FIRST QUARTER 2013

State Regulators and NCUA Hold

National Meeting on Policy Issues

A

nnually, state regulators and the

National Credit Union Administration (NCUA) gather for their National Regulators Meeting for regulatorto-regulator discussion on national policy

issues affecting state-chartered credit

unions. This meeting took place, March

18-20 in San Antonio, Texas.

Nearly 70 state regulators, the NCUA

Board and NCUA senior staff participated in the meeting, focusing on

examination and supervision issues for

state-chartered credit unions. NASCUS

See NATIONAL MEETING Page 2

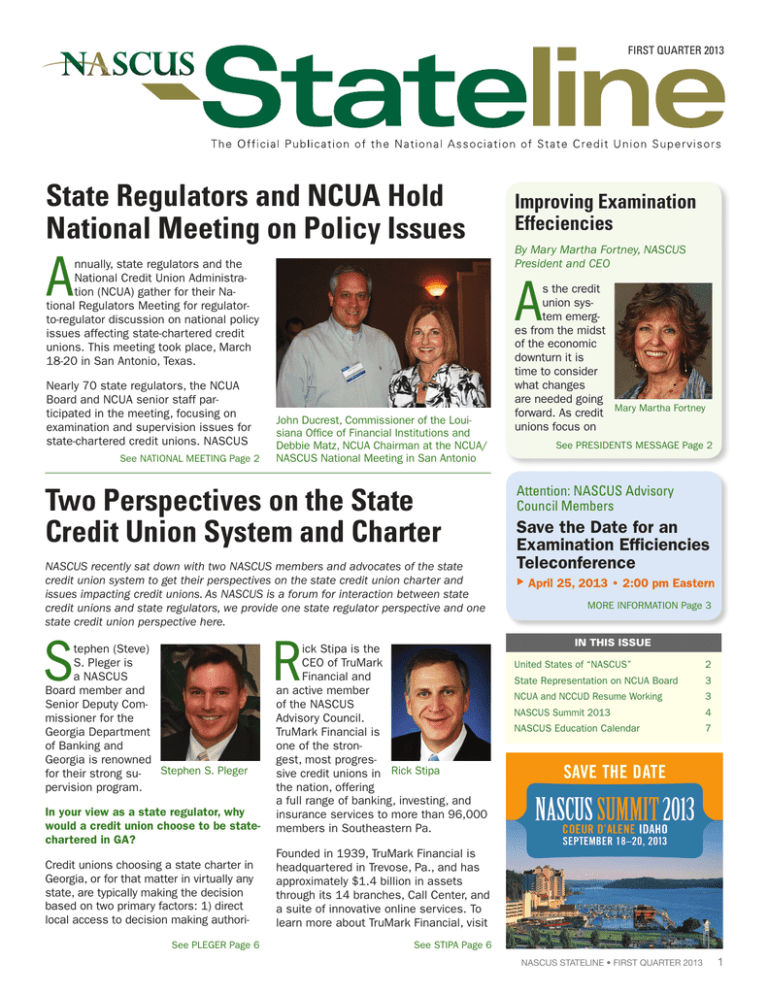

John Ducrest, Commissioner of the Louisiana Office of Financial Institutions and

Debbie Matz, NCUA Chairman at the NCUA/

NASCUS National Meeting in San Antonio

NASCUS recently sat down with two NASCUS members and advocates of the state

credit union system to get their perspectives on the state credit union charter and

issues impacting credit unions. As NASCUS is a forum for interaction between state

credit unions and state regulators, we provide one state regulator perspective and one

state credit union perspective here.

S

In your view as a state regulator, why

would a credit union choose to be statechartered in GA?

Credit unions choosing a state charter in

Georgia, or for that matter in virtually any

state, are typically making the decision

based on two primary factors: 1) direct

local access to decision making authoriSee PLEGER Page 6

By Mary Martha Fortney, NASCUS

President and CEO

A

Two Perspectives on the State

Credit Union System and Charter

tephen (Steve)

S. Pleger is

a NASCUS

Board member and

Senior Deputy Commissioner for the

Georgia Department

of Banking and

Georgia is renowned

Stephen S. Pleger

for their strong supervision program.

