Paumanok Publications, Inc.

Electronic Industries Alliance

November/December 2001

An affiliate publication of the

A sector of the Electronic Industries Alliance

The Only Magazine Dedicated Exclusively To The Worldwide Passive Electronic Components Industry

Dielectrics in Motion:

Buying Capacitors in Changing

Technical Environments

Sons of Gwalia

Clarifies the Tantalum Supply-and-Demand Issue

The Value of Distribution

LRF Thick Film Current

Sense Chip Resistors

The LRF Series 2512

Higher pow er, wider terminat ions ,

smaller package

(2W), 2010 (1W) and

1206 (1/2W) surface

mount chips are rated

at 70°C with values

from 0.003Ω to

0.025Ω, in tolerances to 1% and 5%, and TCRs

of ±100ppm/°C or less. Their ceramic-based

construction makes them considerably more

ugged and stable than metal strip resistors in

high-volume current-sensing and feedback

cuits for disk drives, power supplies,

automotive systems and instrumentation

applications.

RC Advanced Film Division

For more information,

visit www.irctt.com

LRK 2512 Four-Terminal

“Kelvin” Current Sense

Chip Resistors

The LRK chips

LRF3W Series Current Sense Resistors

achieve the ultra-low

resistance values

required for precision

current-sensing circuits

through a unique fourminal design. Used for cur rent-sensing

cuits in portable electronic devices such as

The industry’ s

smallest 3-watt

current sense

chip resistor

aptop computers, the LRK2512 features values

om 0.003Ω to 0.100Ω, with tolerances to 1%

d 5% and TCRs of ±100ppm/°C or less. The

RK Series resistors are rated for 2W @ 70°C.

IRC Advanced Film Division

For more information

visit www.irctt.com

SC-3:Wide Value Range

3W Surface Mount Chip

Resistors

The SC-3 chip resistor

offers a unique space-

High po wer

dissipation –

3 Watts @ 70°C

Large solder

terminations

accommodate

wider PCB traces

used for higher

current

saving alternative to

bulky wirewound

devices. Ideal for

use in a wide variety

Resistance v alues

down to 0.003 Ω

applications, including power supplies,

ogrammable controls and computers, the

SC-3 is rated for 3W at 70°C and terminated

on the long side. Its unique reverse geometry

enables the resistor to carry higher current at

a lower overall temperature. Resistance values

T T electronics’ latest current sense chip resistor offers a spacesaving surface mount alternative to lar ger wirewound and film

devices. The LRF3W Series flip chip is the in dustry’s smallest

footprint resistor to carry a full 3-watt power rating, with a

four-terminal “Kelvin connection” for more accurate curren t

sensing. Its low resistance ran ge (.003-0.1 Ω) and tight TCRs

make it i deal for computers, power supplies and automotive

application s. If your circuits require more power handling in

less space, specify IRC (U SA) or Welwyn Components (Europe).

Low TCRs

(50ppm /°C)

with tolerances

to ±1.0 and ±5.0%

Call 1-361-992-7900 or your local

distributor , or visit www.irctt.com

IRC Advanced Film Division

Welwyn Components

www.irctt.com

afdsales@irctt.com

361-992-7900

www.welwyn-tt.com

sales@welwyn-tt.com

+44 (0) 1670 822181

A subsidiary of TT electronics plc

A subsidiary of TT electronics plc

e as low as 1Ω – 350Ω with tolerances

down to ±1% and TCRs to ±100ppm/°C.

IRC Advanced Film Division

For more information,

visit www.irctt.com

Precision

TaNFilm®

Chip

Resistors

General

Purpose

Chip

Resistors

Low Value

Chip

Resistors

Resistor

Temperature

Sensing

Devices

High

Voltage

Thick Film

Resistors

TaNSil®

Siliconbased

Resistors/

Networks

Surface

Mount

Resistor

Networks

Throughhole

Resistor

Networks

Custom

Thick Film

Resistors

TABLE OF CONTENTS

Volume 3, No. 6

NOVEMBER/DECEMBER 2001

The Only Magazine Dedicated Exclusively To The Worldwide Passive Electronic Components Industry

FEATURE

8

Dielectrics in Motion: Buying Capacitors in Changing Technical

Environments

12

Circuit Protection Components:

Challenges

14

Ultracapacitors:

16

Integral Improvements Increase 0201 Resistor

Placement Capacity and Y ields

18

Dry Stacking Opportunities in Multilayer

Inductor Production

22

What Have We Learned?

