User group - Energinet.dk

advertisement

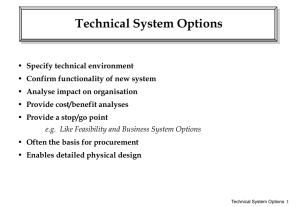

User group - Market Development in Germany and Europe Programme – User group meeting Market development in Germany and Europe – Impact on the Danish gas market Welcome Introduction on EU Time Schedule for Network Code Development Gasunie Transport Services presents the latest status on new German market model adjustments Energinet.dk presents final guidelines for EU Network Code development Topics for discussion: - Auctioning models functioning as capacity allocation mechanism - Bundling versus coordinated products - Restriction on renomination rights - Interruptible products Time plan for market development in EU Commission Consumers Shippers Traders Ag en Producers cy 2010 O TS EN G 2011 Capacity allocation methodologies (CAM) Framw. Net Work Code Guide (ENTSOG) Congestion Management Principles (CMP) Framw. Guide Balancing Harmonisation of tariff structures Interoperability rules Rules for trading Third Party Access Security and reliability 2012 Comitology Comitology Framw. Net Work Code Comitology Guide (ENTSOG) Framw. Net Work Code Comitol Guide (ENTSOG) Framw. Net Work Code Guide (ENTSOG) C Framw. Net Work Code Guide (ENTSOG) Framw. Net Wor Guide (ENTSO Framw. Guide Latest status from Germany Matthias Schulz – Gasunie Transport Services Gasunie takes gas transport further Current developments in Germany Energinet.dk User Group Meeting 09.09.2010 Matthias Schulz Agenda Overview on current developments in Germany Market areas in Germany Current situation / ongoing developments Consultation process initiated by BNetzA KEMA study Capacity management (allocation & congestion) in Germany Current situation Principles laid down in the new grid access order (GasNZV) Consultation process initiated by BNetzA Investment climate in Germany Recent developments / current situation Remaining obstacles Status IOS 6 Overview on current developments in Germany (1) - Background - Regulated TPA introduced in 2005 Market area model (inter TSO entry/exit model) with initially 19 market areas implemented in 2006 Currently 3 L-gas market areas and 3 H-gas market areas New balancing regime (“GABi Gas”) since 10/2008 Change of supplier for households possible, increasing gas-to-gas competition for households 7 Overview on current developments in Germany (2) - Recent developments New grid access order (GasNZV) as of xx.09.2010, a.o. Amendments of ARegV / GasNEV: Improvements for conditions on new investments, further tightening wrt return from base business Pending decision of BNetzA on regulated tariffs for supraregional TSOs (outcome of the efficiency benchmarking) Consultation process wrt combining H- and L-gas market areas Consultation process wrt capacity allocation and congestion management – Modernisation / alignment with current status of development, e.g. balancing regime, grid access model, etc. – Explicit and detailed rules for green gas – Further reduction of market areas ( next charts) – Capacity allocation and congestion management ( next charts) – Extensive competences for BNetzA High momentum in German market development combined with high level of uncertainty (for TSOs) Interferences with European developments / wishes 8 Market areas (1) - Current situation Currently 3 H-gas and 3 L-gas market areas: H-gas market areas TSOs involved L-gas market areas TSOs involved GASPOOL DEP, GUD, ONTRAS, STATOIL, WTKG AEQUAMUS EGMT, EWE, GUD NCG OGE*), bayernets, GVS, Eni, GDF OGE L-gas OGE TG H-gas TG TG L-gas TG *) former EON Gastransport Requirements new GasNZV: – 3 market areas as of 01.04.2011 (2 H-gas & 1 L-gas) – Cost-benefit analysis re further consolidation by 01.10.2012 – Max 2 market areas as of 01.08.2013 Further consolidation wrt smaller market areas expected by April 2011 9 Market areas (2) - Consultation process initiated by BNetzA BNetzA has initiated an open consultation process re the combination of H- and L-gas market areas; open for comments until 22nd of September; – GUD has performed a study together with KEMA – GUD as well as OGE are in favour of commercially combining their respective L-gas market areas with their H-gas market areas – GUD has asked BNetzA for an open consultation since combination of H- and L-gas market areas needs to follow transparent rules and will have an effect on costs for endconsumers at the end – BNetzA has published the KEMA study, the OGE study and has raised different questions Consultation will be decisive on the principal possibility to combine H-gas and L-gas market areas in Germany on the basic rules to combine NCG and OGE L-gas (as of 01.04.2011 ?) as well as GASPOOL and AEQUAMUS (as of … ?) 