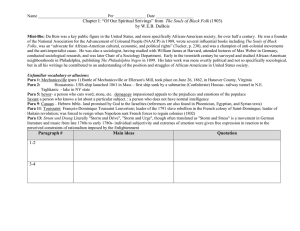

Workshop on Foreign Trade Policy 2009-2014 Agenda

advertisement

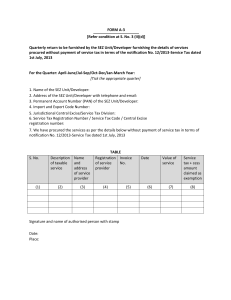

Workshop on Foreign Trade Policy 2009-2014 [Annual Supplement 2010-11] Faculty: Sudhakar Kasture Director, Exim Institute Agenda X Policy in Retrospect X Issues listed by Task Force with respect to FTP X Para by Para Study of Foreign Trade Policy & Procedures X Updates of Special Economic Zones 2 1 Policy in Retrospect Policy in Retrospect X This being the annual updation of Foreign Trade Policy 2009 – 14 (which was announced on 27th August, 2009) one cannot expect too many changes. X The recession is said to be over and therefore additional fiscal support by way of incentives would be for those sectors only which are still lacking behind. X Exports have increased compared to 2008 – 2009 and 2009 – 2010. But, the growth is moderate compared to earlier years, 2002 – 2007. X The excise duties have been increased from 8% to 10% in the last Budget and the revenue receipts for the year 2010 – 2011 as presented in the Union Budget 2011, read as under 4 2 Revenue Receipt (Rs. in Crore) 2009-2010 Budget Estimates 2009-2010 Revised Estimates 2010-2011 Budget Estimates REVENUE RECEIPTS 1. Tax Revenue Gross Tax Revenue 641079 633095 746651 Corporation tax 256725 255076 301331 Income tax 112850 131421 128066 Other taxes and Duties 425 511 603 98000 84477 115000 106477 102000 132000 65000 58000 68000 Taxes of the Union Territories 1602 1610 1651 Less - NCCD transferred to the National Calamity Contingency Fund / National Disaster response fund 2500 3160 3560 Less States' Share 164361 164832 208997 Net Tax Revenue 474218 465103 534094 Customs Union Excise Duties Service Tax 5 Revenue Foregone in financial years 2008-09 and 2009-10 (Rs. in crore) Revenue Foregone in 2008-09 Revenue Revenue Revenue Foregone Foregone Foregone as a per in 2009as a per cent of 10 cent of Aggregate Aggregate Tax Tax Collection Collection in 2008-09 in 2009-10 Corporate Income-tax 66901 11.08% 79554 12.60% Personal Income-tax 37570 6.22% 40929 6.48% Excise Duty 128293 21.25% 170765 27.04% Customs duty 225752 37.39% 249021 39.43% Total 458516 75.95% 540269 85.56% 44417 7.36% 37970 6.01% 414099 68.59% 502299 79.54% Less Export credit related Grand Total 6 3 X Notes: Aggregate Tax Collection refers to the aggregate of net direct and indirect tax collected by the Central Government. The figure of Aggregate Tax collection for 2008-09 is at actuals and that for 2009–10 is based on revised estimates. X To conclude, the amount of revenue foregone continues to increase year after year. As a percentage of aggregate tax collection, revenue foregone remains high and shows an increasing trend as far as Corporate Income-tax is considered for the financial year 2008-09. In case of indirect taxes the trend shows a significant increase for the financial year 2009-10 due to reduction in customs and excise duties. Therefore, to reverse this trend expansion in the tax base is called for. 7 Revenue Foregone on Account of Export Promotion Concessions (Rs. in crore) Sr. Name of the Scheme No. 2008-09 (Provisional) 2009-10 (Estimated) 1 Advance License Scheme 12389 10682 2 EOU/EHTP/STP 13401 8015 3 EPCG 7833 5574 4 DEPB Scheme 7092 8806 5 SEZ 2324 3204 6 DFRC 7 Duty Free Import Authorization Scheme 8 Duty Free Entitlement Credit Certificate 9 Target Plus Scheme 10 Vishesh Krishi and Gram Udyog Yojana (VKGUY) 2059 3886 111 43 1268 1646 418 206 1220 265 8 4 Revenue Foregone on Account of Export Promotion Concessions (Rs. in crore) Sr. No. Name of the Scheme 2008-09 (Provisional) 2009-10 (Estimated) 11 Served from India Scheme 531 526 12 Focus Market Scheme 408 769 13 Total 49053 43622 14 Less Revenue Foregone on account of incentive schemes mentioned at sl. nos. 8 to 12 4636 5652 15 Revenue Foregone on account of input tax neutralization or exemption schemes to be reduced from Gross Revenue Foregone on account of Customs Duty 44417 37970 9 N.B.: These aforesaid estimates of revenue foregone do not include revenue foregone on account of adhoc exemption orders issued under section 25 (2)* of Customs Act, 1962, that relates to circumstances of an exceptional nature. *Section 25 (2) reads as under: “If the Central Government is satisfied that it is necessary in the public interest so to do, it may, by special order in each case, exempt from the payment of duty, under circumstances of an exceptional nature to be stated in such order, any goods on which duty is leviable.” 10 5 Revenue & Exports S. No. Name of the Scheme Revenue forgone amount for the year 2009-10 (Estimated) [In Rs. Crore] % of total exports – Rs. 845506/crore % of indirect tax collection [Cus.+ C.Ex.+ Service Tax= Rs.244477/crore] 1 Advance License Scheme 10682 1.263 4.369 2 EOU/EHTP/STP 8015 0.948 3.278 3 EPCG 5574 0.659 2.280 4 DEPB Scheme 8806 1.042 3.602 5 SEZ 3204 0.379 1.311 6 DFRC 43 0.005 0.018 7 DFIA Scheme 1646 0.195 0.673 8 DFCE Certificate 206 0.024 0.084 9 Target Plus Scheme 265 0.031 0.108 10 VKGUY 3886 0.460 1.590 11 11 Served from India Scheme 526 0.062 0.215 12 Focus Market Scheme 769 0.091 0.315 13 Total 43622 5.159 17.843 14 Less Revenue Foregone on account of incentive schemes mentioned at sl. nos. 8 to 12 5652 0.668 2.312 15 Revenue Foregone on account of input tax neutralization or exemption schemes to be reduced from Gross Revenue Foregone on account of Customs Duty 37970 4.491 15.531 To conclude: The provisions made by finance ministry for release of funds towards export promotion would ultimately decide the future of all promotional schemes. Hence, one should not expect too much on actual incentives. 12 6 Understanding Policy Export Promotion Schemes for import/procurement of Inputs Duty Exemption Duty Neutralisation / Remission Rewards/ Incentives by way of Duty Credit 14 7 Duty Exemption Adv. Autho. Transferable DFIA EOU Import Import All Import duties including Antidumping duty and safeguard duty are exempted. Domestic Procurement Excise Duty is exempted and domestic manufacturer gets Deemed Exports benefits Basic Customs Duty exempted [CVD is payable, however, importer can get Cenvat Credit] 15 Duty Neutralisation / Remission DEPB Neutralisation of BCD on inputs as per SION. It can be debited for payment of any Customs Duty on permissible imports Drawback If Cenvat Credit is availed If Cenvat Credit is not availed Drawback is limited to customs duty only Drawback is available for Customs + Excise duties paid Exemption and Neutralisation / Remission are mutually exclusive 16 8 Rewards/Incentive Schemes administered by DGFT Served from India Scheme [SFIS] Vishesh Krishi and Gram Udyog Yojana [VKGUY] Focus Market Scheme [FMS] Focus Product Scheme [FPS]/ Market Linked Focus Products Scrips [MLFPS] Duty Credit Scrip of 10% Duty Credit Scrip of 5% Duty Credit Scrip of 3% Duty Credit Scrip of 2% Duty credit scrips are Transferable, they can be sold and premium can be earned [except