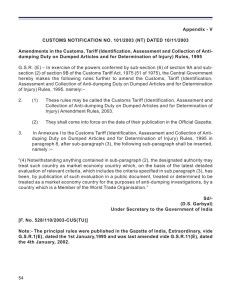

1 A File No. S/10-111/Adjn/Commr/2013-14 B

advertisement