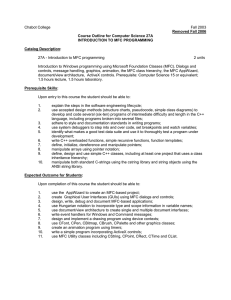

MFC Application Summary

advertisement