Form G - Public registers - Australian Competition and Consumer

advertisement

Form G

Commonwealth of Australia

Competition and Consumer Act 2010 — subsection 93 (1)

NOTIFICATION OF EXCLUSIVE DEALING

To the Australian Competition and Consumer Commission:

Notice is hereby given, in accordance with subsection 93 (1) of the Competition and

Consumer Act 2010, of particulars of conduct or of proposed conduct of a kind

referred to subsections 47 (2), (3), (4), (5), (6), (7), (8) or (9) of that Act in which the

person giving notice engages or proposes to engage.

PLEASE FOLLOW DIRECTIONS ON BACK OF THIS FORM

(L)

N96841

Applicant

(a) Name of person giving notice:

(Refer to direction 2) ^

(b)

(c)

2.

Short description of business carried on by that person:

(Refer to direction 3)

.

Address in Australia for service of documents on that person:

Notified arrangement

(a) Description of the goods or services in relation to the supply or acquisition

of which this notice relates:

.

.

Page 1 of 5

(b)

Description of the conduct or proposed conduct:

(Refer to direction 4)

Persons, or classes of persons, aiffected or likely to be affected by the

notified conduct

(a) Class or classes of persons to which the conduct relates:

(Refer to direction 5L^ .

\

(b) Number of those persons:

(i) At present time:

(ii) Estimated within the next year:

(Refer to direction 6)

(c)

Where number of persons stated in item 3 (b) (i) is less than 50, their names

and addresses:

Page 2 of 5

4.

Public benefit claims

Arguments in support of notification:

(a) (Refer to direction 7)

refer

(b)

Solo^d-eM

Facts and evidence relied upon in support of these claims:

rrQA, Vo

t?uL

5.

Market definition

Provide a description of the market(s) in which the goods or services

described at 2 (a) are supphed or acquired and other affected markets

including: significant suppliers and acquirers; substitutes available for the

relevant goods or services; any restriction on the supply or acquisition of

the relevant goods or services (for example geographic or legal restrictions):

(Refer to direction 8)

Hi

r> \

6.

Public detriments

(a) Detriments to the public resulting or likely to result from the notification, in

particular the likely effect of the notified conduct on the prices of die goods

or services described at 2 (a) above and the prices of goods or services in

other affected markets:

(b)

Facte and evidence relevantto these detriments:

1

o/i/y

Page 3 of 5

9

Further information

(a) Name, postal address and contact telephone details of the person authorised

to provide additional information in relation to this notification:

.i/7/.l5

lied by/on behalfrOfAe applicant

(Signature)

OMr^—

»

(Full Name)

.

j

(Organisation)

fH^

\ <r<: "Vo

'

(Position in Or^isation)

Page 4 of 5

MasterCard Worldwide

Asia/Pacific, Middle East & Africa

Level8,100 Arthur Street

North Sydney NSW 2060

Australia

MasterCard

tel +6,294663700

fax+61299593296

WWW. mastercard. comau

Worldwide

FILE No

Doc

27th May, 20 13

MARS/PRIS

Shannon O'Brien

Managing Director

Sydney Harbour Kayaks

81 Parriwi Road/ Spit Bridge

MOSman NSW 2088

Dear Shannon

LIERCHANT ACRIDlBlvlENT WITH SYDNEYHARBOllRKAYAKS

MasterCard Asia/Pacific (Australia) Pty Limited anN 95/08603345 ("Master Card Australia") is

pleased to confinn the participation of Sydney Harbour Kayaks ABN 57096831051 ("Merchant") in

the MasterCard Priceless Cities Program (the "Program") providing the following benefits to

Master Card cardholders (the "Promotion") on the ternis and conditions set out below

("Agreement!L),,_

I. Promotion

a) in accordance with this Ageement, the Merchant will offer Master Card cardholders the

offers specified in Ninexure I to this letter ("Offers").

a) Merchant will ensure the Offers are in the spirit of MasterCard's 'Priceless' market positioning

and are supplied, packaged and delivered in such a way that they clearly offer appreciable

benefits and opportunities for members of the Program.

2. Validity of Offers

Merchant will ensure the Offers remain available to Master Card cardholders for the period(s) of

time specified in fumexure I to this letter.

3. Terms of Promotion

a) Each Offer will be available to Master Card cardholders who purchase the Merchant's goods

and/or services using a valid Master Card card to redeem the Offer.

by The Offers may be coriumunicated to and redeemed by cardholders residing overseas.

4. Merchant's Obligations

AUST. COMPETITION &

CONSUMER COMMISSION

16,19332-vl\SinDMS\AUSAOM

MasterCard Asla/Padflc (Australia) Pty Ltd A8N 95/08603345

I A JUL 20/3

CANBERRA

In accordance with this Agreement, the Merchant will:

a) Ensure each Offer is fulfilled in accordance with the terms of that Offer' and this Agreement

(including, for the avoidance of doubt, in accordance witli the Terms);

by Pay allcosts associated with the fulfilment of each Offer, including without limitation the cost

of the any merchandise, product, service, discount or othei. expense or activity that is the

subject matter. of any part of the Offer;

c) Where applicable, ensure it has sufficient stock available to satisfy each Offer If sufficient

stock is not available, the Merchant will substitute the product or seivice with a replacement

that is of substantially the same value and specification at no cost to Master Card Australia or

the cardholder;

d) Provide an appi'opriate and commercially reasonable level of customer. service to MasterCard

cardholders who participate in the Promotion;

e) Provide commercially reasonable efforts to resolve any MasterCard cardholder inquiries or

disputes within 3 business days of notice of such inquiiy or dispute. The Merchant

acknowledges and agrees that MasterCard Australia will transfer. any cardholde^ inquiries or

disputes relating to any Offer offered by tile Merchant pursuant to this Agreement to the

Merchant for evaluation, resolution and/or action as appropriate. The Merchant will also

jinmediately notify MasterCard Australia of any cardholde^ dispute;

f) Provide Master Card Australia with any assistance reasonably requested in relation to

preparation of marketing or other materials related to each Offer.