SFIS] 17 Schemes specifically for import/procurement of Capital Goods EPCG Scheme ‘Zero Duty EPCG Scheme’ for specified sectors ‘3% EPCG Scheme’ for all sectors Status Holder Incentive Scrip Works as “zero” duty. Applicable only for status holders of specified sectors EOU Scheme “Zero” duty for EOU/ EHTP/ STP/BTP units 18 9 Issues listed by Task Force with respect to FTP Sr. Issues listed by Task Force No. Whether implemented (9) or pending (±) 1. Application fee for export promotion-related licenses (e.g., DEPB, Advance Authorization, EPCG) should not be charged on ad-valorem basis ± 2. EDI and other IT-related issues with DGFT should be resolved Online application facility should be provided for status holder certification ± Offline software facility should be provided for filing applications on DGFT server 9 Message exchange with Customs should be implemented for Chapter 3 FTP schemes ± Message exchange with Customs should be implemented for other variants of Advance License i.e. Annual Advance License and DFIA 9 Status of redemption of licenses should be available on DGFT server ± EDI system should be developed for issuance of ARO / Invalidation under Advance/EPCG Licenses ± 20 10 3. Requirement of submission of Chartered Engineer Certificate with Para 4.7 applications may be removed 9 4. Adhoc norms should apply to all cases for the same export product upto one year in retrospect 9 5. Requirement of submission of Proforma Invoice for issue of import license for restricted items may be done away with ± 6. Requirement of submission of export order for issue of export license may be done away with ± 7. Requirement of separate Legal Undertakings for each license and each organization may be should be done away with ± 8. Priority treatment should be given to Status Holders while processing applications in DGFT and Customs ± 9. Requirement of submission of hard copies of DEPB EDI shipping bills should be done away with ± 10. Import of spares should be permitted without restriction, with a corresponding export obligation ± 21 11. Time for submission of installation certificate by EPCG holders should be relaxed in case of delays by Central Excise ± 12. MDA assistance should be company-specific and not individualspecific ± 13. Time taken for redemption of Advance Authorization / EPCG licenses should be reduced through better monitoring and self-certification ± 14. Duplicate verification of documents by Customs after redemption of licenses to be done away with ± 15. The monthly exchange rate notified by Customs may be allowed to be used for converting shipping bills into FFE, in the EPCG scheme ± 16. Passport copy of the applicant should be accepted for issuance of IEC ± 17. Requirement of submission of Chartered Engineer Certificate for issuance of EPCG licenses may be removed ± 18. An annual EPCG license scheme should be devised, specially for the service sector 9 19. The norms for calculating average export obligation value under EPCG scheme need to be revised ± 20. SION for fashion related goods need to be revised at regular intervals and self-certification should be allowed for para 4.7 cases ± 22 11 Suggestions by Sudhakar Kasture as a member of Task Force 21. DEPB application should be modified to include FMS/FPS percentage also. Fees for DEPB to be abolished. ± 22. Para 3.12.8 of FTP: Procurement from Domestic ± Sources - Local procurement is allowed under the Served from India Scheme [SFIS]. It was recommended to extend such facility for other Duty Credit Scrips viz. FMS, FPS and VKGUY as well. 23. Simplification of Invalidation of Authorisations – Invalidation process should be made simpler. Instead of issuing ARO etc., a simple endorsement should be done on the body of authorization. ± 24. DEPB Rate Schedule to be aligned to ITC HS Classification for Export & Import Items ± 23 25. Clubbing of Advance Authorisation: As per Para 4.1.3 of FTP there are no separate categories for Advance Authorisation any more. However, operationally, RAs treat Advance Authorisations issued for intermediate supply and Deemed Exports separately and this leads to unnecessary trouble and confusion. Even in guidelines for applicants given in the application format for clubbing, ANF 4D, prescribes that clubbing of Advance Authorisation and Annual Advance Authorisation is not permitted. This seems to be anomaly, as the basic provisions of Clubbing [Para 4.20 of HBPv1] do not contain such provision. It was therefore recommended that A clause should be included in clubbing provisions as well as Export obligation provisions that Export or Deemed Export will qualify for discharge of export obligation against any authorisation howsoever, issued subject to time limit of 36 months for exports, and 30 months for imports. Also the condition mentioned in ANF 4D for clubbing of Advance Authorisation and Annual Advance Authorisation should be deleted. 9 24 12 Para by Para Study of Foreign Trade Policy & Procedures Chapter 1B-FTP Special Focus Initiatives 13 PARA 1B.1 - Special Focus (ii) Technological Upgradation: X At the end of sub-point (a) following sentence is added, which is as under: “This scheme is being expanded to cover more export product groups including marine products, sports goods, toys, rubber & rubber products, additional chemicals / allied products and additional engineering products. The scheme is also being extended upto 31.3.2012.” Remarks: Addition of more products. X New point at sr.no.(c) is added, which is as under; “(c) The facility of EPCG Scheme for Annual Requirement is being introduced to reduce documentation and transaction time.” Remarks: Good provision. 27 (iii) Support to status holders X In the para, Bold sentence is added. “The Government recognized ‘Status Holders’ contribute approx. 60% of India’s goods exports. To incentivise and encourage the status holders, as well as to encourage Technological upgradation of export production, additional duty credit scrip @ 1% of the FOB value of past export shall be granted for specified product groups including leather, specific sub-sectors in engineering, textiles, plastics, handicrafts and jute. This duty credit scrip can be used for import of capital goods by these status holders. The imported capital goods shall be subject to actual user condition. The status holder incentive scrip scheme is being expanded to cover more export product groups including marine products, sports goods, toys, specified chemicals and allied products and additional engineering products. The scheme is also being extended upto 31.3.2012.” Remarks: Welcome provision. 28 14 (iv) Agriculture and Village Industry Sub-point (f) of Agriculture and Village Industry is substituted as under: Substituted point – “(f) Additional flexibility for agri-infra scrip by way of limited transferability to other status holders and the units in Food Parks allowed.” Old point – “(f) Certain specified flowers, fruits & vegetables are entitled to a special duty credit scrip, in addition to the normal benefit under VKGUY.” Remarks: Transferability expanded to Food Park units. 