A Fuel Cell

Primer:

The Promise and the

Pitfalls

"Not long ago, the fuel cell was dismissed as an

environmentalist’s pipe dream....Now it is the subject of a

heavily financed research-and-development race among

some of the world’s biggest auto makers."

Jeffrey Ball, The Wall Street Journal

By Tom Koppel Ph.D. and Jay Reynolds

2000 by Tom Koppel and Jay Reynolds

All Rights Reserved

Table of Contents:

What is a Fuel Cell?............................................................................................................ 4

Not All Fuel Cells Are Created Equal ................................................................................ 5

Ballard and its Allies........................................................................................................... 7

The California Connection.................................................................................................. 9

The Competition, GM and Toyota.................................................................................... 10

Fuel, The Great Unknown................................................................................................. 12

Political Uncertainties....................................................................................................... 14

Commercial-Scale Stationary Power ................................................................................ 15

Home-Size Stationary Power............................................................................................ 19

Portable/Standby Power.................................................................................................... 21

Related Technologies and Markets................................................................................... 22

A Glimpse at the Hydrogen Economy.............................................................................. 23

APPENDICES .................................................................................................................. 26

APPENDIX OF TABULAR DATA................................................................................. 27

APPENDICES OF USEFUL WEB SITES....................................................................... 27

Additional Resources – Video, pdf and Web.................................................................... 27

Hydrogen and Fuel Cell Resources................................................................................... 27

Fuel Cell Companies:........................................................................................................ 28

Governmental Resources: ................................................................................................ 28

Additional Online Resources ............................................................................................ 29

About the Authors............................................................................................................. 30

Disclosures of Our Investments ........................................................................................ 30

Disclaimer ......................................................................................................................... 30

A Fuel Cell Primer: The Promise and Pitfalls

Page 2, Rev 7, May 1, 2001

The incredibly rapid advance of fuel

cell technology shows that necessity

really can be the mother of invention.

There is no mistaking the necessity.

We in the industrialized countries have

been consuming the world’s limited

energy resources at a rate that cannot be

sustained, much of it in inefficient

internal combustion vehicles that burn

non-renewable fuels. And we’ve been

despoiling the environment in the

process. Estimates from the

Environmental Protection Agency

indicate that motor vehicles in the U.S.

account for 78% of all carbon monoxide

emissions, 45% of nitrogen oxide

emissions and 37% of volatile organic

compounds. Worldwide, over one

billion people living in urban areas

suffer from severe air pollution, and

according to the World Bank over

700,000 deaths result each year.

Moreover, each gallon of gasoline

produced and used in an internal

combustion engine releases roughly

twenty-five pounds of CO2, a

greenhouse gas that contributes to global

warming.

In response to the critical need for a

cleaner energy technology, invention

kicked into high gear. Fuel cells

generate energy with little or no harmful

emissions. So, beginning a decade ago,

significant government seed money was

put into fuel cell R & D. Private capital

soon followed. In just ten years, the

power of fuel cells was boosted roughly

twenty fold, making them easily

compact and light enough to power our

cars. Drastic cost reductions have made

them contenders to deliver stationary

and portable energy for a multitude of

other applications. The advances in fuel

cell technology are real. As one leading

fuel cell engineer has said, “This is not

just smoke and mirrors.” Fuel cells

promise to greatly reduce energy-related

environmental impacts without

significantly compromising our modern

lifestyles.

Little wonder, then, that some

investors have been betting, and winning

big, on publicly traded companies with

major stakes in fuel cell technology.

From the beginning of 1995 to the end of

1997, the share price of the

acknowledged leader in the field, Ballard

Power Systems, soared 1100 %. Despite

the tech stock meltdown of last year,

since the end of 1999 Ballard’s shares

rose 182%, closing at $51.34 at the end

of April. The overall performance of a

few of the smaller players was also

impressive. FuelCell Energy’s share

price, for example, shot up a remarkable

255% in that same time period.

However, Plug Power’s stock decreased

66%. In most cases if investors bought

near the high points for these stocks and

held, by April they had lost half their

equity or more. That’s why we speak of

“pitfalls” as well as promise.

Until now, this sort of meteoric rise

in market capitalization was largely

reserved for biotech and Internet stocks.

But as Red Herring magazine observed

last year, “There is potentially far less

economic and political risk associated

with fuel-cell stocks. While biotech

products have to pass Food and Drug

Administration test trials, and many

Internet stocks have unproven revenue

models, fuel-cell companies could

succeed for fundamental business

reasons alone.”

A Fuel Cell Primer: The Promise and Pitfalls

Page 3, Rev 7, May 1, 2001

Still, most of the fuel cell companies

do not yet have a commercial product to

offer and have never turned a profit.

Some of the most important issues

affecting fuel cell commercialization

have yet to be answered. In light of such

rapid technological breakthroughs,

who’s to say that today’s leaders will

remain at the head of an expanding fuel

cell pack. And given the run-up in share

prices, perhaps fuel cell stocks are

already overvalued. The buzz and wellmeaning halo of virtue surrounding this

clean, green technology can be

infectious. But investing in fuel cell

companies is nothing if not speculative.

This report is presented in the hope

that it can help you to cut your way

through the hype and jargon. We will

explain very briefly how fuel cells work;

outline the main types of fuel cells and

their relative merits for specific

applications; and introduce you to a few

of the leading fuel cell companies. We

will also outline their development and

marketing strategies, discuss their

alliances (if any) with larger

corporations; and warn of the major

uncertainties that face this burgeoning

new industry. Finally, we will provide

links and recommended reading that

should expedite your further digging.

All of this will, we trust, help you to

make well-informed decisions.

What is a Fuel Cell?

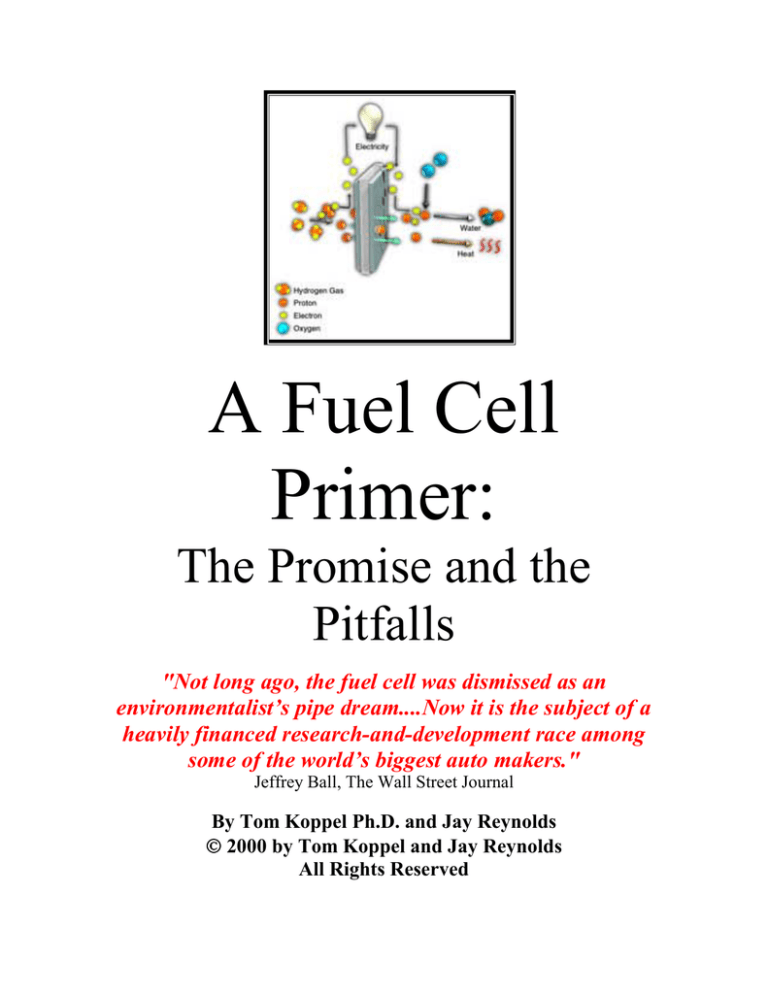

A fuel cell is a clean and quiet device

that generates electricity from hydrogen

and oxygen. An individual cell delivers

very little power, so thin cells are

combined like slices of bread in a loaf to

form a fuel cell "stack." Fuel cells

simply reverse the familiar high school

science demonstration in which

electricity is put through water to

produce hydrogen and oxygen. In the

most common transportation fuel cell, a

polymer plastic membrane coated with

platinum is sandwiched between two flat

electrodes. Hydrogen flows in on one

side, oxygen from the air on the other.

