Econ 202 Final Exam - WVU College of Business and Economics

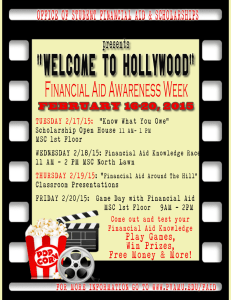

advertisement

Douglas, Spring 2008 PLEDGE: I have neither given nor received unauthorized help on this exam. SIGNED:__________________________ May 7, 2008 PRINT NAME: __________________________________ Econ 202 Final Exam 1. The aggregate supply curve is upward sloping in a. the short and long run. b. neither the short nor long run. c. the long run, but not the short run. d. the short run, but not the long run. 2. Human capital is the a. knowledge and skills that workers acquire through education, training, and experience. b. stock of equipment and structures that is used to produce goods and services. c. total number of hours worked in an economy. d. same thing as technological knowledge. 3. If the reserve ratio is 5 percent, $1,000 of additional reserves can create up to a. $25,000 of new money. b. $20,000 of new money. c. $19,000 of new money. d. $15,000 of new money. 4. If the government raises its expenditures, in the short run, prices a. rise and unemployment falls. b. fall and unemployment rises. c. and unemployment rise. d. and unemployment fall. 5. During the last half of 1980, the U.S. unemployment rate was about 7.5 percent. Historical experience suggests that this is a. above the natural rate, so that real GDP growth was likely low. b. above the natural rate, so that real GDP growth was likely high. c. below the natural rate, so that real GDP growth was likely low. d. below the natural rate, so that real GDP growth was likely high. 6. Which of the following would shift the short-run aggregate supply curve to the right? a. a decrease in the actual price level. b. an increase in the actual price level. c. a decrease in the expected price level. d. an increase in the expected price level. 7. The short-run relationship between inflation and unemployment is often called a. the Classical Dichotomy. b. Money Neutrality. c. the Phillips curve. d. the Keynesian cross. 8. The Federal Funds rate is the interest rate a. banks charge each other for short-term loans. b. the Fed charges depository institutions for short-term loans. c. the Fed pays on deposits. d. interest rate on 3 month Treasury bills. 1 Econ202 Final Exam, Spring 2008 Douglas 9. Classical economist David Hume observed that as the money supply expanded after gold discoveries it took 10. 11. 12. 13. 14. 15. 16. 17. some time for prices to rise and in the meantime the economy enjoyed higher employment and production. This is inconsistent with the classical dichotomy and monetary neutrality because a. monetary neutrality would mean that neither prices nor production should have risen. b. monetary neutrality would mean that production should have risen, but not prices. c. monetary neutrality would mean the prices should have risen, but not production. d. monetary neutrality would mean that prices and production should both have fallen. Other things the same, when the price level rises, a. interest rates rise, so firms increase investment. b. interest rates rise, so firms decrease investment. c. interest rates fall, so firms increase investment. d. interest rates fall, so firms decrease investment. People are likely to want to hold more money if the interest rate a. increases making the opportunity cost of holding money rise. b. increases making the opportunity cost of holding money fall. c. decreases making the opportunity cost of holding money rise. d. decreases making the opportunity cost of holding money fall. If households view a tax cut as temporary, the tax cut a. has no affect on aggregate demand. b. has more of an affect on aggregate demand than if households view it as permanent. c. has the same affect as when households view the cut as permanent. d. has less of an affect on aggregate demand than if households view it as permanent. A decrease in U.S. interest rates leads to a. a depreciation of the dollar that leads to greater net exports. b. a depreciation of the dollar that leads to smaller net exports. c. an appreciation of the dollar that leads to greater net exports. d. an appreciation of the dollar that leads to smaller net exports. What would happen to the equilibrium price and quantity of American cars if the price of American steel fell, and the price of Japanese cars went up? a. Price will fall and the effect on quantity is ambiguous. b. Price will rise and the effect on quantity is ambiguous. c. Quantity will fall and the effect on price is ambiguous. d. Quantity will rise and the effect on price is ambiguous. Which of the following is correct? a. Over the business cycle consumption fluctuates more than investment. b. Economic fluctuations are easy to predict. c. During recessions sales and profits tend to fall. d. Because of government policy the U.S. has suffered no recessions in the last 25 years. The position of the long-run aggregate supply curve a. is unaffected by the aggregate price level. b. is at the point where unemployment is zero. c. shifts to the right when the price level increases. d. is at the point where the economy would cease to grow. In 2002, the United States placed higher tariffs on imports of steel. According to the open-economy macroeconomic model discussed in class, this policy should have a. reduced imports into the U.S. and made U.S. net exports rise. b. reduced imports into the U.S. and therefore U.S. decreased net capital outflow. c. reduced imports of steel into the U.S., but left the overall balance of trade unchanged. d. reduced imports of steel into the U.S. and therefore increased U.S. net capital outflow. 