23

E-mail

24

The Value of Distribution

26

ECA Membership:

28

Sons of Gwalia Clarifies

32

Solid Niobium Capacitors with Equivalent Performance to

Tantalum

33

Aluminum Capacitor Markets are Growing

35

Critical Datacom Applications Require the Use of MLP Capacitors

Technology

Trends and Design

Better Than Ever

Privileges, Rewards, and, Above All, Proven Business

Value

Tantalum Supply-and-Demand Issues

DEPARTMENTS

4

Letter from the Publisher

I am frequently asked how big the worldwide market for passive components is, with respect to dollar value.

6

Letter from ECA

Thanks to the global economy, companies of all sizes are taking advantage of opportunities that didn’t exist 10 years ago.

36

Newsmakers

New product offerings and important developments in the passive component industry.

PASSIVE COMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

3

LETTER FROM THE PUBLISHER

I

the largest volume of

am fr e que nt ly

products shipped.

asked how big the

The graph further

worldwide mardefines the marketket for passive compop l a c e by e x c l u d i n g

nents is, with respect

printed circuit boards,

to dollar value. That is

wire and cable, wire

a difficult question

and cable connectors,

because it is subject to

circuit breakers, and

precise definitions.

power film capacitors

T r a d i t i o n a l l y, m a n y

(large stationary cans)

companies view only

because they are not

fixed capacitors, fixed

electronic components,

r e s i s t o r s, and SMD/ Dennis M. Zogbi

in the true sense. The

leaded inductors as

comprising the true passive com- addition of those markets would

ponents industry; the attached represent an additional US$33 billion

graph indicates that the core pas- in value. However, in order to mainsive components market was val- tain some reasonable parameters, we

ued at US$19.5 billion, world- represent the worldwide passive

wide. In reality, every electronic component market at US$61.9 billion

component

that acts passively within

the greater circuit should

also be considered as a passive device. On

that basis, the

global passive

component

market should

i n cl ude elec tronic connectors, piezo components, relays, switches, Total Passive Components Market: $61.9 billion.

circuit protec- Electronic Connectors (excludes wire and cable connectors).

t i o n c o m p o - Fixed Capacitors: MLCCs, SLCs, tantalum, aluminum, DC film (excludes power film capacitors).

Circuit Protection: Thyristors, SAD diodes, zener diodes, varistors, PTC/NTC thermistors, electronic

nents, variable fuses, gas discharge tubes, & surge networks.

c a p a c i t o r s , Fixed Resistors: Chip resistors, resistor networks & arrays, tin oxide, Nichrome film, wirewound,

variable resis- carbon film, & composition.

tors, and delay Other: Variable capacitors & resistors, delay lines, etc.

lines. These

combined elements value the for 2000. Also, based on prelimiworldwide passive component nary estimates, it is apparent that

market at about US$61.9 billion. the passive component industry

Paumanok further estimates that should lose about 30% of its value

the volume of passive components in 2001 (a loss of about US$19

consumed worldwide in 2000 was billion overall for the industry, as

about 1.9 trillion pieces, with indicated in the graph), which will

MLCCs, chip resistors, and elec- largely wipe out any revenue intronic connectors accounting for creases experienced in 2000.

4

PASSIVE COMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

P UBLI SH ER

DENNIS M. Z OGBI

D IRECTOR OF ADVE RTI SING

B USINESS M ANAGER

SAM COREY

E DIT OR

PAMELA GABRIEL

M AR KETI NG

HEIDY WEGERSKI

ART D IRECTOR

AMY DEMSKO

ADVISORY BOARD

James M. Wilson

Murata Electronics N.A., Inc.

Glyndwr Smith

Vishay Intertechnology, Inc.

Ian Clelland

ITW Paktron

Pat Wastal

Avnet

Craig Hunter

AVX Corporation

Jeff Kalb

California Micro Devices

Daniel F. Persico Ph.D.

KEMET Corporation

Bob Gourdeau

BC Components

Editorial and A dvertising Office

109 Kilmayne Drive, Suite A

Cary, North Carolina 27511

(919) 468-0384 (919) 468-0386 Fax

www.paumanokgroup.com

The Electronic Components – Assemblies – Materials –

Association (ECA) represents the electronics industry

sector comprised of manufacturers and suppliers of passive and active electronic components, component arrays

and assemblies, and commercial and industrial electronic

component materials and supplies. ECA, a sector of the

Electronic Industries Alliance, provides companies with a

dynamic link into a network of programs and activities

offering business and technical information; market

research,trends and analysis;access to industry and government leaders; standards development; technical and

educational training;and more.

