Private Acquisitions Elective Statement of Outcomes: On completion

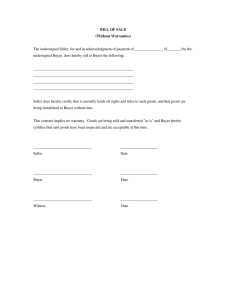

advertisement

Private Acquisitions Elective Statement of Outcomes: On completion of the course successful students will be able, under appropriate supervision, to: 1. demonstrate their knowledge and understanding and employ the applicable skills in the elective area of law and practice : 2. use the legal knowledge, skills, procedures and behaviours appropriate to each client and each transaction or matter; 3. identify the overall nature of the transaction, then plan and progress that transaction or matter through a series of steps and decisions including, where appropriate, drafting documentation; 4. identify the client’s goals and alternative means of achieving those goals and deal appropriately with client care; 5. investigate and identify the relevant facts, research and identify the relevant legal issues, and advise the client on the legal consequences; 6. recognise and act within the rules of professional conduct; 7. identify the client’s reasonable expectations as to quality and timeliness of service. 8. reflect on their learning and identify learning needs. These outcomes will be embedded into the subject, primarily through the design of the sessions and work of preparation and activities during sessions. Our tasks set will be transactional in nature and will require students (either alone or as part of as team) to identify the client’s goals, needs and demands, the alternatives open to the client and any constraints under which they operate. The identification of the matter or transaction, as appropriate, will form part of the student’s pattern of work and they will undertake for themselves the basic or key steps required to advance matters- sometimes as work of preparation and on other occasions during tutor – controlled sessions. In so doing, understanding and skills will be demonstrated at each stage of the course prior to summative assessment. Our students are required to take responsibility for their researches and will frequently be called upon to offer practical advice (orally or in writing). Links with practitioners and local firms will enable us to maintain the currency and realism of tasks set and will assist us and students to ensure that students appreciate the importance of being adaptive and responsive to the needs and perspectives of clients in the SW and of delivering a high quality of service. The design of our sessions will also take into account the need for students to be able to recognise those occasions when their level of understanding is inadequate, and thus when there is need to seek guidance from a principal. In so doing, students will reflect on their individual stage of learning. By the end of the course successful students will be able, under appropriate supervision, to demonstrate their knowledge, understanding and skills in the following specific elements: The course will focus on the following two transactions: 1. Business Sale - The scenario involves a corporate seller selling a newsagent business by way of a going concern. Company background for both buyer and seller, trading account / profit and loss and balance sheet for target, employee lists, supply contracts, official copy and plan etc will be used to create the type of detailed scenario that students would likely encounter in practice. Documentation will be used that reflects the type of documentation that would likely be encountered in such a transaction including: a. Heads of Terms. b. Confidentiality agreements. c. Business Sale agreement. d. Due diligence information request. e. Disclosure documentation. f. Transfer documentation e.g. TR1 for freehold, deed of assignment of goodwill, assignment of intellectual property rights. 2. Share Sale – The scenario involves individual shareholders selling shareholding to a corporate buyer. In this case the target is a printing company. Company background for both corporate buyer and the company of the individual seller shareholders is made available plus accounts for target, employee lists, official copy and plan of freehold property etc in order, as with the Business sale, to create the type of detailed scenario that students would likely encounter in practice. Documentation will be used that reflects the type of documentation that would likely be encountered in such a transaction such as: a. Heads of Terms. b. Confidentiality agreements. c. Share Sale agreement. d. Due diligence information request. e. Disclosure documentation. f. Completion documentation. The course will be run through a mix of podcasts and workshop sessions. Workshops will involve face-to-face tuition and group working and will be designed for small groups. The relevant elements of the Legal Practice Course Outcomes and Vocational Elective statement of outcomes would be provided by way of a combination of podcast and workshops covering the content detailed in the subject outline below. This gives an overview of the matters to be covered in each