-~

-

---^^

--^^^---^-

^

g) Not advertise or promote any Offer unless it has MasterCard Australia's approval in writing to

advertise o1' promote the Offer and subject to the Merchant complying with the telms of this

Agreement, including the Terms. For the avoidance of doubt, all marketing and promotional

activities undertaken by the Merchant in relation to an Offer must be agreed by Master Card

Australia on a case-by-case basis prior to any expenditure in relation to such activities being

incurred and all final promotional material must be approved by MasterCard Australia in

writing prior. to publication;

by Not warrant or Top^OSent to any participant in the Program or any other person that Master Card

Australia is responsible for filmlfuig any Offer. or is liable to any third party (including

meinbel' of the Program) in relation to any Offer; and

Not conduct any sweepstakes, lotteiy, lucky draw, competition or any similar promotion in

connection with any Offer, unless otheiwise agreed with MasterCal'd AUSti'alia. If the parties

agree that either of them will conduct a sweepstakes, lottery, lucky draw, competition or any

similar promotion relating to any Offer. , the parties will enter into a separate agreement

relating to such promotion.

5.

MasterCard Australia's Obligations

1649332-vl\SinDMS\AUSAOM

in accordance with this Agi'Gement, MasterCard Australia:

a) will promote the Progi'am to MasterCard cardholders as a Master'Card-branded promotion, as

it considers appropriate:

(i) via the Program; and

(it) in any other direct-to-consumer web or social networking sites or any communications

channels as dete!mined by Master Card at its sole discretion; and

by is entitled to license or pass thi. ough the rights granted under this Agreement to issuing banks

to promote one or more of the Offers ("Issuer Promotions") as MasterCal. d deems fit. Issuer

Promotions may include, without limitation, promotion of tile Offers in Master'Card

cardholder statement mseits issued by the relevant MasterCard card issuer, electronic

marketing, or direct mail; and

makes no representation or warranty with respect to the scope or extent of any marketing or

promotion of the Offers conducted in accordance with this Agi. Gement.

6. Marketing materials

In accordance with this Agreement, for. each Offer. :

a) the Merchant will provide to Master Card Australia all details and all relevant marketing

materials relating to the Offer ("Marketing Materials"), including:

(i) electronic, high resolution logo type, art and imageiy in the foi'mat(s) requested by

Master Card Australia (including at least EPS and JPEG fonnat); and

.^(ii) all applicable offer GOPy, ingluding redemption and-fulfilment instruGtions, promotion

codes and legal tel'ms and conditions;

b) the Merchant will submit the Mar'keting Materials to Master Card Australia:

(i) if the Offe^ will be launched at the commencement of the Program, within 5 days after

this Agreement commonccs (unless otheiwise agreed by Master Card Australia); and

(ii) for any other Offer, at least 5 weeks prior to the launch date for that Offer or by any

earlier date notified to the Merchant as reasonably requested by Master Card AUSti'an a;

and

MasterCal'd Australia will submit creatives incorporating some or all of the Mall<sting

Materials to the Merchant for review and approval. The Merchant must review and approve

the creatives within 3 business days of receipt from MasterCal'd Australia (unless otheiwise

ageed by MasterCard Australia). If the Merchant makes no objection within 3 business days,

Master'Card Australia will be deemed to have approval.

7. ^xclusivity

The Promotion offered pursuant to this Agreement must be either unique to MasterCard

cardholders or, if not unique, the Promotion must not be lower in valuc compared to any other

offer made to consumers,

16,19332-vl\SYDDMS\AUSAOM

8. Reporting

a) For each Offer, the Merchant will provide to Master Card Australia written reports on a

monthly basis containing details to enable MasterCard to assess the success of the Promotion,

including:

co details relating to conversion of the Offer';

(ii) the number of sales (including the value and volume of sales) relating to the Offer, ; and

(in) the increase in MasterCard-branded card activity during the poliod of the Offer.

Each report is due on the 15th day of the month. The first repoit is due in the month

innnediately following the month in which the Offer is launched.

c) From time to time, the Merchant will supply to MasterCard Australia other. reports relating to

each Offer to support the success of the Promotion as reasonably requested by MasterCard.

d) For the avoidance of doubt, the Merchant will only provide de-identified and statistical

information in its reports. It will not, and will not be requii. ed to, provide any personal

information about cardholders.

9. Merchant contact details

The contact details for' the Merchant's primaly and secondary contacts are:

Primary contact

Secondary contact

Name: Shannon 0'Brien

Name:-SarahSherwood

Telephone N0: 0299694590

Telephone N0: 0299694590

Email address:

Email address:

shannon@sydneyharbourkayaks. coin. au

info@sydneyharbourkayaks. coin. au

The tenns in minexure I and schedules A and B attached to this letter (together, 'Terms") are

incorporated by reference and made a part of this Agreement and will have the same force and effect

as ifit were set out heroin. in the event of any inconsistency between the provisions of the Tenns and

the provisions of this letter, the provisions of this letter will prevail.

1649332-vl\SYDDMS\AUSAOM

Thank you for your support. Kindly indicate Sydney Harbour Kayaks acceptance of this Agreement

by signing below.

Yours sincerely,

Signed on behalf of

Accepted on behalf of

MasterCard Asia/Pacific (Australia) Pty Ltd

Sydney Harbour Kayalrs

^-~~

^^

I\\,,* ,, 7-<~

Name: 6 Wrt'/ IP ,^',<0. ^; t, ^<

Designati n:blU ^1,101\I 11:1='SIbj^"1.17

Name:

hats^ 6 JU 0013 1405TKi^LAS. ,^

Date: 30 May 2013

1649332-vl\SYDDMS\AUSAOM

Shannon O'Br'eru

Designation: Managing Director

Schedule A

Definitions

(a)

"Card" shall include, without limitation, any bank card, credit card, charge card, travel and

entertainment card, coriumercial card, debit card, ATM card, prepaid card, sinait card, storedvalue card, co-branded card, viitual card or any other payment card, mechanism or device and

any account or financial payment systems functionality or features associated witli same.

(b)

"Competitor" means any person or entity that, directly or indirectly, engages in the issuance,

marketing, promotion o1. publicity of any payment system, card or device other' than a

MasterCard payment system, card or device, and the parent, subsidiary and all affiliates of any

such person or entity including, but not limited to, American Express, Carte Blanche, Discover

Card, Paypal, Billpoint, Bill Me Later, interac, JCB, Visa, Travelex and EFTPOS.

(0)

"MasterCard", when used as a noun, means MasterCard Australia and its affiliated entities

and, when used adjectivalIy, refers to the MasterCard@ brand.

(d)

"MasterCard Group" means MasterCard Australia and its affiliated entities.

