Summary Plan Description - Saint Francis Veterinary Center

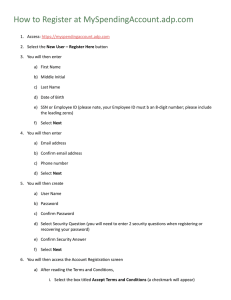

advertisement