Improving Examination

Effeciencies

R

ick Stipa is the

CEO of TruMark

Financial and

an active member

of the NASCUS

Advisory Council.

TruMark Financial is

one of the strongest, most progressive credit unions in Rick Stipa

the nation, offering

a full range of banking, investing, and

insurance services to more than 96,000

members in Southeastern Pa.

s the credit

union system emerges from the midst

of the economic

downturn it is

time to consider

what changes

are needed going

forward. As credit Mary Martha Fortney

unions focus on

See PRESIDENTS MESSAGE Page 2

Attention: NASCUS Advisory

Council Members

Save the Date for an

Examination Efficiencies

Teleconference

u

April 25, 2013 • 2:00 pm Eastern

MORE INFORMATION Page 3

IN THIS ISSUE

United States of “NASCUS”

2

State Representation on NCUA Board 3

NCUA and NCCUD Resume Working

3

NASCUS Summit 2013

4

NASCUS Education Calendar

7

Founded in 1939, TruMark Financial is

headquartered in Trevose, Pa., and has

approximately $1.4 billion in assets

through its 14 branches, Call Center, and

a suite of innovative online services. To

learn more about TruMark Financial, visit

See STIPA Page 6

NASCUS STATELINE • FIRST QUARTER 2013

1

President’s Message

continued from page 1

operations and assimilating new regulations, NASCUS is working with its membership to shape an enhanced regulatory

and supervisory environment for statechartered credit unions.

Developing efficiencies in examination

and supervision is critical for a safe,

sound and viable future for the credit

union system. As might be expected from

such a widespread and lingering economic downturn, Congress and various federal

regulators have responded with additional

layers of regulation and notably with

the creation of the Consumer Financial

Protection Bureau (CFPB): a new federal

agency with far reaching jurisdiction over

both depositories and non-depositories.

The net effect of this has profound implications for both state regulatory agencies

and state credit unions.

From the perspective of a state regulatory

agency, the regulatory changes are leading to increased work load for examiners.

This in turn leads to increased agency

resource expenditures, elevated

Developing

staff turnover, and

efficiencies in

in some cases

examination

to misallocated

priorities during

and supervision

an examination.

is critical for a

NASCUS’ initiative

to identify efficien- safe, sound and

cies in examinaviable future for

tions should help

the credit union

to alleviate many

system.

of these pressures.

Finding efficiencies could allow limited

examination time to be better focused

on material risk in a particular institution.

This focus in turn could provide examiners

the needed time to dig deeper in those

areas to determine if the material risk is

unabated and represents a real risk of

loss to the insurance fund or the failure

of the institution. Conversely, the deeper

dive into the areas of material risk could

provide examiners the time needed to

more fully understand the credit union’s

enterprise wide risk mitigation strategies

for those materially risky activities which

in turn might lead to the conclusion that

the risk is being sufficiently managed.

Increased efficiencies would also benefit credit unions by providing more time

for discussion between regulators and

credit unions of supervisory concerns.

The enhanced communication allows

2

NASCUS STATELINE • FIRST QUARTER 2013

“United States of NASCUS”

We appreciate the steadfast support of longtime NASCUS members who

understand the importance NASCUS’ mission of preserving and strengthening the state charter. We are embarking on an awareness campaign within

the state credit union community to spread the word about NASCUS. In

the campaign, we urge all state credit unions to “Join the United States

of NASCUS,” to influence the policies that will decide the future of the

state system. NASCUS member credit union CEOs and regulators explain,

through video and written testimonials, the importance of becoming a part

of NASCUS. If you have any questions about this campaign or would like to

lend your voice, contact NASCUS President and CEO Mary Martha Fortney

at marymartha@nascus.org.

for clear understandings of issues and

corrective steps needed. In such a way

“unnecessary” enforcement actions may

be avoided and supervisory focus can be

redirected to other credit unions where

the material risk is unmitigated.

Increased efficiencies could potentially

also temper the need for increased funding for regulatory agencies. Through more

focused and efficient examinations, regulators may be able to reduce travel time

for examiners without sacrificing valuable

on-site interactive time with credit unions.

The reduced travel time translates to cost

savings in lower lodging and per diem

expenses. The reduced travel time might

also mitigate examiner burnout, allowing

agencies to retain seasoned examiners

and reduce costs associated with uptraining new hires.