The Electronic Industries Alliance (EIA) is a federation of

associations and sectors operating in the most competitive and innovative industry in existence. Comprised of

over 2,100 members, EIA represents 80% of the $550 bil lion U.S . electronics industry. EIA member and sector

associations represent telecommunications, consumer

electronics, components, government electronics, semiconductor standards , as well as other vital areas of the

U.S. electronics industry. EIA connects the industries

that define the digital age .

ECA members receive a 15% advertising discount for

Passive Component Industry. For membership information, contact ECA at (703) 907-7070 or www.ec-central.org;

contact EIA at (703) 907-7500 or www.eia.org.

LETTER FROM ECA

Turbulent Global Economy Calls for

Just-in- Time and Just-in-Case Strategies

T

hanks to the global economy, companies of all

sizes are taking advantage of opportunities that

didn’t exist 10 years ago. Markets are not only

local and national but also geographic and international.This creates a wealth of opportunity for progressive companies. But, it has implications. September 11

alerted the entire marketplace to the reality that major

tragedies in any one area of the global economy can

have an impact on all other areas.

One area coming under scrutiny since September 11

is just-in-time manufacturing and distribution. Just-intime strategies have become an essential element for

many global participants in the new economy. Whether

it is materials, components, assemblies, or finished

goods, companies believe it is critical to deliver products

quicker and to eliminate excess inventory. Extra time

spent in the supply chain between raw materials and

deliverable products is money wasted. Price and speed

are everything in today’s customer-centric economy.

Strategies for supply chain management are the rage

and every industry is addressing the issues.

Addressing “Just in Case”

Before September 11,“just in time” was a ruling principle in supply chain management. And while it is still

critical to success, over the last few months it has often

taken a backseat to “just in case.” In the immediate

aftermath of September 11, there were major disruptions

in transportation, security, communications, morale,

and other factors affecting productivity. Many major

industries found themselves without the means to deliver

products to waiting customers, leading them to question

their inventory levels and the way they move goods

within their supply chains.

The earthquake in Taiwan last year also created turmoil, but its aftereffects were more contained than those

from the terrorist attacks. If this natural disaster had

occurred in an area containing a higher level of infrastructure that is critical to our industries, the effect would

have been more profound. Disasters, both natural and

man-made, suggest that perhaps we need to go beyond

“just in time” to establish strategies for “just in case.”

EIA and ECA believe this is the case. In January

2002, EIA will sponsor an Executive Leadership Forum

titled ‘‘Electronics/High-Tech Industry Leadership in

Turbulent Times.” The focus of this forum will be to

6

PASSIVECOMPONENT INDUSTRY

assess the impact of volatile markets and political uncertainty that are prevalent in today’s economic environment. Quoting from the preliminary program:

Following the technology slump and the terrorist

attacks of September 11, we need to reaffirm and communicate the lead role of the high-tech industry in a global econom y. Threats to globalization are from those who do not

believe they have a stake in it and those with a protectionism mentality. The global economy presents challenges

and opportunities for all of us. The fundamentals lie in

expanding trade, globalizing supply chains, financial capital flows, open borders, the role of communications

a n d the Internet, privacy/individual rights vs. government

control, mission assurance, and security strategies. We

need to prevent back-peddling on these fundamentals,

which would undermine the growth of our industry and the

world economy.

The policies we develop going forward will play an

important role in sending pro-globalization signals. We need

to use our technologies to encourage connectivity and

growth throughout the world. Economic strength, a t

home and abroad, is the foundation of America’s hard and

soft power. Our industry can and will be the economic engine

for freedom, opportunity and development. Our leadership

in promoting the international economy and trading system

is vital.

Invited speakers for this program represent high

levels of government, industry, and political arenas that

are involved in assessing globalization issues and developing programs to tackle them. Discussions and actions

that arise from this forum will help initiate processes

necessary to implement just-in-case contingencies and

other important global strategies.

The electronic components industry is invited to be

part of this forum. Senior management from the ECA

leadership and colleagues from our alliance partners in

consumer, telecommunications, government, and the

semiconductor industries will be there. For more information, contact ECA at (703) 907-7070 or log on to

ec-central.org or eia.org.