(6)

"MasterCard Card" means a Card bearing the name, logotype, hologi. am, service mai. ks,

trademarks or devices of MasterCard (including, without limitation, those 1.81ating to Maestro,

Cirrus and Mondex) and providing the functionality associated with same.

(f)

''Related Bodies Corporate" has the meaning given to it in section 50 of the Gol:poi, @!ions

A, t 2001 (Cth).

1649332-vl\SYDDMS\AUSAOM

Schedule B

Terms of Participation

The terms of palticipation ("Terms") set out below govern the participation in, implementation of and related administrative

matters pertaining to, the Program between MasterCard Australia and the Merchant.

I.

Duties and Obligations of MasterCard

Australia

MasterCard Australia shall supply all information and

supporting documentation which is reasonably required

by the Merchant. MasterCard Australia shall determine

at its sole discretion any marketing activities relating to

tlie Program to be carried out by Master Card Australia,

including communication of the Promotion to issuer

banks, provided MasterCard Australia shall solely bear

such marketing expenses including the costs of

communicating the terms of the Promotion to its issuer

banks. Costs and expenses incurred by issuer banks in

more prominence than MasterCard and/or

MasterCard branded products.

(g) The Merchant will not enter into any anangements

or ageements similar in narurc to this Agrccmcnt

or the transactions contemplated under this

Agieement with any other payment system

organisation during the term of this Ageement.

(h) The Merchant will ensure that the terms and

conditions of the Promotion and references to the

MasterCard cardholders will be borne by such issuer

terms and conditions of the Promotion in any

promotional materials will contain the following

disclaimer "The products and services purchased to

enter this Promotion are provided solely by the

banks.

Merchant, under such tenns and conditions as

2. Duties and Obligations of Merel, ant

deterTwined by such Merchant, and MasterCard

accepts no liability whatsoeve^ in connection with

such products and services. "

connection with the communication of offers to

(a) ' The Merchant shall not endorse or pennit any

direct references in connection with the

Promotion, or in any marketing matcrials,

advertisements, commercials or press releases,

websites and other communications channels

pertaining to the Promotion, to any payment

system organisation other than MasterCard for

the duration of the Promotion.

(b) The Merchant shall not offer the Promotion to

cardholders of any Cards other than MasterCard

Cards.

(c) Thc MCI'chant must obtain MasterCard Australia's

consent in writing prior to making any references

to MasterCard in any of its advertisements and

other marketing matcrials relating to the

Promotion.

(d) The Merchant will ensure all appropriate sales and

customer service personnel at each Merchant

Outlet (where applicable) are trained in procedures

to comply with thc Mcrchants obligations under

this Agreement. The Merchant undertakes to

procure that all such personnel will abide by and be

bound by the terms of this Agreement as if they

were the Merchant.

(6) The Merchant shall ensure that all appropriate sales

and customer service personnel at each Merchant

Outlet (where applicable) are familiar with the

terms of the Promotion and the offer. to be made to

MasterCard cardholders.

^ The Merchant shall ensure that branding and any

point-Of-Sale (POS) merchant collaterals relating to

other payment system organisations and/or nonMaster Card branded payment products shall not be

displayed by the Merchant in a manner giving them

co The Merchant must maintain insurance, at its own

expense, to cover any and all potential losses and

liabilities whicli may arise from the operations

carried on under this Agreement including, without

limitation, from claims of any nature made by any

person for damage to property or personal injury or

death. The Merchant will provide evidence of such

insurance if requested by MasterCard.

O) It shall be the responsibility of the-Merchant to

obtain all necessary permits, approvals and/or

licences and any other required approvals from the

respective government/statutory authorities or third

parties for the smooth conduct of the Promotion

and the performance of its obligations under this

Agreement. Without limiting the foregoing, the

Merchant shall be responsible for filing any third

line forcing notifications to the Australian

Competition and Consumer Commission for any

Offers that are offer'ed by the Merchant, or its

agent, exclusively to MasterCard cardholders.

3. Confidentiality and privacy

(a) MasterCard Australia and the Merchant agrce that

the tenns of this Agreement including without

limitation any amount payable by MasterCard

Australia to Merchant are confidential and shall not

be disclosed to any third party other than as

mutually agreed by the parties in writing. This

clause shall survive the termination or expiry of

this Agreement.

(b) To the extent Merchant collects or uses personal

information about an identifiable individual

("Personal Information") from or in relation to a

MasterCard cardholder or from or on behalf of

MasterCard Australia, it must collect and handle

this information in accordance with MasterCard's

1649332-vl\SVDDMS\AUSAOM

Privacy Policy (as amended from time to time),

any directions of MasterCard, and any applicable

privacy legislation.

The MeIchant must immediately inform

Master Card of (i) any complaint it receives in

relation to the handling of such Personal

Information; and (i) any breach or potential breach

of the Merchants privacy obligations in this

Agreement, and will coopemte with MasterCard

and comply with Master Card's directions in

relation to responding to and managing any such

complaint, breach or potential brcach.

4. Term of Agreement

Maestro, Mondex or Cirrus as provided to Merchant

by Master Card Australia. Except where otherwise

provided in this Agreement, the Merchant shall not

use the name "MasterCard", "Master" or any other

trade name, trade mark, service mark, logo, symbol

or other intellectual properly of Master Card witliout

the prior approval of MasterCard Australia in

writing. All intellectual property of MasterCard in

the possession of the Merchant shall be either

destroyed or returned (if requested by MasterCard)

promptly after expiration or earlier termination of

the Promotion. Subject to the limited use rights

granted to the Merchant in respect of MasterCard's

trade marks under this Agreement, all powers that

would be conferred on authorised users by section

26 of the Australian 71. @de A10, .kg Zel 1995 are

Unless the Ageement is terminated earlier in accordance

with clause 8, this Agreement shall be effective from the

date of execution of this Agreement, and shall rcmain in

force for a period of 12 months ("nitial Term"). After

the Initial Term the Agreement will automatically renew

for a further 12 months unless either party gives notice to

the other of its intention to teaminate the Agreement 30

days prior to the end of themitialTerm.

5. Trademarl, s and Copyright Information

(a) For the purpose of this Clause 5(a) "Promotion

Marks" shall mean the logos, marks and designs of

the Merchant applicable to the Promotion. The

Merchant hereby grants, or shall procure the grant,

to MasterCard of the right and licence to use on a

royalty frce basis the Promotion Marks (including

but not limited to the use of the Promotion Marks for

activities, promotions, marketing or other events

conducted, organiscd or promoted by MasterCard or

in which MasterCard participates) furnished to

Master Card by the Merchant in relation to the

Promotion for the duration of this Agreement in

accordance with the terms or this Agreement.

expressly excluded.