2 Econ202 Final Exam, Spring 2008 Douglas 18. Tax cuts a. and increases in government expenditures shift aggregate demand right. b. and increases in government expenditures shift aggregate demand left. c. shift aggregate demand right while increases in government expenditures shift aggregate demand left. shift aggregate demand left while increases in government expenditures shift aggregate demand right. Real and nominal variables are intertwined, and changes in the money supply affect real GDP. Most economists would agree that this statement describes a. both the short run and the long run. b. the short run, but not the long run. c. the long run, but not the short run. d. neither the long run nor the short run. As the price level rises a. people will want to hold less money, so the interest rate rises. b. people will want to hold more money, so the interest rate falls. c. people will want to hold less money, so the interest rate falls. d. people will want to hold more money, so the interest rate rises. A steel company sells some steel to a bicycle company for $100. The bicycle company uses the steel to produce a bicycle, which it sells for $200. Taken together, these two transactions contribute a. $100 to GDP. b. $200 to GDP. c. between $200 and $300 to GDP, depending on the profit earned by the bicycle company when it sold the bicycle. d. $300 to GDP. In an open economy the supply of loanable funds comes from a. national saving. Demand comes from only domestic investment. b. national saving. Demand comes from domestic investment and net capital outflow. c. Only net capital outflow. Demand for loanable funds comes from national saving. d. domestic investment and net capital outflow. Demand for loanable funds comes from national saving. What would happen to the equilibrium price and quantity of bread if the price of wheat went up, and the price of bacon, lettuce, and tomato all fell? a. Price will fall and the effect on quantity is ambiguous. b. Price will rise and the effect on quantity is ambiguous. c. Quantity will fall and the effect on price is ambiguous. d. The effect on both price and quantity is ambiguous. Suppose that the exchange rate is 66 Bangladesh taka per dollar, that a bushel of rice costs 186 taka in Bangladesh and $3 in the United States. Then the real exchange rate is a. greater than one and arbitrageurs could profit by buying rice in the United States and selling it in Bangladesh. b. greater than one and arbitrageurs could profit by buying rice in Bangladesh and selling it in the United States. c. less than one and arbitrageurs could profit by buying rice in the United States and selling it in Bangladesh. d. less than one and arbitrageurs could profit by buying rice in Bangladesh and selling it in the United States. d. 19. 20. 21. 22. 23. 24. 3 Econ202 Final Exam, Spring 2008 Douglas 25. In the late summer of 2005 some regions of the country were suffering from drought. What effect would we expect this to have on the stock of companies like John Deere that manufacture farm equipment? a. raise the demand for existing shares of the stock, causing the price to rise b. decrease the demand for existing shares of the stock, causing the price to fall c. raise the supply of the existing shares of stock, causing the price to rise d. raise the supply of the existing shares of stock, causing the price to fall 26. When the money supply decreases a. interest rates fall and so aggregate demand shifts right. b. interest rates fall and so aggregate demand shifts left. c. interest rates rise and so aggregate demand shifts right. d. interest rates rise and so aggregate demand shifts left. Table 24-1 year 2005 2006 Peaches $11 per bushel $9 per bushel Pecans $6 per bushel $10 per bushel 27. Refer to Table 24-1. Suppose the typical consumer basket consists of 10 bushels of peaches and 15 bushels 28. 29. 30. 31. 32. of pecans. Using 2005 as the base year, what was the inflation rate in 2006? a. 20 percent b. 16.7 percent c. 10 percent d. 8 percent If the Fed conducts open-market purchases, the money supply a. increases and aggregate demand shifts right. b. increases and aggregate demand shifts left. c. decreases and aggregate demand shifts right. d. decreases and aggregate demand shifts left. An increase in the U.S. real interest rate induces a. Americans to acquire more foreign bonds, which increases U.S. net capital outflow. b. Americans to acquire more foreign bonds, which reduces U.S. net capital outflow. c. foreigners to acquire more U.S. bonds, which reduces U.S. net capital outflow. d. foreigners to acquire more U.S. bonds, which increases U.S. net capital outflow. Which of the following Fed actions would both increase the money supply? a. buy bonds and raise the reserve requirement b. buy bonds and lower the reserve requirement c. sell bonds and raise the reserve requirement d. sell bonds and lower the reserve requirement The sticky-wage theory of the short-run aggregate supply curve says that when the price level rises more than expected, a. production is more profitable and employment rises. b. production is more profitable and employment falls. c. production is less profitable and employment rises. d. production is less profitable and employment falls. Which of the following is not included in M1? a. currency b. demand deposits c. traveler’s checks d. credit cards 4 Econ202 Final Exam, Spring 2008 Douglas 33. Which of the following policies would Keynes' followers support when an increase in business optimism 34. 