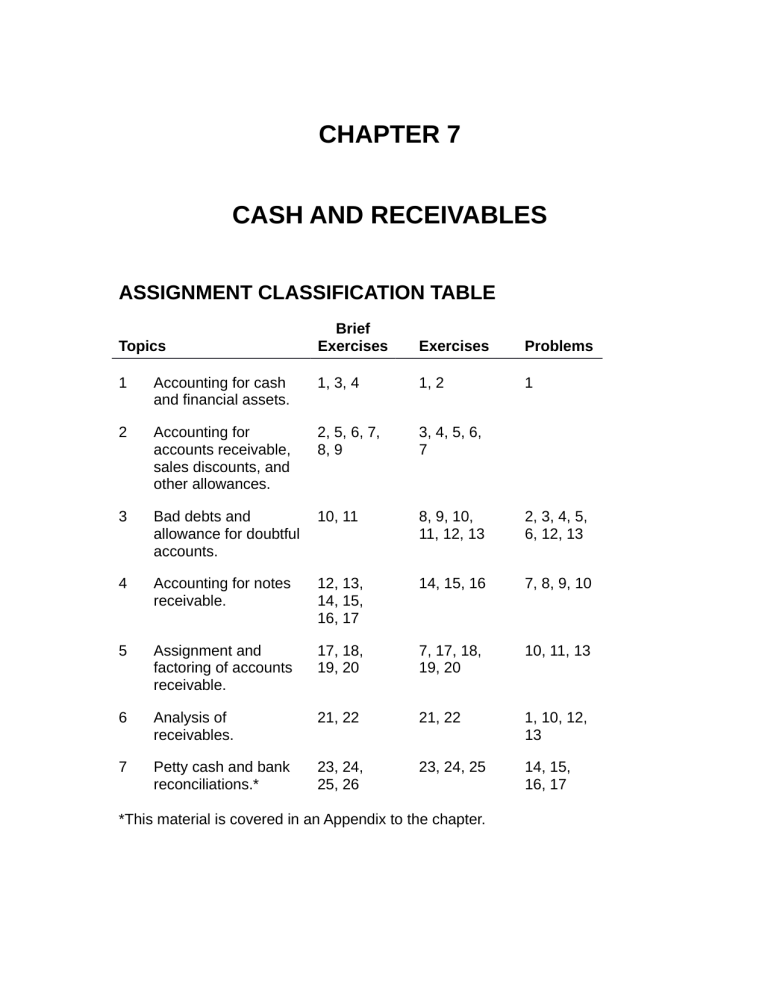

Chapter 7

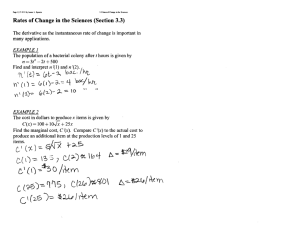

advertisement