KH - changes in italics ken to Karen to Kerry to Danny and back to

advertisement

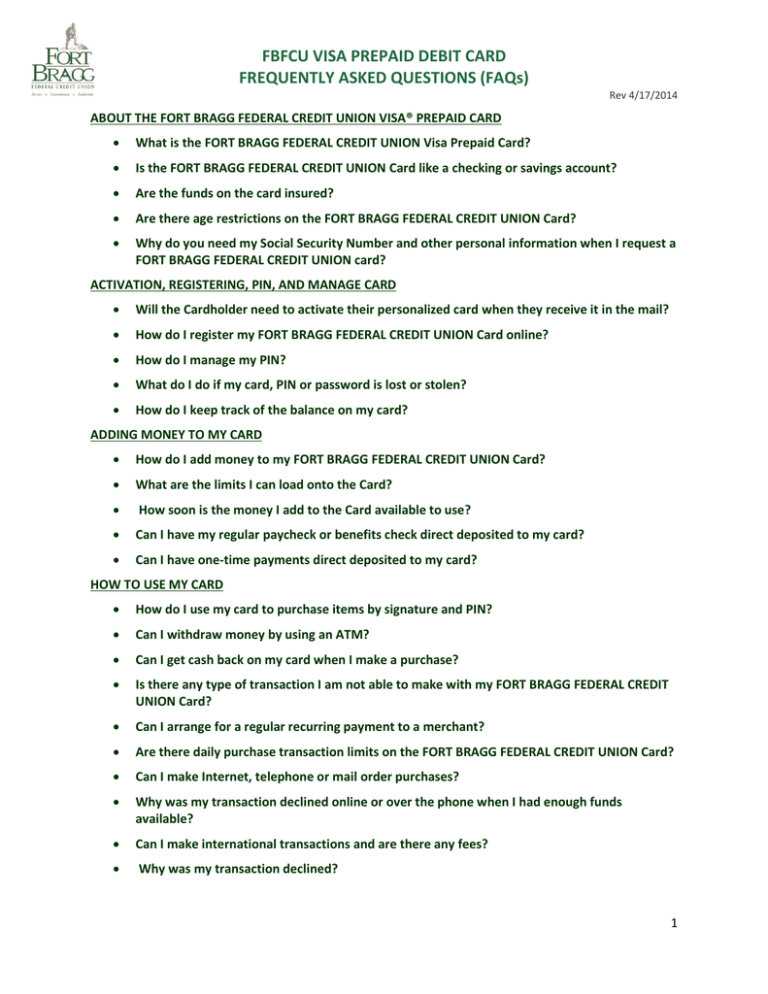

FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 ABOUT THE FORT BRAGG FEDERAL CREDIT UNION VISA® PREPAID CARD What is the FORT BRAGG FEDERAL CREDIT UNION Visa Prepaid Card? Is the FORT BRAGG FEDERAL CREDIT UNION Card like a checking or savings account? Are the funds on the card insured? Are there age restrictions on the FORT BRAGG FEDERAL CREDIT UNION Card? Why do you need my Social Security Number and other personal information when I request a FORT BRAGG FEDERAL CREDIT UNION card? ACTIVATION, REGISTERING, PIN, AND MANAGE CARD Will the Cardholder need to activate their personalized card when they receive it in the mail? How do I register my FORT BRAGG FEDERAL CREDIT UNION Card online? How do I manage my PIN? What do I do if my card, PIN or password is lost or stolen? How do I keep track of the balance on my card? ADDING MONEY TO MY CARD How do I add money to my FORT BRAGG FEDERAL CREDIT UNION Card? What are the limits I can load onto the Card? How soon is the money I add to the Card available to use? Can I have my regular paycheck or benefits check direct deposited to my card? Can I have one-time payments direct deposited to my card? HOW TO USE MY CARD How do I use my card to purchase items by signature and PIN? Can I withdraw money by using an ATM? Can I get cash back on my card when I make a purchase? Is there any type of transaction I am not able to make with my FORT BRAGG FEDERAL CREDIT UNION Card? Can I arrange for a regular recurring payment to a merchant? Are there daily purchase transaction limits on the FORT BRAGG FEDERAL CREDIT UNION Card? Can I make Internet, telephone or mail order purchases? Why was my transaction declined online or over the phone when I had enough funds available? Can I make international transactions and are there any fees? Why was my transaction declined? 1 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 SPLIT TRANSACTIONS Can I pay for part of a purchase with my FORT BRAGG FEDERAL CREDIT UNION Card and pay for the other part of the cost with another type of payment? HOTELS, LODGING, RENTALS and “HOLDS” What does it mean when a merchant places a “hold” on my card? Can I use my Card to reserve a Hotel, Lodging, Car Rental or similar purchases? RESTAURANTS, BEAUTY SALONS, LIMOS AND TAXIS How do I use my Card at restaurants and other businesses that accept “tips”? Can I buy gas with my Card? RETURNS AND REFUNDS If I am not satisfied with a purchase I made with my Fort Bragg Federal Credit Union Visa Prepaid Card, may I return the purchase? CARD EXPIRATION AND CANCELLING Will my Fort Bragg Federal Credit Union Visa Prepaid Card ever expire? Can I cancel my Fort Bragg Federal Credit Union Visa Prepaid Card? Can FORT BRAGG FEDERAL CREDIT UNION cancel my card? CARD FEES Will I be charged any fees for using a Fort Bragg Federal Credit Union Visa Prepaid Card? When is the monthly program fee deducted from my Card? What happens if I don’t use my Card for a few months and there is money still loaded on it? CUSTOMER SERVICE AND DISPUTES How do I report an error on my Card? How do I get answers to my questions that are not answered in this FAQ? ABOUT THE FORT BRAGG FEDERAL CREDIT UNION CARD VISA PREPAID CARD (1) What is the Fort Bragg Federal Credit Union Visa Prepaid Card? The Fort Bragg Federal Credit Union Visa Prepaid Card (FORT BRAGG FEDERAL CREDIT UNION Card) is a prepaid general purpose reloadable debit card that must have funds loaded on to it before you are able to use it. Once you load funds to your Card, you can use it to make purchases in person or online, wherever Visa® cards are accepted. You may also use your FORT BRAGG FEDERAL CREDIT UNION Card to withdraw money at ATMs. You are only able to spend or access the amount of money you have available on the card. You can load additional funds on to your FORT BRAGG FEDERAL CREDIT UNION Card when your funds run low. The Fort Bragg Federal Credit Union Visa Prepaid Card is not a credit card. 2 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 When you receive, register and use your FORT BRAGG FEDERAL CREDIT UNION Card, you accept and agree to follow all of the rules, terms and conditions outlined in the Cardholder Agreement included with the card. (2) Is the FORT BRAGG FEDERAL CREDIT UNION Card like a