podcast and workshop with linkage to elements of law and practice which are also shown below. The podcasts are intended to provide students with a background explanation of core aspects of the law and procedure and will enable students to repeat play if required which will enhance the learning experience. The workshops will, in the main, focus on the two private acquisition scenarios outlined above. There will be consideration of how clients fund acquisitions and the different options available (business sale vs share sale), how targets are valued and how risk is apportioned by appropriate use of warranties, indemnities, disclosure documents etc. Aside from workshops and podcasts that give overviews of these types of transactions the transactional nature of the course and the extensive package of relevant documents will ensure that students will, by the end of the course, be able to identify the overall nature of a private acquisition transaction and to be able to progress such transaction through a series of steps, performing the tasks required to advance such transactions with particularly strong emphasis on the drafting / amendment of documentation. The skills of writing and the skill of Practical Legal Research (e.g. researching nature and purpose of warranties and requirements for effective disclosure) will also be encountered at various points in the course. Students will also be required to write letters of advice and presentation skills will also feature. The course will require quite extensive use of IT e.g. LGS 4 tax learning exercise, Much investigative research and drafting of documentation will require the use of electronic library software. The internet will be used to gain access to regulatory and other sources where appropriate; for example Competition ommission, Takeover Panel (re overview City Code takeovers) etc. The elective is primarily linked to some aspects of Business Law and Practice core subject requiring a knowledge of matters linked to corporate law such as director and shareholder matters, company constitution etc. There is also some fairly extensive linkage to the tax planning with a requirement for basic knowledge of tax, particularly capital gains tax, VAT, SDLT and corporation tax. Additionally there is linkage to PLP with basic knowledge requirement of freehold transaction with some focus on leasehold matters too, mainly in the context of business sale, but also linked to due diligence in general. The course will provide students with a sound understanding of the legal, practical and commercial principles of a private share sale and a business sale. Students will be required to consider share sales and business sales from the point of view of both seller and buyer. Additionally the course will provide students with a concise overview of how the city works (primarily focussing on raising equity and “City Code” takeovers). The course will enable students to apply substantive law to practical situations. Students will not be expected to become experts, but should achieve sufficient understanding to be able to fulfil, and benefit from, their role as a trainee solicitor in a team working in this field. ELEMENTS 1) Raising capital Students will: a) be able to distinguish between equity and debt finance, b) give an account of the advantages and disadvantages of raising capital by way of equity and debt finance. c) advise on the principal methods of raising private equity. 2) Overview of share sale and business sale Students will: a) be able to give an overview of the structure of both a share sale and a business sale. b) be able to compare and contrast the share sale and business sale. c) be able to explain to a client the main advantages and disadvantages of a share sale and a business sale. 3) Tax considerations Students will be able to: a) Provide an overview of the taxation implications of a share sale and a business sale from the perspective of both buyer and seller. b) Explain the difference in taxation implications for a corporate / individual buyer and seller. 4) Payment, pre-contractual documentation and due diligence Students will be able to: a) Define due diligence and explain the importance of due diligence in a share sale and business sale. b) Analyse financial information in order to value a business in a business sale and shares in a share sale. c) Explain, in the context of a share sale, the advantages and disadvantages of different types of consideration. d) Explain the purpose and basic form of pre-contractual documentation. 5) Agreements and sellers options to restrict liability Students will be able to: a) Demonstrate an understanding of share sale and business sale agreements by explaining the content and purpose of these agreements. b) Demonstrate an understanding of the methods by which a seller seeks to restrict liability and in particular, to explain the content and purpose of disclosure document. 6) Warranties and indemnities Students will be able to: a) Explain the purpose of warranties and indemnities. b) Define and explain potential remedies available to an aggrieved buyer. 