Plug-in Hybrid Electric Vehicles

advertisement

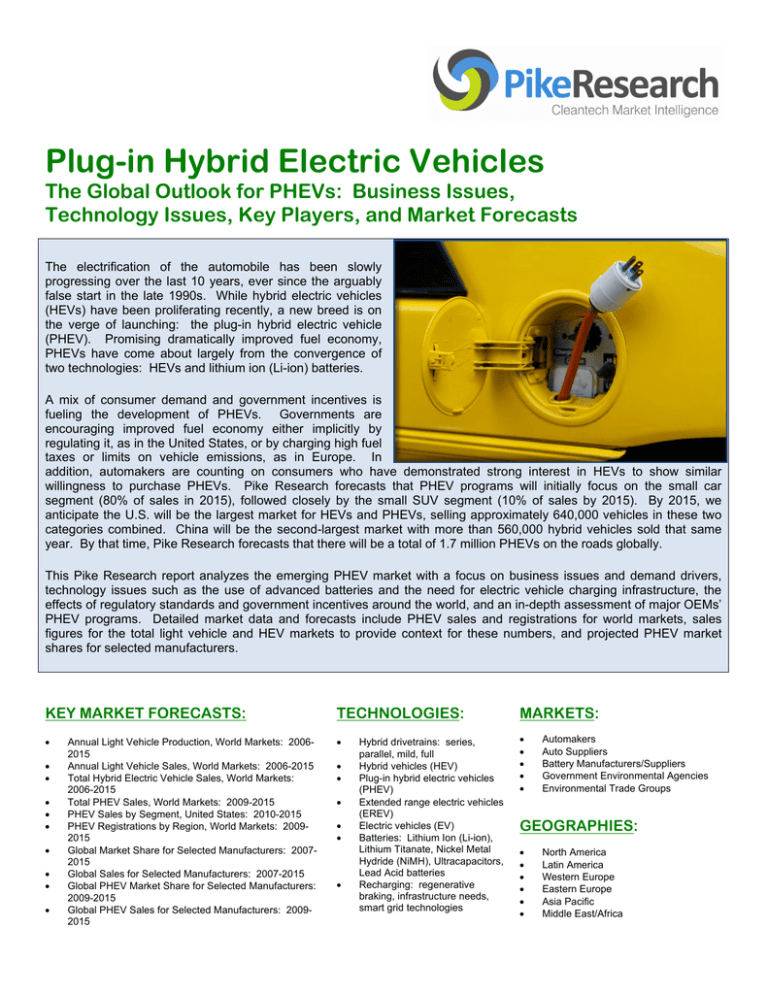

Plug-in Hybrid Electric Vehicles The Global Outlook for PHEVs: Business Issues, Technology Issues, Key Players, and Market Forecasts The electrification of the automobile has been slowly progressing over the last 10 years, ever since the arguably false start in the late 1990s. While hybrid electric vehicles (HEVs) have been proliferating recently, a new breed is on the verge of launching: the plug-in hybrid electric vehicle (PHEV). Promising dramatically improved fuel economy, PHEVs have come about largely from the convergence of two technologies: HEVs and lithium ion (Li-ion) batteries. A mix of consumer demand and government incentives is fueling the development of PHEVs. Governments are encouraging improved fuel economy either implicitly by regulating it, as in the United States, or by charging high fuel taxes or limits on vehicle emissions, as in Europe. In addition, automakers are counting on consumers who have demonstrated strong interest in HEVs to show similar willingness to purchase PHEVs. Pike Research forecasts that PHEV programs will initially focus on the small car segment (80% of sales in 2015), followed closely by the small SUV segment (10% of sales by 2015). By 2015, we anticipate the U.S. will be the largest market for HEVs and PHEVs, selling approximately 640,000 vehicles in these two categories combined. China will be the second-largest market with more than 560,000 hybrid vehicles sold that same year. By that time, Pike Research forecasts that there will be a total of 1.7 million PHEVs on the roads globally. This Pike Research report analyzes the emerging PHEV market with a focus on business issues and demand drivers, technology issues such as the use of advanced batteries and the need for electric vehicle charging infrastructure, the effects of regulatory standards and government incentives around the world, and an in-depth assessment of major OEMs’ PHEV programs. Detailed market data and forecasts include PHEV sales and registrations for world markets, sales figures for the total light vehicle and HEV markets to provide context for these numbers, and projected PHEV market shares for selected manufacturers. KEY MARKET FORECASTS: TECHNOLOGIES: MARKETS: Annual Light Vehicle Production, World Markets: 20062015 Annual Light Vehicle Sales, World Markets: 2006-2015 Total Hybrid Electric Vehicle Sales, World Markets: 2006-2015 Total PHEV Sales, World Markets: 2009-2015 PHEV Sales by Segment, United States: 2010-2015 PHEV Registrations by Region, World Markets: 20092015 Global Market Share for Selected Manufacturers: 20072015 Global Sales for Selected Manufacturers: 2007-2015 Global PHEV Market Share for Selected Manufacturers: 2009-2015 Global PHEV Sales for Selected Manufacturers: 20092015 Hybrid drivetrains: series, parallel, mild, full Hybrid vehicles (HEV) Plug-in hybrid electric vehicles (PHEV) Extended range electric vehicles (EREV) Electric vehicles (EV) Batteries: Lithium Ion (Li-ion), Lithium Titanate, Nickel Metal Hydride (NiMH), Ultracapacitors, Lead Acid batteries Recharging: regenerative braking, infrastructure needs, smart grid technologies Automakers Auto Suppliers Battery Manufacturers/Suppliers Government Environmental Agencies Environmental Trade Groups GEOGRAPHIES: North America Latin America Western Europe Eastern Europe Asia Pacific Middle East/Africa TABLE OF CONTENTS: 1. Executive Summary 2. Market Issues 4.2 Government