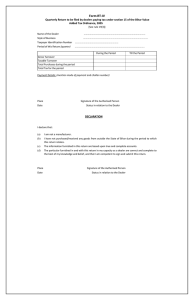

Haryana Value Added Tax Act, 2003

advertisement