checking or savings account? Your FORT BRAGG FEDERAL CREDIT UNION Card is not a checking or savings account, but it can be used to help you manage your money. Use it like a checking account For example, you can load funds on to the card and use it to make purchases or ATM withdrawals. You can also have your paycheck or government benefits check direct deposited to your FORT BRAGG FEDERAL CREDIT UNION Card. Use it like a savings account The funds loaded to your FORT BRAGG FEDERAL CREDIT UNION Card do not expire, so you can build up your card balance if you are saving for a large purchase or payment. The maximum value that you can store on your FORT BRAGG FEDERAL CREDIT UNION Card is $10,000. You will continue to be charged a monthly maintenance fee of $5.00 until your card reaches a zero balance. Funds loaded to the FORT BRAGG FEDERAL CREDIT UNION Card do not earn interest and you cannot write checks. (3) Are funds loaded on to the FORT BRAGG FEDERAL CREDIT UNION Card insured? Yes, the funds you load to your FORT BRAGG FEDERAL CREDIT UNION Card are insured by the National Credit Union Share Insurance Fund (NCUSIF), up to the maximum amount provided by applicable law. (4) Are there age restrictions on the FORT BRAGG FEDERAL CREDIT UNION Card? Yes. You must be at least 18 years of age to receive and register the Card, and you may only authorize someone who is 18 years of age or older to use the Card. A parent or guardian can register a minor (someone at least 16 years of age and younger than 18 years of age) as an authorize user of a card. If a minor is authorized, both the adult and minor have to be registered on the prepaid account. Anyone you authorize to use your FORT BRAGG FEDERAL CREDIT UNION Card is also required to follow all card rules, terms and conditions set forth in the Cardholder Agreement. Please refer to the Cardholder Agreement for all card rules, terms and conditions. TO ACTIVATE, REGISTER, CHANGE PIN or MANAGE YOUR CARD (5) Will I need to activate my personalized FORT BRAGG FEDERAL CREDIT UNION Card or companion card that I receive in the mail? 3 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 Yes, simply follow the instructions included with your FORT BRAGG FEDERAL CREDIT UNION Card to activate your personalized card. Ways to activate a card: Call the customer service IVR number: 866-510-2983 (domestic) or 919-576-9931 (international) and follow the prompts Go to www.thecardcenter.com/fbfcu and follow the activation instructions (6) How do I register my FORT BRAGG FEDERAL CREDIT UNION Card online? After you receive your FORT BRAGG FEDERAL CREDIT UNION Card, go online and visit the website www.thecardcenter.com/fbfcu then sign in with your temporary password (your four digit year of birth). This allows you to complete the registration process. The first time you sign in, you will be asked to choose a new, personal password. You will then be able to sign in to the website to check your available balance or view your transaction history. Keep the Customer Service Number in a safe place. Write down the Customer Service Number and keep it in a place separate from your FORT BRAGG FEDERAL CREDIT UNION Card. This will be very helpful if your FORT BRAGG FEDERAL CREDIT UNION Card is ever lost or stolen. The Customer Service Number is 866-510-2983 (domestic) or 919-576-9931 (international). If you are not reporting a lost or stolen card or are activating a card there will be a $1 per minute customer service charge. Accessing your account online is free. Keep your contact information current. It is also your responsibility to keep your personal contact information current, including your current email address. Don’t forget to sign the back of your FORT BRAGG FEDERAL CREDIT UNION Card. The person who receives the FORT BRAGG FEDERAL CREDIT UNION Card and in whose name the card is issued must sign the back of the card in the designated space. (7) How do I change and manage my PIN? You will select your Personal Identification Number (PIN) when you received your FORT BRAGG FEDERAL CREDIT UNION Card. Your PIN is a 4-digit number that you will need in order to make cash transactions at ATM machines; you can also use your PIN at point of sale terminals. To change your PIN, log onto www.thecardcenter.com/fbfcu and follow the prompts. CAUTION: You are responsible for keeping your password and PIN safe and not sharing them