EQUIPMENT LEASING ASSOCIATION Construction and Agricultural

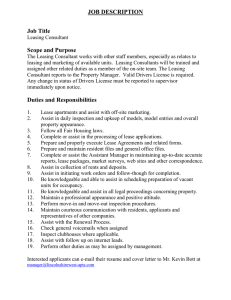

advertisement