NOVEMBER/DECEMBER 2001

— Bob Willis is president of ECA, the electronic components sector of the Electronic Industries Alliance

(EIA). He can be reached at robertw@eia.org.

FEATURE

Dielectrics in Motion: Buying

Capacitors in Changing T echnical

Environments

Changes in the Picofarad Range

The low end of the capacitor industry contains the

multilayered ceramic chip capacitors and the DC film

capacitors; both are electrostatic in nature and have

combined shipments worldwide exceeding 600 billion

pieces, mostly in the picofarad range. Because of sheer

volume on printed circuit boards, these capacitors have

been targeted for replacement by other technologies.

The MLCC, with its low picofarad value, is the primary target for displacement. It dominates printed circuit boards and accounts for approximately 200 units

per cellular phone and as many as 700 units in a laptop

computer. These end-use segments, among others, have

volumetric efficiency problems caused by the use of so

many MLCCs for bypass, decoupling, and filtering.

One method for

making MLCCs more

efficient has been the

multichip array package, which combines

four MLCCs in an 0805

footprint. Another

technique uses ion implantation machines to

manipulate silicon into

silicon dioxide and silicon nitride capacitors

that are assembled

into preformed packages known as integrated passive devices

(IPDs). These IPDs—

produced by such companies as California

Micro Devices, TT electronics, Vishay Intertechnology, STMicroelectronics, ON Semiconductor, and

Telephus (Korea) — can replace up to 18 MLCCs with

one IPD. Although IPD capacitor technology is limited,

generally to less than 2,000 picofarads (although some

higher capacitance versions do exist), it demonstrates

8

one method where active component technology is

displacing individual discrete technology through the

manipulation of silicon. Currently, this encroachment

into the MLCC market is happening at the extreme low

end of the MLCC capacitance spectrum.

Paumanok Publications, Inc., estimates that in 2000,

IPDs accounted for global revenues of less than US$100

million, which means that their penetration into the

MLCC business has been less than 2% of total available

market value, to date.

Changes in the Microfarad Range

While MLCCs are being crowded by silicon-enabled

capacitors at the low end of the picofarad range, MLCC

manufacturers are extending capacitance values deep

into the microfarad

range (at this writing,

up to 100 µF with

high-cap MLCCs). The

microfarad range has

traditionally been

dominated by tantalum and aluminum

electrolytic capacitors,

which, by nature, create higher capacitance

in small case sizes.

Since the scientific

maxim applies, whereby capacitance is directly proportional to

the physical size of the

f i n i s h e d c ap a c i t o r,

MLCC manufacturers

have successfully and

economically developed

MLCCs with as much as 700 layers in traditional

MLCC case sizes by employing extremely thin nickel

electrodes and extremely thin advanced dielectric layers

in very small packages. TDK Corporation, Taiyo Yuden

Corporation, and Murata Manufacturing have led the

PASSIVE COMPONENT INDUSTRY NOVEMBER/DECEMBER 2001

Dielectrics

developments for extremely high-capacitance MLCCs

since 1993. In 2000, products in key competitive values

were produced that stabbed deep into the heart of the

microfarad range: 2.2, 4.7, 6.8, 10, 22, 27, 33, 47 and

100 µF, ranges traditionally dominated by molded and

coated chip tantalum capacitors and surface-mount

aluminum electrolytic capacitors.

Another factor benefiting high-capacitance MLCCs

are the supply chain problems in the

tantalum capacitor industry that came

to a peak in 2000 with the extreme

shortages of tantalum capacitors. The

resulting skyrocketing prices fueled

demand for alternative technologies,

the most promising being the highcapacitance MLCCs, which were limited only by the number of suppliers

and not by any problems in the supply chain. There is also the perception

that high-capacitance MLCCs, with

their base-metal electrode technology,

have the ability to lower future prices

as higher purchase volumes arise.

Paumanok Publications estimates

that sales for MLCCs with capacitance values between 1 µF and

100 µF totaled about US$1.5 billion

worldwide in 2000, a testament to

their accepted replacement for tantalum chip and surface-mount aluminum capacitors. Many end-use

markets are replacing tantalum with

high-capacitance BME MLCCs. The

majority of volume displacement

activity occurs in the 1 µF–10 µF

range, although it is perceived that

the value equation still lies in the

10 µF–100 µF range.

