INDUSTRIAL MARKET REPORT

Inland Empire

1st Quarter 2016

Produced in partnership with

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

Table of Contents/

Methodology of Tracked Set

Xceligent is a leading provider of verified commercial real estate information which assists real estate

professionals, appraisers, owners, investors and developers that make strategic decisions to lease, sell,

buy and develop commercial properties.

Table of Contents and Methodology/Map

2-3

Market Overview

4-5

Statistics by Market

6

Vacancy Rates & Asking Rates

7-8

Leasing & Absorption

9-10

New Construction

11

Industrial Advisory Board Members

12

Xceligent Team

13

The Inland Empire tracked set consists of an inventory of buildings considered to be competitive by

the brokerage community. All buildings within the competitive tracked set have been reviewed and

verified by members of the Advisory Boards for the market area.

Tracked

Inventory

(Industrial)

The total square feet of all single and multi-tenant buildings greater than 10,000 sf, including

owner occupied facilities. Flex/R&D buildings with an office build out greater than 30% and a

parking ratio greater than 3:1,000 are excluded.

Available SF

All of the available leasable space within a building, whether it is occupied or vacant, for

direct lease or sublease space. Space can be available but not vacant, for example, if the

landlord, or his agent, is marketing space that will be coming available at a future date

because a tenant is planning to move.

Vacant SF

The total of the direct vacant square footage in a building that is being marketed.

Net

Absorption

The net change in occupied square feet from quarter to quarter, expressed in square feet.

Note

This report reflects Direct Vacancy and Absorption, Sublease space is excluded.

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

2

Industrial Market Map

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

3

Inland Empire Industrial Overview

Overview

After a record year in 2015, the Inland Empire kicked off 2016 right where it left off posting a solid 1.8 million square

feet of positive net absorption.

6.95 million square feet of new product was delivered in the first quarter, 2.7 million square feet of the new

construction remains vacant.

Despite having 5+ consecutive quarters with positive net absorption, the vacancy rate remains at 3.4%, right where

it was 1 year ago.

Amazon continues to expand its Inland Empire presence by signing a new 1.1 million square foot lease at the newly

constructed Alliance California Gateway South development in San Bernardino.

# of Bldgs

Inventory (SF)

Total Available (SF)

Total Vacant (SF)

Total Vacancy

Rate (%)

Total Quarterly Net

Absorption (SF)

YTD Total Net

Absorption (SF)

Whse/Mfg Class A

1,062

218,132,051

18,308,112

12,166,705

5.6%

2,022,924

2,022,924

Whse/Mfg Class B

3,336

222,676,170

8,876,255

3,334,000

1.5%

61,751

61,751

Whse/Mfg Class C

1,950

58,220,410

2,587,446

1,371,939

2.4%

(281,335)

(281,335)

Grand Total

6,348

499,028,631

29,771,813

16,872,644

3.4%

1,803,340

1,803,340

# of Bldgs

Sum of Direct

Available SF

Inventory (SF)

Direct Vacant (SF)

Direct Vacancy Direct Quarterly Net

Rate (%)

Absorption (SF)

YTD Direct Net

Absorption (SF)

Whse/Mfg Class A

1,062

218,132,051

16,062,258

12,015,221

5.5%

2,013,613

2,013,613

Whse/Mfg Class B

3,336

222,676,170

8,428,694

3,315,800

1.5%

(199,677)

(199,677)

Whse/Mfg Class C

1,950

58,220,410

2,560,872

1,361,585

2.3%

(285,179)

(285,179)

Grand Total

6,348

499,028,631

27,051,824

16,692,606

3.3%

1,528,757

1,528,757

# of Bldgs

Inventory (SF)

Available Sublease

(SF)

Sublease Vacant Sublease Vacancy Sublease Quarterly

(SF)

Rate (%)

Absorption (SF)

YTD Sublease Net

Absorption (SF)