They combine to form water so pure you

can drink it and generate electricity

without combustion or nasty emissions.

A fuel cell is a bit like a battery, but

better, because it needs no slow

recharging. It produces electricity as

long as fuel and air are supplied to it.

British lawyer and physicist Sir

William Grove discovered the principle

of the fuel cell in 1839, decades before

the invention of the internal combustion

engine. But then it largely languished

until the Apollo space program in the

1960s. No batteries could last long

enough for a flight to the moon. NASA

spent tens of millions of dollars in a

successful crash program that used fuel

cells to power the on-board electrical

systems.

They worked, but the commercial

potential of fuel cells seemed minimal.

The cells that NASA deployed were

hand-built and used exotic materials, so

the cost per kilowatt of power was

astronomical. They were also bulky.

Other types of fuel cells were more

promising, though, and research

continued at a low funding level at

several national laboratories and

universities. Beginning in the mid1980s, government agencies in the US,

Canada and Japan significantly increased

their funding for fuel cell R & D.

Meanwhile, the environmental

advantages of fuel cells became a

political factor, and their green potential

A Fuel Cell Primer: The Promise and Pitfalls

Page 4, Rev 7, May 1, 2001

began to capture the public imagination.

When advances in the output of fuel

cells reached the point where it was clear

they could power a car, investment in the

technology began to grow exponentially.

The rest, as they say, is history.

Not All Fuel Cells Are

Created Equal

There are six major types of fuel

cells with potential for a variety of

commercial applications.

The first to be fired into space was

the proton exchange membrane (PEM)

fuel cell, which was developed by GE

and performed successfully on the

Gemini orbital missions of the mid1960s. Then it was abandoned, and

GE’s patents gradually ran out. Ballard

Power Systems, with Canadian

government funding, began improving

PEM in 1984, as told in the book by one

of us, Powering the Future: The Ballard

Fuel Cell and the Race to Change the

World. Today, PEM is the main type

being commercialized to power

automobiles.

The Apollo moon missions used the

alkaline fuel cell (AFC) developed by

United Technologies Corporation. Now,

under the aegis of its subsidiary,

International Fuel Cells, a greatly

improved version provides electrical

power to the space shuttles. AFCs

worked well in space, where the rocket

was already supplied with extremely

pure liquid hydrogen and oxygen. But it

was not suited to operating on air and

impure hydrogen.

By contrast, PEM had the potential

to work on air and less pure hydrogen

(such as gas that is "reformed" from a

convenient liquid fuel like methanol).

This makes PEMs more suitable than

AFCs for use down here on earth. But

the early PEM cells needed so much

expensive platinum catalyst that this was

prohibitive except for space and some

military uses. (This has been solved by

spreading such a thin layer of

microscopic platinum particles on the

electrodes that very little is now

required.) Another plus for PEM is that

it begins generating power at room

temperature and attains its peak power at

about 80° Celsius (176° Fahrenheit),

allowing the relatively fast startup

needed for cars. And it responds almost

instantaneously to changing power

demands, which is crucial for

transportation.

The phosphoric acid fuel cell

(PAFC) was actually the first type to be

commercialized (by US and Japanese

companies) at a very modest level for

stationary power use, beginning in the

1980s. Several hundred units, mainly

using natural gas and generating 200 to

250 kilowatts, have been installed

around the world. Like PEM, PAFC can

run on impure hydrogen and air. But its

power output is considerably lower than

PEM; it does not respond well to

changing power demands; and its

operating temperature of around 200°

Celsius (395° Fahrenheit) means much

longer startup times. Still, in the late

1980s and early 1990s, the US

government put tens of millions of

dollars into PAFC. The thinking was

that PAFC was a relatively proven

technology. And with a large battery

bank for peak acceleration and hill

climbing, it might be suitable for buses.

Two other types of cells operate at

much higher temperatures of 650° to

A Fuel Cell Primer: The Promise and Pitfalls

Page 5, Rev 7, May 1, 2001

1000° Centigrade (1202° to 1831°

Fahrenheit), making them even less

suitable for ground transportation

because of their long warm-up time. But

they have other advantages. The solid

oxide fuel cell (SOFC) uses a cheap

catalyst and can operate on unreformed

natural gas or propane. It has high

overall efficiency, which can be

improved further if the heat it gives off

is captured and used (e.g. to drive a

turbine or heat a building.) It can also be

made relatively small.

The molten carbonate fuel cell

(MCFC) also uses an inexpensive

catalyst, has high efficiency and

produces excess heat that can be

captured and utilized. It can run not only

on natural gas and propane, but even on

diesel fuel, which makes it suitable for

ships and stationary power in remote

places, such as islands, where delivering

a supply of natural gas is difficult or

impossible.

Finally, the direct methanol fuel

(DMFC) cell is a lot like PEM in terms

of its catalyst and operating temperature.

It has the advantage that it can be

directly fed unreformed liquid methanol,

rather than gaseous hydrogen from a

reformer. The technology is years

behind PEM at present. If perfected,

though, it would eliminate the need for

fuel reformers in cars.

Markets and Major Companies

By far the greatest public interest has

focused on fuel cells for transportation,

especially cars and buses. This reflects

both the urgent need for cleaner cars and

the colossal size of the transportation

market. The amount of money that has

gone into R & D for fuel cells aimed at

the car and bus markets has eclipsed

expenditures on all other types

combined. Moreover, it was putting

prototype fuel cell vehicles on the road

in the mid-to-late 1990s -----with wellpublicized “roll-outs” in places like

Berlin’s Brandenburg Gate and in front

of California’s state capitol in

Sacramento-----that really gave this

technology visibility. Finally, we all

drive cars, right? So we can easily

imagine owning one powered by clean,

quiet fuel cells in the not-too-distant

future. It is what most of us picture

when we think of the coming fuel cell

revolution.

Vehicles, and especially cars, impose

special requirements on fuel cells. They

must be able to start up quickly and

operate in environments ranging from

extreme winter cold to dry desert heat.

They must be compact and as

lightweight as possible. They must be

able to stand vibrations and respond well

to rapidly changing power demands.

Finally, a supply of fuel must be widely

available.

The only well-advanced type of fuel

cell that is really suitable for mass

transportation is PEM. This is mainly

because its low operating temperature

allows for relatively short start-up times

(thirty seconds or less) and because it

responds almost instantaneously to

changing power demands, a

characteristic known as “loadfollowing”. PEM cell stacks have

already been made compact and

powerful enough to fit easily into a

passenger car, and they offer power and

acceleration equal to, or even better than,

the internal combustion engine. So there

is no reason to expect them to encounter

consumer resistance if they can be made

A Fuel Cell Primer: The Promise and Pitfalls

Page 6, Rev 7, May 1, 2001

cost competitive, and if the needed fuel

infrastructure can be established. Two

big ifs.