with others. Do not release your PIN for on-line (internet) transactions. (8) What do I do if my Card, PIN or password is lost or stolen? Please call Customer Service at 866-510-2983 (domestic) or 919-576-9931 (international) IMMEDIATELY if you think your password, your PIN, or your FORT BRAGG FEDERAL CREDIT UNION Card have been lost, stolen, or otherwise compromised. (9) How do I keep track of the balance on my FORT BRAGG FEDERAL CREDIT UNION Card? 4 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 There are four ways to keep track of your FORT BRAGG FEDERAL CREDIT UNION Card balance: Log in to www.thecardcenter.com/fbfcu to view your transaction history and card balance. There is no charge for this service. Call Customer Service at 866-510-2983 (domestic) or 919-576-9931 (international), and then listen for the “Prepaid Card” prompt. A live customer service fee of $1.00 per minute applies. Perform a “Balance Inquiry” at a Fort Bragg FCU ATM for free. At non-Fort Bragg FCU ATMs there will be a $1 charge per inquiry.. You can receive a paper statement each month for a $1 charge each month. You can also request a 30 -day written history of your account transactions by writing to us at our mailing address. There will be a $1.00 fee per request for this service. Our mailing address is: FORT BRAGG FEDERAL CREDIT UNION Prepaid Card (MAV) 455 S. Gulph Rd, Ste 405, King of Prussia, PA 19406. ADDING MONEY TO MY CARD (10) How do I add money to my FORT BRAGG FEDERAL CREDIT UNION Card? There are three ways to add additional funds to your FORT BRAGG FEDERAL CREDIT UNION Card: FREE - Add funds (cash) by going to any authorized FORT BRAGG FEDERAL CREDIT UNION location. FREE - Arrange for your employer or benefits provider to make a direct deposit to your FORT BRAGG FEDERAL CREDIT UNION Card. See the FAQ section titled “Direct Deposit to your Card” for more details Green Dot MoneyPak – A service fee up to $4.95 will apply. We may change acceptable card funding methods at any time for legal or other reasons. (11) What are the limits I can load onto my FORT BRAGG FEDERAL CREDIT UNION Card? The minimum amount you may load on a FORT BRAGG FEDERAL CREDIT UNION Card at any time is $10.00. The maximum load amount you may load on your Card is $10,000. Please note that the maximum load amount is not tracked by calendar month. For example, if you load your card on October 19, the thirty day period begins that day. We may change these limits at any time without notice to you for security or legal reasons. (12) How soon are my funds available to use? Cash: Any cash you load on to your FORT BRAGG FEDERAL CREDIT UNION Card is available immediately. This includes cash loaded at one of the authorized FORT BRAGG FEDERAL CREDIT UNION locations. CAUTION: If you are loading your card at a Green Dot merchant, please refer to the instructions that will accompany your money pack. In most cases cash loads at these merchants will not be immediately available. 5 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 Direct Deposit: Funds from direct deposits will be available to you on the same day the funds are credited from the Federal Reserve. Check: Funds from checks could have up to a 10 business day delay before being made available in your Prepaid Card balance. (13) Can I have my regular paycheck or government benefits check direct deposited to my FORT BRAGG FEDERAL CREDIT UNION Card? Yes and it is safe and very easy! Step 1: Log on to www.thecardcenter.com/fbfcu Step 2: Print and sign the Direct Deposit form that is prefilled with all the information your employer or benefits administrator will need. The Pre-paid card routing number is 053185671. Step 3: Give to your employer or benefits administrator That’s it, you are ready to go. This can give you peace of mind knowing your funds will be available each pay period on a specific day without delay. Please note that it can take a couple of pay periods to have your deposit made directly to your FORT BRAGG FEDERAL CREDIT UNION Card account. If you have arranged for a regular direct deposit to be made to your FORT BRAGG FEDERAL CREDIT UNION Card account, you can check your account balance online at www.thecardcenter.com/fbfcu or call Customer Service 866-510-2983 (domestic) or 919-5769931 (international) to find out if the deposit has been made. You should get in the habit of regularly checking your balance