Many end-use markets are attracted

to high-capacitance MLCCs, although the major converts have been

the wireless communications companies, computer motherboard manufacturers, and automotive electronic

subassembly manufacturers. Due to

the success of high-capacitance

MLCCs from TDK, Taiyo Yuden, and

Murata, other traditional manufacturers of MLCCs have also expanded

their base-metal MLCC programs to

include higher capacitance parts.

New competitors who have joined the

market include Phycomp, KEMET,

AV X , M a t s u s h i t a , S a m s u n g, a n d

Kyocera, among others.

The Tantalum Capacitor Industry Responds to

Pressure

Obviously, the industry under the greatest threat

from the successful development and implementation of

high-capacitance MLCCs is the tantalum chip capacitor

industry. One response by traditional tantalum capacitor manufacturers (including KEMET, AVX, Vishay,

NEC/Tokin,EPCOS, Hitachi,Matsushita, Nichicon,and

PASSIVECOMPONENT INDUSTRY

SEPTEMBER/OCTOBER 2001

9

Dielectrics

Matsuo, among others) has been to either increase

production or to develop larger case size tantalum

parts that are currently unaffected by high-capacitance MLCC encroachment. Another strategy has been

to specialize parts production, whereby tantalum capacitor manufacturers lower the equivalent series resistance of their parts by developing either multiple

anode chip solutions or replacing the manganese dioxide cathode with an organic polymer material such as

polypyrole or polythiolene (or a combination of both).

A significant move by tantalum capacitor manufacturers has been the development and introduction of

niobium capacitors. Niobium is an element on the periodic table, typically found in mining operations in

conjunction with tantalum ore. Niobium has tremendously high capacitance value per gram of material,

which means it can create much higher capacitance

values than traditional tantalum capacitor parts, albeit at a lower level of comparable performance. The

strategy is to introduce niobium capacitors as a logical

extension of the tantalum capacitor product line that

can encroach on the aluminum electrolytic capacitance

range in a surface-mount design. Niobium also has a

lower raw material cost structure, when compared to

tantalum. Plus, because of its use in steel production,

its volume usage worldwide is much higher than tantalum and therefore less prone to price swings. It is

widely speculated that niobium capacitors may, in

fact, cannibalize some of the tantalum capacitor industry, especially in applications where the performance characteristics of tantalum are not as important

as the capacitance value in a small case size. Paumanok Publications anticipates that the initial battleground for niobium will be in modem card applicat i o n s, where niobium capacitors will displace

surface-mount aluminum electrolytic capacitors. The

key battleground, however, will be in cellular telephones, where it may be highly likely that niobium capacitors will replace the tantalum capacitors that

have not, as of yet, been displaced by high-capacitance

M L C C s. Companies that are working on or hav e

a lready offered niobium capacitors for sale include

KEMET, EPCOS, Vishay, and Nichicon, each of which

also has tantalum capacitor assets.

One of the more interesting developments in the

tantalum capacitor industry has been the introduction

of the P-case size tantalum chip capacitor, which at

this point appears to be limited to Japanese markets.

The P-case is smaller in size than the A-case (a P-case

is a 0603 ceramic equivalent), and therefore uses less

raw material in its anode. The P-case, developed by

such companies as NEC/Tokin and Hitachi, should be

priced competitively against high-capacitance ceramics and be a viable competitor in the 1 µF– 4.7 µF

range.

10

The Aluminum Industry Responds to Pressure

Aluminum electrolytic capacitor manufacturers have

responded to encroachment pressures by developing

specialized aluminum capacitors and extremely highcapacitance products based on carbon technology, thus

expanding their product offering into the farad range to

compete against rechargeable batteries.

Electrolytic in nature (just like tantalum), aluminum

capacitors also respond to the use of organic polymer

technology to lower their equivalent series resistance.

Many aluminum capacitor manufacturers watched the

success of Sanyo Video Component’s OS-CON line of

low-ESR aluminum electrolytic capacitors, which are

used by Intel to decouple its advanced lines of highspeed microprocessors. Companies such as Matsushita,

Nichicon, Nippon Chemi-Con, and KEMET (with

Showa-Denko) have developed polymer aluminum

capacitors in high-capacitance values with extremely

low ESR to compete against the OS-CON line in the

computer industry.