Also under development, though, is

the direct methanol fuel cell (DMFC),

which may in a few years provide

serious competition to PEM for cars. Its

advantage, as mentioned, is that it can

run on methanol without a separate fuel

reformer. Its main drawback, until now,

is that its power density was much lower

than PEM, but improvements on that

score have been rapid. The development

of a small, efficient and inexpensive

methanol reformer for PEM is one of the

current challenges facing the car makers.

Yet methanol could turn out to be the

only practical way of delivering

hydrogen for fuel cell cars, at least over

the next decade or longer. So if the

methanol reformer proves to be a

stumbling block, DMFC could yet turn

out to be the technology of choice. Even

Ballard, the PEM leader, has hedged its

bets by purchasing non-exclusive rights

to a proprietary DMFC technology

developed by the Jet Propulsion

Laboratory and Loker Hydrocarbon

Research Institute.

transit buses were put onto the streets of

Chicago and Vancouver.

Ballard Powered Transit Busses

They proved themselves by

successfully carrying thousands of fare

paying passengers on normal transit

routes for two years. In Germany,

Daimler-Benz has put Ballard cells into

its own prototype NEBUS (short for

New Electric Bus), which is similar, but

not identical, to the ones in Chicago and

Vancouver. Meanwhile, Daimler put

Ballard cells into its series of prototype

cars (called NECARs, for New Electric

Car).

Ballard and its Allies

In the race to put fuel cells into cars

and buses, the apparent leader is Ballard

in partnership with DaimlerChrysler and

Ford. Starting in 1990, Ballard put its

fuel cells into a series of increasingly

impressive prototype buses that ran on

compressed hydrogen. The first small

bus, rolled out for the media in 1993,

was the first-ever fuel cell vehicle

capable of carrying passengers with

reasonable speed and operating range.

Several larger prototypes followed. In

the late 90s, six Ballard-built fuel cell

The Necar 3

In 1997 Daimler-Benz (soon to

become DaimlerChrysler) and Ballard

made a $ 390.8 million ($ 508 million

Canadian) deal under which Daimler

acquired a 25% stake in Ballard. They

also formed a joint venture company

called DBB Fuel Cell Engines (owned

two-thirds by Daimler, one-third by

Ballard) to manufacture fuel cell

engines. These engines integrate the

A Fuel Cell Primer: The Promise and Pitfalls

Page 7, Rev 7, May 1, 2001

fuel cell stacks (built by Ballard) with all

the other equipment required for fuel

supply, cooling, electronic controls and

the like, since an automotive fuel cell

has to be about ten times more powerful

than those for residential use.

A half year later, Ford joined this

alliance by investing $ 420 million ($

616 million Canadian) in cash,

technology and assets to acquire a 15%

equity interest in Ballard Power Systems

and a 22% equity interest in Xcellsis (the

new name for DBB Fuel Cell Engines.)

The net effect was the reduction of

Ballard’s equity interest in Xcellsis from

33% to 27%. The addition of Ford to the

alliance also included the formation of

Ecostar Electric Drive Systems in which

Ballard has a 21% interest. Thus,

Ecostar brings to the alliance Ford’s

design and production expertise in

electric drivetrains.

Ballard’s early prototype vehicles

were buses, mainly because in the early

1990s the fuel cell stacks were not yet

compact enough to fit into a car.

Likewise, the first commercial fuel cell

vehicles to hit the road will also be

buses. In this case, though, the reason is

in part that supplying a fleet of buses

with fuel is a much simpler proposition

than providing fuel to thousands of cars.

DaimlerChrysler has sold its first 30

busses to 10 European cities from

Madrid to Reykjavik. These will enter

service starting 2002.

But fuel cell cars are only a few

years behind, and the car market is the

major leagues. DaimlerChrysler intends

to inject $ 1.5 billion into its fuel cell

auto effort over the next few years. The

aim is to offer fuel cell cars for sale by

2004. This is expected to be a four-tofive seater based on the small A-class

Daimler car that is already being sold in

Europe with an internal combustion

engine. Ford seems to have a similar

target date for its first commercial fuel

cell car, a five-passenger sedan.

Press releases from the Daimler,

Ford and Ballard alliance indicate an

initial production level of 40,000 fuel

cell engines a year, rising to 100,000

within another year or two. Meanwhile,

Ballard recently opened its first

production facility in Canada. But this is

a relatively small plant aimed mainly at

working out the production-line bugs

and satisfying demand for fuel cell

stacks up until the 2004 entry into the

auto market.

Looking ahead, Ballard is currently

sitting on over $ 500 million ($ 800

million Canadian) in cash, most of it

earmarked for building a much larger

plant. The location has not yet been

announced, but it is likely to be in the

US. This plant will be capable of

building 250,000 to 300,000 fuel cell

stacks a year. Most will probably be

sold through Xcellsis to supply the fuel

cell engines needed by DaimlerChrysler

and Ford. But Ballard is also “open for

business,” as its management likes to

say. It is free to sell its stacks to buyers

outside its alliance with DaimlerChrysler

and Ford. And nearly every other major

auto company in the world has, over the

last decade, leased and tested Ballard’s

cell stacks. For this reason, some

euphoric commentators have argued that

Ballard could perhaps become the Intel

of the fuel cell industry, supplying the

cell stacks to nearly all the car

manufacturers.

A Fuel Cell Primer: The Promise and Pitfalls

Page 8, Rev 7, May 1, 2001

The California Connection

One major incentive for auto

companies to bring fuel cell cars to

market has been the regulations of the

California Air Resources Board

(CARB). These require that, starting in

2003, 10% of all new cars sold in that

state will have to be extremely low

emission models. Of these, 20% (or 2%

of all cars) must be “zero-emission”

types (ZEVs), a requirement that can be

satisfied only by battery or fuel cell

powered vehicles. As the regulations

now stand, auto makers that fail to

comply will face stiff fines under a

complex formula of penalties and

credits. The largest manufacturers are

most heavily targeted by the regulations.

Not surprisingly, the major auto

companies have lobbied to have the ZEV

mandate weakened and its starting date

postponed. They point to difficulties in

meeting the target date, especially

doubts that a fuel infrastructure for fuel

cell cars can be in place by the deadline.

At the same time, environmental groups

urged the state government to stick to

the mandate and its strict timetable.

Other states have watched closely, as has

the federal government and four states

have indicated that they would follow

California’s lead. At a September 2000

meeting, CARB voted unanimously to

uphold the so-called ZEV mandate, but

since then it has cut the 4% requirement

to 2%.

But California will not have to leap

in cold turkey. A program called the

California Fuel Cell Partnership is

paving the way for the introduction of

fuel cell vehicles in the Golden State.

This collaboration, launched in April

1999, initially involved the State of

California, DaimlerChrysler, Ford,

Ballard and three large oil companies:

ARCO, Texaco and Shell. The purpose

was to establish cooperation between the

car companies and fuel suppliers, to

experiment with the necessary fuel

infrastructure, and to demonstrate fuel

cell vehicles under realistic day-to-day

driving conditions. Since last year,

several other auto companies have

signed on, along with another major fuel

cell company, International Fuel Cells,

and Methanex, the world’s largest

supplier of methanol. And in October

2000 GM and Toyota announced that

they would join as well.

Under the Partnership about 70 fuel

cell cars and buses will be tested

between 2001 and 2003. Fourteen

vehicles, most of them powered by

Ballard cells, were unveiled at a gala

event in Sacramento in November.

Judging by the interest generated by the

Ballard buses in Chicago and

Vancouver, the California media will

keep fuel cells and their environmental

upside in the news over the next few

years.