so you always know how much money you have available on your FORT BRAGG FEDERAL CREDIT UNION Card. (14) Can I have one-time payments direct deposited to my FORT BRAGG FEDERAL CREDIT UNION Card? Yes! You can arrange to have a one-time payment – like an income tax refund check – direct deposited to your FORT BRAGG FEDERAL CREDIT UNION Card. You must provide your FORT BRAGG FEDERAL CREDIT UNION Card account number and the Pre-paid card routing number (053185671) to the payor. This is the same information that is provided on the Direct Deposit form. HOW TO USE MY CARD (15) How do I use my PIN or use my signature for store purchases when I use my FORT BRAGG FEDERAL CREDIT UNION Card? 6 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 You can use your FORT BRAGG FEDERAL CREDIT UNION VISA PREPAID Card anywhere Visa Debit Cards are accepted. You can use it either with your 4 digit PIN or by Signature. Signature Purchase: Swipe your FORT BRAGG FEDERAL CREDIT UNION Card at the point of sale terminal and press “Clear,” “Cancel,” or “Credit” to process your transactions as a signature purchase. Then, sign your name when you are prompted to do so. PIN Purchase: Swipe your FORT BRAGG FEDERAL CREDIT UNION Card and press “Debit,” then enter your PIN when prompted. CAUTION: To keep your FORT BRAGG FEDERAL CREDIT UNION Card secure, never write your PIN on your card or share your PIN with anyone. (16) Can I withdraw money using an ATM? Yes. The maximum ATM withdrawal amounts are $500 per day, which includes any fees assessed.. Use the “withdrawal from checking” option on the ATM keypad to withdraw cash. Visit any ATM displaying the network logo(s) on the back of your card to withdraw cash. If you use an ATM you may be charged a fee by the individual ATM owner in addition to the fee disclosed in the FORT BRAGG FEDERAL CREDIT UNION Cardholder Agreement. (17) Can I buy gas with my card? Yes, but when you use your FORT BRAGG FEDERAL CREDIT UNION Card at a gas station, be sure to pre-pay the cashier inside before you fill up and tell the cashier the exact amount of gas you wish to purchase with your FORT BRAGG FEDERAL CREDIT UNION card. Do not swipe your card at the pump or you may incur a hold of up to $75. We recommend that you always pay the cashier first for the amount of gas you wish to purchase. (18) Can I get cash back on my FORT BRAGG FEDERAL CREDIT UNION Card when I make a purchase? Yes, depending on the amount of funds you have available in your FORT BRAGG FEDERAL CREDIT UNION Card account. You may be able to perform this type of cash-back transaction at any merchant that accepts Visa Debit Cards. CAUTION: Not all merchants will permit this type of transaction. (19) Is there any type of transaction I am not able to perform with my FORT BRAGG FEDERAL CREDIT UNION Card? You cannot use your FORT BRAGG FEDERAL CREDIT UNION Card for online gambling or any other illegal transactions. Please see the FORT BRAGG FEDERAL CREDIT UNION Cardholder Agreement for details. (20) Can I preauthorize a recurring payment to a merchant? 7 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 Yes. To authorize a one-time automatic payment OR a regular recurring payment to a merchant you must provide the merchant with your 16-digit card account number from the front of the FORT BRAGG FEDERAL CREDIT UNION Card. CAUTION: You must have funds available on your FORT BRAGG FEDERAL CREDIT UNION Card to cover these payments; your FORT BRAGG FEDERAL CREDIT UNION Card does not carry a credit line or any Overdraft Protection. (21) Are there daily purchase transaction limits on my Card? Yes. These limits are described below. You may not exceed the amount of available funds on your card. Type of Transaction Signature Transaction PIN transaction ATM Daily $1,000 $500 $500 For security reasons, we may impose additional limits on the amount, number or type of transactions you can make with your FORT BRAGG FEDERAL CREDIT UNION Card, and we may restrict access to your card if we notice any suspicious activity. (22) Can I make Internet, telephone or mail order purchases? Yes, you may use your FORT BRAGG FEDERAL CREDIT UNION Card to purchase goods or services over the internet, by telephone or by mail order. These purchases are subject to the following limits: Type of Transaction Signature Transaction PIN transaction Daily $1,000 $500 Please make sure to provide the valid