Mergers & Acquisitions Assessment: Finance Questions

advertisement

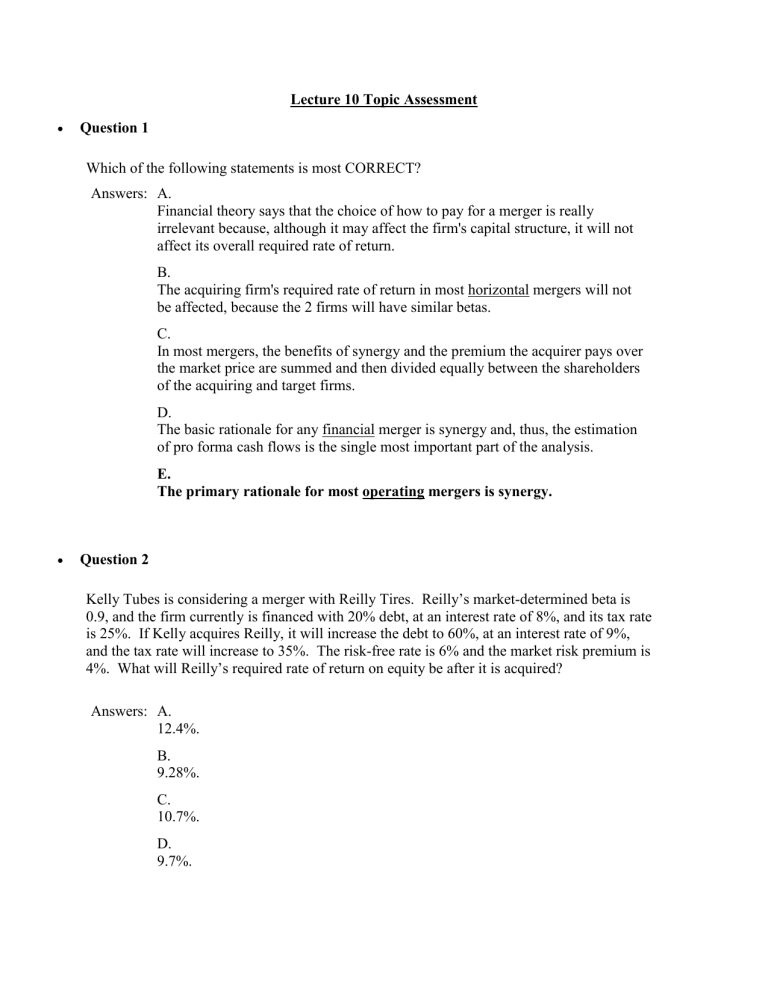

Lecture 10 Topic Assessment Question 1 Which of the following statements is most CORRECT? Answers: A. Financial theory says that the choice of how to pay for a merger is really irrelevant because, although it may affect the firm's capital structure, it will not affect its overall required rate of return. B. The acquiring firm's required rate of return in most horizontal mergers will not be affected, because the 2 firms will have similar betas. C. In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed and then divided equally between the shareholders of the acquiring and target firms. D. The basic rationale for any financial merger is synergy and, thus, the estimation of pro forma cash flows is the single most important part of the analysis. E. The primary rationale for most operating mergers is synergy. Question 2 Kelly Tubes is considering a merger with Reilly Tires. Reilly’s market-determined beta is 0.9, and the firm currently is financed with 20% debt, at an interest rate of 8%, and its tax rate is 25%. If Kelly acquires Reilly, it will increase the debt to 60%, at an interest rate of 9%, and the tax rate will increase to 35%. The risk-free rate is 6% and the market risk premium is 4%. What will Reilly’s required rate of return on equity be after it is acquired? Answers: A. 12.4%. B. 9.28%. C. 10.7%. D. 9.7%. Calculate the current required return to Reilly’s equity: rK = rRF + b(RPM) = 6% + (0.9)4% = 9.6%. Calculate Reilly’s unlevered cost of equity: rsU = wdrd + wsrs = 0.20(8%) + 0.80(9.6%) = 9.28%. Calculate Reilly’s levered cost of equity at the new capital structure with the new cost of debt: rsL = rsU + (rsU – rd)(D/S) = 9.28% + (9.28% - 9%) x (0.6/0.4) = 9.70% Question 3 Blazer Inc. is thinking of acquiring Laker Company. Blazer expects Laker’s NOPAT to be $9 million the first year, with no net new investment in operating capital and no interest expense. For the second year, Laker is expected to have NOPAT of $25 million and interest expense of $5 million. Also, in the second year only, Laker will need $10 million of net new investment in operating capital. Laker's marginal tax rate is 40%. After the second year, the free cash flows and the tax shields from Laker to Blazer will both grow at a constant rate of 4%. Blazer has determined that Laker’s cost of equity is 17.5%, and Laker currently has no debt outstanding. Assume that all cash flows occur at the end of the year, Blazer must pay $45 million to acquire Laker. What it the NPV of the proposed acquisition? Note that you must first calculate the value to Blazer of Laker’s equity. Answers: A. $ 69.83 million B. $ 78.66 million C. $ 72.64 million D. $ 86.53 million FCF1 = 9 FCF2 = 25-10 = 15 TS2= 5 x 40% = 2 HVFCF=(15x1.04)/(0.175-0.04) = 115.56 HV-TS=(2x1.04)/(0.175-0.04) = 15.41 Vops = $9/(1.175) + (FCF2+TS2+?1+?2) / (1.175)2 = 114.8306 = V equity since there is no debt. The NPV is ?3 – $45 = $69.83 Question 4 Brau Auto, a national autoparts chain, is considering purchasing a smaller chain, South Georgia Parts (SGP). Brau's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values: Year Free Cash Flow Unlevered Horizon Value Tax Shield Horizon Value of Tax Sheild 1 2 3 $1 $3 $3 1 1 2 4 $7 75 3 32 Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau? Answers: A. $58.78 million. B. $84.65 million. C. $64.56 million. D. $61.96 million. rsL = rRF + b(RPM) = 8% + 2.0(4%) = 16%. rsU = wdrd + wsrs = 0.30(10%) + 0.70(16%) = 14.2%. Since all of the cash flows are to be discounted at the same rate, we don’t need to separately calculate the values of the tax shield and unlevered value of operations. We can simply add the tax shields and free cash flows together each year to input in the financial calculator: Financial calculator solution: (In millions) Inputs: CF0 = 0; CF1 = 2; CF2 = 4; CF3 = 5; CF4 = 117; I/YR = 14.2 Output: NPV = 76.96 = Value of operations. Value of equity = Value of operations – Value of debt = 76.96– 15 = 61.96. Question 5 The The owners of Arthouse Inc., a national artist supplies chain, are contemplating purchasing Craftworks Inc, a smaller chain. Arthouse's analysts project that the merger will result in incremental free flows and interest tax savings with a combined present value of $72.52 million, and they have determined that the appropriate discount rate for valuing Craftworks is 16%. Craftworks has 4 million shares outstanding and no debt. Craftworks' current price is $16.25. What is the maximum price per share that Arthouse should offer? Answers: A. $16.97 B. $17.42 C. $16.25 D. $18.13 Price per share = $72.52 / 4 million = $18.13 Question 6 Firms use defensive tactics to fight off undesired mergers. These tactics do not include Answers: A. changing the bylaws to eliminate supermajority voting requirements. B. getting white knights to bid for the firm. C. repurchasing their own stock. D. raising antitrust issues. E. getting a white squire to purchase stock in the firm. Question 7 Which of the following statements is most CORRECT? Answers: A. Managers who purchase other firms often assert that the new combined firm will enjoy benefits from diversification, including more stable earnings. However, since shareholders are free to diversify their own holdings, and at what's probably a lower cost, diversification benefits is generally not a valid motive for a publicly held firm. B. The smaller the synergistic benefits of a particular merger, the greater the scope for striking a bargain in negotiations, and the higher the probability that the merger will be completed. C. Operating economies are never a motive for mergers. D. Since mergers are frequently financed by debt rather than equity, a lower cost of debt or a greater debt capacity are rarely relevant considerations when considering a merger. E. Tax considerations often play a part in mergers. If one firm has excess cash, purchasing another firm exposes the purchasing firm to additional taxes. Thus, firms with excess cash rarely undertake mergers. Question 8 Multi-part:(The following data apply to Problems a through c.) Magiclean Corporation is considering the acquisition of Dustvac Company. Dustvac has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Dustvac's