29 (v) Handlooms X Following new sub point is added “(a) 2% bonus benefits under focus product scheme.” X Bold sentence is added “(c) Duty free import entitlement of specified trimmings and embellishments is 5% of FOB value of exports during previous financial year. Handloom made-ups have also been included for the entitlement.” (vi) Handicrafts New sub point (h) is added, which is as under: “(h) In addition to above, 2% bonus benefits under Focus Product Scheme for Handicraft exports.” 30 15 (vii) Gems & Jewellery Bold words are added in sub point (b) under Sector (vii) Gems & Jewellery, which reads as under: “(b) Duty Free Import Entitlement (based on FOB value of exports during previous financial year) of Consumables, Tools and additional items allowed for: 1. Jewellery made out of: (a) Precious metals (other than Gold & Platinum) – 2% (b) Gold and Platinum – 1% (c ) Rhodium finished Silver – 3% 2 . Cut and Polished Diamonds – 1%” 31 (viii) Leather and Footwear Following two new sub points are added “(a) Additional 2% bonus benefits under Focus Product Scheme. (b) Finished Leather exports to be incentivized under Focus Product Scheme.” Underlined words are replaced by bold words in sub para (i) Re-export of unsold hides, skins and semi finished leather shall be allowed from Public Bonded warehouse (OLD- at 50% of the applicable export duty) without payment of export duty. 32 16 (ix) Marine Products X Sub point (e) is amended as under: New Para – “(e) Marine products are incentivized at special higher rate under VKGUY scheme.” Old Para – “(e) Marine products are considered for VKGUY Scheme.” X Following new sub point (f) is added: “(f) Marine sector included for benefits under zero duty EPCG scheme.” (x) Electronics and IT Hardware Manufacturing Industries Two new sub points are added “(a) Export of electronic goods to be incentivized under Focus Product Scheme. (d) Electronics Sector included for benefits under SHIS scheme.” 33 (xi) Sports Goods and Toys Two new sub points are added “(e) In addition to above, 2% bonus benefits under Focus Product Scheme for Sports Goods & Toys. (f) Sports goods & Toys included for benefits under zero duty EPCG and SHIS schemes.” General Remarks for point nos. (v), (vi), (vii), (viii), (ix), (x) and (xi): Additional benefits are granted for various sectors. 34 17 Chapter 1-HBP Introduction PARA 1.1 – Notification Underlined words are replaced by bold words In pursuance of the provisions of paragraph 2.4 of FTP, the Director General of Foreign Trade (DGFT) hereby notifies the compilations known as HBPv1, HBPv2 and Schedule of DEPB rates. These compilations, as amended from time to time, shall remain in force until 31st March, 2014, except DEPB scheme, which shall continue to be operative till 31st, December 2010 or till a replacement scheme is announced, whichever is earlier 30th June, 2011. Remarks: DEPB scheme extended upto 30th June, 2011. 36 18 Chapter 2-HBP General Provisions Regarding Imports and Exports PARA 2.49 – Application for Grant of Export Licence/ Certificate / Permission – In the first sentence of para mentioned after Point NO. IV of ‘procedure/guidelines for filing/evaluation of applications for entering into an arrangement or understanding for site visits, on-site verification and access to records /documentation’ - words “for export of any other item which is not restricted or prohibited for export” are substituted by words “for export of items not covered under Drugs &Cosmetics Act, 1940, which have usage in hospitals, nursing homes and clinics, for medical and surgical purposes and are not prohibited for export.”. Substituted words “for export of items not covered under Drugs & Cosmetics Act, 1940, which have usage in hospitals, nursing homes and clinics, for medical and surgical purposes and are not prohibited for export” were appearing in the FTP earlier, which were replaced by PN No. 64 Dtd. 18.05.2010 and now are reintroduced. Remarks: Reintroduction of earlier provision. 38 19 PARA 2.70.6 - New EDI Initiatives – Deleted Deleted para reads as under: To further improve quality of services some new EDI initiatives are being taken by DGFT: Electronic Message Exchange between Customs and DGFT in respect of incentive schemes under Chapter 3 will become operational by 31st December, 2009. Remarks: In practice, Customs demand certificate of genuineness from DGFT, which defeats the purpose of EDI initiatives otherwise also. 39 Chapter 3-FTP Promotional Measures 20 PARA 3.12.6- Imports Allowed Second sub-para of para 3.12.6 amended, which reads as under: “Utilization of Duty Credit scrip earned shall be permitted for payment of duty in case of import of only those vehicles, which are in the nature of professional equipment to the service provider.” Old para “Utilization of Duty Credit scrip earned shall not be permitted for payment of duty in case of import of vehicles, even if such vehicles are freely importable under ITC (HS).” Remarks: These would be vehicles similar to golf carts, battery operated vehicles used to carry equipments in studios etc. (mainly off the road vehicles) 41 PARA 3.13.4 - Agri. Infrastructure Incentive Scrip i) In the first para, Para no. ‘3.7.2 of HBPv1’ is replaced by Para no. ‘3.4 of HBPv1’. Remarks: Para 3.4 of HBPv1 deals with ‘refusal/suspension/ cancellation of status certificate’ and Para 3.7.2 of HBPv1 is relating to Agri. Infrastructure Incentive Scrip. This is an error, will be corrected subsequently. ii) In last sub-para of para 3.13.4 following bold words are added: “However, for import of Cold Chain Equipment, this Incentive Scrip shall be freely transferable amongst Status Holders as well as to Units (the term ‘Units’ shall not include Developers) in the Food Parks.” Remarks: Limited additional transferability provided. 42 21 PARA 3.15.2- Entitlement [Focus Product Scheme (FPS)] Following sub-para is added at the end of para 3.15.2 New sub-para: “Further, Focus Product(s) / sector(s) that are notified under Table 7 of Appendix 37D shall be granted additional Duty Credit Scrip equivalent to 2% of FOB value of exports (in free foreign exchange) over and above the existing rate for that product / sector from the admissible date of export / period specified in the public notice issued to notify the product / sector.” Remarks: BONUS 43 PARA 3.16.1- (Status Holders Incentive Scrip) X Bold words in first para are added: “With an objective to promote investment in upgradation of technology of some specified sectors as listed in Para 3.16.4 below, Status Holders shall be entitled to incentive scrip @1% of FOB value of exports made during 2009-10, 2010-11 and during 2011-12, of these specified sectors, in the form of duty credit.” X New sub-para added: “The Status Holders of the additional sectors listed in the Para 3.10.8 of HBPv1 2009-14 (RE-2010) shall be eligible for this Status Holders Incentive Scrip on exports made during 2010-11 and 2011-12.” 