sweat Bonuses: widely used arrangements within law firms by which associates receive extra bonuses in

a year if they record more than a specified number of billable hours.

Lampert, Hausler & Rodman PC v. John F. Gallant, et al (p. 103): what is the issue in this case? Their

business is practicing law; fighting with each other over the righ to the proceeds from contingency cases;

everything depends on what the partner’s initial agreement was and what fiduciary duties each owes to

the other; law practices can’t enforce non-compete covenants on each other b/c it interferes with the

clients right to choose their own counsel

Meehan v. Shaughnessy (p. 104): This is an unusual partnership agreement in that it lumps rightful and

wrongful dissolution together and provides what is going to happen. The court looks at the agreement and

basically ratifies the agreement. It sees no conflict between the agreement and the UPA. In this case,

some of the partners went to young associates and solicited business for their new firm. They held that

the old per se rule of setting up shop while being employed didn’t apply to a law firm because at a law

firm the main parties to be protected are the clients, and the clients can’t get good service unless there is

work up front. The court found a violation, holding that the old partners had a right to have their

solicitation sent to the clients at the same time that the departing partners sent theirs. Note that you

can’t forcibly take clients with you.

Gibbs v. Breed, Abbott & Morgan (p. 107): question is ‘how do you play nice when you are breaking

up?’ and ‘what’s required to be nice?’; In Gibbs, a case involving the question whether departing law firm

partners had breached fiduciary duties they owed to the partnership; Two attorneys, Charles F. Gibbs and

Robert W. Sheehan, were partners of Breed, Abbott & Morgan (Breed, Abbott) specializing in trusts and

estates. They withdrew from Breed, Abbott in 1991 to join Chadbourne & Parke (Chadbourne). At the

time, they were the only active partners in the Breed, Abbott trusts and estates department. What are the

rules with respect to soliciting clients when leaving a firm? Issue No. 1: Commencing at a point before

they announced their intent to others in their firm, the fiduciaries (partners in the Gibbs case; officers and

directors in Duane Jones and Lord, Geller) discussed among themselves plans to depart and take some of

Carmen Corral

22

Spring ’06

the business of the enterprise with them (a law practice in Gibbs; an advertising business in Duane Jones

and Lord, Geller). Issue No. 2: The departing fiduciaries took with them confidential information relating

to firm clients.

Conclusion:

The Appellate Division decision in Gibbs is troublesome for two reasons:

(i) It recognizes a right of partners withdrawing from a law firm to plan among themselves

their departure and their taking of clients of the firm (and to discuss these plans with competing

law firms) without first announcing to their partners their intention to do so.

(ii) The decision allows departing partners to take with them confidential information involving firm

clients without first reviewing that information with their partners.

Historically, the standard of fiduciary duty owed by departing law partners to their firm has taken

into account the public policy of supporting clients' freedom of choice among lawyers. This public

policy does not apply to executives in business enterprises generally.

Similarly specific agreement should be made with regard to the process of review of any files and

other material that is confidential in nature. Obviously, law firms are under constraints as to what

they can do in this regard that general business enterprises are not. General business enterprises, in

contrast to law firms, frequently require no-compete agreements as well as non-solicitation and

confidentiality agreements. It behooves all enterprises seeking to protect their businesses to review

what they can and cannot do under applicable law and to implement reasonable agreements to

protect the enterprise in this regard.

E. Dissolution – UPA §§29-43

Dissolution: the change in the relation of the partners caused by any partner ceasing to be associated in the

carrying on as distinguished from the winding up of the business UPA §29

Dissolution of a partnership does not immediately terminate it; the partnership continues until all of

tis affairs are wound up per UPA §30

RUPA §§601-603 & 701-705

o Refers to what UPA calls dissolution as ‘Dissociation’

o Dissolution in the RUPA is used to refer only to an event that leads to the winding up of

the business

Major facet that distinguishes partnerships from corporations is that each partner has the power to

dissolve the relationship at any time

Causes of dissolution: unless otherwise provided for in the partnership agreement, the following may result

in a dissolution

Expiration of partnership term:

o Fixed Term: even where the partnership is to last for a fixed term, partners can still terminate

at will (but it will be a breach of the agreement by the terminating partner, which may result

in damages charged to the terminating partner)

o Extension of term: the partners can extend the partnership by creating a partnership at will on

the same terms

Choice of a partner: any partner can terminate at will; however, if it is motivated by bad faith, it

may be a breach of the agreement

Assignment: an assignment of a partner’s interest is not an automatic dissolution, nor is the levy of a

creditor’s charging order against a partner’s interest. But an assignee or the creditor can get a

dissolution decree on expiration of the partnership term or at any time in a partnership at will per