(d) All trade marks, photographs, transparencies and

similar production material relating to the Promotion

produced by Master Card hereunder shall be the

exclusive property of Master Card apart from the

intellectual property of the Merchant. All

intellectual property of the Merchant including

without limitation the logo, trade marks and

tradenames and their reproductions shall be the

exclusive property of the Merchant and shall be,

either destroyed or Tclumcd (if requested by

Merchant) promptly after expiration or earlier

termination of the Promotion.

6. Legal Riglits

(a) Master Card Australia and the Merchant warrant and

represent that they have the right and authority to

enter into this Agreement and their performance of

their obligations under this Agreement shall not

conflict with the rights granted to any party under

any other agreement.

(b) Subject to the indemnity provided by Master Card

(b) The Merchant further hereby grants, and shall

procure the grant, to each MasterCard issuer bank

the right and licence to use on a royalty free basis

the Promotion Marks (including but not limited to

the use of the Promotion Marks for activities,

promotions, marketing or other events conducted,

organised or promoted by the relevant issuer bank or

in which the relevant issuer bank participates)

furnished to MasterCard by the Merchant in relation

to the Promotion for the duration of this Agreement

in accordance with the terms of this Agreement. For

thc purposc of this clause, the parties agree that

MasterCard Australia shall store the Promotion

Marks furnished by the Merchant in an image library

within a secured website that is accessible by

merchants or issuer banks, as applicable, via a

secured password.

Australia for IP Claims under clause 9 of this

Agreement, Merchant is responsible for compliance

of the Promotion, including without linttation all

advertising and promotional materials, with all

applicable laws including without limitation

providing any notifications required to regulatory

authoritics.

(0) Each party will conduct all activities and perform all

its obligations under this Agrccmcnt in full

compliance with all applicable laws and regulations.

(d) This Agreement will be governed by the laws of

New South Wales, Australia and the parties agree to

submit to the nori-exclusive jurisdiction of the courts

of New South Wales.

7. Responsibility

(c) Subject to the prior written approval of Master Card

and for the purpose of the Promotion only, Merchant

shall be granted the right and licence to use on a

royalty free basis the trade names, trade marks,

service marks, logos, symbols and other intellectual

property of MasterCard, including without limitation

1649332-vl\SYDDMS\AUSAOM

It is hereby agreed and acknowledged by the parties that:

(a) neither MasterCard Australia nor any, member of the

Master Card Group assume any responsibility for the

products or services purchased by cardholders to

enter into the Promotion. The products and services

are sold or licensed or provided solely by the

Merchant, its affiliates, agents or sub-contractors

under such terms and conditions as determined by

such vendors, and no member of the Master Card

Group accepts any liability whatsoever in

connection with the products and services; and

B. the In doinnified Party provides such

information, assistance and

co-

operation as the Indemnifying Party

may request from time to time in

relation to the IP Claim;

C. The Indemnifying Pal'ty will have

full and sole discretion to defend,

compromise or settle any such IP

(b) thc products and services purchased by cardholders

to enter the Promotion have not been certified by

any member of the MasterCard Group or tested for

certification purposes by any member of the

Master Card Group and under no circumstances shall

the inclusion of any product or service in the

Promotion be construed as an endorsement or

recommendation of such product or service by any

member of the MasterCard Group.

8. Termination

Either party may terminate the Agreement at any time by

written notice to the other party with immediate effect

from that or any later date that the notifying party may

nominate in the event that . (a) the other party has

breached any material term of this Agreement and has

not remedied such breach within 14 days after written

notice from the notifying party specifying the breach; or

(b) the other party is unable to pay any of its debts as

they fall due, commences negotiations with its creditors

with a view to an adjusiment of its debts or any step is

taken or proceedings commenced for its winding up,

liquidation, rcccivership, administration or protection or

relief nom creditors or any distress or execution on its

property. Termination in accordance with this clause 8

shall be without prejudice to the parties' accrued rights

and liabilities arising under the Agreement, including for

reac .

9. Indemnity and Limitation of Liability

(a) Indemnification

Claim on such terms as the

Indemnifying Party thinks fit (and the

Indemnified Party must not defend,

compromise or settle any claim on

th* Indemnifyi"g Party's behalf

without the Indemnifying Panty's

written consent); and

D. The hadeiriintying Party will have no

liability to indemnify or defend any

IP Claim if the Indcmnificd Party

modifies the intellectual property of

the Indemnifying Party.

If an IP Claim is made against the

hidernnified Party, the Indemnifying

Party will (at the Indemnify ing Party's

sole option) endeavour to:

A. obtain for the Indelnnified Party the

right to continue to use the leievant

intellectual property of the

Indemnifying Party; or

B. replace or modify the relevant

intellectual property of the

Indemnifying Party to make it noriinfringing; or

C. if neither A nor B is possible, either

party .may terminate this Agreement

on written noti6e~t6~the other party.

) Clauses 9(a)(i) and (ii) state the entire

liability of the Indemnifying Party and the

solo and cxclusivc rcmcdics of the

Indemnified

tlie

party against

co Each party ("Indemnifying Party") agrees to

defend, indemnify and hold the other party and,

where the Merchant is the Indemnifying Party,

) Merchant agrees to defend, indemnify and

MasterCard AUStraluls Related Bodies

hold MasterCard Australia, its directors,

Corporate and MasterCard issuer banks

('Tndemnified Party") harmless from and

against any damages awarded against the

In denmified Party and any liability under any

settlement of any claim negotiated in

accordancc with this clause (including

reasonable legal fees and expenses) as a result

of any claims ("IP Claims") by third parties

that the use by the In delnnificd Party of any

intellectual property of the Indemnifying Party

in accordance with this Agreement infringes

any intellectual property rights of those third

parties, provided that:

A. the hidernnthed Party promptly

notifies the Indemnifying Party in

writing after the In delnnified Party

first learns of the IP Claim;

1649332-vl\SVDDMS\AUSAOM

Indemnifying Party for IP Claims.

officers, employees, agents and

MasterCard issuer banks harmless from

and against any and all liabilities, claims,

suits, damages, judgments, costs and

expenses (including reasonable legal fees

and expenses) arising out o^ or in

connection with:

A. Merchant's breach of this

Ageement;

B. any act or omission of the Merchant

which leads in any way to damage to

MasterCard's brand image and/or

reputation; and

C. the activities of the Merchant

relating to this Agreement or the

Promotion, including, without

limitation, any claims rclating to

Merchant's fulfillment of (or failure

,

to fulfill) any order or the quality,

legitimacy, or legality of any

Promotion, product or service, any

product liability claim, and any

cardholder dispute concerning any

matter, cause or thing relating to this

Agreement or the Promotion(s).

