Current Situation and Economic Feasibility of e

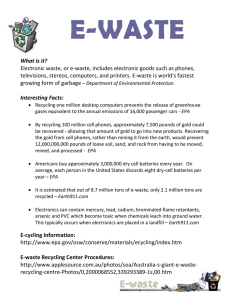

advertisement