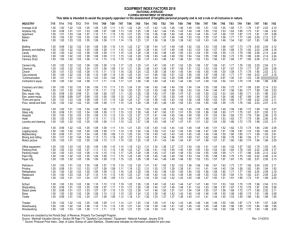

U.S. Agricultural Equipment Report

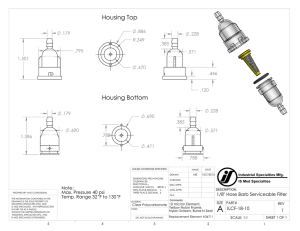

advertisement