(b) Liability Limitation

Other than in respect of the obligations in clause 3

and the indemnities in clauses 9(a)(i), 9(a)(iv)(B)

and 9(a)(iv)(C), to the extent permitted by law, in no

event will either party to this Agreement be liable to

the other party for incidental, consequential,

punitive, special or remote damages, or for any loss

of profit, loss of business or loss of business

opportunity, regardless of the form of action,

whether in contract, statutory warranty, tort

(including negligence), unjust. enrichment, under an

indemnity or otherwise, even if foreseeable and/or

advised in advance of the possibility of such

damages. Subject to each party's indemnification

obligations dcscribcd above, in no event will either

party be liable to the other party for acts or

omissions of third parties (other than its officers,

employccs, contractors or agcnts) including, but not

limited to, MasterCard issuer balks.

(c) This clause 9 shall survive the termination or expiry

of this Agreement

10. Miscellaneous

(a) Should any clause of this Agreement be found to be

invalid or unenforceable it shall not affect the other

clauses~of this'Agreement and^rich^Iause~(or~part

thereof) shall be deemed severed from this

Agreement and the other clauses hereof shall remain

in full force and effect as if this Agreement had been

executed without the offending clause appearing.

1649332-vl\SinDMS\AUSAOM

(by The Merchant shall be liable for all taxes which

might be payable in respect of the payments by

MasterCard Australia under this Agreement.

(c) The Merchant shall not assign, transfer or charge or

purport to assign, transfer or charge this Agreement

or any of its rights or obligations thereunder or any

part thereof without the prior express written

consent of MasterCard Australia. MasterCard

Australia may assign its rights or obligations under

this Agreement or any part thereof to any of its

affiliates or Related Bodies Corporate (the consent

of the Merchant to such transfer being hereby

irrevocably given).

(d) No amendment to this Agreement, for whatever

reason, shall be of any force or effect, 11nless it is

reduced to writing with reference to this Agreement

and signed by a duly authorised officer or

representative of each of the parties.

(e) Nl notices required or authorised by this Agreement

are to be in writing in the English language and are

to be delivered by either party to the other by hand

or by registei'ed post to such address as the parties

may inform each other from time to time in

accordance with this section. Notices delivered by

hand will be deemed given upon hand delivery.

Notices delivered by registered post will be deemed

given on the fifth working day after' the envelope

containing the same was posted.

(f) Nothing in this Agrccmcnt shall constitute or to

deemed to constitute a partnership between the

parties or render the other the agent of the other for

any purpose whatsocvcr. NGithcr party shall have

anIhorliy~o1 power to~bind the other 10 contract or

create a liability against the other in any way.

(g) This Agreement constitutes the entire ageement of

the parties and supersedes in all respects any and all

prior oral or written agreements or understandings

pertaining to the subject matter hereof.

Annexure I

Offers

Offer I

oner pv I

ssi nDat lady in in)

06/05/20 3

Merch IP rtn rN me

S d eyH rbou

C to Iv ype

S ort

T' r yP

3-All MasterCar Ca holde s

a aks

^.

q. ,

^

Of Leng^tes and Times

t a p aronthe*site

ar

Date Idd/mm/ivyy)

2 106120L3

Time inn;@,,'Pin'

I00 AM

Tkylsd r fer t w e the ffer

sbe p t d stp,

ea

esslf he f I on at

rede

Offe

o

in

at da e efe 3'to w

n off site

301 61^014

I. '30 P

t eo erlf

e d no thesie)

e rom

Offer O

Ti dateiefeat h the offer

25/06 201.3

cabeirs emed uc ed,

ok o

ear '

co a co onste

e

etor

ed e ble r e opr

pro tt o rn un c .I ths

I s a etheo e will ap earons e

.

,.,

aC ING N

^

Me

.=,

ere n me

,. .

Sydney Harbour Kayaks

Me^ hant. on tagt name

V ulp^tlon a e

Address

dd ss2

@it

81. Parriwi Road

Smiths Boat Shed

The Spit Bridge

MOSman

Sa

NSW

POS c de

2088

tele one numbe

0299604389

Fin^or address

info@sydneyharbourkayaks. coin. au

1649332-vl\SinDMS\AUSAOM

http://WWW. sydneyharbourkayaks. coin. au/

We site URL

S

Q^'pr Ti to

tor objle a de ktop site

Charaeteisllmlt <36 cha acters

S D cipti

(f ino Leandd s t site)

Characte!\!jin1 - <70 characters

Latit de( objl ite)

,I'.:

I.

I

.

,

I

.

objle si e

,,! I

'!,

a! e rog 'tio

C cte in t-<20ch a ter

(Upgrade o pith to Dr kPe

S Ie, If ces etc. ..

etajle Descrtptio

MERG AN OVER IEW - e erence o Iy

16epe c Information o11 coinpa VIProd c

ohelpMasterCardcra c pyfo o r

offer

I) Tell us about your brand/product

2)~Flow did your brand^^t start^d

Sydney Harbour Kayaks has been renting & selling kayaks,

teaching kayaking and guiding tours around Middle Harbour

from the Spit Bridge since 1991. . Their backyard is the

beautiful Middle Harbour and lessons are their speciality

teaching from beginners through to Professional level. We

take great pride in our kayak rental fleet and kayaking tours

and aim to offer the best possible experience. The kayak tours

are a lot of fun and offer a wholesome day out on the water,

exploring Sydney from a whole new perspective.

OFE R DETAIL

ISPeclco reltedlnformatlo, pleasel t co $u errleva tpoltsregadlng

the fun

I) Tell us what you're locally famous for?

,u

I-

2) Do You have any unique selling points you can give detail

on?

3) What's the experience that consumers have as a part of the

offer you've developed?

1649332-VIEYDDMS\AUSAOM

a,

t^*

4) What is the exclusive/priceless element about this offer?