Although not nearly as large a

market as autos, fuel cell buses still offer

great potential profits for companies like

Ballard and DaimlerChrysler. And

buses have advantages over cars for

initial market entry. Transit buses

operate on fixed routes within the limits

of a city or district. The fuel, therefore,

can be compressed hydrogen gas that is

dispensed daily at central depots. There

is no need for an extensive network of

fueling stations. Compressed hydrogen

is bulky, so fuel cell buses have rooftop

tanks that give them a high profile. The

car-buying public might not like the

high-top look, and extra wind drag is a

A Fuel Cell Primer: The Promise and Pitfalls

Page 9, Rev 7, May 1, 2001

consideration for cars driving at 60 mph

or more. But no one cares much what a

transit bus looks like, and their average

speed is much lower.

Buses have another advantage. It is

mainly public agencies that operate

transit fleets. They have political

incentives to demonstrate at least a

symbolic commitment to cleaner

vehicles. Current estimates are that the

purchase price of the first generation of

fuel cell buses may be as much as twice

as high as ordinary diesel buses. For

private cars, such a price penalty might

doom the introduction of fuel cells. But

public subsidies for zero emission buses

would be no more of a political problem

than subsidies for other mass

transportation.

Only Ballard (which has a small

separate bus engine facility in

California) and DaimlerChrysler (the

world’s largest manufacturer of buses)

are moving quickly into the bus market.

The Competition, GM and

Toyota

No other pure fuel cell company is a

close contender with Ballard for

automobile or bus fuel cells. However,

International Fuel Cells (IFC), the

subsidiary of United Technologies

Corporation, is a possible long-term

threat. Until recent years, its main focus

was on alkaline fuel cells (e.g. for the

space shuttle) and phosphoric acid units

for stationary power generation. (It has

sold over 200 of these power plants

around the world.) More recently,

though, IFC has moved into PEM

development as well. It has

demonstrated a 40 kilowatt PEM stack

that runs on hydrogen and is working on

a 50 kilowatt model that it intends to run

on gasoline (presumably with a gasoline

reformer). IFC also promises to

demonstrate a PEM bus in 2001. That it

is serious about auto fuel cells is shown

by its recent agreement to work with

Hyundai on a fuel cell stack. (Hyundai

is also leasing cell stacks from Ballard.)

IFC also has a new joint venture with

Shell to develop fuel processors for PEM

cells.

There is also Johnson Matthey (JM),

of Britain, the world’s largest supplier of

noble metal catalysts for such things as

catalytic converters to reduce emissions

in cars. Since 1994 JM has worked

closely with Ballard and other

companies on reducing the amount of

high-priced platinum for fuel cell

catalysts. Recently, though, JM has

announced that it intends to enter the

PEM fuel cell market itself. Given its

size (over 8000 employees), JM has to

be taken seriously as a dark horse in the

fuel cell race.

The most serious challenge to

Ballard and its allies for the auto market

is likely to come from other huge auto

companies that can afford to put billions

of dollars into fuel cell R & D. They are

under the same pressure as

DaimlerChrysler and Ford to put zero

emission cars onto the California market

within a few years. The key players

appear to be General Motors and Toyota.

General Motors had a modest PEM

fuel cell program in the mid-to-late

1980s. Then, after apparently shutting it

down for a year or two, it has been

working on its own PEM fuel cells since

the early 1990s. (At the same time it has

leased and experimented with Ballard

fuel cell stacks, but these are sealed to

A Fuel Cell Primer: The Promise and Pitfalls

Page 10, Rev 7, May 1, 2001

protect Ballard’s proprietary

technology.) GM is well situated to

compete not only due to its sheer size

and financial muscle but also because it

already has the electric drive train

technology and know-how gained from

its development of “pure” electric cars

such as the EV-1. (Several hundred of

these battery-powered vehicles were

leased to customers in California and

Arizona in the late 1990s. But

considering GM’s huge investment, the

program has to be considered a failure,

and the EV-1 was withdrawn from the

market in January 2000.)

Toyota also has expertise in

advanced electric vehicle technology,

mainly gained in developing its RAV4

electric vehicle and its “hybrid” Prius,

which combines a small gasoline engine

with a rechargeable battery. More than

35,000 Prius vehicles are already on the

road in Japan. Boasting mileage of 52

mpg in city driving and 45 mpg on the

highway, the Prius is now selling

throughout the U.S. at a list price of

$20,450. (City mileage is higher.)

For an excellent source on the

development of hybrid cars, see

Forward Drive: The Race to Build

“Clean” Cars for the Future, by Jim

Motavalli.

Toyota has said that it intends to be

first to market with a fuel cell car and

recently specified that this will be a

hybrid vehicle combining a fuel cell and

a sizable battery. GM has announced

that it plans to have a “production ready”

fuel cell car in 2004. (GM has clarified

that this does not necessarily mean

having cars in the showroom that year.)

How likely is it that either company, or

both, can enter the fuel cell auto market

as early as DaimlerChrysler or Ford,

with their Ballard technology?

In mid-1998 the California Air

Resources Board published a massive

and detailed status report on the

development of, and prospects for, fuel

cell cars. This study was compiled by a

panel of fuel cell experts who had visited

virtually all the relevant companies in

the world. It concluded that the alliance

using Ballard technology was at least a

year or two ahead of both GM and

Toyota. GM’s fuel cells seemed clearly

behind Ballard’s in power density at the

time. But GM was devoting

considerable resources to fuel cells

(mainly through its Opel division) and

could hardly be ignored. Toyota was

particularly cautious about revealing the

details of its fuel cell program to the

visitors. The statistics revealed for

Toyota’s fuel cells showed them to be

lagging far behind on power density, but

the report noted that Toyota was very

strong in related technologies required

for electric vehicles.

In 1999 GM and Toyota announced

an agreement to share fuel cell

technology with each other. This was an

unprecedented step. Obviously, they are

determined not to fall behind

DaimlerChrysler and Ford. And in

February 2000 GM claimed that it had

developed the “most advanced

operational fuel cell today,” with a stack

15 percent smaller than the nearest

competitor. This claim, if valid, would

presumably make the GM stack more

compact than Ballard’s 900 series stack,

which was unveiled a month earlier. A

five-seat Opel prototype car, running on

liquid hydrogen and using this stack,

was the pace car for the marathon at the

A Fuel Cell Primer: The Promise and Pitfalls

Page 11, Rev 7, May 1, 2001

Summer 2000 Olympic Games in

Sydney, Australia.

In July 2000 Mitsubishi revealed that

it has developed its own “high

efficiency” auto fuel cell, and a compact

reformer to allow it to run on methanol.

The system is said to fit under the floor

of a small car, and the company is

working on the “practical application” of

this technology. So, perhaps Mitsubishi

also has to be counted as a dark horse in

the auto fuel cell race. Along with

several other Japanese companies,

Mitsubishi will also be receiving

government funding to develop direct

methanol fuel cells.

Two other heavyweight contenders

are Honda and Nissan. In August Honda

surprised the industry by announcing

plans to commercialize a PEM fuel cell

car in 2003. Honda has been developing

its own fuel cell technology while

leasing Ballard cell stacks as well. It put

a Ballard-powered prototype car on the

road in California toward the end of last

year. So did Nissan.

Of the other major auto companies,

most have leased Ballard technology and

apparently intend to buy future fuel cell

stacks rather than develop their own.

These include Volkswagen, Yamaha and

Hyundai, although, as mentioned, the

latter is also working with International

Fuel Cells on PEM technology for cars.

Why all the emphasis on a “race” to

have the first commercial fuel cell car?

Ballard and Daimler executives have

stated that being first to market would

allow them to help determine the

regulations, safety standards and

comparative performance benchmarks

for fuel cell autos and stacks.

Fuel, The Great Unknown

Although the commercial

introduction of fuel cell cars could be

only three to four years away, one huge

unknown still overshadows this step. It

is not yet absolutely certain what the

actual fuel will be for the first generation

of cars.