pre-merger beta is 1.36. Magiclean's beta is 1.02, and both it and Dustvac face a 40% tax rate. Magiclean's capital structure is 40% debt and 60% equity. The free cash flows from Dustvac are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%. a. What Dustvac’s pre-merger WACC? b. What discount rate should you use to discount Dustvac’s free cash flows and interest tax savings? c. What is the value of Dustvac’s equity to Magiclean? (Round your answer to the closest thousand dollars.) Answers: A. a. 9.83%. b. 11.29%. c. $16.12 million B. a. 9.83%. b. 12.94%. c. $17.111 million C. a. 9.83%. b. 11.29%. c. $17.111 million D. a. 10.72%. b. 11.29%. c. $17.111 million a. Topic-WACC of target The pre-merger weight of debt is $5/($5 + $10) = 0.333 The pre-merger required rate of return on equity is 6% + 1.36(4%) = 11.44%. WACC = wdrd(1 – T) + wSrS = 0.333(11%)(1 – 0.40) + 0.667(11.44%) = 9.83% b. Topic-Discount rate for value of operations The correct discount rate is the unlevered cost of equity. The levered cost of equity is 6% + 1.36(4%) = 11.44%, the percent of debt is $5/($5 + $10) = 0.333. The rate on the debt is 11%. The unlevered cost of equity is wdrd + wsrsL = 0.333(11%) + 0.667(11.44%) = 11.29% c. Topic-Value of equity Because the cash flows are all discounted at the same rate, we don’t need to separately calculate the unlevered value of operations and the value of the tax shield. We can simply enter the sum of the tax shields and free cash flows and their horizon values for each year into the financial calculator: Financial calculator solution: Inputs: CF0 = 0; CF1 = 4,000,000; Nj = 3; CF2 = 19,000,000; I/YR = 11.29% Output: PVInflows = $22.11 = Vops. Value of equity = Vops – Debt = $22.11 – $5 = $17.11 Question 9 A regional restaurant chain, Club Café, is considering purchasing a smaller chain, Sally's Sandwiches, which is currently financed using 20% debt at a cost of 8%. Club Café's analysts project that the merger will result in incremental free cash flows and interest tax savings of $2 million in Year 1, $4 million in Year 2, $5 million in Year 3, and $117 million in Year 4. (The Year 4 cash flow includes a horizon value of $107 million.) The acquisition would be made immediately, if it is to be undertaken. Sally's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8%, and the market risk premium is 4%. What is the appropriate rate for use in discounting the free cash flows and the interest tax savings? Answers: A. 14.4% B. 13.9% C. 16.9% D. 12.0% rsL = 8% + 2.0(4%) = 16%; rsU = 0.20(8%) + 0.80(16%) = 14.40% Question 10 Which of the following statements about valuing a firm using the APV approach is most CORRECT Answers: A. The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows before the horizon date at the unlevered cost of equity. B. The value of equity is calculated by discounting the horizon value and the free cash flows at the cost of equity. C. The value of equity is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity. D. The APV approach stands for the accounting pre-valuation approach. E. The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.