Brand Portfolio Strategy and Firm Performance

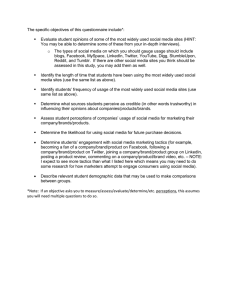

advertisement