In some ways it would be simplest

and best to have auto fuel cells directly

supplied with pure hydrogen. This

would be made (most likely from natural

gas) at industrial-scale plants and then

dispensed. Such a fuel infrastructure

would eliminate the on-board “reformer”

needed to produce gaseous hydrogen

from a liquid fuel such as methanol or

possibly gasoline. Environmental

studies show that if the hydrogen for

cars were produced from natural gas at

centralized facilities, the amount of

carbon dioxide released across the entire

fuel cycle would be much less than if

methanol or gasoline were reformed on

board the car.

But dispensing and carrying

hydrogen entails major problems.

Compressed hydrogen is bulky, which is

why the Ballard and Daimler buses have

large rooftop tanks. For a car, using

current technology the required rooftop

tank to allow 250 miles of driving

between refills would have to measure

about three feet on each side, and it

would raise the car’s roof profile about

eight inches, not even counting the

thickness of the tank itself. And of

course the tank would have to be strong

to withstand the pressure, so its weight

would be added up top. (Newer nonmetallic tanks will lessen this handicap.)

For the auto industry, and probably for

A Fuel Cell Primer: The Promise and Pitfalls

Page 12, Rev 7, May 1, 2001

consumers, such a design seems to be a

non-starter. In any case, no

infrastructure for making, distributing

and dispensing compressed hydrogen for

tens of thousands of cars yet exists.

Establishing one would certainly be

expensive.

Liquid hydrogen is much more

compact. It would fit into tanks only

slightly larger than a conventional

gasoline tank for a comparable range.

But to liquefy hydrogen requires first

refrigerating it to minus 253° Celsius

(490° Fahrenheit), a process that makes

huge energy demands of its own. Then

the liquid has to be kept in expensive

cryogenic storage tanks. In a car, over

time between visits to the filling station,

some of the hydrogen would boil off and

disperse as a gas, thereby going to waste.

In closed garages, this could also pose

safety problems. Finally, all the

production and distribution issues for

compressed hydrogen would exist, in

spades, for liquid hydrogen.

A long-term alternative that may

prove safer and simpler for cars is the

on-board storage of hydrogen absorbed

in tanks containing powdered metal

hydrides. This is being developed by a

number of companies, including Energy

Conversion Devices “ENER”.

Comparisons of the amount of hydrogen

that can be stored for each liter of

volume tell the story. For compressed

hydrogen, 31 grams per liter. For liquid

hydrogen, 71 grams. But for ENER’s

metal hydride system, 103 grams.

With metal hydride enough hydrogen

for a car’s normal range could be held in

a tank comparable in size to a

conventional gasoline tank. A similar

concept, but one that is only at the

earliest stages of development, is to have

the hydrogen absorbed into extremely

fine carbon, called nanotubes or

nanofibers. The metal hydrides are

heavy, adding undesirable weight to the

vehicle. Carbon, however, is light, and

it seems to promise vastly greater

storage capacity than hydrides. (There

have been claims that with carbon

storage a car might fill up only once a

month!) In both cases, gaseous

hydrogen would be pumped (injected)

into a “tank” full of these hydrides or

fibers. As the car runs, the hydrogencontaining medium would be heated to

draw off a steady stream of gaseous

hydrogen to be fed to the fuel cell.

Because of all the unknowns

surrounding “direct” use of hydrogen in

fuel cell cars, the auto manufacturers and

government agencies have focused

attention on deriving the hydrogen from

a liquid fuel, at least for the first decade

or two. Liquid fuels are easy to

transport, and people are accustomed to

handling them.

The main candidates are gasoline

and methanol. Both must be “reformed”

at fairly high temperatures to generate

gaseous hydrogen for the fuel cell. The

reformer is really a miniature

petrochemical factory, and it represents a

difficult technological challenge in its

own right.

Of the two, gasoline is considered by

far the more difficult fuel to reform. In

fact, Chrysler (together with the Arthur

D. Little company) had been working on

a gasoline reformer for fuel cell cars at

the time it merged with Daimler-Benz.

The project was not going well, and was

shelved. Since then, however, a number

of companies have reported progress on

A Fuel Cell Primer: The Promise and Pitfalls

Page 13, Rev 7, May 1, 2001

gasoline reforming. One of them,

Nuvera Fuel Cells, announced last year

that it would supply prototype gasoline

reformers to four auto companies, as

well as to the fuel cell company Plug

Power under a Department of Energy

program. International Fuel Cells, in

collaboration with Toshiba, is also

working on a gasoline reformer. And

even DaimlerChrysler, which has

emphasized methanol, is now also

hedging its bets with resumed work on

gasoline reforming. The jury is still out.

If an efficient and low cost gasoline

reformer can be developed, the first fuel

cell cars could run on ordinary (or more

likely a special grade of) gasoline. This

would eliminate most of the cost,

complication and delay of installing a

separate fuel infrastructure.

However, because of the apparent

difficulties with gasoline reforming,

methanol has been in the fuel cell

limelight almost by default. It is a

relatively easy to handle liquid that is

made from natural gas. The world

currently produces a surplus of natural

gas, much of which is flared off or

vented in distant oil fields. But even

methanol reforming is difficult.

DaimlerChrysler had promised to unveil

its latest fuel cell car, designed to run on

methanol, in late 1999 or early 2000. It

was not demonstrated until late 2000.

One reason was probably delays in

perfecting the reformer.

If a good methanol reformer is ready

in time to put cars on the road in

California in, say, 2004, there will have

to be filling stations equipped to

dispense it. Estimates are that installing

a new methanol retail system at a typical

gas station costs $ 55,000 to $ 70,000,

and retrofitting a gasoline system for

methanol about $ 40,000. (This is for

cleaning the old tank and installing a

liner.) The methanol industry estimates

that it would cost $ 3 billion to equip

every third gas station in the US with a

methanol tank and pump. That’s no

small change, although the cost would

probably not be prohibitive. Still, the

question remains, who will pay for, or

subsidize, this new infrastructure?

Methanol, therefore, may prove to be

a viable fuel for fuel cell cars. Yet,

some hydrogen enthusiasts raise an

interesting question. If practical “direct”

hydrogen technologies (such as metal

hydrides) are only a few years farther

down the road, why spend billions to

install a methanol infrastructure that may

be used for perhaps a decade? Some

also hope that once a hydrogen

infrastructure is in place, older internal

combustion engines can be retrofitted to

run on hydrogen as well. BMW, of

Germany, has been developing hydrogen

internal combustion engines for 20

years, and Daimler-Benz also put

considerable R & D money into them in

the past. Burning hydrogen in engines is

not as clean or efficient as feeding it to a

fuel cell, but it is still a lot cleaner than

burning gasoline.

With the 2003 California mandate

looming, the auto companies will have

to look hard at these choices and

soon.

Political Uncertainties

As already discussed, the California

mandate has largely set the auto fuel cell

timetable. But it is not carved in stone.

Originally, back in the early 1990s,

California was going to require that 2%

of new cars be ZEVs by 1998. At that

A Fuel Cell Primer: The Promise and Pitfalls

Page 14, Rev 7, May 1, 2001

time, with fuel cell cars barely on the

distant horizon, this meant pure battery

powered electrics like GM’s EV-1 or

Toyota’s RAV4. But when it became

clear that the car companies could not

meet the target, California backed off. Is

there the political will this time to retain

the 2003 mandate in the face of heavy

lobbying? A crucial question.

Ensuring that a fuel infrastructure is

in place on time is not an imaginary

problem dreamed up by Detroit. Will

California, and other states that have

been following its lead on clean air

regulations, come up with the needed

subsidies? And will Congress pass

pending legislation to subsidize

alternative fuel vehicles?