10 Market areas (3) - KEMA study KEMA presents a practical way to combine H-gas and L-gas market areas in the regulatory framework in Germany, i.e. – Full flexible entry and exit capacities, independent from gas quality at the respective points – H-gas and L-gas points can be combined in one balancing group – Balancing within the balancing groups, independent from gas quality at the respective points L-gas exits can be served from H-gas entries and vice versa KEMA proposes a combination of 3 measures in its conceptual study – Virtual or commercial quality conversion – Technical quality conversion (blending) – Switch of markets from L-gas to H-Gas The combination of these 3 measures is the best way to combine H- and L-gas areas in one balancing zone on short notice and to deal with the decreasing L-gas production in Germany mid term 11 Capacity management (1) - Current situation First come first serve is main allocation principle in Germany Entry / exit capacities nearly completely booked on short term and significantly booked on mid / long term Monitoring of BNetzA shows in average low level of usage of booked capacities in major pipelines Acc. to BNetzA contractual congestion is limiting further development of the market, physical congestion is not in the focus yet; Capacity allocation & congestion management are the remaining issues to be solved by regulation in Germany New GasNZV is dealing mainly with capacity allocation & congestion management and will be further detailed by BNetzA decision following the planned consultation 12 Capacity management (2) - New rules laid down in the new GasNZV In general: Supra-regional TSOs (“TSOs”) have to calculate full-flexible entry & exit capacities in accordance with specific rules; aim is to maximize entry & exit capacities (base capacity); – based on historical and assumed flows in the market area BNetzA has to approve the calculated base capacity for each TSO; – if full-flexible base capacity is too low TSO may after prior approval of BNetzA pay for flow commitments or reduce flexibility; TSO may offer additional capacity to the market based on additional (short term) assumptions; 50% of additional revenues / costs for those additional capacities are for the benefit / burden of the TSO; TSO may buy back capacities from the market to secure technical integrity of their systems; TSOs are obligated by 1st of April each year to explore and publish the long term capacity demand for the market area; Obligation for TSOs to maximize capacity offer and (limited) incentive to offer additional capacity by way of taking additional risks 13 Capacity management (3) - (New) rules laid down in the new GasNZV Capacity products: Full flexible firm and interruptible entry & exit capacities for terms of at least 1 day, 1 month, 1 quarter and 1 year; TSOs have to establish entry & exit zones to further simplify grid access and to maximize the capacities offered to the market; Max 65% of all entry & exit capacities can be booked with a duration of more than 4 years; 20% of all entry & exit capacities needs to be reserved for bookings with a duration of max 2 years; – Deviation from 65% after prior decision of BNetzA possible Existing contracts are not affected by new rules re terms BNetzA to report about the experiences re term of contracts by 01.10.2013 14 Capacity management (4) - (New) rules laid down in the new GasNZV Marketing of capacities: TSOs have to establish one common IT platform for booking of entry & exit capacities on the primary market by 01.08.2011; TSOs have to establish one common IT platform for selling / leasing entry & exit capacities on the secondary market; shippers are obligated to sell or lease entry & exit capacities to other shippers only via this platform; – Tariffs on secondary capacity market must not exceed tariffs on the primary market significantly Allocation of entry & exit capacities at cross border points and market area points as of 01.10.2011 onwards only by way of auctioning – Tariff to be paid = clearing price (“Markträumungspreis”) Allocation of all other entry & exit points (e.g. storages, green gas, production, LNG, end consumer) acc. to first come first serve; Revenues from auctions exceeding the regulated revenues to be used by TSOs for measures to mitigate the congestion 15 Capacity management (5) - (New) rules laid down in the new GasNZV Unused capacities: Until moment of nomination Shippers are obligated to offer fully or partly unused firm entry & exit capacities on the secondary market or to return them to the TSO; After moment of nomination TSO is obligated to offer fully or partly not nominated entry & exit capacities of a shipper (after respective consideration of re-nomination rights) as firm capacity on the primary market for the next day; – Shipper remains responsible for paying the tariff 16 In case of contractual congestion “use-it-or-lose-it” – rule (period of consideration: 3 months) Capacity management (7) - Content of the consultation process / capacity decision Bundling of capacities at market area points and cross border points Start of yearly contracts either 01.10. or 01.01. to be decided; Tariffs for terms less than one year pro rata temporis; Point of nomination / restriction of re-nomination rights – – Obviously limited