7) Exchange to completion Students will be able to: outline and explain the principal procedural steps to be taken between exchange and completion, for both a share sale and business sale, and to explain the significance of these steps. 8) MBO and City Code takeovers Students will be able to: a) Identify and explain the main differences between a general share sale and a management buy-out. b) Give a basic overview of group structures and tax considerations. c) Give an overview of the City Code and impact on takeovers. 9) Topical knowledge and application Students will be able to: a) apply their knowledge of acquisitions law to make basic comment on major current transactions as reported in the press and publicly available documents. 10) Skills and Professional Conduct. Students will: a) have developed their Legal Practice Course skills; b) be able to recognise when and in what ways rules of professional conduct impact on their practice; c) have reflected on their learning; d) have practised their use of primary source and practitioner materials. PRIVATE ACQUISITIONS ELECTIVE COURSE OUTLINE 2009/2010 Podcasts (each of 1 hour) 1 Overview and Finance Workshop Sessions (each of 1.5 hours) Introduction to methods of raising capital and exit strategies for investors. Structure of typical share sale and business sale with focus on advantages and disadvantages. (Elements 1 and 2) 2: Prelim considerations Introduction to pre-contractual commercial issues and documentation and an overview of content of share sale and business sale agreements. (Elements 2 and 4 and 5) 3: Payment and price What is being bought and sold in share sale and business sale, methods of valuation and types of consideration. (Elements 1 and 4) Regulated activities and financial promotion. (Element 10) 4: Taxation (1 hour + e-learning ex) Taxation considerations from the perspective of both buyers and sellers in a share sale and business sale (Element 3) 5: Due diligence & investigation (1.5 hours) Due diligence in a share sale and business sale including the purpose and process of due diligence and the role of advisors. (Element 4) 1: Comparisons between share sales and asset sales (1): overview (2 hours) Outline of share and business sale transactions and contrasting of core requirements and documentation for both (Elements 2, 4, 5 and 7) 2: Comparisons between share sales and business sales (2): Payment and taxation Overview of different payment structures and their taxation implications for specific share and business sale transactions from the perspective of both the buyer and the seller (Elements 2, 3, 4 and 10) 3: Preliminary documentation 6: Warranties and indemnities (Element 6 and 5) Review of the need for and basic contents of pre contractual documentation. Document analysis and commercial awareness (Elements 4 and 10) 7: Remedies 4: Due diligence & investigation of target Purpose and effect of warranties and indemnities and links to disclosure Buyer’s remedies and seller’s options for limiting liability (Elements 6 and 5) Consideration of pre-contract enquiries and the value of due diligence. (Elements 4 and 10) 8: Completion process 5: The sale and purchase agreement (1): key clauses Exchange and completion matters for share sales and business sales. (Element 7) Consideration of key clauses of precedent share sale agreement (Elements 5 and 10) 6: The sale and purchase agreement (2): warranties Consideration and negotiation of warranties, indemnities and vendor protection provisions (Elements 6 and 10) 9: Business sales (1 hr) 7: Remedies, vendor protection and disclosure Main differences between share sale process and business sale process esp. TUPE & transfer of key contracts. (Elements 2, 5) Consideration of the purpose and effect of disclosure (note link to remedies in WS 9) (Elements 5, 6 and 10) 8: Completion Consideration of the completion process and resolution of problems (Element 7) 10: Groups 9: Post completion breaches Overview of group structures, reorganisations and basic tax considerations (Element 8) Self assessed questions Consideration of remedies for breaches of agreement discovered post completion and effect of entire agreement clause (Element 6, 5 and 10) 11: MBOs 10: Business sales(1) (2 hours) Management Buyouts (Element 8) Consideration of key clauses in an asset sale agreement (and comparisons with share sale agreement) (Elements 2, 3, 4, 5 and 6) 12: Overview of the “City” 11: Business sales (2) (2 hours) Overview of how the City Works, introduction to City Code Takeovers. (Elements 1, 8, 9 and 10) Detailed consideration of specific aspects of a business sale agreement by ref to case study 2 in particular (Elements 2, 3, 4 ,5 and 10) 12: MBOs and venture capital Consideration of legal, financial and practical issues arising from an MBO (to consolidate existing knowledge of share and asset sales and compare with variations required for an MBO) (Element 1, 6 and 8) Total 12.5 hours Podcasts Total 18 hours Workshops