To identify efficiencies and general improvements in the examination process,

NASCUS’ initiative is taking a comprehensive look at the process from prescoping through conclusion and delivery

of a final report. Already, some interesting concepts are being identified and

developed. These promising concepts

include improving the entrance letter and

the procedures for identifying and collecting pre-examination information from

credit unions. The initiative is also evaluating improved information transmission

between credit unions and regulators.

Additional concepts being evaluated involve centralized subject matter experts

for uniform portfolio analysis and use of

more specialized examiners.

Another area suggested by credit unions

for evaluation is clarifying the authority given to “guidance” as opposed to

regulation and improving the processes

for reconciling divergent opinions between

examiners and credit unions regarding

“best” business practices. Clarifying

the distinctions between guidance and

regulation will lead to an evaluation of

how examination findings are presented.

Clarifying such issues and improving the

presentation of examination findings benefits both regulators and credit unions.

Examination reports are more effective

when they clearly distinguish opinions and

suggestions from regulatory violations

and mandatory remedial actions.

NASCUS’ examination efficiencies initiative is a concrete step that will deliver

real benefits to both regulators and credit

unions. To learn more about the project or

to share your thoughts on how to improve

examination efficiency, contact NASCUS.

National Meeting

continued from page 1

state regulators and NCUA meet in

person several times a year, as well as

by teleconference each month to discuss

critical issues impacting credit unions.

NASCUS state regulators and the NCUA

will also meet in-person later this year

during NASCUS’ State System Summit,

Sept. 18-20 in Coeur D’Alene, Idaho.

NASCUS asks Congress to Include

LICU Designation

State Representation on NCUA Board

tate-chartered credit unions will

N

ASCUS submitted a statement to

the Subcommittee on Financial

Institutions and Consumer Credit

for the April 10 Hearing on Examining

Credit Union Regulatory Burden.

NASCUS’ testimony touches on several

concepts for consideration to improve the

regulatory supervision of state-chartered

credit unions while providing prudent

regulatory relief, including the need for

credit union capital reform, state regulatory representation on the National Credit

Union Administration (NCUA) Board, and

increasing the size of the NCUA Board.

NASCUS’ recommendations for regulatory relief emphasize reforms that

both improve the regulatory supervision of credit unions and enhance the

consumer member access to quality

credit union products and services and

enhance the capabilities of state-chartered credit unions. Ultimately these

recommendations will benefit the tens

of millions of credit union consumer

members that belong to the nation’s

state-chartered credit unions.

“NASCUS is supportive of Congress’ efforts to provide regulatory relief, and we

want to ensure that state charters benefit from relief initiatives” said NASCUS

President and CEO Mary Martha Fortney.

“NASCUS continually works to raise

awareness of regulatory relief for the

state system both in Congress and at

NCUA.”

To see the testimony click here.

NCUA and North Carolina Credit Union Division

(NCCUD) Resume Working Relationship

A

t NASCUS, we work diligently to

preserve and protect state authority in the oversight of

state-chartered credit unions.

Dedicated to defending and

advancing a strong state

credit union system, NASCUS

and its members actively

support this mission and

value every day. Along

with others in the credit

union system including the North Carolina

Credit Union League,

NASCUS recently played

an instrumental role in

helping to restore the working relationship between the National Credit Union

Administration (NCUA) and the North

Carolina Credit Union Division, which is

positive news for the North Carolina state

Attention: NASCUS Advisory

Council Members

Save the Date for an

Examination Efficiencies

Teleconference

uA

pril 25, 2013

2:00 pm Eastern

credit unions and the state-chartered

credit union system nationwide. NCUA

and the NCCUD have agreed to

resume a working relationship.

On February 8, after a meeting

between the NCUA Chairman

and Rose Conner, North Carolina’s Acting Administrator, the

Division notified NC’s state

credit unions that NCUA’s

separate contacts will cease.

Ms. Conner also informed

the credit unions that the

NCCUD and NCUA will again

work to coordinate examination schedules. NASCUS

is looking forward to working with Acting

Administrator Conner and North Carolina’s

credit unions as the supervision process

for North Carolina state-chartered credit

unions returns to business as usual.

