2003-2009 SiC market analysis for

material, devices and applications

Norstel AB

© 2005

Copyrights © Yole Développement SARL. All rights reserved.

Content

•

•

•

•

Applications roadmap

New players on the market place

Status of SiC market in 2004 and 2009 projection

Focus on power electronics

– Schottky diode business

– Automotive applications

• Opto business: SiC vs. sapphire

• SiC material status

• CREE and conclusion

© 2005 •

2

Copyrights © Yole Développement SARL. All rights reserved.

SiC-based applications roadmap

SiC electronics in power

distribution networks

SiC electronics in rail traction

SiC electronics in EV, HEV & FCV cars

SiC electronics in industry

SiC MESFET in 3G ,WiMax, SatCom & defense RF systems

SiC Schottky diodes in Power Factor Correctors for power supplies

HB-LEDs GaN/SiC for lightning

2004

© 2005 •

3

2005

Copyrights © Yole Développement SARL. All rights reserved.

2006

2007

2008

SiC roadmap

2009

2015

Who’s new on the market place since 2003 ?

•

Companies:

– Bridgestone (J). They are using their expertise in SiC powder and poly-crystal

substrates to enter in single crystal SiC manufacturing. They have demonstrated 6H

polytype.

– NeoSemiTech (Korea) has entered in SiC single crystal business

– CR Semiconductor Wafer & Chips (China) is launching developments in SiC Schottky

barrier diodes

– IntrinSiC (US), who has acquired Bandgap Technologies, Inc., proposing silicon carbide

wafer products.

– Okmetic that turns into Norstel (SW), still focusing on HT-CVD grown SiC material.

•

New start-up:

– Caracal Inc. (US, Pittsburg), hold by Dr. Olle Kordina -> SiC power devices (new gasbased technique epi solution using HCl as an additive, : growth rate x 3: 28µm/h) and

SiC material

– GeneSiC Semiconductor Inc. (US, Maryland), hold by Dr. Ranbir Singh -> SiC devices for

ultra-high voltage applications (MOSFETs, IGBTs, Thyristors, …). Under contract with

Darpa.

– TranSiC (SW), funded in 2005, will bring power bipolar transistors to the market during

2006.Pr. Mikael Östling, entrepreneur Bo Hammarlund and Martin Domeij Ph D and

researcher at KTH are the three founders

© 2005 •

4

Copyrights © Yole Développement SARL. All rights reserved.

SiC new players

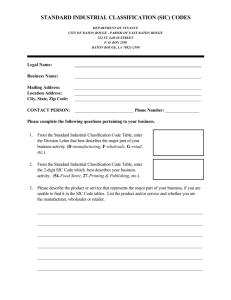

Status of SiC-based devices in 2004

and 2009 projection

2004 Market

status

2004 SiC wafers

consumption

(2” eq.)

Players on

the market

place

Challengers

2009 market

forecast

© 2005 •

5

HB-LED

GaN/SiC

Schottky diode

MESFET

MOSFET / JFET

PiN diode

BJT /

Thyristor

$540M

In Production

$11.7M

Pre-prod.

~ 1$M

MOSFET:R&D.

Pre-prod in 2008

JFET: emerging

R&D. Preprod in 2008

R&D

320,000 x 2”

13,000 x 2”

< 500 x 2”

R&D level

R&D level

R&D level

n/a

n/a

n/a

Cree: $240M

Osram

Infineon

Cree

Rockwell

Rohm

Cree: < $1M

Rockwell

New Japan Radio

Northrop Grumman

SemiSouth

IntrinSiC

No new company

STM

Int. Rectifier

GE

Toshiba

Mitsubishi

SemiSouth

Dynex

EcoTron

Fuji

> $800M

depending on

Osram involvement

in SiC-based LEDs

Copyrights © Yole Développement SARL. All rights reserved.

~$45M for PFC

+

growing curve for

others apps.

SiCed

Toshiba

Mitsubishi

Philips

Denso

Rohm

Fuji

Sumitomo

Rockwell

United SiC

Could be > $80M

Market to start

depending on SiC vs.