address information when making these types of purchases to avoid unnecessarily declined transactions. (23) Why was my transaction declined online or over the phone when I had enough funds available? One possibility the purchase you made online may have been declined is the address you provided to the merchant is different than the address we have on file for your FORT BRAGG FEDERAL CREDIT UNION Card. (24) Can I make international transactions and are there any fees? Yes, you can make international transactions. If you make a transaction in a currency other than U.S. Dollars, Visa® will convert the transaction amount into U.S. Dollars using its currency conversion procedure. Conversion rates and fees will apply. For each transaction made in a 8 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 country other than the United States or its territories, you will be charged a fee equal to 1 percent of the U.S. Dollar amount of the transaction. For more details, please refer to your FORT BRAGG FEDERAL CREDIT UNION Cardholder Agreement. You may also use your FORT BRAGG FEDERAL CREDIT UNION Card at international ATM’s if they are a part of a network who’s logo is imprinted on the back of your card. Please note you will be assessed the appropriate ATM fees as described in your FORT BRAGG FEDERAL CREDIT UNION Cardholder Agreement. (25) Why was my transaction declined? The most common reasons a transaction may be declined are: Insufficient funds are available. Please check your funds availability and transaction history. The restaurant or merchant you patronized authorized the transaction for 20 percent more than the original purchase price to cover a possible gratuity. You attempted to use your FORT BRAGG FEDERAL CREDIT UNION Card at a “Pay at the Pump” gas station and there is a temporary hold of $75.00 on your card. Please make sure to pre-pay for any gas purchases with the cashier. There is an extended hold placed on your card from activity at a hotel, car rental, or similar merchant. SPLIT TRANSACTIONS (26) Can I pay for part of a purchase with my FORT BRAGG FEDERAL CREDIT UNION Card and pay for the other part of the purchase with another type of payment? Some merchants do not allow cardholders to conduct split transactions where you would use your FORT BRAGG FEDERAL CREDIT UNION Card as partial payment for goods and services and then pay the remainder of the balance with another form of legal tender. If you wish to conduct a split transaction and it is permitted by the merchant, you must tell the merchant to charge only the exact amount of funds available on your FORT BRAGG FEDERAL CREDIT UNION Card to the Card. You must then arrange to pay the difference using another payment method. Some merchants may require payment for the remaining balance in cash. If you fail to inform the merchant that you would like to complete a split transaction prior to swiping your FORT BRAGG FEDERAL CREDIT UNION Card, your transaction will likely be declined. HOTELS, LODGING, RENTALS and “HOLDS” (27) What does it mean when a merchant places a “hold” on my card? When you use your FORT BRAGG FEDERAL CREDIT UNION Card to pay for goods or services, some merchants (typically car rental companies and hotels) may authorize the transaction in advance. This places a temporary “hold” on your card for the amount of the sale plus an additional amount or percentage greater than the sale amount depending on the individual merchant. 9 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 If your transaction is for a high dollar amount, some types of merchants may place extended holds on your card for 10 days (up to 90 days for car rentals). Once your purchase goes through, any excess holds will be removed from your card. If you begin a transaction that requires a hold on your funds and then cancel the transaction, there still may be a temporary hold on your funds for up to ten (10) days or more. CAUTION: Please note we cannot manually release authorizations or holds without a certified letter or fax from the merchant. (28) Can I use my FORT BRAGG FEDERAL CREDIT UNION Card for a reservation at a Hotel, other Lodging, Car Rental or similar purchases? Yes, but these companies may authorize, or place a “hold” (as described above) for much more money than the actual cost of the service to be provided. For example, the Rental Car Company or hotel will not know if