NASCUS regulator members are taking a comprehensive look at the examination process to

determine efficiencies in an effort to make use

of agency and credit union resources more

effectively (See President’s message for more

information). Join State Regulator Linda Jekel

and NASCUS Management on this important

effort by participating in this teleconference. If

you have any questions, email Brian Knight at

Brian@nascus.org. Dial in info will be sent to

all NASCUS Advisory Council members shortly.

S

now find it easier to determine if

they are eligible for designation as

low-income credit unions (LICU) through

a cooperative effort by the National

Credit Union Administration (NCUA) and

NASCUS.

State regulators can now provide limited

geographic and income data to NCUA’s

AIRES system when they upload their

examinations. NCUA will use that data

to determine if there are state-chartered

credit unions eligible for the low-income

designation and provide a list to state

regulators on a quarterly basis. State

regulators have the sole authority to

make the LICU designation for statechartered credit unions.

“Consistency and cooperation are fundamental to effective regulation, and so

is creating opportunities,” NCUA Board

Chairman Debbie Matz said. “This is a

great example of how state and federal

regulators can work together to help

state-chartered credit unions that qualify

obtain a low-income designation. NCUA

will provide state regulators with lists of

credit unions that could qualify, and the

states take it from there.”

“Streamlining the process for federally insured, state-chartered credit unions that

might seek the low-income credit union

designation is a tangible benefit to the

state system,” NASCUS President and

CEO Mary Martha Fortney said.

To qualify as a LICU, a majority of a credit

union’s membership must meet low-income thresholds based on 2010 Census

data. A LICU designation can provide

certain regulatory benefits to qualifying

state-chartered credit unions under certain circumstances and when state law

permits, including:

•E

ligibility for Community Development

Revolving Loan Fund grants and lowinterest loans;

• Ability to obtain supplemental capital;

•E

xemption from the 12.25 percent

statutory cap on member business

loans; and

•A

bility to accept non-member deposits

from any source.

NASCUS STATELINE • FIRST QUARTER 2013

3

Registration Open

NASCUS SUMMIT 2013

COEUR D’ALENE IDAHO

SEPTEMBER 18–20, 2013

N

ASCUS conferences are

designed to help strengthen

state-chartered credit unions

and state supervision.

Attendees benefit from

industry-leading presenters and

exclusive networking events. NASCUS

promotes education, collaboration

as well as collectively articulating

concerns and leveraging collective

resources to improve state credit

unions.

NASCUS invites you to join the

system’s leaders to address the top

challenges confronting state credit

unions and regulators at the 2013

NASCUS State System Summit in

Idaho.

4

NASCUS STATELINE • FIRST QUARTER 2013

Here are just a few reasons why you should attend:

• Influence the future of the state-chartered credit union system

•C

ollaborate with your peers to address the growing regulatory

burden which continues to put a burden on credit union

operations

•K

eep current on state and national issues facing state-chartered

credit unions

Lodging

Agenda

The Summit will take place at

the Coeur D’Alene, ID. The hotel

is located at 115 S. 2nd Street,

Coeur D’Alene, ID 83814.

Please note our program begins at

8:00 a.m. on Wednesday, September 18 and concludes at 12 p.m.

on Friday, September 20, 2013.

A full schedule of speakers and

events will be forthcoming at

www.nascus.org.

For reservations, dial 1-800-6885253 and ask for the NASCUS

room block at the Coeur D’Alene

Hotel. The NASCUS rate is $99

for the North Tower and $199 for

the Lake Tower/Park Tower.

These room rates expire at

midnight on August 1, 2013 but

may sell out prior to this date

make your reservations early.

Register at www.nascus.org or

by faxing the adjacent form to

(703) 528-3248. Please copy for

additional registrants.

REGISTER ONLINE

Registration Form

Register at www.nascus.org or by faxing

this form to (703) 528-3248.

Please copy for additional registrants.

REGISTER ONLINE

Name

Scholarships Available for

State Regulators

Due to the generosity of the NASCUS

Credit Union Advisory Council members

who donate to NISCUE, Summit

scholarships are available for state

regulators. Contact Jenny Champagne

at jenny@nascus.org for information

and an application.