Whse/Mfg Class A

1,062

218,132,051

2,245,854

151,484

0.1%

9,311

9,311

Whse/Mfg Class B

3,336

222,676,170

447,561

18,200

0.0%

261,428

261,428

Whse/Mfg Class C

1,950

58,220,410

26,574

10,354

0.0%

3,844

3,844

Grand Total

6,348

499,028,631

2,719,989

180,038

0.0%

274,583

274,583

Historical Vacancy Rate & Net Absorption

8,000,000

3.8%

6,000,000

3.6%

3.4%

4,000,000

3.2%

2,000,000

3.0%

-

2.8%

2015 Q1

2015 Q2

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

2015 Q3

2015 Q4

2016 Q1

4

Inland Empire Industrial Overview

Historical Vacancy Rates by Use

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

2016 Q1

2015 Q4

2015 Q3

Whse/Mfg Class A

2015 Q2

Whse/Mfg Class B

2015 Q1

Whse/Mfg Class C

Historical Net Absorption by Use

5,552,098

5,500,000

4,500,000

3,613,013

3,500,000

2,832,266

2,365,234

2,500,000

2,022,924

1,500,000

1,375,878

693,552

265,155

500,000

389,570

219,081

61,751

(281,335)

204,405

50,210

344,984

(500,000)

2015 Q1

2015 Q2

Whse/Mfg Class A

2015 Q3

Whse/Mfg Class B

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

2015 Q4

2016 Q1

Whse/Mfg Class C

5

Statistics by Market

# of Bldgs

Inland Empire East

Inventory (SF)

Total Vacant (SF)

Sublease

Vacant (SF)

Vacancy

Rate (%)

Total Quarterly

Absorption

YTD Total Net

Absorption (SF)

2,827

214,708,125

11,400,972

161,838

5.3%

2,611,297

2,611,297

10,000 - 24,999 SF

1,480

23,291,454

481,275

10,354

2.1%

138,062

138,062

25,000 - 49,999 SF

609

21,175,481

529,485

-

2.5%

(11,452)

(11,452)

50,000 - 99,999 SF

336

22,996,043

428,835

-

1.9%

(11,357)

(11,357)

100,000 - 249,999 SF

222

33,201,471

1,013,371

151,484

3.1%

323,022

323,022

250,000 - 499,999 SF

82

30,240,947

1,838,506

-

6.1%

753,590

753,590

Greater than 500,000 SF

98

83,802,729

7,109,500

-

8.5%

1,419,432

1,419,432

Inland Empire West

3,521

284,320,506

5,471,672

18,200

1.9%

(807,957)

(807,957)

10,000 - 24,999 SF

1,667

25,916,749

249,271

1,400

1.0%

68,663

68,663

25,000 - 49,999 SF

712

24,636,063

219,119

-

0.9%

61,553

61,553

50,000 - 99,999 SF

432

30,120,854

441,735

16,800

1.5%

(36,851)

(36,851)

100,000 - 249,999 SF

410

62,261,859

802,632

-

1.3%

(33,934)

(33,934)

250,000 - 499,999 SF

208

74,104,662

1,561,328

-

2.1%

56,838

56,838

92

67,280,319

2,197,587

-

3.3%

(924,226)

(924,226)