they need to charge you for additional expenses like damages or extra days until you return the vehicle or check-out of the hotel. These authorized funds will be held and unavailable for you to spend until the final transaction is posted to your card. This means that you might not have access to these funds for as long as 90 days. To avoid problems our advice is to first call the company and ask them what their policy is regarding the use of prepaid debit cards. CAUTION: Please note we cannot manually release authorizations or holds without a certified letter or fax from the merchant. GAS STATIONS, RESTAURANTS, BEAUTY SALONS, LIMOS AND TAXIS (29) How do I use my FORT BRAGG FEDERAL CREDIT UNION Card at restaurants and other businesses that accept “tips”? These merchants typically place holds for the amount of the bill plus a percentage (typically 20 percent) for the tip or gratuity. If the amount of the requested hold exceeds the amount of money available on your FORT BRAGG FEDERAL CREDIT UNION Card, the transaction may be declined. After the final transaction settles any excess holds will be removed from your card. (30) Can I buy gas with my card? Yes, but when you use your FORT BRAGG FEDERAL CREDIT UNION Card at a gas station, be sure to pre-pay the cashier inside before you fill up and tell the cashier the exact amount of gas you wish to purchase with your FORT BRAGG FEDERAL CREDIT UNION card. CAUTION: Do not swipe your card at the pump or you may incur a hold of up to $75. We recommend that you always pay the cashier first for the amount of gas you wish to purchase. RETURNS AND REFUNDS 10 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 (31) If I am not satisfied with a purchase I made with my FORT BRAGG FEDERAL CREDIT UNION Card, may I return the purchase? All purchases you make with your FORT BRAGG FEDERAL CREDIT UNION Card are subject to the merchant’s return policies. If you are entitled to a refund for any reason, it may be made as a “credit” to your card or you may receive cash. The amount of the refund credit may not be available to you right away – you may have to wait up to five business days from the date of the refund to make sure the amount of the credit has cleared and is available to you to spend. CARD EXPIRATION AND CANCELING (32) Will my FORT BRAGG FEDERAL CREDIT UNION Card ever expire? There is a “Valid Thru” date on your FORT BRAGG FEDERAL CREDIT UNION Card. You may not use the card after this date. You should receive a replacement card from us before your old card expires. The funds you have available on your FORT BRAGG FEDERAL CREDIT UNION Card remain good even if the “Valid Thru” date passes. The funds will be available on the replacement card. If you do not receive a replacement card before the date on the old card passes, please call Customer Service at 866-510-2983 (domestic) or 919-576-9931 (international). If we are unable to send you a replacement card for any reason, keep your old card and call Customer Service at 866-510-2983 (domestic) or 919-576-9931 (international). (33) Can I cancel my FORT BRAGG FEDERAL CREDIT UNION Card? Yes. You may cancel your FORT BRAGG FEDERAL CREDIT UNION Card at any time by visiting your local Fort Bragg Federal Credit Union branch or by calling Customer Service at 866-5102983 (domestic) or 919-576-9931 (international). If there are any funds remaining on your card, we may issue a check to you for this amount, minus the check issuance fee of $2.00. We will verify that all card transactions are posted before we process a refund. We reserve the right to investigate all requests for cancellation before issuing any refunds. (34) Can you cancel my FORT BRAGG FEDERAL CREDIT UNION Card? Yes, we reserve the right to cancel your card if you have not used or loaded your card in one year’s time. We may also cancel your card under the following conditions: If you violate any of the card rules, terms and conditions set forth in the Cardholder Agreement, as may be amended from time-to-time. If you do not pay any necessary fees within forty-five (45) days after they are due. If we believe there is fraud or security risks connected to your FORT BRAGG FEDERAL CREDIT UNION Card. For any other reason allowed by law. 11 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 If we cancel your card, you will not be able to use your card to make purchases or transactions at ATMs. We