Name preferred on badge

Title

Organization

Mailing Address

City

StateZip

PhoneEmail

Spouse/Guest name

Registration Fee Summary: NASCUS Members*

First Timer Free

Non-Members

Spouses/Guest Program**

Before July 31, 2013

After July 31, 2013

$995

$1,095

$0

$0

$1,095$1,245

$300

$400

*A special state agency rate is available for state regulators. Contact Isaida Woo at

isaida@nascus.org for details. Also, Credit Union Advisory Council members can bring a

colleague for half price with a paid registrant.

**NASCUS’ Spouse/Guest Program includes:

• Breakfast with attendees on September 18-20

• Networking Luncheon on September 18

• NASCUS Chairmen’s Lunch on September 18

Cancellation Policy

All refunds/cancelations must be made in writing by September 1, 2013 and are

subject to a $75 administrative fee. No refunds will be accepted after this date.

Substitutions are permitted at any time.

Method of Payment

¢ Check/Share Draft________________________________________________________

¢ Send me an invoice_______________________________________________________

¢ Charge my credit card__________________________________ Exp. Date__________

Questions? Contact NASCUS at (703) 528-0796 or email isaida@nascus.org.

NASCUS STATELINE • FIRST QUARTER 2013

5

Pleger

continued from page 1

ties, and 2) a charter option designed

to meet the unique characteristics and

needs of the local market. For example,

our Commissioner and staff are routinely

engaged, by telephone or in person, by

credit union managers and trade association representatives to discuss new

authorities or activities in order to gauge

the Department’s perspective on the

legalities and risks. In addition, these

same representatives are often onsite at

the Georgia State Capitol to directly voice

their opinions on legislative matters, ensuring that state-chartered credit union interests are considered and appropriately

balanced in the state lawmaking process.

Through this collaborative effort involving

lawmakers, credit unions, and regulators,

a unique Georgia state-charter has been

designed to meet the specific wants and

needs of Georgians; wants and needs

that may differ materially from those in

California, Kansas, or Maine due to the

unique characteristics of each state’s

demographics and economy. Through this

process, the states serve as laboratories

of innovation, with the most beneficial

ideas spreading through a combination

of competition and best practice to other

state-charters as well as the federal system. A good example is the community

based charter, which as that charter is

defined in Georgia, offers a very attractive

business model option and broadened access to credit union services. Innovations

in this charter option at the state-level

create a healthy tension with other state

and federal regulators to ensure that

their charter options retain equally safe,

sound, and competitive characteristics.

CUNA’s recent exam survey cited some

dissatisfaction in credit unions with

joint FISCU Examinations. NASCUS

state regulators are committed to

ensuring joint examinations are positive

experiences. From your perspective,

what can the states and NCUA do to

improve credit union’s experience during joint examinations?

What we state regulators and the NCUA

can and should do is trust in and rely

upon each other’s work. Duplicating each

other’s efforts or failing to coordinate

and communicate on the timing and

nature of exam activities should not happen, or at least be the very rare exception. In addition, we should promote

procedures that minimize the potential

for mixed messages or muddled communication of exam findings and ratings

6

NASCUS STATELINE • FIRST QUARTER 2013

on joint exams. Both the state and NCUA

have legitimate stakes in the supervision of federally insured state-chartered

credit unions, but poorly coordinated

or disjointed exam processes diminish

the value of state charters and threaten

the dual chartering system. The NCUA,

with its unique structure as both federal

chartering agency and deposit insurer,

should be particularly sensitive to any

actions on its part that may potentially

damage the value of state charters, and

we state regulators should be open and

transparent in our engagement with the

NCUA to ensure that it has full access to

information critical to its important role

Stipa

continued from page 1

www.trumarkonline.org.

We understand that TruMark Financial

had a very successful year in 2012. Tell

us a little about your success in terms

of growth and return on assets.

Last year was the most profitable since

Trevose, Pa.-based TruMark Financial

Credit Union’s founding in 1939, earning

net income of

$14.5 million.