44 22 PARA 3.16.1- (Status Holders Incentive Scrip) Remarks: Status holder incentive scrip is further extended for one more year for 2011 – 2012 exports. The benefits of the scheme have been extended to additional sectors such as “Chemical & Allied products, paper, paperboard and articles thereof, ceramic products, re-fractories, glass & glassware, rubber & articles thereof, plywood and allied products, electronics products, sports goods and toys and additional engineering products”. Such additional sectors shall be entitled for the benefit only on exports made during 2010-11 and 2011-12. 45 PARA 3.16.4 Following sub-para added at the end of para 3.16.4: “The Status Holders of the additional sectors listed in the Para 3.10.8 of HBPv1 2009-14 (RE-2010) shall be eligible for this Status Holders Incentive Scrip on exports made during 2010-11 and 2011-12.” Remarks: The additional sectors shall now enjoy the benefit of Status Holders Incentive Scrip. 46 23 Chapter 3-HBP Promotional Measures PARA 3.7.2 – (VKGUY) Third para of Para 3.7.2 of HBPv1 is amended, which reads as under: “Applications received after the last date shall be summarily rejected, as Para 9.2 [OLD- Para 9.3] and Para 9.3 [OLD-Para 9.4] shall not be applicable.” Remarks: Para 9.3 of HBPv1 is related to imposition of late cut, Para 9.4 of HBPv1 is related to supplementary claims. Here also there is an error, as Para 9.2 of HBPv1 is about Denomination of Import Authorisation / Licence / Certificate / Permissions. 48 24 PARA 3.10 - Procedure for Status Holders Incentive Scrip Para 3.10.3 amended to read as under: Amended Para: “The last date of filing the application shall be 31st March 2011/2012/2013 for SHIS scheme for exports made during 200910/2010-11/2011-12 respectively. Further, in view of fourth sub-para of Para 5.1A of HBPv1: a) Para 9.3 of HBPv1 shall not be applicable for SHIS Scheme in cases where the SHIS application (say for exports made during 2009-10) has been filed after the prescribed date (i.e. after 31st March 2011) and Zero Duty EPCG Authorisation has been issued to the applicant by any RA during the year 2010-11 (from 1.4.2010 till 31.3.2011). 49 b) Similarly for SHIS Applications for exports made during 2010-11 & 2011-12 filed late (i.e. after the prescribed dates of 31st March 2012/2013 respectively), Para 9.3 shall not be applicable in cases where Zero Duty EPCG Authorisation has been issued to the applicant by any RA during the year 2011-12 (from 1.4.2011 till 31.3.2012) or 2012-13 (from 1.4.2012 till 31.3.2013) as the case may be. c) In case SHIS Application is filed within the prescribed date (for exports made during 2009-10/2010-11/2011-12 as the case may be, including any supplementary claim under Para 9.4 of HBPv1) and where Zero Duty EPCG Authorisation has been issued to the applicant by any RA during the relevant year (i.e. during 2010-11/2011-12/2012-13 respectively, as the case may be), SHIS application shall be summarily rejected in view of fourth sub-para of Para 5.1A of HBPv1.” Old para 3.10.3: “The last date of filing the application shall be 31st March 2011 for SHIS Application on exports made during 2009-10 (and 31st March 2012 for SHIS Application on exports made during 2010-11).” 50 25 Remarks: Date of filing of application would be within one year of the year of exports effected. Duty credit scrip applications shall not be considered: − In case, it is filed beyond prescribed last date of application. − In case, Zero Duty EPCG Scheme is availed in the particular period i.e. 2010–11, 2011–12 & 2012–13. Provision of late cut is not applicable, which please note. 51 PARA 3.10.8 – New para added X The following additional sectors shall be eligible for Status Holders Incentive Scrip on exports made during 2010-11 and 2011-12: Contd……. 52 26 Sl. No. Products / Product Groups ITC(HS) 1 Chemical & Allied Products (other than Bulk minerals, Granite/Stones, Processed minerals, Cement, Clinkers and asbestos) (i) Rubber products, 4001 to 4010, 4014 to 4017 (ii) Paints, Varnishes & Allied Products 3208, 3209, 3210 (iii) Glass and glassware Chapter 70 (iv) Plywood and allied products Chapter 44 (v) Ceramics / refractories Chapter 69 (vi) Paper, Paper Boards & Paper products Chapter 48 (vii) Books, Publications & Printings (viii) Animal By-products (Codes 35030030, 05079010, 05079020, 05079050, 23011010, 96062910 and 96063010) (ix) Ossein & Gelatine Chapter 49 05069099, Various codes 23011090, Codes 05061039 and 35030020 (x) Graphite Products (Codes 3801, 85451100 and 85451900) & Various codes Explosives (Codes 3601, 3602 and 3603) (xi)Misc. Products (Codes 3201, 32029010, 32030010, 3604, Various codes 3605, & 38021000) 2 Electronics Products 3 Sports Goods and Toys 4 Engineering products for the three groups Chapter 72 indicated below 53 Contd…… Chapter 95 and Codes 420321, 650610 (i) Iron and Steel (ii) Pipes and tubes (iii) Ferro Alloys Remarks: SHIS is now extended to above mentioned additional sectors. 54 27 PARA 3.11 - Common procedural features for promotional schemes, applicable to all schemes in this chapter, unless specifically provided for: PARA 3.11.8 - Declaration of Intent on Free Shipping Bills Bold paras are reintroduced which were deleted and replaced vide PN.82 dtd.16.07.2010 and other paras are newly introduced: “For export shipments filed under Free Shipping Bill category, for exports of products / to markets eligible under Chapter 3 of FTP (Appendix 37A, 37C, 37D), the exporter shall state the intention to claim benefits under Chapter 3 of FTP by declaring on the Free Shipping Bills as under: ‘I/We, hereby, declare that I/We shall claim the benefits, as admissible, under Chapter 3 of FTP’. This declaration shall not be required for export shipments under any of the schemes of Chapter 4 (including drawback) or Chapter 5 of FTP. Contd…… 55 Further for products, markets notified during the year, this declaration shall be necessary for exports under Free Shipping Bills, only after a grace period of one month from the date of relevant public notice. Moreover for exports made prior to date of notification of products / markets, such a declaration will not be required, since export shipments under Free Shipping Bills have already taken place. Newly introduced paras are : For exports made w.e.f 1st January 2011, the above Paragraph shall be replaced as under: ‘For products/markets listed in Appendix 37A, 37C, 37D that are eligible for benefit under Chapter 3 of FTP, exporters shall declare their intention to claim benefit by stating in all categories of Shipping Bills as under: ‘I/We, hereby, declare that I/We shall claim the benefits, as admissible, under Chapter 3 of FTP’. Contd…… 56 28 This declaration shall also be required on export shipments under any of the Schemes of Chapter 4 or Chapter 5 or Chapter 6 of FTP as well as on Bills of Exports filed for Supply to SEZ. No claim under Chapter 3 shall be admissible without this declaration. However, Schemes names are not required to be mentioned in the declaration of intent. Further, for products / markets notified during the year, the declaration of intent shall be necessary for exports under all categories of Shipping Bills only after a grace period of one month from the date of relevant Public Notice which notifies such product / market. For exports made prior to date of notification (i.e. the date of the relevant Public Notice which notified such product / market), such a declaration will not be required since export shipments have already taken place.’” Remarks: Procedural clarification. 