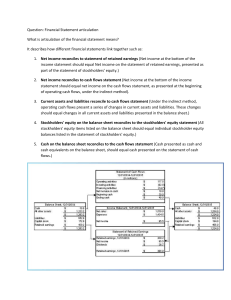

Chapter 1 - Accounting Information and Decision Making

advertisement