The other major accomplishment by aluminum capacitor manufacturers has been the development of

double-layer carbon capacitors (popularly termed

“supercapacitors” by the industry) extending their

aluminum capacitor lines from the high-microfarad

range into the farad range (extremely high capacitance).

These devices, developed and marketed by traditional

electrolytic houses such as Matsushita, Elna Capacitor,

and NEC/Tokin, are based on extruded carbon slurries

or activated carbon fabric materials. New entrants into

the supercapacitor market include Nichicon, AVX,

Hitachi (with Maxcel), and Shizuki Electric; all have

experience with electrolytic capacitor or power film capacitor technology and markets. These companies have

developed products that are in the 0.25 F–1 F range, are

either small can or button cell in configuration, and extend capacitor technology into the small battery market

as replacements for NiCad, NiMH and, in some instances, Li-ion batteries in CMOS protection (clock

backup) circuits in consumer electronics or battery

load-leveling in wireless communications. This concept

has also been taken to the extreme by such companies

as Maxwell Technologies, EPCOS, Montena, Ness, and

SAFT, who have developed high-capacitance cells (up to

2,700 F) and linked them together in series for use as

large battery load-leveling devices for electric drive systems (e.g., buses, trains, and electric vehicles), as well as

for applications in load-leveling battery functions in

large power supplies and for the displacement of

mechanical actuators.

Conclusion

From the capacitor buyer’s perspective, choices

abound for bypass, decoupling, and filtering, thanks to

advances in raw material technology. Traditional semi-

PASSIVE COMPONENT INDUSTRY NOVEMBER/DECEMBER 2001

Dielectrics

conductor companies have been able

to manipulate silicon to create capacitance that can displace discrete

MLCCs on the printed circuit board,

while MLCC companies have used

advanced raw materials and new

manufacturing methods to create

high-capacitance MLCCs that can

compete against tantalum chip capacitors. Tantalum capacitor manufacturers have, in turn, either specialized their product offering or

developed niobium capacitors to extend capacitance range into that of

aluminum capacitors. Aluminum

capacitor manufacturers hav e

r esponded by developing carbonbased capacitors that extend their

product offerings into the farad

r a n g e, thus competing against

batteries.

Would you like to receive

future editions of

this magazine?

If so, fax your name,

company, postal address,

phone, fax and e-mail

address to us at

(919) 468-0386

or send e-mails to

sales@paumanokgroup.com.

Passive Component Industr y

(ISSN 1527-9170)

is published bimonthly by

PaumanokPublications, Inc.

109 Kilmayne Drive, Suite A

Cary, North Carolina 27511 USA

2001 Paumanok Publications, Inc.

All rights reserved.

Reproduction in whole or part

without written permission

is prohibited.

POSTMASTER:

Send address changes to

Paumanok Publications, Inc. at

109 Kilmayne Drive, Suite A,

Cary, NC 27511.

Annual subscription rates for

nonqualified individuals: $65.00,

U.S.; $75.00, Mexico; $85.00,

Canada; $130.00, other countries.

Back issues $25.00, when available.

PASSIVE COMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

11

FEATURE

Circuit Protection Components:

Technology Trends and Design Challenges

Tom Wortmann

Manager, Market Development

Littelfuse, Inc.

T

o properly discuss the outlook

for the circuit protection component market, we have to

understand the future trends of the

end markets that use these electronic devices. They are (1) growth

of dense-board applications, (2)

increasing acceptance of USB 2.0

and IEEE 1394 plug-and-play protocols, (3) convergence and connectivity of end-use functionality, and

(4) growing concern for electrostatic

discharge (ESD) protection.

Throughout the entire electronic

components marketplace, we see a

growing need to provide current

product functionality in smaller

footprints. Portable phones and

PDAs, for example, are compelled to

fit more user functionality into a

smaller device, resulting in a denser

printed circuit board (PCB). To meet

size constraints and provide ESD

protection in a smaller footprint,

overvoltage component manufacturers have developed 0402-sized

varistor and diode products. The

ESD event, if not stopped, can cause

damage, ranging from soft failure

(data corruption) to permanent

damage of the chip. Because of the

need to properly handle the high

voltages of an ESD event (up to

15,000 V ) , many component

manufacturers are finding that they

have “stretched” the limits of the

current technology and are unable

to shrink” their current products

any further. Component manufac-

12

PASSIVE COMPONENT INDUSTRY

turers are challenged with developing different ways of providing the

same performance in smaller packages. Similar to the board-density

challenges for overvoltage protection, applications for overcurrent

devices have required manufacturers to “shrink” their current

products. Overcurrent products generally must be rated to carry the same

amount of current as previous products; this requires that the energy

density of the devices be increased.