Because of its

high regard for

Although the

rate environemployees, a

ment made net

consortium of

interest margin

business leaders

a challenge,

other sources of

recognized Truincome elevated

Mark Financial

earnings. The acamong the Best

tive mortgage refinancing market

Places to Work

was instrumental,

in Pennsylvania

allowing the

2012.

credit union to

sell $151 million

in first mortgages

while retaining the loans’ servicing

rights. This helped push non-operating

income to $4.1 million. Contributing

another $17.6 million to the credit union,

non-interest income’s leading sources

included interchange on credit and debit

cards, investment sales to members,

insurance and debt protection sales, and

service charges related to a new relationship checking account program.

The credit union also enjoyed significant

loan growth at 11 percent in 2012. Total

assets increased 2.9 percent, with the

credit union finishing the year just shy of

$1.4 billion. That combined with strong

as deposit insurer. In addition, we state

regulators should be respectful of the

role of the NCUA in its interpretation and

enforcement of applicable federal laws.

NCUA and NASCUS leadership have

renewed their commitment to a strong

and cooperative partnership. We must

ensure that this renewed commitment is

fully understood and practiced by examiners in the field operating in a cooperative spirit of mutual respect. Otherwise,

state-chartered credit unions get caught

in the middle, and the dual chartering

system suffers.

To see Steve’s full interview click here.

income growth moved the net worth from

9.56 percent in 2011 to 10.33 percent

in 2012.

We know success does not just “occur.”

What do you feel are some of the things

TruMark Financial has done to position

itself for these opportunities?

The credit union’s Officials and management realize TruMark Financial is no

overnight sensation. The success it saw

in 2012 came from decades of member

growth, organically and through mergers;

from constant process improvements

and product enhancements; from adding

10 additional branches in as many years;

from changing its charter to communitybased; from creating and growing a new

brand identity; and from developing,

rewarding, and motivating its employees.

The credit union’s Officials and management strive to create a positive, rewarding experience for employees. Ongoing

employee satisfaction surveys provide

direction as to what employees enjoy and

what opportunities exist for change.

Because of its high regard for employees, a consortium of business leaders

recognized TruMark Financial among

the Best Places to Work in Pennsylvania

2012 through a program coordinated by

the Central Pennsylvania Business Journal. The credit union also earned similar

kudos when The Philadelphia Inquirer’s

Top Workplaces 2013 program recognized it as one of the top 100 places

to work in the Philadelphia region for

the fourth consecutive year. The impact

shows through annual member satisfaction surveys, too, where TruMark Financial consistently ranks above its peers.

In 2012 alone, the credit union added

1,292 members through mergers or

See STIPA Page 8

NASCUS Upcoming Educational Events

Email isaida@nascus.org with your questions

NASCUS Information Technology

School

Register online

for all events at this link.

Ohio Examiners’ Conference

(Open to all Credit Union Examiners Nationwide)

June 4-6, 2013 Columbus, Ohio

More than two-and-half days of instruc- This event is the one NASCUS

education event for regulators-only,

tion, this forum will provide attendees

allowing for open regulator-to-regulator

with an in-depth look at information

technology (IT) issues for credit unions. discussion on the most pressing

issues and challenges facing state

The school will focus on the following

examiners. The school includes twotopics:

and-half-days of sessions on diverse

training for state examiners. Topics

•Threats and Regulations: A look at the revolve around three core themes

current “threatscape,” hackers and an — Consumer Compliance, Lending

intro to Gramm-Leach-Bliley Act (GLBA) (member business and specialized)

and Federal Financial Institutions Exand Corporate Governance.

amination Council (FFIEC) guidelines

April 29-May 2, 2013

Sacramento, CA

•Basic Technical Skills: Discussion

of networks and network diagrams,

anti-malware, vulnerability and patch

management

•Other IT Compliance Areas: Vendor

management, business continuity

planning and disaster recovery and

emerging tech including social networking, virtualization and cloud

The early bird rate is $695 before April

18 for NASCUS members and $795 for

non-members. This school is open to

both credit union and examiners.

NASCUS Directors Colleges

Springfield, Illinois

May 2, 2013

Mission, Kansas

May 8, 2013

Milwaukee, Wisconsin

June 18, 2013

NASCUS is proud to work with state

regulatory agencies and leagues

around the country as we continue

our Directors College series. Please

save the date for these popular oneday events geared toward enhancing

directors’ understanding of the critical

statutory, fiduciary and regulatory

responsibilities of a director. Email

isaida@nascus.org with your questions

on the NASCUS Directors College

series.