UPA §§30-32

Death of a partner: the surviving partners are entitled to possession of the partnership assets and are

charged with winding up the partnership affairs without delay per UPA §37; the surviving partners

Carmen Corral

23

Spring ’06

are also charged with a fiduciary duty in liquidating the partnership and must account to the estate of

the deceased partner for the value of the decedent’s interest

Withdrawal or admission of a partner: most agreements provide that losing or admitting a partner

will not result in dissolution; new partners may become parties to the pre-existing agreement by

signing it at the time of admission to the partnership per UPA §13(7); when an old partner leaves,

there are usually provision for continuing the partnership and buying out the partner who is leaving

Illegality: dissolution results from any event making it unlawful for the partnership to continue in

business

Death or bankruptcy: without a provision in the partnership agreement to the contrary, the

partnership is dissolved on the death or bankruptcy of any partner per UPA §31(4) & (5)

Partner expulsion: in a term partnership, if the majority ousts the deficient partner, this

dissociation could be deemed ‘wrongful’, exposing the ousting partners to substantial liability;

unless otherwise provided, the right to expel will be governed by partnership law, including

fiduciary duties; UPA §31(1)(d)

o The one narrow exception to a firm’s ability to expel someone is if it can be shown that they

expulsion was so that the profits wouldn’t have to be shared with that person anymore

Dissolution by court decree: a court, in it discretion, may in certain circumstances dissolve a

partnership; these circumstances include per UPA §32:

o Insanity of a partner

o Incapacity

o Improper conduct

o Inevitable loss

o and/or wherever it is equitable

The Consequence of Dissolution:

Distribution of Assets o Partnership debts: these must be paid first

o Capital accounts: these are paid next; paid to the partners in the form of their capital

contribution plus accumulated earnings and less accumulated losses

o Current earnings: if there is anything left over, the partners receive their agreed share of

current partnership earnings per UPA §40

o Distributions in kind: where there are no partnership debts, or where the debts can be handles

from the cash account, partnership assets may not be sold, but they may be distributed in kind

to the partners

o Partnership losses: where liabilities exceed assets, the partners must contributed their agreed

shares to make up the difference per UPA §18(a)

Rights of the Partners o No violation of agreement: if the dissolution does not violate the partnership agreement, then

the partnership assets are distributed as set forth above, and no partner has any cause of action

against any other partner

o Dissolution violates agreement: if the dissolution does violate the partnership agreement (i.e.

the fixed term of the agreement), then the innocent partners have rights in addition to those

listed above

Right to damages: innocent partners have a right to damages (i.e. lsot profits due to

dissolution, etc.) against the offending partner per UPA §38(2)

Right to continue business: the innocent partners also have the right to continue the

partnership business (i.e. not sell off and distribute the assets) by purchasing the

offending partner’s interest in the partnership per UPA §38(2)(b); alternatively, of

course, the innocent partners may simply dissolve and wind up the business, paying

the offending partner her share, less damages

Carmen Corral

24

Spring ’06

Effects of Dissolution o Partners are liable until debts discharged: the liability of partners for existing partnership

debts remains until they are discharged

o New partnership remains liable for old debts: when there has been a dissolution due to death,

withdrawal, or admission of a new partner and the partnership business is continued, the new

partnership remains liable for all the debts of the previous partnership per UPA §41

o Retiring partner’s liability for debts incurred by partners continuing the business: dissolution

end the power of a partner to bind the partnership except to the extent necessary to wind up its

affairs per UPA §33; if, however, 3rd parties do not know of the dissolution, contracts entered

into with a partner bind the partnership; so, a retiring partner must make sure that presecribed

procedures are followed to terminate any possible liability for partnership obligations; the

UPA provides that notice of withdrawal or dissolution may be published in a newspaper of

general circulation per UPA §35(1)

UPA

Dissolution (§29): Any change of partnership

relations, e.g., the exit of a partner.