57 Chapter 4-FTP Duty Exemption & Remission Schemes 29 PARA 4.1.10- Advance Authorisation for Annual Requirement Sentence in bold is added in first sub para. Remaining sub paras remain unchanged. “Advance authorisation can also be issued for annual requirement. Imports are exempted from payment of basic customs duty, additional customs duty, education cess, antidumping duty and safeguard duty, if any.” Remarks: This is just compliance, which was otherwise due; since goods imported are not meant for domestic consumption. 59 GEMS AND JEWELLERY PARA 4A.1.1 – Word in bold is deleted from the sentence “Replenishment authorisation may also be issued for consumables & tools as per paragraph 4A.28 of HBP v1.” Remarks: Tools are not “inputs” and hence this deletion. 60 30 Chapter 4-HBP Duty Exemption & Remission Schemes PARA 4.7.1 - Entitlement i) Words in bold are added in the second sub para “However, in cases where NC has already ratified norms for same export and import products in respect of an authorization obtained under paragraph 4.7, such norms shall be valid for a period of one year, both with retrospectively as well as prospectively, reckoned from the date of ratification.” Contd…… 62 31 PARA 4.7.1 - Entitlement ii) Sentence in bold is added at the end of third sub para “In such cases Authorisations shall be issued by RA concerned under "Adhoc Norms Fixed" category and application copies need not be forwarded to NC for fixation / ratification of norms. Where the application has already been forwarded before the ratification of Norms, the RA shall finalise the case as per the norms subsequently ratified by NC in a similar case.” Remarks: This would solve the problems of pending cases for redemption purposes, provided the provision is implemented in true spirit. 63 PARA 4.20 - Facility of Clubbing Sentence in bold is added at the end of the para “Facility of clubbing shall be available only for redemption /regularisation of cases and no further import or export shall be allowed. For this facility, authorisations are required to have been issued under similar Customs notification even pertaining to different financial years. However in case of Authorisations issued in 2004-09 period and thereafter, Advance Authorisations with different customs notification can be clubbed. Advance authorisation for annual requirement can also be clubbed with the advance authorisation.” Remarks: Long overdue amendment – finally approved. 64 32 PARA 4.21 - Enhancement/ Reduction in the value of Authorisation Bold words are deleted, in the first sentence of this para “In respect of an Advance Authorisation, RA concerned (as per their financial powers) may consider a request for” Remarks: All enhancement / reduction to be carried out by regional authority, only – procedural simplification. 65 GEMS AND JEWELLERY PARA 4A.28 - Replenishment Authorisation for Import of Consumables etc. Words in bold are added in the first sub para “A replenishment authorization for duty free import of Consumables, Tools and other items namely, Tags and labels, Security censor on card, Staple wire, Poly bag (as notified by Customs) for Jewellery made out of precious metals (other than Gold & Platinum) equal to 2% and for Cut and Polished Diamonds and Jewellery made out of Gold and Platinum equal to 1% of FOB value of exports of the preceding year, may be issued on production of Chartered Accountant Certificate indicating the export performance. However, in case of Rhodium finished Silver jewellery, entitlement will be 3% of FOB value of exports of such jewellery. This Authorisation shall be non- transferable and subject to actual user condition.” Remarks: Good Provision 66 33 Chapter 5-FTP Export Promotion Capital Goods Scheme PARA 5.1 – Zero duty EPCG Scheme i) The additional products are added in second sub para. The added products are marked in bold. “The scheme will be available for exporters of engineering & electronic products, basic chemicals & pharmaceuticals, apparels & textiles, plastics, handicrafts, chemicals & allied products, leather & leather products, paper & paperboard and articles thereof, ceramic products, refractories, glass & glassware, rubber & articles thereof, plywood and allied products, marine products, sports goods and toys subject to exclusions as provided in HBP Vol. I. Contd……… 68 34 ii) In third sub para, the operational period of “Zero duty EPCG Scheme” is extended for the further period of one year. The old and new sentence is as under: Old sentence of third sub para: The zero duty EPCG scheme will be in operation till 31.3.2011. New sentence of third sub para: The zero duty EPCG scheme will be in operation till 31.3.2012. Remarks: Zero Duty EPCG scheme has been extended by one more year till 31.03.2012. 69 PARA 5.2D – EPCG Authorization for Annual Requirement X New para added, which reads as under: “EPCG Authorization can also be issued for annual requirement to Status Certificate Holders and all other categories of exporters having past export performance (in preceding two years), both under zero duty and 3% duty Schemes. The annual entitlement in terms of duty saved amount shall be upto 50% of FOB value of Physical Export and / or FOR value of Deemed Export, in preceding licensing year.” 70 35 PARA 5.2D – EPCG Authorization for Annual Requirement Remarks: Good provision. Exporter shall now have the flexibility to get a high value EPCG authorisation by filing application on Annual basis, instead of multiple individual applications. It will reduce paper work against filing of multiple applications and monitoring thereof. It will also reduce transaction time and cost. It is applicable only to the Status Holder AND other categories of exporters having export in atleast preceding two years. The upper limit of duty saved amount for the purpose of EPCG authorisation is limited to 50% of preceding year’s exports. 71 Chapter 5-HBP Export Promotion Capital Goods Scheme 36 PARA 5.1A – Exclusions under Zero Duty EPCG Scheme Second and third sub paras are amended. The amended paras are as under: “Chapters 1, 2, 4 to 24, 25 to 27, 31, 43, 44 (except plywood and allied products), 45, 47, 68, 71, 81 (metals in primary and intermediate forms only), 89, 93, 97, 98. ITC(HS) 4011 to 4013, ITC(HS) 7401 to 7406, 7501 to 7504, 7601 to 7603, 7801,7802, 7901 to 7903, 8001, 8002 and 8401. However, zero duty EPCG Scheme will be available for handicraft exports under Chapters 5, 68, 97.” 