to the willingness of foreign TSOs Existing contracts ? – – – 10:00 am as initial nomination deadline to establish a day-ahead capacity market Restriction of re-nomination rights after 10:00 am to free up unused firm capacity for second marketing through the TSO … – – – Dates and frequency of auctions One-level or multi-level auction process … – – Anonymity Technical implementation Details for the auctioning of capacities, e.g. Principles for the primary capacity platform, e.g. Deadlines for implementation TSOs are currently in detailled discussions with BNetzA Participation of the market (BNetzA consultation) expected in the next days … 17 Investments in infrastructure (1) - Recent developments / current situation Intensive discussions with BNetzA and politicians re needs & economic conditions for investments in gas infrastructure over the past 12 months; Amendments of ARegV improves economic conditions for new investments since TSOs are now allowed to earn back the OPEX related to an investment (e.g. fuel gas for a compressor station) However, in general return from base business will further decrease through recent amendments of GasNEV since – “Planning” costs are no longer allowed – “One-time” costs are no longer allowed Methodical deficit re cost coverage ! Lack of an integrated regulated approach taking the different situation of TSOs into account Willingness vs. obligation vs. ability for TSOs to invest 18 Investments in infrastructure (2) - Remaining obstacles - Rate of returns for new investments still too low to activate capital Effect of new investments in efficiency benchmarking / incentive regulation still unclear / most probably negative Outlook for return from base business negative, i.e. ability for financing of new investments questionable Dominating mindset: TSOs earn too much ! Role of natural gas in the future in Germany ??? (energy concept of government) Outlook and sustainability of new investments ??? … 19 Thank you very much …. … However, we are still believing in and working for a better future … 20 Framework Guidelines on Capacity Allocation Mechanisms Based on ERGEG’s final version on 10th June 2010 TSO Corporation FG should specify procedures for adjacent TSO’s to corporate on following topics: Harmonisation and coordination of capacity services Harmonisation and coordination of allocation procedures Coordination of maintenance affecting IP’s Common communication procedures Calculation and maximisation of capacity Forecast information Potential congestions and the use of CMP measures Breakdown and offer (quotas) At least 10 % of the available capacity shall be reserved for firm short term capacity products Short term = less than 1 year The amount for each capacity service should be aligned between adjacent TSO’s Bundled services TSO’s should jointly offer bundled services Single allocation procedure Single nomination Bundling does not apply capacity allocated before Regulation 715/2009 enters into force March 2011 Entire technical capacity bundled 5 years after binding network code has entered into force Presumably 2017-2018 Capacity allocation TSO’s should offer capacity on a regular basis For all firm and interruptible services The longer the capacity duration, the longer the lead time Allocation procedures should be timed on EU level for all IP’s Capacity allocation - auctions Firm capacity should be allocated through auctions Anonymous Transparent Online based Day-ahead auctions are required Pro rata may be used for other durations (than day-ahead) where conditions for efficient and fair auctions are not met Auction revenues can be used for: Lowering network tariffs Investment in removing congestion Incentive for TSO to offer maximum capacity Interruptible services TSO’s should align interruptible capacity at every interconnection point Interruptions should be coordinated Network code should define reasons for interruptions, classes and sequence how interruptions takes place Within day interruptible nominations should be allowed Without having capacity Specific topics to discuss Bundling vs. coordinated products Auctioning models Interruptible products Restriction on renomination rights (CMP) Bundling vs. coordinated products Should trading on border points still be a possibility, or should all capacity be bundled? How to create a compromise (smaller shippers / traders urge for bundled products)? Auctioning models as allocation mechanism for capacity Is it acceptable to have different auctioning models for the different products (year, month, week, day)? Should the auction model be theoretical optimal, or include other aspects/requirements? Interruptible products Shall the interruptible product be based on nominations or by contracts? How should interruptible products be designed in the future, in relation to auctions? Restrictions on renomination rights Congestion Management Principle Is restrictions on renomination rights acceptable in a lighter version (e.g. German model)?