6,348

499,028,631

16,872,644

180,038

3.4%

1,803,340

1,803,340

Greater than 500,000 SF

Grand Total

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

6

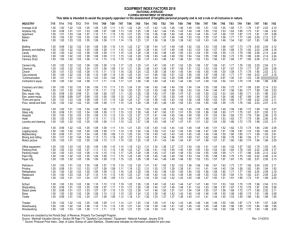

Vacancy Rates & Asking Rates

Vacancy Rate %

Average Weighted Direct Asking Rate

2015 Q1

2015 Q2

2015 Q3

2015 Q4

2016 Q1

2015 Q1

2015 Q2

2015 Q3

2015 Q4

2016 Q1

5.2%

4.8%

5.8%

5.3%

5.3%

$0.37

$0.41

$0.42

$0.44

$0.40

Whse/Mfg Class A

7.9%

7.6%

9.6%

8.8%

8.5%

$0.34

$0.37

$0.40

$0.40

$0.39

Whse/Mfg Class B

2.7%

2.2%

2.0%

2.0%

2.1%

$0.54

$0.55

$0.55

$0.45

$0.44

Whse/Mfg Class C

3.1%

3.0%

2.6%

1.6%

2.1%

$0.36

$0.37

$0.36

$0.36

$0.37

2.1%

2.0%

2.0%

1.5%

1.9%

$0.44

$0.43

$0.41

$0.51

$0.53

Whse/Mfg Class A

2.8%

2.7%

2.9%

1.9%

2.7%

$0.42

$0.41

$0.37

$0.49

$0.53

Whse/Mfg Class B

1.6%

1.4%

1.4%

1.1%

1.2%

$0.49

$0.44

$0.42

$0.55

$0.54

Whse/Mfg Class C

2.6%

2.6%

2.2%

2.2%

2.8%

$0.59

$0.61

$0.60

$0.50

$0.51

3.4%

3.2%

3.6%

3.1%

3.4%

$0.39

$0.42

$0.42

$0.46

$0.44

Inland Empire East

Inland Empire West

Grand Total

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

7

Vacancy Rates & Asking Rates

Vacancy Rate by Submarket

5.3%

1.9%

Inland Empire East

Inland Empire West

Average Weighted Asking Rates by Submarket

$0.53

$0.40

Inland Empire East

$1.20

$1.00

Inland Empire West

Asking Lease Rate Range by Type (NNN)

$1.01

$0.95

$0.80

$0.70

$0.60

$0.40

$0.20

$0.47

$0.37

$0.42

$0.31

$0.43

$0.29

$-

Whse/Mfg Class A

Whse/Mfg Class B

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

Whse/Mfg Class C

8

Leasing & Absorption

Largest Absorption Changes

Property Name

SF Occupied or Vacated

555 E Orange Show Rd

1,102,639

7295 San Gorgonio Dr

Tenant Name

Submarket

Specific Use

Amazon

Inland Empire East

Whse/Mfg Class A

582,772

Ascena Retail Group

Inalnd Empire East

Whse/Mfg Class A

19520 W Baseline Rd

373,771

Under Armour

Inalnd Empire East

Whse/Mfg Class A

27334 San Bernardino Ave

341,280

Munchkin, Inc.

Inland Empire East

Whse/Mfg Class A

1508 W Casmalia St

219,024

Guitar Center

Inland Empire East

Whse/Mfg Class A

2553 Sampson Ave

193,268

Nielsen Bainbridge Group Inland Empire East

Whse/Mfg Class A

17825 Indian St

160,795

Fisker Automotive

Inland Empire East

Whse/Mfg Class A

3655 E Philadelphia St

(333,206)

SYNNEX Corporation

Inland Empire West Whse/Mfg Class A

1990 S Cucamonga Ave

(416,713)

Home Depot

Inland Empire West Whse/Mfg Class A

9774 Calabash Ave

(591,020)

Distribution Alternatives

Inland Empire West Whse/Mfg Class A

14800-14900 Meridian Pkwy

(607,259)

Fresh & Easy

Inland Empire East

Whse/Mfg Class B

Submarket

Specific Use

Top Transactions

Property Name

2250 W Lugonia Ave

1464 W Merrill Ave

10395 Nobel Ct

Sale Price

SF Sold

Buyer

Ashley Furniture

$79,040,000 1,013,331

Industries Inc

Exeter 1464

$34,000,000

436,650

West Merrill LLC

Mintra

$16,905,000

154,380

Investments LLC

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

Seller

Redlands Business

Center LLC

Inland Empire East

Whse/Mfg Class A

Prologis LP

Inland Empire East

Whse/Mfg Class A

PSIP WR Mira Loma

Inland Empire West

Commerce Center II

Whse/Mfg Class A

9

New Construction

Current New Construction by Submarket

9,000,000

8,000,000

7,000,000

6,000,000

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

-

Inland Empire East

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

Inland Empire West

10

Industrial Advisory Board Members

Inland Empire

Dave Consani

CBRE

Jim Koenig

Mark Zorn

Colliers International

Josh Hayes

Rick John

Daum Commercial

Gus Andros

JLL

Lee & Associates

Mike McCrary

Michael Chavez

Majestic Realty Co.

Kyle Valley

NAI Capital

Nick Chang

Mark Kegans

Newmark Grubb Knight Frank

Ron Washle

Strata Realty

Voit Real Estate Services

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

Tim Hawke

Walt Chenoweth

11

Xceligent Inland Empire Team

This information has been obtained from sources believed reliable. While we do not doubt its accuracy, we

have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to

independently confirm its accuracy. For more information, please contact :

Matt Nelson

Director of Analytics

714-509-1404

mnelson@xceligent.com

Monique Ebel

Director of Research

714-538-8432

mebel@xceligent.com

Sean Pullin

Director of Client Services

714-855-5801

spullin@xceligent.com

Tim Hayes

Executive Director - AIR

213-687-8777

thayes@airea.com

Produced in partnership with

2016 Q1 Market Trends © 2016 by Xceligent, Inc. All Rights Reserved

12