Discover Sydney Harbour from a different perspective - take

the family on a day of discovery to the secluded beaches,

whilst kayaking and picnicking on the Sydney harbour.

Discover Sydney's Middle Harbour with a private 2.5 hour tour

with professional guide at an exclusive price just for

MasterCard customers. Including delicious morning or

afternoon tea and snacks on a secluded beach. The kayaks

used are all top end/ light weight composite sea kayaks.

*'*-^.,..

. . .,... ,1 . *,.- ""'31. "

*, , *- -' .3.1", I^. ,;

W TIST^!EEXCLU N ELEMENTTO Asj RC RD?

.*& ';\ '. t - ,. .. ',,

.. , , ,, .-* ' 16:4 ' -' # *:, ,,;.,

. .,:'*,',',<,., "3,.-a,IF^*

-'\:!$3*-, . -*,

-"- - ,- ;

I at elem t ab tthe offer Is e clqsjveto M^S erCard rdholde s I

Exclusive Price

, A ' ; \ * **.,;$*'* .,> t'*=' '*. *

' ' . . ;,.$;>, ' 'ae, -^s -: "' ', ., I *.

RIG

I!!g!g, de Co of offer/Item aqganyp cha erelated ter s-to be de lied as p c

bay

;' " ' - ^:'*: :.,- : a * ;:$;,'

$480 for up to 6 people (RRP $594)

, .*""' "' " 35?,_ .

" :':: -4;. ';^*;:*' . :. t - ' * . - . ,, .., **.' $1*, *. **. " . .

.~.,

EVE T DATE n E I appjicabi^too I

A. , ; -- .,.. *;*.,'-*,;, ,,.. .;;.. . Available 7 days a week - contact us to book in advance

.

..

.

.

' " ,. 0, Q

, f ' *jig $3!;

. ^$1

I

.. :,* , _ ..-..,

" ' "" ' I L- ';:, ' '

.; - , ~ -;^!. t;a; , -- -. ;:,"\*;, a** *

, 13;-, at; -; * 11^,.. . *- . .*.; I'

'.' '.;* '. *""$!' .\4 $1 *',,,^.

, .',***$\ 't\\;*?$ ' ':- 4. -'-r;.

" "' "4: ?" <e".*: a $.. * ;.

"

**-

--. - - I - -.$' ,

,

*

'.

.'

.

.,

a2*

. Offers are_subjectto meLcbaiLt terms and con ' i10 S.

. Offer subject to availability.

. If paddling with children, please read our paddling

with children policy prior to booking htt : WWW. s dne harbourka aks. coin. au rivac -

129^^

. Bad weather policy

I. Sydney Harbour 1<ayal<s reserves all lights to cancel or

reschedLile the activity in the event of adverse weat heI'

conditions or other Lintoreseen circumstances.

2. All participants that bool<ed directly through Sydney

Hai'bow' 1<ayal<s will be given a refuncl or a credit in this

situation.

'..'*.

;.Aq;*.,

. ,*',' t":

*.. + . ,e

j. -. ;, t. , *$. I ' .h ', "" IC *

I' , , L ,... _ ~ .#,*.

.. ,. ..,$ . . + .. .,

,;;;^:**'* a;*;^$;,;.. r . *

,#*..;A1^;$$$. *^,*:..*.' *

-.'!\.-; ':t" , .-;'i*-, $:;;.' - ;

, ..

. a*

',. . ;,

,. ,.

* .*,.

*

,'*,:a. - ..- * .^i;^* -, .'

';'$^;" . * is$* .*:** , \

....

*...

.

.

..

..

.

4.1f it is raining o11 the day of the tour or I'ental, we will riot

necessarily cancel the tom' or rental (we can I)rovide You

with a rain jacl<et).

5. ToLirs and rentals can be ti'ansferi'ed to another person or

family Inembei'.

Cancellation Policy

I. All I>articipants need to read and agi'ee to the Indemnity

form prioi' to each tour or lesson.

2.1f You would like to transfer o1' postpone Your booking

after 5 p. in. on the previous day or on the day of the tour or

lesson a $25.00 administration fee will be cliai. ged.

3. No refunds will be given toI' cancellations after 5 pin. on

the revious da or on the da of the tour.

1649332-vl\SinDMS\AUSAOM

1st tic io son 61N to

Priceless Site

R ee ffer

. Priceless Offer Detail page

I

. Click on Call to Action

,

Sydney Harbour Kayaks

. Customer calls Sydney Harbour Kayaks on Call to

action

. Customer speaks to Sydney Harbour Kayaks

representative and mentions Priceless Sydney offer

. Customer books their private tour and pays on

MasterCard

. Customer arrives at Sydney Harbour Kayaks on their

reserved date

. Customer enjoys private tour of private beaches and

locally known treasures

Calt aei Option

( ICO ON or otion

PPIlcab e rede pilo o

Call 0299604389/ In store

d ing detail i. , websl e a dress,

' am r, in letc, q de t^

the rest.

C^!! To etion

@a o Action Descr'pt'

arecte jini -<I c araeters

co

^

Off rl agefiles

,

e

e age linage

(^^00 y 575p I

e:O Iy, eg Ired!f fi'erl aHer

Den

Off

*L

Offer eta I in I

ge category

ro g

ipbyO

Jet nZb t

(Note, y o ton

plea ens re I thes e OS

Thunibnoijimo e

Ii

in

g

29PX ^X 160px)

UV Ie: I a eu

s in jino e

rowdedf o er deco")

M^rcha t ogo '

( a 75p In width,

ge

e 811t v table)

Se reb

Keywo ds

FD site sea ch'f nct'on ally, please

a hiso e with a . 5reeva t

ke lito ds)

1649332-vl\SYDDMS\AUSAOM

.a

^

O ffe r 2

oner Overview

S^bini^sion a dd/mm/ )

r h n IP rtnerName

Cat.eg

O 10 12003

yd ey b rK y ks

Sport

ye

3. A1

T er Type

to Card Car o ders

a.

.

*.,

^

.

Otter at san Ti us

ate ,,,, Iy""

ertoapp on{ e t

25 08 203.3

I e ip@,@@:p )

I .00 AM

Thi date of rsto heritheoff r

artsblng o oed nste

e^$r, s155 the of e I riotyet

de in able)

Off to come down o ite

(JIS e ej o h theoffelf

off e ite

t e

fferOIIS I from

2 1061

I ate of rs owh

"^

0106 01.

s e ee e

e

arll

^.

eo e

Urc se

11-61t

P

the date off rls

in ord t t ~

o r ad

offer 11

Q. .

eabo Ite

.

