CESTAT Rulings: Central Excise - 2015

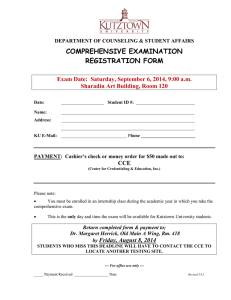

advertisement