Emissions Regulations 4.2.1 United States 4.2.1.1 CAFÉ Standards 4.2.1.2 EPA Emissions Limitations 4.2.2 Canada 4.2.3 Mexico 4.2.4 Europe 4.2.5 Japan 4.2.6 China 4.2.7 India 2.1 History 2.2 Plug-in Hybrid Electric Vehicles 2.2.1 PHEVs by Vehicle Type 2.2.1.1 Passenger Cars 2.2.1.2 Light Trucks 2.2.2 Competition from Chinese Manufacturers 2.3 Product Demand vs. Development 2.3.1 Other “Green” Vehicle Technologies 2.3.1.1 Battery Electric Vehicles 2.3.1.2 Hydrogen-Powered Vehicles 2.3.1.3 Fuel Cell Vehicles 2.3.2 Chrysler and General Motors Bankruptcy Impact on PHEV Development 2.3.3 Automotive X-Prize 2.3.4 Urban Planning Impact on Automobile Development 3. 4.3 Government Incentives 4.3.1 American Recovery and Reinvestment Act of 2009 (ARRA) 4.3.2 Canada 4.3.3 Europe 4.3.4 Japan 4.3.5 China 4.3.6 Other Regulatory Incentives 5. 5.1 Original Equipment Manufacturers 5.1.1 BMW/Mini 5.1.2 Chinese Manufacturers 5.1.3 Chrysler 5.1.4 Daimler 5.1.5 Ford Motor Co. 5.1.6 Fiat 5.1.7 General Motors 5.1.8 Honda 5.1.9 Hyundai/Kia 5.1.10 Mitsubishi 5.1.11 Nissan/Renault 5.1.12 PSA Peugeot/Citroen 5.1.13 Toyota Motor Corp. 5.1.14 Volkswagen/Audi Technology Issues 3.1 Plug-in Hybrid Electric Vehicle Drivetrains 3.1.1 Terminology Defined 3.1.2 Parallel Hybrid Design 3.1.2.1 Belt Alternator Start 3.1.2.2 Mild Hybrids 3.1.2.3 Full Hybrids 3.1.3 Series Hybrid Design/Extended Range Electric Vehicle 3.2 Battery Technology 3.2.1 Battery Chemistry 3.2.1.1 Lead Acid Batteries 3.2.1.2 Nickel-Sodium Chloride Batteries 3.2.1.3 Nickel Metal Hydride Batteries 3.2.1.4 Lithium Ion Batteries 3.2.1.5 Lithium Titanate Batteries 3.2.1.6 Growing Geopolitical Concerns with Lithium and Other Advanced Battery Chemicals 3.2.2 Safety Concerns 5.2 Key Suppliers 5.2.1 A123 Systems 5.2.2 Cobasys 5.2.3 Eaton Corp. 5.2.4 EnergyCS (Battery Management Systems) 5.2.5 Enova Systems, Inc. 5.2.6 GS Yuasa 5.2.7 Johnson Controls-Saft 5.2.8 LG Chemical/Compact Power 5.2.9 National Alliance for Advanced Transportation Battery Cell Manufacture (NAATBCM) 5.2.10 Panasonic EV Energy 3.3 Ultracapacitors 3.4 Regenerative Braking 3.5 Recharging Infrastructure 3.5.1 Electric Utilities and Smart Grid Technologies 3.5.2 Vehicle Electronics and Engine Monitoring 4. Demand Drivers 4.1 Market-Based Demand 4.1.1 Fuel Prices 4.1.1.1 Hypermiling 4.1.2 Consumer Preference 4.1.2.1 Niche Manufacturers 4.1.3 Global Warming and Peal Oil Awareness Key Industry Players 6. Market Forecasts 6.1 Global Vehicle Sales Forecast: 2006-2015 6.1.1 United States and Canada 6.1.2 Latin America 6.1.3 Europe 6.1.4 Asia Pacific 6.2 Hybrid Electric Vehicles Forecast: 2006-2015 6.2.1 HEV Forecast 6.2.2 PHEV Forecast 6.2.3 HEV and PHEV Forecast for the Rest of the World 6.3 PHEV Sales Forecast by Vehicle Segment, United States: 2015 6.4 PHEV Registrations Forecast: 2009-2015 6.4.1 North America 6.4.2 Europe 6.4.3 Asia Pacific 6.5 Global Market Share Forecasts for Selected Manufacturers 6.5.1 Selected OEM PHEV Market Share Forecasts: 2010, 2015 6.5.1.1 Toyota Motor Corp. Market Share Forecasts: 2010-2015 6.5.1.2 General Motors Market Share Forecasts: 2010-2015 6.5.1.3 Ford Motor Co. Market Share Forecasts: 2010-2015 6.6 Summary and Conclusions 7. 8. 9. 10. 