Updated January 4, 2016 - National Hospice and Palliative Care

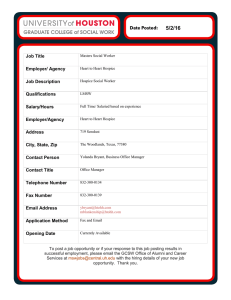

advertisement