35. 36. 37. 38. 39. 40. shifts the aggregate demand curve away from long-run equilibrium? a. decrease taxes b. increase government expenditures c. increase the money supply d. None of the above is correct. If policymakers expand aggregate demand, then in the long run a. prices will be higher and unemployment will be lower. b. prices will be higher and unemployment will be unchanged. c. prices and unemployment will be unchanged. d. None of the above is correct. According to the crowding-out effect, an increase in government spending a. increases the interest rate and so increases investment spending. b. increases the interest rate and so decreases investment spending. c. decreases the interest rate and so increases investment spending. d. decreases the interest rate and so decreases investment spending. Other things the same, an increase in the aggregate price level makes consumers feel a. less wealthy, so the quantity of goods and services demanded falls. b. less wealthy, so the quantity of goods and services demanded rises. c. more wealthy, so the quantity of goods and services demanded rises. d. more wealthy, so the quantity of goods and services demanded falls. Which of the following assets is most liquid? a. capital goods b. stocks and bonds with a low risk c. stocks and bonds with a high risk d. funds in a checking account Supply-side economists believe that a reduction in the income tax rate a. always decrease government tax revenue. b. shifts the aggregate supply curve to the right. c. provides no incentive for people to work more. d. would decrease consumption. When the dollar appreciates, U.S. goods become a. less expensive relative to foreign goods, which makes exports rise and imports fall. b. less expensive relative to foreign goods, which makes exports fall and imports rise. c. more expensive relative to foreign goods, which makes exports rise and imports fall. d. more expensive relative to foreign goods, which makes exports fall and imports rise. The key determinant of a person's standard of living in a country is a. the amount of goods and services produced from each hour of a worker's time. b. the nominal amount of goods and services produced within the country. c. the total amount of its physical capital. d. the amount of money available in the economy. 5 Econ202 Final Exam, Spring 2008 Douglas Short Answer Questions. Answer in the space provided. NAME_______________________ 41. a. According to economist Robert Shiller, prices of homes nearly doubled between 1998 and the 2006, after holding more or less steady for 50 years. As home prices rise, families become wealthier. According to economic models discussed in class, this historic increase in personal wealth tended to encourage U.S. private savings to -- circle one: (RISE, FALL), interest rates to (RISE, FALL), the trade deficit to (INCREASE, DECREASE) and the dollar’s exchange rate to (APPRECIATE, DEPRECIATE). Show your reasoning using a graph or graphs below. Be sure to label all curves and axes. b. Housing prices in many markets in the U.S. have fallen by 10% or more in the past year, and seem likely to continue to fall. By itself, in the SHORT run this drop in wealth will tend to (INCREASE, DECREASE) consumption, will tend to cause GDP to (RISE, FALL), unemployment to (RISE, FALL), and the inflation rate to (RISE, FALL). Illustrate your answer on a graph below or on the next page. Label curves & axes. 6 Econ202 Final Exam, Spring 2008 Douglas c. Name a Federal Reserve policy that could offset or counteract the effect you described in part b. d. Why would Milton Friedman argue that your policy prescription from part c is unnecessary or even harmful? You might find a graph handy for illustrating your answer. 7 ID: A Econ 202 Final Exam Answer Section MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: D A B A A C C A C B D D A D C A C A B D B B B B B D A A C B A D D B B A D B D A MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: MSC: Definitional Definitional Applicative Analytical Applicative Interpretive Definitional Definitional Interpretive Definitional Analytical Definitional Analytical Applicative Definitional Interpretive Applicative Applicative Interpretive Analytical Interpretive Definitional Analytical Analytical Analytical Applicative Applicative Analytical Analytical Definitional Definitional Definitional Applicative Analytical Analytical Interpretive Interpretive Definitional Analytical Interpretive 1 ID: A SHORT ANSWER 41. ANS: a. Savings FALL. Interest rates RISE. Trade deficit INCREASES. Dollar APPRECIATES. Chapter 14 model. b. Consumption DECREASES, GDP FALLS, Unemployment RISES, inflation FALLs. AS/AD Model. c. Expansionary policy: Buy bonds, lower the discount rate, or lower the reserve ratio. d. In the long run, the economy should self-correct. Expansionary policy will permanently increase inflation in the long run without permanently decreasing unemployment. AS/AD diagram, with AS shifting to the right in the long run. Or, long-run Phillips curve shifts. 2 Name: ________________________ Class: ___________________ Date: __________ MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E A B C D E 1 ID: A