Examiners Forum

May 14-16, 2013

Los Angeles, CA

The Examiners Forum is scheduled for

May 14-16, 2013 in Los Angeles, CA.

The Examiners Forum hosted by California Credit Union is open to both examiners and credit unions.

Some of our topics include Operational

risk, in this session we will focus on how

to mitigate operational risks by reviewing:

Fraud losses — frequency/severity and

mitigation steps. Attendees will also have

an discuss managing Fraud and case

studies that focus on wire transfers,

fraudulent deposits and lending.

The Examiners Forum will also cover internal fraud, which will focus on growing

concern with employee dishonesty such

as current internal fraud trends and driving factors, common behavioral red flags,

case studies and real-life examples. The

fee for the examiners forum is $695.

NASCUS is offering state agencies rate

of $995 for a single registration and

$1295 for up to three registrations to

attend the Summit. NISCUE is also

offering scholarships for regulators who

otherwise cannot attend the Summit.

Please email jenny@nascus.org for an

application.

Hotel: Address:

Phone: Fax: The Coeur D’Alene

115 S. 2nd Street

Coeur d’Alene, ID 83814

208-765-4000

208-664-7276

NASCUS/CUNA 2013 Bank Secrecy

Act Conference

November 3-6, 2013

Orlando, FL

NASCUS and CUNA will continue its

partnership on this comprehensive

BSA training event that brings together

BSA compliance officers, examiners

and regulators and industry experts for

nearly four days of discussion, networking and education on BSA compliance

issues.

Follow NASCUS on Twitter

NASCUS can be

found on Twitter as

TheNASCUS. Follow

us for NASCUS

news and announcements. Contact Jenny Champagne at jenny@

nascus.org with your questions.

The school is open to both credit union

and examiners. Register at this link.

NASCUS 2013 State System Summit

September 18-20, 2013

Coeur d’Alene, Idaho

Plan now to join us in Idaho in

September! Don’t miss the annual

gathering of the state credit union

system! For more information please visit

www.nascus.org.

Renew Your NASCUS

Dues Online!

LOG IN HERE

at www.nascus.org

NASCUS STATELINE • FIRST QUARTER 2013

7

NASCUS Thanks NISCUE Donors!

Stipa

he National Institute of State Credit Union Examination (NISCUE), through the

generosity of NASCUS Credit Union Advisory Council members, funds training

programs designed specifically for state credit union examiners. These programs

are offered throughout the year directly at locations convenient to state credit union

agencies and online to ensure that training is available when examiners in your state

need it.

purchase and assumption transactions.

Another 7,556 members joined of their

own volition, with referrals from existing

members being the greatest source followed by indirect lending. In an unprecedented move, the credit union launched

a summertime ad campaign with Cole

Hamels, the Phillies’ star pitcher, to raise

funds for Hamels’ philanthropic foundation while bringing more than 950 new

members with checking accounts.

T

NISCUE sponsors training focused on enhancing examiners skill levels in several

states concentrating on critical examination areas including asset/liability management, information technology, member business lending and consumer compliance.

NASCUS thanks the following NASCUS Credit Union Advisory Council members who

fund programs for state examiners through donations to NISCUE.