One factor that may affect the

outcome is that hybrid cars combining

gasoline engines and battery power are

already on the market and proving to be

popular. Many additional models are on

the way from nearly every major

manufacturer, including some targeted at

the large sport utility vehicle sector.

Hybrids can more than double

conventional gasoline mileage. Because

their small gasoline engines run at

optimum speed to minimize emissions,

they also greatly reduce overall air

pollution. In the jargon of California’s

air resources board, the Honda Insight

has been certified as an Ultra Low

Emission Vehicle (ULEV), while the

Toyota Prius is a Super Ultra Low

Emission Vehicle (SULEV). (SULEVs

run 75 percent cleaner than ULEVs, and

they are both a lot better than what most

of us have been driving.)

Might not the very success of

hybrids satisfy government regulators

(and even the environmentally conscious

public) enough to reduce the urgency to

push for the even cleaner ZEVs, which

include fuel cell cars?

These are among the toughest

questions to be asked by any investor

who feels inclined to bet on the rapid

commercialization of transportation fuel

cells.

Commercial-Scale

Stationary Power

Providing electrical power to

individual buildings, businesses or even

entire villages or small towns (so-called

“distributed power”) is potentially a

huge market for fuel cells. Globally,

stationary power generation is already a

$ 100 billion market and bound to grow.

An estimated 750 million households,

mainly in the Third World, are not

electrified, and for many of these

households there is no nearby power

grid. As Seth Dunn, author of

Micropower: The Next Electrical Era,

argues: "In these parts of the world,

decentralized technologies have

enormous potential to bring power to the

people, allowing the development of

stand-alone village systems and doing

away with the need for expensive grid

extension. And for a rapidly growing

urban base, small-scale systems can

substantially reduce the economic and

environmental cost of electrical

services."

But even where a power grid exists,

as in the US, voltage fluctuations and

total power outages can wreak havoc at

places like computer centers and

hospitals. An estimated $ 4 billion is

spent each year in the US just to ensure

uninterrupted power supplies when the

grid fails. This alone creates a very

significant niche market for the high-

A Fuel Cell Primer: The Promise and Pitfalls

Page 15, Rev 7, May 1, 2001

quality, reliable power that commercialscale stationary fuel cells, mainly

running on natural gas, can provide.

And when a stationary unit is running

and generating more power than needed,

the excess power can be sold back to the

grid.

It is a market that is already

established on a modest scale.

International Fuel Cells has sold over

220 of its 200 kilowatt phosphoric acid

power units around the world. One of

them was bought by a data processing

center in Nebraska following a costly

computer crash in 1997. Last year, five

200 kilowatt IFC units were installed at

a post office in Anchorage Alaska. And

soon six will be installed at a school in

Connecticut. To quote Seth Dunn

again:"We're beginning the 21st century

with a power system that cannot take our

economy where it needs to go. The kind

of highly reliable power needed for

today's economy can only be based on a

new generation of micropower devices

now coming on the market. These allow

homes and businesses to produce their

own electricity, with far less pollution."

Stationary fuel cells are in many

ways simpler to design than those for

transportation, which is one reason their

commercialization has already begun.

They don’t need to be particularly

compact or light weight. Nor is there

usually any need for them to start up

quickly. In most cases they are meant to

run continuously for days, weeks,

indefinitely, which makes high

temperature types of fuel cells

acceptable. In fact, the excess heat can

be captured and used to heat water, or to

run a turbine, and thereby generate

additional electricity. This allows them

to achieve higher overall efficiencies

than transportation fuel cells. (Even

with PEM stationary cells, which operate

at relatively low temperatures, some heat

can be captured and used to heat water.)

The entire stationary power market is

also less dependent on politics and

regulation. In fact, recent moves toward

deregulation have encouraged new

options, including feeding excess power

back to the grid.

Whereas only PEM cells are well

suited for transportation (with direct

methanol possibly waiting in the wings),

there are four types of cells contending

for the stationary market.

As mentioned, phosphoric acid

(PAFC) units have already been on the

market for about ten years and have been

built in sizes ranging up to 11

megawatts. Most common, though, are

units in the 50 to 500 kilowatt range.

PAFC stacks need to have their fuel

“reformed” to eliminate carbon

compounds that would poison their

noble metal catalysts. But the reformers

do not have to be compact or start up

quickly, and so are less difficult to

design than reformers for vehicles. The

200 kilowatt power plants sold by

International Fuel Cells can run on a

choice of fuels: natural gas, propane,

butane or methanol. . Their efficiency is

between 40% and 50%, about the same

as PEM. Cost has been a problem,

though. The cost per kilowatt generated

by PAFCs (around $ 4000) is much

higher than is acceptable for really

widespread commercial acceptance.

(The ordinary gas turbines used by

utilities to generate electricity come in at

$ 500 to $ 1000 per kilowatt.) There

have been rapid cost reductions for other

stationary fuel cell types, but not PAFC.

This may make them a technological

A Fuel Cell Primer: The Promise and Pitfalls

Page 16, Rev 7, May 1, 2001

dead end, and in the last few years most

R & D money has been going elsewhere.

Just approaching commercialization

are Ballard Power’s 250 kilowatt PEM

stacks, which are designed to run on

natural gas. The first three

demonstration units have been installed,

including the one mentioned in Berlin,

Germany. Like PAFCs, PEM stacks

need to have fuel reformers. Because

PEMs run at a low temperature and

cannot generate steam, it is harder to

capture their excess heat and channel it

into useful applications for

“cogeneration” of both heat and

electricity. Like PAFCs, PEMs have

efficiencies in the 40 to 50% range. At

first glance, it may look as though they

have no advantages over PAFCs.

However, because stationary PEMs are

made out of the same materials as

transportation PEMs, the economies of

scale that will kick in as the bus and car

engines are commercialized should help

bring down the unit cost of stationary

PEMs as well.

Ballard is the clear leader in the

stationary PEM field. As in

transportation, so in stationary Ballard is

allied with other corporations that offer

deep financial pockets and existing

marketing networks. One is the French

company Alstom, which owns 15.8 % of

Ballard Generating Systems and has the

exclusive franchise to sell Ballard’s

stationary units in Europe. For the large

Japanese market there is EBARA, which

last year injected an extra $ 19 million ($

28.3 million Canadian) thereby boosting

its stake in Ballard Generating from 6 %

to 11.4%. EBARA is more interested in

small, single home generating units than

in the large 250 kilowatt power plants.

The partner for the rest if the world is

New Jersey-based GPU International,

which holds 10.4 % of Ballard

Generating. Ballard’s geographically

spread alliances give it a good strategic

position to market its technology

worldwide. But IFC also has alliances,

notably one with Toshiba to develop and

distribute PEM stationary fuel cells in

Japan.

For stationary power, fuel cells

running at much higher temperatures

than either PAFC or PEM have distinct

advantages. There are two main types in

contention.

Molten carbonate fuel cells (MCFC)

achieve relatively high basic efficiencies

of 60% or more, and when the intense

heat is captured and harnessed for

cogeneration, between 70% and 80%.

They use inexpensive catalysts, rather

than costly noble metals. And because

of their high-temperature operation, they

don’t need reformers to run on a wide

range of fuels, including natural gas,

propane and even diesel. As mentioned,

the latter makes them especially

appropriate for remote places such as

islands, and also for ships.

The company that appears to have

the edge in MCFC is FuelCell Energy

(FCEL), which is headquartered in

Danbury, Connecticut. Like Ballard in

the early 1990s, the company, formerly

called Energy Research Corp., pursued

both battery and fuel cell technologies.