<.,

00

e chan Name

^

Sydney Harbour Kayaks

Merehan. C nt at a

Venue/Loca 10n nanag

81 Parriwi Road

Adj! es ,!.

Add es 2

Smiths Boat Shed

rig

U.

The Spit Bridge

i^

Cit

MOSman

State

NSW

postcode

2088

tele h eDumber

0299604389

Email addr ss

info@sydneyharbourkayaks. coin. au

http://WWW. sydneyharbourkayaks. coin. au/

Website URL

1649332-vl\SinDMS\AUSAOM

a.

I,

rig

1.1

.

e

O er in

(o

bi an

e ktopsit )

eha cter 11 It <36 characters

S or es iption

(for obile d desktop site

ha attoi*limit <70 char c ers

L ti de objlesite

t, ! ,

tr, ,:, at 1'1, .:I, ut, :lit

*i, 11:1. o1 ,. , illJ

V, .,@ ~

Longitu e 11^o Ile site)

I. " "'11n v

' F I'* a It. * .,

* .,, .;j, j=..

',, 14";I , .' e "

,' '. ' lama

1811 .I I

Va ue propo ' to

Ch act rlimit <2 b re ers

UpBra e, Co PIl on YDr k re, VI Access e c. ..)

De re Decipon

MBR@HANT VE V -refe e coony

IQ^!$9ri

Infor a 10 o

ffer

Qin any or co I help

ter d re copy o yo

3) Tell us about your brand/product

4) How did your brand get started

Sydney Harbour Kayaks has been renting & selling kayaks,

teaching kayaking and guiding tours around Middle Harbour

from the Spit Bridge since 1991. Their backyard is the

beautiful Middle Harbour and lessons are their speciality

teaching from beginners through to Professional level. We

take great pride in our kayak rental fleet and kayaking tours

and aim to offer the best possible experience. The kayak tours

are a lot of fun and offer a wholesome day out on the water,

exploring Sydney from a whole new perspective.

O FER D ^

( pecMc off rel ted In or adon, ease 11st al consume rele ant points regardl

the ffer)

I) Tell us what you're locally famous for?

2) Do you have any unique selling points You -can give detail

on?

3) What's the experience that consumers have as a part of the

offer you've developed?

4) What is the exclusive/priceless element about this offer?

A family day of exercising the local's favourite way - sea

1649332-vl\SYDDMS\AUSAOM

,.,

^

kayaking on the harbour at The Spit, head toward Grotto Point

and Middle Head, or adventure into the beautiful Garigal

National Park, giving you a taste of the life around one of

Sydney's wonderful Iy secret waterways. This is a great day out

for groups of friends too.

MasterCard Cardholders can Rent a Kayak for 3 Hours and

receive a FREE upgrade to a top end Composite Sea kayak &

Paddle. You will also receive a complimentary water proof

Camera Rental to capture the day

W AT Is THE EXCLUSIVE E^EMEN To MAST^ OARD?

I I ele ant ab ut the o er I^ exclusi e to Mast IC Jd co dhdd rs?)

Complimentary Upgrade - Complimentary waterproof camera

rental

PRICE

.Y

11n Iud cost o offer/Ite and any p chas e ed te s-to be delaled as ptyce

' * :*^,,,.,!- . ,-. . -* . , , . ,

-'-;'

'*^!$.;ti*/^*

' " ,t I. ',44

;;::

,4:,*\.,

$* ..*!\*

, .,,

44. ., ,j- mm

..,t;"':^'$"-;'^I--^!*?*L*!'- * 2:4 ;!.".,'.-,* *,#;,,

,,,,,,$^,

.., ^.ig^.*

;: ,;$:14!^$*

'-; \ -.^^.* '.' \*$ * ':.*!^;;@*:,..,-,, t

0.0

.

41*'3 ' " "'

.\,

\

L

,'

.\

.'a*

,*'

"- $6^. ,\-#$;', "f .'.'; ;^,-.:*.*:.. *.. * a - ".. . . ..!r. t$ a. *

.^:~~44. :.. *.-.,". - '. ,j. "ratI-,.

..,

*

...

.':;>, , r "'. *.. ". ' ' '

""' ' " *~*: -*'.-,

.1.4.

-

.,;.

..

...*,

, .."*';'' .I L,

.'- :.

, I...'%.,"--'LO

'6;

',.,J

. . .L, I ~ ' '";^,,$. aji. ..

.,; '.--' :{**;*. ..;* *..' , Is' ..

,.,.. ,..,. ***'j* ,-..-'$;:*$;4$

.

-.-.~....

.

'

$50.00 for I kayak or $88.00 for L double kayak (upgrade RRP

$19)

VENT D TE & IME cyan 11 baton er)

7 days a week - customer must contact us to book

.

,,

..,

pe perso I

'

'

...

,"'

*

-.

:to

-* .. I. :L:",= <:1^,:1- - ' ,^' I. ;- t. *

'. I-*#. ' I. -;. "' I ' '**' ..:..,,

-"

.'

',

'

htt : WWW. s dne harbourka aks. coin. au rivac -

29!^^

. Offers are subject to merchant terms and conditions.

. Offer subject to availability.

Bad weather policy

I. Sydney Harbour 1< ayal<s reserves all rights to cancel or

reschedule the activity in the event of adverse weather

conditions or othei' Linfoi'eseen circumstances,

2. All participants titat bool<ed directly through Sydney

1.1ai'bour Kayaks will be given a refund or a credit in this

situation.

"

, '. ..,

*!!:*' $*.$- f " :*"' *-.*,=^j\*

~ , -* '.. *#,.

^.**

. Enter any additional terms and conditions

If addlin with children please read our paddling

with children policy prior to booking -

.

.

4.1f it is raining on the day of the tour or rental, we will

not necessarily cancel the tour or rental (we can provide

you with a rain jacket),

5. Tours ancl rentals can be transferred to another person

or fainily member.

" ' $9; '\*, it *.$^'. , , , I ,

-, ' ;$ ^- $'.. . ^. , -*}.' :" '.

*

.

P.

*.,,.\

,,,

.

t

'*

.,.

*'

1649332-vl\SVDDMS\AUSAOM

Cancellation Policy

I. All participants Ileed to read anti agree to the

Indemnity form prior to each toui' or lesson.