73 Remarks: Benefit of the scheme is expanded to cover paper & paperboard and articles thereof, ceramic products, refractories, glass & glassware, rubber & articles thereof, plywood and allied products, marine products, sports goods and toys and additional engineering products. Since there is addition and deletion in Chapters and ITC (HS) codes, it is necessary to check the exclusion list carefully before availing of Zero Duty EPCG Scheme. (The list is given below) Chapters deleted from exclusion 3, 40, 44 (except plywood and list allied products), 48, 49, 69, 70 ITC (HS) added under exclusion 4011 to 4013, list ITC (HS) deleted from exclusion 7201 to 7212, 7218 to 7220, 7224 list to 7226 Chapter deleted from Zero EPCG 44 Scheme for Handicraft Exports 74 37 PARA 5.2A – EPCG Authorisation for Annual Requirement New para added, which reads as under: “The Authorization for Annual Requirement will be issued subject to the following conditions in addition to other terms and conditions governing the EPCG scheme:Authorizations shall be issued with a specific duty saved amount and corresponding export obligation. The applicant would be required to indicate export products proposed to be exported under the authorization. The authorization holder shall also be required to submit a Nexus Certificate from an independent Chartered Engineer (CEC) in Appendix 32A, to the Customs authorities at the time of clearance of imported capital goods. A copy of the CEC shall be submitted to the concerned Regional Authority along with copy of the bill of entry, within 30 days from the date of import of the Capital Goods.” Contd……. 75 Remarks: Procedural simplification. Now EPCG authorisation for annual requirement can be granted upto 50% (duty saved value) on FOB value of preceding year’s exports. Details of products proposed to be exported should be given while filing initial application. Nexus certificate as per prescribed format is to be submitted at the time of physical import, at Customs authority instead at initial stage of application with concerned RA. Thereafter, copy of the same should be submitted to RA along with Bill of Entry, within 30 days of import. In other words, nexus will be monitored by Customs instead of Regional Authority. This provision would be very useful to large companies where all details of imports are not finalised in advance. It will reduce the application fees substantially. Very welcome provision. 76 38 Chapter 8-HBP Deemed Exports PARA 8.3.1 – Procedure for claiming Deemed Exports Drawback & Terminal Excise Duty Refund / Exemption First point of the para is substituted as under Words in bold are added “An application in ANF 8 along with prescribed documents, shall be made by Registered office or Head office or a branch office or manufacturing unit of supplier to RA concerned. Where applicant is branch office or manufacturing unit of a supplier, it shall furnish self certified copy of valid RCMC. Recipient may also claim benefits on production of a suitable disclaimer from supplier in the format given in Annexure III of ANF 8 along with a self declaration in the format given in Annexure II of ANF 8 regarding non-availment of CENVAT credit in addition to prescribed documents.” Remarks: Good procedural simplification. 78 39 NOTE: X There are no practical changes made in the following chapters: Chapter 1C-FTP - Board of Trade Chapter 2-FTP - General Provisions Regarding Imports and Exports Chapter 6-FTP and HBPv1 - Export Oriented Units (EOUs), Electronics Hardware Technology Parks (EHTPs), Software Technology Parks (STPs) and Bio-Technology Parks (BTPs) Chapter 8-FTP - Deemed Exports Chapter 9-FTP - Definitions Chapter 9-HBP - Miscellaneous Matters 79 Updates on SEZ 40 Fact Sheet on Indian SEZ X No. of Notified SEZs as on 20.07.2010 – 358 (out of 575) + (7 Central Govt. + 12 State/Pvt. SEZs) X No. of valid formal approvals – 576 X No. of valid in-principle approvals – 155 X Operational SEZ as on 31.12.2009 – 114 (Out of these 14 are multi-product SEZs, remaining are IT/ITES, Engineering, electronic hardware, textiles, Biotechnology, Gem& Jewellery SEZs and other sector specific SEZs) X Units approved in SEZs as on 30.06.2010 – 3,048 Source: www.sezindia.nic.in 81 SEZs-Area Requirement SEZ Formally approved and notified SEZs Area Estimates [approx] (in hectares ) 69,324 In-principal approvals 1,29,668 Total Area for proposed SEZs 1,98,992 82 41 Fact Sheet on Indian SEZ Total Investment made in notified SEZs (as on 30th June 2010) Employment created in notified SEZs (as on 30th June 2010) Employment in Govt. SEZs Rs. 1,49,744.55 cr 2,89,738 persons 2,00,327 persons 83 Fact Sheet on Indian SEZ Exports from the functioning SEZs during the last three years are as under: Year Exports (Rs. crores) Growth Rate of exports 2003-2004 13,854 39% 2004-2005 18,314 32% 2005-2006 22,840 24.71% 2006-2007 34615 52% 2007-2008 66638 93% 2008-2009 99688.87 50% 2009-2010 2,20,711.39 121.40% Exports in 2010-11 as on 30.06.2010 - Rs. 58,685.46 crore 84 42 Changes effected till August 2010 SEZ Draft Guidelines Dtd.13.11.09 Guidelines for Development of SEZs X Draft Guidelines were issued by the Ministry of Commerce and Industry (MoC&I) on 5th August, 2009 and were circulated to SEZ Developers. On getting suggestions from the SEZ developers, revised draft guidelines are issued by this notification. 86 43 S.O. 75 Dtd. 13.01.2010 On 13th January, 2010 following sections of SEZ Act, 2005 have been operationalised Sections 20-Agency to inspect Section 21-Single enforcement officer or agency for notified offences Section 22-Investigation, inspection and search or seizure. S.O. 76 Dtd. 13.01.2010 MoC&I specified acts or omissions punishable under the Foreign Trade (Development and Regulation) Act, 1992 (28 of 2005) as notified offences for the purposes of the Special Economic Zones Act, 2005. S.O. 77 Dtd. 13.01.2010 MoC&I authorizes Development Commissioner [DC] to be the enforcement officer in respect of the notified offences [as given in S.O. 76 Dtd. 13.01.2010] committed in a SEZ. 87 S.O. 78 Dtd. 13.01.2010 Director STPI would no more be In-charge of SEZ particularly IT/ ITES/ Software SEZs. S.O. No. 228 Dtd. 03.03.2010 Very important amendment. SEZs are authorized as deemed licensee for the purposes of distribution of electricity. Hence notified SEZs (notified under sub-section (1) of section 4 of the SEZ Act, 2005) need not make application for obtaining licence for distribution of electricity under clause (b) of Section 14 of the Electricity Act, 2003. S.O. No. 527 Dtd. 03.03.2010 Clause (u) of section 2 of the Special Economic Zones Act, 2005 (definition of “offshore banking unit”) would not apply to offsite Automated Teller Machines [ATM] in the Special Economic Zones, and branches in Special Economic Zones by Banks, not licensed as Offshore Banking Units; with the prior permission of the Reserve Bank of India under section 23 of the Banking Regulation Act, 1949. 