Then it sold its battery business to

shareholders under the name Evercel,

and in September 1999 the company was

renamed FuelCell Energy, which has

been focused on large-scale stationary

power. It had 114 employees at the end

of 1999 and enjoys a strong financial

position following an April stock

A Fuel Cell Primer: The Promise and Pitfalls

Page 17, Rev 7, May 1, 2001

offering that netted it $ 58 million. This

is earmarked for greatly expanding its

current production capacity. Also, like

Ballard, FCEL has enjoyed very strong

government support, receiving upwards

of $ 200 million from the Department of

Energy (DOE) over the years for a

variety of projects. With over $ 60

million in the bank, and renewal by DOE

of a $ 40 million contract, FCEL is in a

strong financial position to forge ahead

with its commercialization plans.

FCEL’s primary focus is on modular

and scalable “building block” units of

250 to 300 kilowatts each. In part this is

because the company sees it's power

plants as being ideally suited for "baseload" applications (running full time

once started up), rather than for stand-by

or peak-power use. But FCEL also

believes that the cost of the necessary

supporting equipment for a fuel cell

power plant is so high (50 to 75% of the

total) that it only becomes economically

viable at this size. FCEL expects to take

its first commercial orders for these units

in the second half of 2001. With Ballard

also focusing on 250 kilowatt PEM

units, FCEL is its most direct

competitor.

FCEL’s Modular Cell

FCEL has also taken the strategic

partnership route in moving to

commercialization. It has licensed to

MTU (a division of DaimlerChrysler)

the exclusive rights to sell it’s

technology in Europe and the Middle

East. In Asia, the Marubeni Corporation

of Japan is FCEL’s key partner. In June

2000 Marubeni committed itself to a

$6.25 million contract under which

FuelCell Energy will deliver one 250

kilowatt plant in 2001, followed by

either four more 250 kilowatt plants or a

one megawatt plant. FCEL also

apparently has the inside track for a

contract to supply a one megawatt

demonstration plant for King County,

Washington (the Seattle area) that would

run on gas from municipal waste.

The electricity would be used for

water treatment under a program

supported by the US Environmental

Protection Agency.

Like MCFCs, solid oxide fuel cells

(SOFC) can attain higher efficiencies

than PEM or PAFC, which could prove

to be essential in stationary applications

where the units are competing directly

with the cost of electric power via the

grid. In medium to large units, where

excess heat is used to power a turbine,

they can attain 75% efficiency or better.

Also like MCFC, because of their high

temperature, which burns the carbon

oxides that poison the catalysts of lower

temperature fuel cells, SOFC’s can

operate on natural gas, propane and

methanol without the need for

reforming.

No small exclusively fuel cellfocused company is working on

commercial-size stationary SOFCs.

They are of interest to investors,

therefore, mainly as potential

competition for FCEL and Ballard. The

leading company is Germany’s Siemens.

A Fuel Cell Primer: The Promise and Pitfalls

Page 18, Rev 7, May 1, 2001

It 1998 Siemens acquired Westinghouse

Power Generation, which had also been

developing SOFC technology. Now

they are working on a “hybrid” SOFC

system with DOE support. The $16

million system combines a 200 kilowatt

Siemens Westinghouse solid oxide fuel

cell and a 50 kilowatt turbine, and it

reportedly performed well in its initial

test.

Stationary power is shaping up to be

a market with enormous growth

potential for fuel cells. However, there

is already competition for similar-sized

power plants, and additional companies

are likely to enter the field. Of the pure

fuel cell companies, Ballard is certainly

off to a good start with its PEM units

and strong alliances in North America,

Europe and Japan. Ballard’s PEM cell

stacks, which are built out of thin layers

of materials that can roll off a largely

automated assembly line, are simple to

manufacture and are likely to enjoy an

initial unit cost advantage. On the other

hand, for sizable fixed generating units,

initial cost is not the only consideration.

FCEL has a technology with a

significant edge in efficiency and an

advantage on fuel type that could prove

to be decisive in the longer run. The

company further claims a significant

advantage in simpler and less costly

supporting equipment. In particular

MCFCs, unlike PEMs, need no complex

fuel reformation to operate on natural

gas. SOFCs offer similarly high

efficiency, especially where

cogeneration is possible.

To summarize, the fuel question is

simpler for stationary than for

transportation fuel cells, and fuel

infrastructure is no barrier to

commercialization. Still, the overall

long-term outlook in stationary fuel cells

is also quite complex. What is the cost

tradeoff, for example, between the

relative simplicity of PEM’s

manufacturing, on one hand, and its need

for a fuel reformer on the other?

Governmental incentives will likely

foster the buyback of “green power” by

utilities. This could significantly reduce

the importance of initial investment

costs (which may favor PEM) relative to

long-term considerations such as total

efficiency (which probably favors

MCFC or SOFC). As with

transportation fuel cells, for stationary

fuel cells too the likely interplay of

politics and ordinary commercial

considerations is difficult to assess.

Home-Size Stationary

Power

Although commercial-size stationary

fuel cells are already on the market,

much smaller home-size units are not far

behind. These can range down to as

small as one kilowatt, which is enough

for lights and small appliances, but not

things like electric stoves and dryers.

One kilowatt is apparently considered

suitable for the Japanese market, with its

small homes and apartments. For the US

market, though, the power plants being

developed are mainly in the three to

seven kilowatt range. About the size of

a refrigerator, these have the capacity to

run major appliances and also provide

some cogeneration of hot water or even

central heating. The fuel of choice is

natural gas.

The main players to date are Ballard

and Plug Power, based in Latham, New

York. Both are using PEM technology.

But they are not in direct competition.

Ballard’s effort has been in the one

A Fuel Cell Primer: The Promise and Pitfalls

Page 19, Rev 7, May 1, 2001

kilowatt range for the Japanese market in

cooperation with EBARA and Tokyo

Gas, Japan’s largest gas utility. A

possible indicator that

commercialization is on track is the

recent increase in EBARA’s stake in

Ballard Generation Systems.

Plug Power is 20% owned by GE

Power Systems. In the first quarter of

2000 Plug produced 22 fuel cell systems

for laboratory and field testing. Its plan

for the remainder of 2000 had been to

produce 500 “pre-commercial” units,

which were to be purchased by GE for a

very extensive field test. The next target

was to bring its commercial units to

market in 2001. Based on this ambitious

schedule and the strength of GE behind

it, Plug’s share price soared more than

1000% in a single year, making it –

briefly--one of the real darlings of the

fuel cell speculative play.

In May, however, Plug suffered a

setback when the pre-commercial units

did not satisfy GE’s specifications for

operations independent of the power

grid. GE is no longer contractually

obligated to purchase what was to have

been 485 units. Plug has stated that its

relationship with GE remains intact, and

the chief operating officer of GE Power

Systems recently joined the Plug board.

However, in August Plug announced that

it was delaying the launch of its first

commercial product until the first half of

2002. The share price tumbled. But in

April 2001, Poug backtracked and said it

will sell 125 to 150 five kilowatt units

this year, starting in July. .

A newcomer to PEM home power is

H Power, (HPOW) recently taken

public, with 85 employees in New Jersey

and its Canadian affiliate in Quebec. H

Power's proposed entry into the home

power market follows their delivery of

50 (of 65 ordered) backup power units to

the New Jersey Department of

Transportation to power variable

message highway signs.

In March 2000, H Power installed

the first prototype stationary fuel cell

system for ECO Fuel Cells, LLC, a

subsidiary of Energy Co-Opportunity,

Inc., an investor in H Power. ECO has

agreed to purchase 12,300 stationary fuel

cell systems over several years for an

aggregate purchase price of

approximately $81 million, dependent

upon ECO's ability to purchase and

resell those systems to their rural

customers. Like Plug, H Power's goal is

to begin shipping commercial units in

the second half of 2001.