2.1f you would like to transfer or postpone Your booking

after 5 p. in. o11 the previous day or on the day of the tour

or lesson a $25.00 administration fee will lie cliargecl,

3. No refunds will lie given for cancellations after 5 p. in.

on the previous day or on the day of the tour.

I st uetions on how to

Redee e

, ,,;^

111, I

Priceless Site

<. 11 I 11' ' q I

Sydney Harbour Kayaks

. Customer calls Sydney Harbour Kayaks on Call to

. Priceless Offer Detail page

,

11 ill

I 1. '

. Click on Call to Action

action

. Customer speaks to Sydney Harbour Kayaks

representative and mentions Priceless Sydney offer

. Customer books their kayaks for the family and pays

on MasterCard

. Customer arrives at Sydney Harbour Kayaks on their

reserved date

. Customer enjoys kayaking with the family

C " o ctio Opton

Call 0299604389I Or go in Store

\

,.

At.

all o Action

Call o ctio De Gript'on

Characte Ii it - <4.50 characters

co

^

Offer Image files

Hero p epage) jig

(UDOpx v^7 P I

Not : Only re u"ed I offer Is o Hero

,ffe

Offe d t^. 11 I a e/ca e ory

.

er I age

(6 0p by 400p

ItV e:It!a o toI

Ieose 7150 e I is

in inbn Windge

Toe h nl t

e so e OS

in aji I '

132 px y 6 )

ore:Pledseu eso elm g

o Ided orO e re @10

e eha t o o' age

I x, ^ 5pxin Idth Ilei htv nan!ej, ,

Search

1649332-vl\SinDMS\AUSAOM

co

^

^

>

co

=

S;:

co

^

.

;^

co

I'

^

<

a

^

C

by

IAI

I\,

^

=; CD 40.

FF

=

PI

^ ~"

.^.

431 _

"~

3<

^

_,. FD.

\.,

inO

a

onin

.

o

~ ~.*><

,aq 10

Notification of Third Line Forcing Arrangements

Below is an overview of the process for filing a third line forcing notification. This is provided for

guidance only. The merchant is responsible for making its own enquiries about when a

notification is required and the process that must be followed to file a notification.

What is third line forcing?

Third line forcing occurs when a merchant provides a promotional offer exclusively to

MasterCard cardholders.

A merchant will engage in third line forcing conduct if it

. (a) supplies (or offers to supply) goods or services, or (b) supplies (or offers to supply)

goods or services at a particular price, or (c) gives a discount (or allowance, rebate or credit)

on a supply or proposed supply of goods or services, to a consumer

on the condition that the consumer will acquire other specific goods or services directly or

indirectly from another person.

A merchant will also engage in third line forcing conduct if it refuses to:

. (a) supply goods or services, or (b) supply goods or services at a particular price, or (c) give

a discount (or allowance, rebate or credit) on the supply of goods or services, to a consumer

because the consumer has not acquired or agreed to acquire other specific goods or

services directly or indirectly from another person.

For example, it is third line forcing if a merchant offers to provide a product/service to a

consumer, or give the consumer a discount on a producVservice, only if that consumer has

acquired a MasterCard credit or debit card from the cardholder's issuing bank.

These kinds of arrangement are a form of 'exclusive dealing' and are illegal in Australia

regardless of their effect on competition or their intended purpose.

Australian Competition & Consumer Commission ("ACCC")

The ACCC is the statutory body responsible for prosecuting people and organisations that

breach Australia's competition laws. For a corporation, the maximum penalty which the ACCC

can impose for a breach is the higher of $10 million, three times the value of the benefit, or 10

% of annual turnover.

Notification

The ACCC can grant immunity from legal action for exclusive dealing conduct in certain

circumstances. One way to obtain immunity is to notify the details of the proposed arrangement

to the ACCC. This must be done by following the ACCC's exclusive dealing notification

process.

The notification must be lodged by the party engaging in the third line forcing conduct (that is,

by the merchant).

The ACCC has published guidelines on its exclusive dealing notification procedure (click here).

Required form

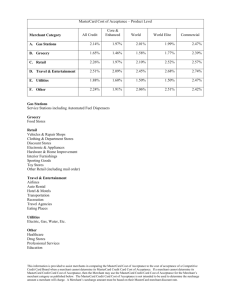

1608937-v3\SYDDMS\AUSAOM

To lodge a notification, the merchant must complete the ACCC's Form G (click here) providing

all the required information and send this to the ACCC along with the required lodgement fee.

The fee is currently $1 00.

The form requires the merchant to provide the following key information:

Details of the merchant, including a short description of the business carried on by the

merchant;

Details of the proposed arrangement, including a description of the goods and services

that relate to the arrangement. If a merchant is making more than one promotional offer

exclusively to MasterCard cardholders, the merchant must describe each offer;

The persons, or classes of persons, affected or likely to be affected by the notified

conduct;

.

The benefit which the merchant claims the proposed arrangement will have to the public;

.

A description of the market(s) affected by the proposed arrangement; and

.

A description of any detriment to the public resulting or likely resulting from the

notification.

Once lodged, the notification will be publicly available.

How to lodge

Exclusive dealing notifications can be lodged at any ACCC office by mail or in person.

However, the ACCC encourages notifications to be lodged at its national office in Canberra,

addressed to:

The General Manager

Adjudication Branch

Australian Competition and Consumer Commission

GPO Box 3131

Canberra ACT 2601

Notifications can also be lodged by email to adjudication@accc. gov. au or faxed to (02) 6243

I211.

The ACCC prefers 10dgment fees for notifications to be paid by cheque. Notifications lodged by

email or fax should be accompanied by a covering letter including details of how and when the

10dgment fee will be paid. A notification is not considered valid until the 10dgment fee is

received by the ACCC.

Clearance

The ACCC applies a "net public benefit" test to determine whether to allow immunity from

prosecution. Immunity is automatically granted 14 days from the date of lodgement unless the

ACCC notifies the merchant otherwise within the I4-day period.

This means the merchant must lodge the notification at least ,.^;.^!^y^ prior to engaging in

the third line forcing conduct.

The immunity afforded by a third line forcing notification will only extend to the conduct

described in the notification (and will not extend to any conduct engaged in before immunity was

granted). The ACCC may remove the immunity at any time. It will provide notice to the parties

and have a pre-decision conference before removing immunity.

1608937-v3\SYDDMS\AUSAOM