GaN competition on

3G & WiMax business

depending on HEV &

EV market volume

and SiC use in cars

SiC market segmentation

SiCed

Cree

GE

Rockwell

Kansai Electric

GE

Cree

United SiC

PowerSiCel

> $10M

mainly In

industry and

power

distribution

Emerging

TAM~ $200M /

year

SiC: from material to device to market:

Focus on electronic applications

Semi-insulating

Semi-insulating

SiC

SiC

Conductive

ConductiveSiC

SiC

Rectifiers

Rectifiers

Bipolar

Bipolar

diodes

diodes

Schottky

Schottky

diodes

diodes

PiN

PiN

>>22kV

kV

© 2005 •

6

Switches

Switches

Unipolar

Unipolar

transistors

transistors

MOSFET

MOSFET

0.3

0.3->

->1.2

1.2kV

kV

Copyrights © Yole Développement SARL. All rights reserved.

JFET

JFET

0.3

0.3->

->1.2

1.2kV

kV

Bipolar

Bipolar

transistors

transistors

BJT

BJT

Thyristor

Thyristor

(GTO)

(GTO)

>>22kV

kV

SiC

SiC

market

crystalsegmentation

growth

RF

RFtransistors

transistors

MESFET

MESFET

RF

RF/ /HF

HF

SiC devices:

Power electronics market

© 2005

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics

SiC power electronic devices:

Market status: small but promising…

• Reality of the market in 2005:

– As in 2003, only one component, Schottky diode (SBD),

has reached the commercialization stage and met the

market requirements.

– The applicative market is the PFC (Power Factor

Correctors) for high-end power supplies.

– 3 main players are active on this segment: Infineon, Cree

and Rockwell.

– 2005 revenues for this segment will reach $17.6M at device

level

• We forecast this market will handle 6.5 million units of Schottky

devices in 2005.

• The related wafers consumption should reach about 13,000

substrates (2”+3”). Transition to 3” wafer is now a clear trend.

© 2005 •

8

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics

SiC power electronic devices:

Market status: small but promising…

•

•

This market level is not big enough to sustain the activity of many other

companies!! ...

….. But future can be brighter:

– With Schottky ASP reduction down to ~$0.2/amp, the potential market can be

extended to mid and even low-end applications using PFC: a ~$45M market is

viewed in 2009 for SBD with a related 35,000 wafers consumption.

– Automotive manufacturers are more and more involved with SiC devices to

develop efficient hybrid or full electric cars. Coupled with high power density

silicon transistors, it will help to decrease power loses and system size/weigh

in inverters and converters. Next step will be the emergence of reliable SiC

transistors to provide a full-SiC solution. But:

• EV or HEV market is slowly emerging. Big volumes are linked to oil price, ecological

behavior and governmental financial incentives

• Silicon is still on the run to compete in high power density field. Trench MOSFET

technology is a pertinent candidate to take market share over SiC future transistors.

– Other applications are expected improvements thanks to SiC devices:

• Defense, rail traction, industry, electrical power distribution network, …

© 2005 •

9

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics

SiC Schottky Barrier Diode (SBD)

Device and related markets

© 2005

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Schottky

SiC Schottky diodes

2004 market status

In terms of components using SiC hetero-structures as active layers, the

most advanced component remains SiC Schottky diodes. This component

is at a production level and we estimate that ~4 million Schottky diodes

have been produced in 2004.

Today, only 3 companies are producing such a component:

• Cree (US)

• Infineon (D): Epi and R&D made by SiCed (Erlangen, D) and chips made in

Infineon 3’’ fab in Villach (Au). Customers example: Lambda (NV series

power supplies).

•Rockwell (US).

Rohm (J) should have been entered in Schottky business spring 2004. Others

companies like Fuji (J), Hitachi (J), International Rectifier (I), Matsushita (J), STM (I),

Toshiba (J), EcoTron (J), CSWC (C) have a strong R&D related to process Schottky

diodes but have no entered in a production stage yet.

© 2005 •

11

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Schottky

SiC Schottky diodes

Devices specs roadmap

2005

10A/1200V

2007

40A/1200V

2009

100A/1200V

• Roadmap is given for single chip device

• This evolution is linked to the improvement of useable area, and so to micropipes

density

• A 100A diode will need about 10x10 mm² micropipe-free active area. 1200 V breakdown

voltage requires about 12-15 µm epilayer thickness.