Over the next year, the data protocols driving much of the electronic

circuit protection products in use

today will increase significantly with

respect to speed. This evolution will

drastically change the board-level

ESD protection market. ESD protection has commonly been accomplished with varistor and diode technologies. Both technologies offer

excellent ESD protection and are

compatible with low-to-medium

speed data rate lines. For example,

the USB 1.1 data speed protocol

operates at 12 Mbs; devices utilizing

that protocol can protect the microprocessor chips from ESD damage

with diodes and varistor products.

However, the capacitance of those

devices is too high to be used on the

signal lines of USB 2.0, IEEE 1394,

or Infiniband™ devices. As these

data rates increase, the need for lowcapacitance ESD devices (sub-1 pF)

also increases in order to maintain

signal integrity on the signal lines.

New polymer ESD suppression technologies offer low capacitance (sub1 pF), low leakage current (very important in low-power portable equipment), fast response time (<1 ns), low

NOVEMBER/DECEMBER 2001

clamping voltage (100 V), the ability

to withstand multiple ESD pulses,

and can be manufactured in many

different configurations.

The resettable polymer PTC technology has been adopted as the preferred method for protecting plugand-play applications. With the

growth of USB- and IEEE 1394enabled products, the circuit protection

industry has responded by introducing resettable PTC products in a

1206 package with the same current

handling of previous generation

devices. This decrease in size required

a 300% increase in the power density of the devices. The industry will

continually be challenged to change

its designs and develop new polymer

formulations that can handle the

current levels required, without sacrificing safety and reliability of the

overcurrent protection that users

demand.

One of the changes most difficult

to gauge in the electronic component

marketplace is the convergence and

connectivity of electronic devices,

raising multiple questions. Will the

business and consumer electronics

markets demand a wireless phone

with digital camera and Internet capabilities, or will they prefer a wireless phone with PDA capabilities—

or both? What role will the personal

computer play in the future—will it

be the device with which all other

devices “sync-up”? Will all devices be

sold with “cradle” capabilities, so

that your digital camera, PDA, and

wireless phone can all be synchronized with your personal computer?

The answers remain unclear. ElecContinued on page 25

FEATURE

Ultracapacitors: Better Than E ver

Bobby Maher, Applications Engineer

Maxwell Technologies, Inc.

PowerCache Ultracapacitors

U

ltracapacitors, also known

as d o u b l e - l ayer capacit o r s, have existed for many

years. They are available in capacitances ranging from millifarads to

several farads and have been used

largely as a very low-drain energy

backup source in, for example, electronic appliances because of their

high internal resistance. For such

applications, ultracapacitors are

used primarily because they can

store and deliver energy more reliably than a battery, making them

ideal as a backup power source.

In recent years, a new version of

ultracapacitors has been introduced

into the market. The major advantages of these new ultracapacitors

are their high power density, long

cycle life, and DC life —features

that make them a maintenance-free

product, thereby allowing for highpower applications ranging from a

few seconds to several minutes. Indeed, they feature capacitances

ranging from several farads to a

few thousand farads, with a much

lower internal resistance than

previous ultracapacitors, making

them perfect for high power-burst

applications.

High power-burst applications fit

into two categories: small-cell and

large-cell. Small-cell applications

include those found in digital cameras, wireless personal PCs, scanners, actuators, and toys. In those

systems, ultracapacitors are used to

load-level the pulse from the main

energy source, which can be batteries, fuel cells, or other devices. The

14

PASSIVE COMPONENT INDUSTRY

high power density of ultracapacitors has allowed designers to substitute widely available alkaline

batteries for the high-power batteries

they have traditionally designed

into these products because the

ultracapacitor relieves the battery

of pulsed power functions. As such,

an energy-rich, lower power a l k aline battery can be used, decreasing

cost and increasing product life.

Because of these advantages, the

market for ultracapacitors in

small-cell power-burst applications

continues to grow stronger. In fact,

with most electronic equipment

going wireless and the much

greater need for pulse power, the

use of ultracapacitors has expanded

to the point where the current

market exceeds hundreds of million

of units per year.