11. Company Directory Acronym and Abbreviation List Table of Contents Table of Charts and Figures Scope of Study, Sources and Methodology, Notes TABLE OF TABLES: TABLE OF CHARTS & FIGURES: Total Hybrid Sales (HEVs and PHEVs), World Markets: 2007-2015 HEV and PHEV Sales, World Markets: 2007-2015 PHEV Sales by Segment, United Sates: 2015 Global Lithium Reserves Base by Country: 2005 Vehicle Sales, World Markets: 2006-2015 Vehicle Sales, United States and Canada: 2006-2015 Vehicle Sales, Latin America: 2006-2015 Vehicle Sales, Western and Eastern Europe: 2006-2015 Vehicle Sales, China, Japan, and India: 2006-2015 HEV Sales, World Markets: 2006-2015 PHEV Sales, World Markets: 2009-2015 Total Hybrid Sales (HEVs and PHEVs), World Markets: 2007-2015 PHEV Sales by Vehicle Segment, United States: 2015 PHEV Registrations Forecast, World Markets: 2009-2015 Selected OEM Global Market Shares, World Markets: 2007, 2009, 2015 Selected OEM PHEV Market Shares, World Markets: 2010, 2015 Typical State of Charge for Plug-in Hybrid Electric Vehicles Series and Parallel Hybrid Drivetrains Diagram Peak Oil Curve – World Oil Production (Crude Oil + NGL) and Forecasts (1940-2050) Annual Automobile Vehicle Miles of Travel (VMT) per Capita: 1997 PHEV Product Plans, North America: 2010-2012 & Beyond PHEV Product Plans, Europe: 2010-2012 & Beyond PHEV Product Plans, Asia Pacific: 2010-2012 & Beyond Consumer Preferences for Electric Vehicle Range Lithium Production, Country Markets: 2005 Annual Growth in Light Vehicle Production, World Markets: 2007-2015 Annual Light Vehicle Production, World Markets: 2006-2015 Annual Growth in Total Vehicle Sales, World Markets: 20072015 Annual Vehicle Sales, World Markets: 2006-2015 HEV Sales Growth Rate, World Markets: 2007-2015 HEV Sales, World Markets: 2006-2015 PHEV Sales Growth Rate, World Markets: 2010-2015 PHEV Sales, World Markets: 2009-2015 Total Hybrid Electric Vehicle Sales (HEVs and PHEVs) Growth Rate, World Markets: 2007-2015 Total Hybrid Electric Vehicle Sales (HEVs and PHEVs), World Markets: 2006-2015 PHEV Sales by Segment, United Sates: 2010-2015 PHEV Registration Growth Rates by Region, World Markets: 2010-2015 PHEV Registrations by Region, World Markets: 2009-2015 Global Market Share for Selected Manufacturers: 2007-2015 Global Sales for Selected Manufacturers: 2007-2015 Global PHEV Market Share for Selected Manufacturers: 20092015 Global PHEV Sales for Selected Manufacturers: 2009-2015 PHEV Sales, World Markets: 2009-2015 700,000 600,000 Sales (Vehicles) 500,000 Africa/Middle East Asia Pacific 400,000 Eastern Europe 300,000 Western Europe Latin America 200,000 North America 100,000 2009 2010 2011 2012 2013 2014 2015 (Source: Pike Research) KEY QUESTIONS ADDRESSED: What HEV and PHEV programs are planned for the next few years? What are the consumer acceptance issues associated with PHEVs? How will the PHEV market be segmented between different vehicle classes? What are the key technologies used in HEVs and PHEVs? How big are the HEV and PHEV markets and how large are these markets expected to grow? What are the key drivers of growth in the HEV and PHEV markets? What will be the effects of regulatory standards and government incentives on the emerging PHE V market? Who are the key industry players in the HEV and PHEV markets? How will the adoption of PHEVs vary by world region? WHO NEEDS THIS REPORT? OEM Vehicle Marketing Managers Vehicle Component Suppliers Battery Manufacturers Government Environmental Agencies Government Transportation Agencies Environmental Transportation Advocacy Groups Vehicle Trade Associations Utility Managers Investor Community REPORT DETAILS: Price: $2500 Pages: 61 Tables, Charts, Figures: 42 Release Date: 3Q 2009 TO ORDER THIS REPORT: Phone: +1 303 997 7609 Email: sales@pikeresearch.com