the future of the biomedical industry in an era of globalization

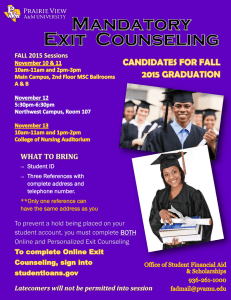

advertisement