Alabama Telco Credit Union, AL

Fort McClellan Credit Union, AL

Alabama Teachers Credit Union, AL

Arizona State Credit Union, AZ

Educational Employees Credit Union, CA

America’s Christian Credit Union, CA

Sooper Credit Union, CO

Boulder Valley Credit Union, CO

Floridacentral Credit Union, FL

Mutual Savings Credit Union, GA

Pinnacle Credit Union, GA

Combined Employees Credit Union, GA

1st Choice Credit Union, GA

Delta Community Credit Union, GA

Flowers Employees Credit League Credit

Union, GA

Savannah Postal Credit Union, GA

Cedar Falls Community Credit Union, IA

Idaho Central Credit Union, ID

A+ Credit Union, ID

Public Employees Credit Union, ID

Great Lakes Credit Union, IL

Motorola Employees Credit Union, IL

Forum Credit Union, IN

Kokomo Post Office Credit Union, IN

Bluestem Community Credit Union, KS

New Century Credit Union, KS

Medical Community Credit Union, KS

Michoud Credit Union, LA

River Cities Credit Union, LA

Tangipahoa Parish Teachers Credit Union, LA

Louisiana Central Credit Union, LA

Co-Op Services Credit Union, MI

Kalsee Credit Union, MI

Great Lakes Members Credit Union, MI

Astera Credit Union, MI

Chippewa County Credit Union, MI

Sterling Van Dyke Credit Union, MI

Total Community Credit Union, MI

Thornapple Valley Community Credit Union, MI

My Postal Credit Union, MI

Eastern Michigan University Credit Union, MI

Bear Paw Credit Union, MT

Charlotte Fire Department Credit Union, NC

Blue Flame Credit Union, NC

Hanesbrands Credit Union, NC

Mountain Credit Union, NC

Members Credit Union, NC

State Employees’ Credit Union, NC

Credit Union of New Jersey, NJ

Akron Firefighters Credit Union, OH

Postal Family Credit Union, OH

8

NASCUS STATELINE • FIRST QUARTER 2013

Millstream Area Credit Union, OH

Kemba Credit Union, OH

Universal 1 Credit Union, OH

Genesis Employees Credit Union, OH

BSE Credit Union, OH

GROhio Community Credit Union, OH

PSE Credit Union, OH

Greater Cincinnati Credit Union, Inc., OH

Oregon Community Credit Union, OR

Benton County Schools Credit Union, OR

Unitus Community Credit Union, OR

Community Regional Credit Union, PA

White Rose Credit Union, PA

Northampton Area School District Employees

Credit Union, PA

Norristown Bell Credit Union, PA

Southeast Financial Credit Union, TN

Knoxville News Sentinel Employees Credit

Union, TN

The Tennessee Credit Union, TN

Bowater Employees Credit Union, TN

Nashville Firemen’s Credit Union, TN

McNairy County Employees Credit Union, TN

Kimberly Clark Credit Union, TN

Life Credit Union, TN

Knoxville Post Office Credit Union, TN

Linkage Credit Union, TX

Southern Star Credit Union, TX

Texas Workforce Credit Union, TX

Amarillo Postal Employees Credit Union, TX

Metro Medical Credit Union, TX

Light Commerce Credit Union, TX

Memorial Credit Union, TX

P&S Credit Union, UT

San Juan Credit Union, UT

P&S Credit Union, UT

Virginia Credit Union, VA

University of VA Community Credit Union, VA

Old Dominion Credit Union, VA

Richmond Fire Department Credit Union, VA

BECU, WA

Harborstone Credit Union, WA

Red Canoe Credit Union, WA

Columbia Credit Union, WA

School Employees Credit Union of

Washington, WA

Community First Credit Union, WI

CONE Credit Union, WI

Fox Communities Credit Union, WI

Westconsin Credit Union, WI

Pluswood Credit Union, WI

continued from page 6

The credit union’s management also established performance metrics and strategies centering on areas for improvement

including financial targets, direct auto loan

growth, penetration of direct deposit, and

expanding its base of younger members.

This approach not only clarified the credit

union’s priorities in 2012, it set initiatives

in motion for the credit union’s long-term

sustainability as well.

To give back to the community it

serves, TruMark Financial focuses on

financial literacy. Employees regularly

visit local high schools’ classroom to

teach topics ranging from funds and

credit management to avoiding fraud

and ID theft to improving interviewing

skills. Through 62 visits and 116 presentations for the 2011-2012 school

year, credit union representatives presented to more than 3,800 students.

Each spring, the credit union hosts

an annual Financial Jeopardy event

with seniors from those high schools

competing for scholarships of up to

$5,000. Then in the autumn, the credit

union holds its annual Kiss a Pig event,

raising $36,000 for financial literacy

programs at area schools in 2012. The

credit union also operates student-run

branches in two local high schools.

To see Rick’s full interview, click here.

National Association of

State Credit Union Supervisors

1655 N. Fort Myer Drive, Suite 650

Arlington, VA 22209

(703) 528-8351 • www.nascus.org

©NASCUS 2013. All rights reserved.

Contact NASCUS’ Communications

department by emailing jenny@nascus.org.

Newsletter Design by Levinson Design:

www.levinsondesign.com