Refinement of Income and Rent Rule

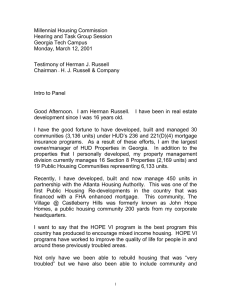

advertisement