Another possible contender for the

home market is a Canadian company

based in Calgary, Global

Thermoelectric. It has 110 employees

and a recent market cap of $337 million

but its main commercial focus has been

thermoelectric generators and diesel

fired heaters. These are used by oil and

pipeline companies for power and

heating at extremely remote locations.

For both applications, fuel cells could

also play a role.

Global purchased an existing SOFC

technology from a German company and

has been improving it with the small

home market in mind. Another possible

use is to generate electric power for

internal combustion engine cars (to run

air conditioning, for example) even

when their engines are turned off.

Global has been working on this with the

huge Delphi car accessory company

(formerly part of the GM empire) and

also with BMW.

A Fuel Cell Primer: The Promise and Pitfalls

Page 20, Rev 7, May 1, 2001

Small SOFCs can also be applied to

home use. With cogeneration they

should be able to attain efficiencies

considerably higher than PEM. As with

larger SOFC’s, they do not need fuel

processors and can run on a variety of

fuels. In July 2000 Global got a

welcome injection of new financing

when a major Canadian gas utility,

Enbridge Inc. spent $ 17 million ($ 25

million Canadian) for preferred shares in

Global “to give the firm the financial

clout it needs for commercial launch of

its residential natural gas fuelled unit

within five years.” Enbridge distributes

natural gas to 1.5 million residential

customers in Ontario and could also act

as distributor for the fuel cell power

plants. Global is expected to deliver its

first test units to Enbridge in 2001.

Shares in Global jumped 11 percent on

the news.

The potential market for individual

home units is difficult to quantify, but it

could well turn out to be enormous,

especially if the cost of electricity from

the grid continues to spiral upward. In

addition, utilities have not expanded

their capacity to keep up with demand.

One California utility recently warned of

“rolling brownouts” in extremely hot

weather when air conditioners push the

grid beyond its capacity.

Of course, once such units are on the

market, it will also become practical to

build houses in more remote places

where the cost of bringing in power lines

would be exorbitant. The units should

also offer uninterrupted power, which

could be important to individual

households with computers and other

electronics, just as it is for businesses.

Certainly in some parts of the US, and in

much of the Third World, the ability to

have quiet, clean, reliable power could

be decisive. Noisy and quirky gasoline

or diesel generators are just not the

same. Finally, there are places where

natural gas is cheap relative to grid

electricity, making self generation a very

competitive option.

Portable/Standby Power

Another possibly huge niche market

is small portable units. Ballard, in

collaboration with the Coleman

Sunbeam company (makers of camping

gear such as Coleman stoves, and

Sunbeam appliances) promised to

demonstrate such a product by the end of

2000 and to have it in stores by the end

of 2001. It has missed this first target

but still plans to deliver to stores by late

this year. However, for most of us, this

may be the first fuel cell we can actually

buy and use. Ballard and Coleman have

been very quiet about the details, such as

exact size and the fuel it will use, but

most speculation is that it will be around

one kilowatt and use replaceable or

refillable cylinders of compressed gas.

This would put it in direct competition

with very small home gasoline

generators for backup power when

windstorms bring down the power lines.

It might also be popular for camping

trips, or for recreational vehicles, or

simply to run electric tools in places that

are too far to reach with normal

extension cords. Ballard and Japanese

consumer products giant Matsushita

have announced an even smaller 250

watt portable unit for the Japanese

market.

Finally, another notch down in size

are very small PEM fuel cells to run

electronic devices and for such niche

A Fuel Cell Primer: The Promise and Pitfalls

Page 21, Rev 7, May 1, 2001

markets as bicycles. Ballard and H

Power, for example, have developed

prototypes in the 20 to 100 kilowatt

range.

One cutting edge company investors

may want to look at is Manhattan

Scientifics Inc, which has offices in Los

Alamos, New Mexico and New York.

Manhattan bought a very compact PEM

technology from a German company and

has further developed it to power the

world’s first prototype fuel cell bicycle.

Using a 670 watt PEM cell, the niftylooking Hydrocycle can go 70 to 100

kilometers on a two-liter tank of

compressed hydrogen.

Fuel Cell powered “Hydro Cycle”

As the company’s literature points

out, in China, India and Japan alone

there are currently 405 million bicycles

in use. The air in those countries is

already heavily polluted by emissions

from two-stroke and diesel engines. So

there should be an enormous world

market for clean electric bicycles.

Manhattan Scientifics is also

developing really tiny direct methanol

fuel cells that fit in the palm of your

hand and could replace batteries for a

vast number of consumer products, from

laptops to camcorders and cell phones.

They claim that these have three times

the energy density of advanced nickel

metal hydride batteries. But the little

Los Alamos lab is not alone. Much of

the work on these so-called micro fuel

cells is being done by huge electronics

and battery companies, such as

Motorola. None of them seem close to

having a commercial product yet, and

the work is shrouded in secrecy. But

surprises in this potentially lucrative

field can be expected.

Related Technologies and

Markets

A large number of companies—some

of them small, innovative and worth

considering by investors—are

developing and/or already

manufacturing a wide range of products

and equipment supportive of fuel cells.

These include power management

systems, hydrogen sensors, pressure

equipment, fuel reformer components,

etc. The success of such companies may

depend on the overall pace of fuel cell

commercialization, and on which

specific fuel cell technologies turn out to

be the winners. We will briefly mention

only a few to indicate the broad areas

investors may want to consider.

Methanex corporation,

headquartered in Canada, is by far the

world’s largest producer of methanol.

This is made from natural gas at

facilities mainly in Chile and New

Zealand and transported in special

supertankers. Methanol is used as a

chemical in a vast number of industrial

applications and in a number of

consumer products, including paint

strippers, duplicator fluid, model

airplane fuel, and dry gas. It can be

manufactured from a variety of carbonbased feedstocks such as natural gas,

coal, and biomass. In the last few years

A Fuel Cell Primer: The Promise and Pitfalls

Page 22, Rev 7, May 1, 2001

there has been an oversupply of

methanol on world markets. Methanex

has responded by buying up smaller rival

companies and in a number of cases

mothballing facilities. But Methanex is

also a member of the California Fuel

Cell Partnership. If it appears likely that

methanol will become the fuel for the

first generation of fuel cell cars, demand

for Methanex’s product should increase

significantly. And Methanex will have

the capacity to expand production

rapidly.

Nuvera Fuel Cells is a privately held

corporation (resulting from the merger

of De Nora Fuel Cells and Epyx

Corporation) based in Cambridge, MA.

Nuvera announced in July 2000 that it

was about to ship the world’s first

gasoline reformer for testing by four

auto companies in the US, Europe and

Japan. The company will also deliver a

reformer to Plug Power under a US

Department of Energy program. If this

gasoline reformer is efficient and can be

produced at a reasonable price, Nuvera

could have the inside track on a very

large market.

Regardless of what fuel is used in

cars, fuel cell buses are likely to run on

compressed hydrogen. DCH, of

Middleton, Wisconsin, manufactures

hydrogen sensors and related safety

equipment for use in garages and similar

spaces.

As the stationary fuel cell power

market grows, so will the demand for

technology to process that power. Fuel

cells generate direct current, but most

electrical uses require alternating

current. So the demand for power

converters (which have been marketed

for decades for use with solar systems)

should increase. Many companies

already manufacture these devices, but

this entire small industry should enjoy a

boost as fuel cells come to market.

As mentioned, stationary systems

may generate more power than needed at

any given time. If the system has grid

access, the excess power can be sold

back to the grid. But this requires

specialized equipment. Satcon

Technology, of Cambridge,

Massachusetts, has developed a utility

grid interface for fuel cell distributed

power generation systems up to 50

kilowatt. The interface also inverts the

low voltage DC power from fuel cells

(or other distributed power generation

systems) into useable AC power.

Finally, there are companies with a

sizable stake in hydrogen storage

technologies. Energy Conversion