will issue you a refund. CARD FEES (35) Will I be charged any fees for using an FORT BRAGG FEDERAL CREDIT UNION Card? Yes. The complete and most current fee schedule is posted at www.thecardcenter.com/fbfcu. The Cardholder Agreement that came with your card also shows a list of fees; however these may not be the most current, depending on when you received your card. Please see check the website at www.thecardcenter.com/fbfcu to view the current Cardholder Agreement. (36) When is the monthly program fee deducted from my FORT BRAGG FEDERAL CREDIT UNION Card? Monthly fees are assessed on the first day of every calendar month. What happens if I don’t use my card for a few months and there is money still on it? You will continue to be charged a monthly maintenance fee until the account balance reaches Zero. If you like you can visit your local Fort Bragg Federal Credit Union branch or call 866-5102983 (domestic) or 919-576-9931 (international) to have the account closed and a check will be sent to you with the remaining balance minus the $2.00 check issuance fee. CUSTOMER SERVICE AND DISPUTES (37) How do I report an error on my FORT BRAGG FEDERAL CREDIT UNION Card? Telephone us at the Customer Service Number, 866-510-2983 (domestic) or 919-576-9931 (international) as soon as you can, if you think an error has occurred in your Card account. Describe the error or transaction that you are unsure about, and explain as clearly as possible why you believe that it is an error or why you need more information. Also provide the dollar amount involved and approximately when the error took place. We must allow you to report an error until 60 days after the transaction posting date. For disputes or fraud, cardholders will complete, in its entirety, the Prepaid Cardholder Dispute or Fraud Form, which can be obtained at any branch of the credit union. The form may be mailed, faxed, or e-mailed to a cardholder by a credit union staff member. Or, the form may be obtained at our website, www.fortbraggfcu.org. See Applications & Forms/Forms. The cardholder will be sure to sign their name on the form in front of a Notary Public and have the form notarized. Submissions of the completed form will be made directly to: Billing Errors (FBS-MVK), 455 S Gulph Road, Ste 405, King of Prussia, PA 19406. Error corrections and refunds are processed by FIServ/PPM. There is a complete explanation of our process for investigating errors in the FORT BRAGG FEDERAL CREDIT UNION Cardholder Agreement and at www.thecardcenter.com/fbfcu. Investigating errors takes time, and if it is determined that there was an error on your account it may take time to credit your account for the amount of the error. 12 FBFCU VISA PREPAID DEBIT CARD FREQUENTLY ASKED QUESTIONS (FAQs) Rev 4/17/2014 (38) How do I get answers to my questions that are not answered in this FAQ? We know from time to time you may have additional questions. You may email a question to us from the “Contact Us” page at www.thecardcenter.com/fbfcu or call Customer Service at 866510-2983 (domestic) or 919-576-9931 (international). TROUBLE SHOOTING DECLINES and CARD NOT WORKING MESSAGES 1. Check to make sure the Card is active. 2. Check the available balance on the Card. Pay close attention to any pending authorizations or “Holds” that may be on the Card. 3. Incorrect PIN being used. Cardholder can change their PIN by logging in to www.thecardcenter.com/fbfcu. 4. Internet and phone purchases may decline if the address provided to the merchant does not match the address registered to the card. 5. Certain business categories may cause unexpected declines: a. Gas Station “Pay at the Pump”: Cardholders who use the “Pay at the Pump” automated method may incur a $75.00 authorization. Cardholders should pre-pay with the cashier for the exact amount to avoid any unnecessary holds. b. Restaurants, Beauty Salons, Spas, Barbers, Taxis and Limos: Typically authorize the card for 20 percent above the purchase amount to cover any potential tip. c. Hotels, Motels, Resorts and other Lodging: They will often place a significant “Hold” above and beyond the expected room rate to cover potential additional room expenses. d. Car and Truck Rental: They will often place a significant “Hold” above and beyond the expected rental rate to cover potential additional rental expenses. e. Craigslist does not allow Prepaid Card purchases. 13