• It’s now all a question of material ! …. and cost….

© 2005 •

12

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Schottky

SiC Schottky diodes market forecasts

30 000 000

60

SiC Schottky diodes market forecasts

25 000 000

50

20 000 000

40

15 000 000

30

10 000 000

20

0.5$ / Amp

5 000 000

10

0

0

2003

2004

2005

2006

2007

2008

2009

Cree shows $3 M revenues on Schottky business in 2004

© 2005 •

13

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Schottky

Market (M$)

Volume (units)

0.3$ / Amp

SiC devices:

Automotive applications

© 2005

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Automotive

Why SiC in cars ?

•

•

Electronics is now accounting for more than 25% of cars cost.

Power electronics will be more and more implemented in car due to:

– The emergence of 42 volts electronics with related systems: electric steering

and breaks, X-by-wire commands, piezo fuel injectors, …

– The high market penetration of hybrid cars (HEV), electric cars (EV) and future

fuel-cells cars (FCV) over regular internal combustion engine cars (ICE).

– The need for high pressure and high temperature sensors that can benefit

from SiC hardness and robustness.

•

•

In every case, SiC can handle improved power density with lower power

losses, and will help to decrease the size and so the weight of power

drivers.

When ?

– Today, current systems are using silicon devices but weight, size, power

efficiency and limited junction T° remain an issue.

– According to car manufacturers, SiC could be implemented in large volume by

2009. SiC diodes will be the first target, followed by SiC transistor switch when

it will be ready. Use of silicon trench-gate transistor could bring a first

solution.

© 2005 •

15

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Automotive

Automotive Application:

Hybrid Electrical Vehicle (HEV) requirements.

•

DC-DC converter

– Goal: to provide a high voltage (400V) to

12V output, with an option to provide a

42V output.

– Typical power rating: 3 to 10kW

with switching frequency of 50-100 kHz

Isolated full-bridge step-down dc-dc converter

•

Inverter (DC-AC 3-phases converter)

Typical 400 V DC

battery pack

– Goal: To develop an integrated

motor/controller comprised of the motor

and inverter in a single package. The

goals for the system include an

integrated power electronics system

capable of 15 years lifetime and capable

of delivering at least 55 kW of power for

18 sec and 30 kW continuous power.

– Up to 300 A per motor phase

– Cost < 7$/kW

© 2005 •

16

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Automotive

Each transistor and diode has to

handle 400 V and 200 A peaks.

Three-phase inverter traction drive

Typical motor: 30 kW,

230 V, 4-pole, 3000 rpm

Sales projection for EV, HEV & FCV

to 2020 in million units

16

Forecasted annual sales of EV+HEV+FCV

(million units)

14

12

10

8

6

4

2

0

2002

2004

2006

2008

2010

2012

2014

2016

Emergence of fuel-cell based

electrical cars

© 2005 •

17

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Automotive

Sales volume projection for SiC diodes and

transistors in automotive applications

300

Forecasts for SiC diodes & Transistors

volume in EV, HEV and FCV

250

SiC transistors need (Munits)

200

SiC diodes need (Munits)

150

100

50

0

2002

2004

2006

2008

2010

2012

2014

Based on average figure of 24 SiC diodes and 10 SiC transistors per car. SiC

market share goes from 5% in 2008 to 50% in 2016

© 2005 •

18

Copyrights © Yole Développement SARL. All rights reserved.

Power electronics: Automotive

2016

SiC / sapphire substrates volume estimation for

GaN-based LED production

Market hypothesis:

• Illumination high-volume market will not start before 2007

• SiC substrates (mainly Cree and Osram) will loose market shares, facing sapphire high

volume productions from Asia

• LED ASP will remain around 0.10$ (Emergence of new high-end products with higher ASP

facing ramping-up of low-end, large scale production LEDs with lower ASP)

3,5

Technical hypothesis:

• Production yield will

reach 85% in 2007

• 11,000 LEDs on 2”

sapphire substrate

• 16,000 LEDs on 2” SiC

substrate

Number of 2" equivalent substrates to process

for GaN-based LED production (Million units)

3,0

0,33

SiC (2")

2,5

0,32

Sapphire (2")

0,30

2,0

0,27

1,5

0,24

2,50

1,15

0,68

0,0

2001

© 2005 •

19

Copyrights © Yole Développement SARL. All rights reserved.

