Counting and Claiming—Table of Contents

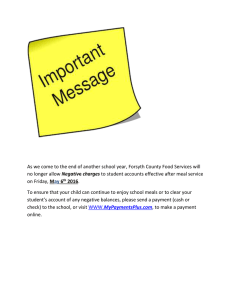

advertisement