88 44 G.S.R. 501(E) Dtd. 14.06.2010 – Amends SEZ Rules, 2006 Rule 3, 5, 6, 8, 9, 11 and 12 are amended and Rule 3A, 6A and 78 are inserted. By this notification, following Forms are also added. Form-A1 APPLICATION FORM FOR APPROVAL OF CO-DEVELOPER Form-C1 APPLICATION FOR EXTENSION OF VALIDITY OF APPROVAL GRANTED UNDER RULE 6(2)(a) Form-C2 APPLICATION FOR EXTENSION OF VALIDITY OF APPROVAL GRANTED UNDER RULE 6(2)(b) Form-C3 APPLICATION FOR SEEKING CHANGE IN SECTOR Form-C4 APPLICATION FOR INCREASE IN AREA Form-C5 APPLICATION FOR DECREASE IN AREA Form-C6 APPLICATION FORM FOR DENOTIFICATION Form-C7 APPLICATION FOR APPROVAL OF AUTHORISED OPERATIONS Explanation on each amendment/insertion of rule is provided in EPCES Cir. No. 113 Dtd. 14.07.2010. 89 G.S.R. 597(E) Dtd. 12.07.2010 – Amends Rule 5 (2) (b) of SEZ Rules, 2006 This notification amends Rule 5 (2) (b) related to sector specific SEZ. The inserted proviso prescribes minimum built up area for SEZs located in the cities as categorized under Annexure-IV. Annexure IV is also inserted by this notification. The minimum built up area prescribed is as under: B1 category cities 50% of the area specified in Rule 5(2)(b) B2 category cities 25% of the area specified in Rule 5(2)(b) Third Proviso of Rule 5(2) (c) related to FTWZ is also amended. The proviso says that in SEZ for a specific sector, FTWZ may be permitted with no minimum area requirement, provided maximum area of FTWZ should not be more than 20% of processing area. This criterion under third proviso was applicable to Sector Specific SEZ, now after amendment, this provision is made applicable to SEZs “having area less than 1000 hectares”. 90 45 EPCES Cir. No. 100 Dtd. 08.01.2010 This circular is issued referring A.P. (DIR Srs.) Cir. No. 22 Dtd. 29.12.2009. In this circular it was clarified that SEZ developers are allowed to open, hold and maintain EEFC account and to credit up to 100% of their foreign exchange earnings. EPCES CIRCULAR NO. 104 DATED 2-3-2010 IT/ITES SEZs can also house electronic hardware units in these SEZs. For setting up a unit in the SEZ, where Industrial Licence is required, permission can be given by Board of Approvals. 91 EPCES CIR. NO. 112 DTD. 16.06.2010 - Revised discussion paper on Direct Tax Code, released by Ministry of Finance on 15-6-2010. Very important circular relating to revised discussion paper on Direct Tax Code (DTC) released by Ministry of Finance on 15th June, 2010. Finance Minister has proposed in Revised DTC paper for discussion, in Chapter VII that, provision to protect profit linked deductions of units already operating in SEZs, for the unexpired period, will be incorporated. However, he has further clarified that since Profit linked deductions are distortionary in nature as they create an incentive to inflate profit as well as to transfer profits from a taxable entity to a non-taxable one, it has been decided not to extend the scope or the period of profit linked deductions. This amendment only meets the requirement of SEZ partially, as it protects only the existing SEZ units. This would practically close the door for new investment in the SEZ and hence, Dr. L.B. Singhal DG, EPCES, has invited representations from the Industry upto 30.06.2010. 92 46 Instruction No. 37 Dtd. 07.09.2009 – Clarification on whether import, re-melt, re-make and export of imported finished jewellery is an authorized activity in SEZ In view of the provisions contained in Section 2(r) of SEZ Act, 2005 read with Rule 27(1) of SEZ Rules, it is clarified that import of jewellery and its remaking is an authorised manufacturing activity by an SEZ unit holding letter of approval for manufacturing of jewellery. Further import would include re -import of exported jewellery. Instruction No. 38 Dtd. 11.09.2009 - SEZ Online Project. MoC is executing agreement with NDML for SEZ online project. This is to establish a nationwide integrated e-governance solution for the administration of SEZ and to facilitate speedy processing of transactions of SEZ Developers SEZ units. Instruction No. 39 Dtd. 11.09.2009 - Procedure for consideration of operational issues regarding SEZs. Very important instruction. For approvals or operational issues related to SEZ, the matter should be referred to Unit Approval Committee [UAC] or Board of Approval [BoA] and not to the individual Departments of Government of India. 93 Instruction No. 40 Dtd. 01.10.2009-Effective implementation of the Hazardous Waste Rules, 2008 For ensuring compliance with Hazardous Waste Rules, 2008, following recommendations are made by the Ministry of Environment and Forests [MOEF]. Officers of the State Pollution Control Boards [SPCBs] are advised to attend the meetings of the Approval Committee and assist the Development Commissioner [DC] in ensuring compliance of the environmental regulations, especially Hazardous Waste (Management, Handling & Transboundary Movement) Rules, 2008. SPCBs are also advised to monitor the units which are recycling/ reprocessing imported waste on a regular basis. Instruction No. 41 Dtd. 13.11.2009 - Clarification on calculation of NFE as per Rule 53 of the SEZ Rules, 2006 NFE is to be calculated in rupee terms only. In cases where SEZ unit achieves negative NFE due to foreign exchange fluctuations, they can approach Approval Committee. However, in such cases, SEZ unit will have to get the computations certified by the Authorised Bank, on a case to case, basis. 94 47 Instruction No. 42 Dtd. 18.11.2009 - Guidelines for consideration of proposals for authorized operations by the BoA. All requests for carrying out authorized operations, whether covered in the default list or not, are to be made initially to the concerned Development Commissioner [DC]. The DCs will send only such requests/items for consideration by BoA, which are outside their powers with their recommendations. Instruction No. 43 Dtd. 23.11.2009 - Procedure for seeking clarification on policy issues relating to SEZ Act and Rules from Department of Commerce. This is to facilitate speedy disposal at the hands of Zonal DC related to procedure for seeking clarification on policy issues relating to SEZ Act and Rules from Department of Commerce 95 Instruction No. 44 Dtd. 24.11.2009 - Reports to be furnished by DCs for review/monitoring of performance of SEZs DCs are required to submit monthly reports for reviewing/monitoring of performance of SEZs in the prescribed forms A to F, formats of which are given in the Instruction. Further, Zonal DCs are also required to submit such reports in the Format G and H. Following is the list of these formats. Format of monthly reports to be furnished By DCs A. Approval of activities under SEZ Rules 17 & SEZ Rules 18,19 B. Other Permissions C. Permissions under Rule 74 D. Statement on monthly Data on Export Duty, Import Duty and Duty Foregone E. Import and Export Data F. Statement in respect of SEZ Developers coming under the Jurisdiction of DC I. Information regarding staffing positing in SEZs. By Zonal DCs G. INFORMATION on CST claims and drawback H. [No title is given, however, information relates to built up and land space] 96 48 Instruction No. 46 Dtd. 12.01.2010 - Setting up of small scale units in Central Government SEZ Development Commissioners of Central Govt. SEZ should give preference to “small scale units” as defined under the Micro, Small and Medium Enterprises Development Act, 2006. DCs of the IT/ITES SEZs are required to ensure that the IT/ITES SEZs are advised to set up incubators of size of minimum 200 seats and the minimum 10% of the space in the SEZ may be reserved for SSI IT/ITES units. All other SEZs should allocate 10% space to SSI units. 