2,95

1,59

0,16

0,5

2,71

2,12

1,0

SiC-based LEDs represented

25 % of market in 2001 and is

now only 12 % in wafers

volume

0,36

2002

Optoelectronics

2003

2004

2005

2006

2007

From a material point of view…

Total SiC substrates market was in the $90M range in 2004.

II-VI + Norstel +

IntrinSiC +

Dow Corning +

Sixon +Nippon

Steel

+SiCrystal +

Others

30%

This figure includes the internal Cree consumption for LED

business

We consider the remaining open market to be ~$30M

Cree

70%

SiC substrates sales breakdown over

the $30M open market

© 2005 •

20

Copyrights © Yole Développement SARL. All rights reserved.

SiC Material

Cree business-model evolution and

conclusion

•

•

•

•

Fact 1: Cree was representing approximately 1/4 of wafers consumption for HBLEDs production in 2001 and that should decrease down to 10% in 2007.

Fact 2: Cree is moving to packaged LEDs business.

Fact 3: Osram, the only other SiC user for LED business, is now trying to escape

from Cree monopoly using thin-film technology on sapphire substrates.

Analysis:

– SiC is no more the “ideal” substrate for high performances LEDs: Sapphire can compete

on high-end LEDs segment (see Lumileds, Nichia, …).

– Thin-film approach allows now back-face contact possibility, like SiC does -> smaller

dies.

– Cree has to move one step ahead, to packaged LEDs, in order to benefit from larger

added-value products.

•

Conclusion:

– SiC has to find another playground to grow. Opto business is captive to Cree and the

emergence of electronic devices with related applications is the only way to make a

profitable business at material or component level.

– SiC has to fight with GaN on RF markets but is the only pertinent solution for high

power electronic market, especially for automotive, industry and power distribution.

– SiC transistor is now widely welcome...

© 2005 •

21

Copyrights © Yole Développement SARL. All rights reserved.

CREE & Conclusion

High Technology Focus

SiC material,

devices & applications

Evaluation of the 2003-2008 SiC

market and analysis of the major

technology and industrial trends

2005 edition

89 profiles

COMPONENTS

Acreo - Sweden

Advanced Power Technology - USA

Caracal - USA

Cree - USA

Denso - JP

Dynex Semiconductor - UK

Fuji Electric - JP

Fujitsu Laboratories - JP

GE Global Research Center – USA

GeneSiC Semiconductor Inc. - USA

Hitachi Research Laboratory - JP

Infineon Technologies - GER

International Rectifier - IT

Kansai Electric Power - JP

Matsushita Electric Industrial - JP

Microsemi - USA

Mitsubishi Electric - JP

NEC - JP

Nissan Motor - JP

Norse Semiconductor

Northrop Grumman - USA

Oki Electric Industry - JP

Osram Opto Semiconductors - GER

Philips Semiconductors Nijmegen - NL

Qinetiq - UK

RF Micro Devices Charlotte - USA

Rockwell Scientific - USA

Rohm - JP

Sanyo Electric Company - JP

Shindengen Electric Laboratories - JP

Siced - GER

STMicroelectronics – FR and IT

Tohoku Electric Power – JP

Toshiba – JP

Transic - SW

United Silicon Carbide - USA

EQUIPMENTS

Annealsys - FR

Epigress - SW

Linn High Therm – GER

LPE EPI – IT

MATERIALS

Bridgestone - JP

Caracal - USA

Cree - USA

Dow Corning - USA

Hoya Advanced Semiconductor Technologies

- JP

Intrinsic – USA

Neosemitech - Korea

Nippon Steel – JP

Norstel - SW

Novasic - FR

Semisouth - USA

Showa Denko - JP

SiCrystal - GER

Sixon - JP

Soitec - FR

Technologies and Devices International - USA

Tohoku Electric Power

Toshiba Ceramics, Tocera – JP

Toyota - JP

II VI - USA

MEMS

Boston Microsystems - USA

Cornell University – USA

FLX Micro - USA

Innovative Scientific Solutions - USA

Kulite - USA

Olivetti I Jet - IT

Taitech - USA

R&D CENTERS

AIST - JP

APEI - USA

Auburn University - USA

Case Western Reserve University - USA

Centro Nacional De Microelectronica - SP

Chalmers University of Technology - SW

Crhea - FR

F-A University Erlangen Nuremberg – GER

Institut für Kristallzüchtung - GER

INPG – FR

Ioffe Physico-Technical Institute - RUS

Kyoto University - JP

Linköping University - SW

Mississippi State University - USA

Nasa Glenn Research Center - USA

Purdue University - USA

Rensselaer Polytechnic Institute - USA

Rutgers University, SiCLab - USA

Texas A&M University - USA

University of Arkansas - USA

University of Newcastle - UK

University of South Calorina - USA

University of South Florida - USA

EUROPE

ACREO

ACREO AB

Electrum 236

SE-164 40 Kista

SWEDEN

Tel: +46 8 632 77 00

Fax: +46 8 750 54 30

www.acreo.se

Email: info@acreo.se

Key managers and/or contacts

Susan Savage

SiC Activity Manager

+46 8 632 7808

susan.savage@acreo.se

Company Overview

Acreo AB is a non-listed limited company. The majority of the shares are held by the Association

FMOF(Mikroelektronisk och Optisk Forskning). The minority owner is the holding company IRECO,

controlled by the Swedish Ministry of Industry and the Foundation KKS. ACREO is a result of the

merging of IOF (Institute of Optical Research) and IMC (Industrial Microelectronics Center) in 1999.

Acreo’s technical development areas are Imaging, Interconnect and Packaging, Photonics, RF and

Power Components, Microsystem Technology, Surface Characterisation and System-level Integration.

Business Services is dedicated to technology transfer and market support for small and medium-sized

companies. Semiconductor technology plays a central role in all operations.

Market and customers

Open collaboration with all kind industrial players, as Volvo, Ford, Vattenfall or AppliedSensor.

As a laboratory, they offer technologies, not products.

Agreements and Alliances

Partners

University of Linköping

Partnership type

Swedish centre for Sensor Development at

ACREO

2

Mecel in Åmål

Volvo in Göteborg

Vattenfall

AppliedSensor

Hoya Advanced

(HAST)

Linköping university (S-SENCE) : R&D on

SiC gas sensor

Semiconductor

Technology R&D collaboration

Financial data

Investors and/or parent company

% of

shares

FMOF

IRECO AB

60%

40%

Spin off

AMDS - Advanced Microwave Device Solutions

AMDS - Advanced Microwave Device Solutions - is a spin-off company from Acreo launched at the

end of 2001 in order to exploit the development of SiC RF components that has been on-going at

Acreo since 1997. It has been sold to Intrinsic Inc in 2004.

In € million

Total sales

Employees

2003

22,2MSEK

169

2004

21,2MSEK

160

2005 (est.)

156

In 2004, Acre revenues coming from industrial partners accounted for approximately 44%

Main Products

SiC Gas sensor :

Acreo had worked together with the Swedish centre for Sensor Development at Linköping university

(S-SENCE) to develop gas sensors based on the semiconductor material SiC. The collaboration has

resulted in a proprietary design based on a MOSFET type component using a catalytic metal as the

active gate contact. S-SENCE have made detailed studies of the gas sensing capability of different

catalytic metals while Acreo have been responsible for the high temperature MOSFET design.

The silicon carbide based sensors, MISiC sensors, can be operated at temperatures up to 700° C and

have the advantage of being chemically very inert.

These sensors are developed in a project with Volvo in Göteborg and Ford in Dearborne, Michigan,

USA to control the SCR, Selective Catalytic Reduction, process, where NO and NO2 are reduced by

NH3 in the catalytic converter to nitrogen and water. NH3 is injected into the exhaust gases as urea

dissolved in water, which forms NH3 and CO2. According to industry partners, this method will have to

be used to fulfill the much stricter legislations for NOx emissions, which are valid from year 2007.