97 Instruction No. 47 Dtd. 04.03.2010 - Procurement, Import and Export of Prohibited and Restricted Goods Following clarifications are provided in respect of procurement, Import and Export of Prohibited and Restricted Goods Export of prohibited items is permitted provided required raw materials are imported. Items which are prohibited for import can also be imported by SEZ Units if such imports are made for manufacturing export goods. In respect of supply of Restricted Items by a DTA unit to SEZ Developer/Unit, the DTA unit can supply such items to a SEZ Developer or unit for setting up of infrastructure facility or for setting up of a unit. DTA units can also supply restricted raw materials to SEZ unit for undertaking a manufacturing operation except refrigeration, cutting, polishing and blending. However for all the above activities Prior Approval from Board of Approval is required. 98 49 Instruction No. 49 Dtd. 12.03.2010 - Clarifications on FTWZ issues Ministry of Commerce & Industry has issued clarification on following issues related to FTWZs. No approval for procurement of service “Rental” of immovable property for office outside the Special Economic Zone/FTWZ can be given. Import of prohibited items will be as per Rule 27, Rule 26 and Instruction No.47 Dtd. 04.03.2010. Diesel is permitted to be procured for authorized operations in the processing area including material handling equipment. There are no limitations on Units set up in FTWZs located in Sector Specific SEZs to carry out Trading and Warehousing Activities in respect of any product. Trading and Warehousing units located within FTWZ can carry out DTA to FTWZ and FTWZ to DTA transactions. Requests for allowing cutting, polishing, blending etc. as part of authorised operation of a FTWZ unit can be considered by the Approval Committee on a case to case basis based on the merits of the case. 99 Instruction No. 51 Dtd. 25.03.2010 - Declaration of Raw material components etc. imported by G&J units in respect of goods to be manufactured by them Important circular for G&J units in SEZ. In terms of Rule 17 of the SEZ Rules SEZ units are required to file a declaration in Form-F while submitting an application for setting up of a unit. The Approval Committee considers the same before granting Approval for issue of LOA. In this connection, procedure prescribed in this instruction should be followed by all G&J units for bringing in jewellery, broken jewellery etc. for remaking, remelting, repairing, etc. Instruction No. 52 Dtd. 20.04.2010 - Clarification on broad- banding in IT/ITES Sector SEZ It is informed by this instruction that no approval of BoA is required in case of developers in IT/ITES sector to broad-band their product profile by including electronic hardware. This is because IT/ITES includes both Hardware and Software. 100 50 Instruction No. 58 Dtd. 21.05.2010 – Allowing of authorized employees of IT/ITES units in SEZ to work from home. Off-site employees of the IT/ITES units in SEZ are also permitted to work from home or from place outside the SEZ. It is also stated in the instruction that IT units in DTA can carry out their job-work in a SEZ Unit by following procedures mentioned in Rule 43 of SEZ Rules, 2006. Instruction No. 59 Dtd. 18.06.2010 - Requests for transfer of units from one SEZ to another SEZ Board of Approval [BoA] permits shifting of units from one SEZ to another SEZ, provided all such proposals are placed before the BoA. Instruction No.60 Dtd. 06.07.2010 – Clarification on holding of goods by units in FTWZ. Doubt raised by the FTWZ Developers: Whether units in the FTWZ can hold goods on behalf of Foreign Buyer, DTA Supplier and Buyer. Clarification provided by Department of Commerce: Subject to provisions of Rule 18 (5) of SEZ Rules, 2006, FTWZ units can hold goods on behalf of foreign supplier and buyer and DTA supplier and buyer. 101 Instruction No. 61 Dtd. 14.07.2010 – Withdrawal of Instruction Nos. 36, 25, 24 and 16. Following instructions are withdrawn Instruction No. 36 Dtd. 03.09.2009 – Instructions regarding proposals to be considered by BoA Instruction No. 25 Dtd.16.07.2009 – Guidelines regarding “Putting up of a boundary wall” Instruction No.24 Dtd.16.07.2009 – Guidelines for dealing with “Requests for change in area of SEZs” Instruction No. 16 Dtd. 11.06.2009 - Validity of Formal Approval This is because issues addressed in these instructions are now considered and carried out in the SEZ Law, by amending the SEZ Rules, 2006 by G.S.R. No. 501 Dtd. 14.06.2010. 102 51 Instruction No. 62 Dtd. 23.07.2010 – Procedure for clearance of State SEZ Bills. This is regarding faster procedure for clearance of State SEZ Bill. It is decided that Department of Commerce will create consensus of all concerned Departments and will send the recommendations and No Objection of concerned Departments of Government of India to the Ministry of Home Affairs [MHA] for final approval and MHA would get the assent of the President on the Bill. Instruction No. 63 Dtd. 10.08.2010- Procedure regarding removal of goods to bonded warehouse under Rule 46(13) of SEZ Rules, 2006 Procedure for removal of goods from SEZ unit to the Bonded Warehouse under Rule 46 (13) of SEZ Rules, 2006 has been prescribed in this Instruction. Instruction No. 64 Dtd. 11.08.2010 – Role of Zonal DCs This Instruction is about responsibilities allocated to the Zonal Development Commissioner [DC]. 103 Thought for the Day… “The beauty of life is, while we cannot undo what is done, we can see it, understand it, learn from it and change. So that every new moment is spent not in regret, guilt, fear or anger, but in wisdom, understanding and love.” - Buddha 104 52 105 Sudhakar Kasture Mumbai - Head Off. A-203, Everest Chambers, Next to Star TV Office, Near Marol Naka, Andheri-Kurla Road, Andheri (East), Mumbai – 400 059. Tel: 022-28507615/28507329/65769126 Fax: 022-28506419 E-mail: exim@helplineimpex.co.in Pune - Branch Off. EPI Centre, Opp. Indsearch, Law College Road, Pune 411004. Tel: 020-65246159 Fax: 020-25465195 Email: eximpune@helplineimpex.co.in 106 53