Large-cell applications include

those found in the transportation,

industrial, uninterruptible power

supply (UPS), and renewable energy

source industries. With the push

toward 42-volt subsystems in the

automotive market, as well as a

desire for distributed power in commercial vehicles, demand for ultracapacitors has become critical

because they provide designers with

several advantages over batteries,

such as longer life, lighter weight,

lower cost, and a wider temperature

range. General belief is that the

market for large-cell applications

will grow to hundreds of millions of

units by 2005.

As the automotive market

adopts ultracapacitor technology,

other industries will benefit. The

UPS market has traditionally

used batteries to store energy.

With the cost-competitive advanNOVEMBER/DECEMBER 2001

tages of ultracapacitors over

b a tteries, UPS systems designers

now have another option. Ultracapacitors offer the same benefits

to this market as they do to automotive, and growth in this sector

will likely mirror the growth, proportionally, as that seen in the

transportation sector.

Continued developments in ultracapacitor manufacturing will also

contribute to increased demand. In

recent years, several companies

h ave moved the manufacturing

technology for high-power ultracapacitors from the lab to the manufacturing floor and into reliable

high-volume production. Some of

the best known in the industry

i nclude Maxwell Te ch n o l o g i e s,

Panasonic, and Montena. Maxwell,

for example, offers a wide range of

products, including individual cells

ra te d from 4–2 ,70 0 fa rads an d

42-volt modules designed for the

transportation market. Moreover,

several integrators, i n cl u d i n g

Solectria Corporation, ISE Research,

and Exide Technologies, h av e

started offering ultracapacitors.

They are concentrating on developing modules using individual

capacitors along with control electronics in order to create a plugand-play module.

These advances, along with drastic price reductions, have turned

ultracapacitor technology into a

viable solution. Maxwell predicts

that the price of ultracapacitors will

be $0.01 per farad in high volumes

by 2004. Furthermore, slow advancements in advanced batteries (e.g.,

Li-ion and Ni-MH) have made ultracapacitors one of the top choices in

high-power applications.

FEATURE

Integral Improvements Increase 0201

Resistor Placement Capacity and Y ields

E

nd-product designers are in a seemingly constant

struggle to reduce component count and increase

functional density in order to lower costs. One of

the latest advances in the SMD arena is the 0201 package style for passives that offers up to a 60% reduction

in size over the 0402 series. However, because the techniques required for high board-yield production have

not been fully developed for this vastly reduced package

outline, many companies

that could benefit from full

0201 implementation have

yet to completely embrace

the new standard. The new

requirements for placement accuracy, electrical

performance, and contamination prevention for the

new size have, in turn, lead

component suppliers to

revisit packaging techniques for the 0201. The

latest improvements have

come from companies like

resistor-maker Kamaya,

who has introduced two

new process approaches

that have dramatically

lowered placement error

rates.

aging anomalies may push the capabilities of current

placement equipment to compensate during assembly.

For instance, if a placement system has an accuracy of

± .02 mm, placement pitch could be as fine as .04 mm.

At these tolerances, component irregularities due to processing beyond a few hundredths of a millimeter could

cause placement errors, resulting in solder defects.

Also, with new smaller sizes come higher potential

contamination and obstruction of the placement and

soldering process from the

normal separation of fibers

from the paper tape carrier

itself. Consequently, the

largest improvement gain

will follow from methods

that can keep component

outline tolerance variations

to a minimum and improve

placement nozzle-to-component contact integrity.

Fortunately, two advances

promise progress in these

essential areas.

Cut and tape, cut and

tape

In the making of chip

resistors, resistive-conductive inks are typically applied to a ceramic substrate

Smaller is better , if . . .

in the form of a 60 mm x

The territory entered

5 0 m m she et. Fr o m th is

with the 0201 promises New advances in 0201 resistor packaging and

monolithic sheet, individamazing options for board tape carrier design have dramatically

ual resistor blanks are

designers: Most important decreased potential placement error rates by

physically separated by

is the ability to vastly in- up to 100 times over current approaches.

Hansen, Motorola)

being snapped at score

crease package flexibility, (Graph courtesy of G.

lines that are molded into

essentially maximizing the

advances in both traditional PCBs and higher level in- the ceramic substrate. After this, final finishing, such as attegration systems such as MCMs (multichip modules) tachment of electrodes, takes place. Although typically acthat now allow more direct die placement of discrete curate, inconsistencies can develop along the molded score

passive components prior to final processing. However, lines due to variances in ceramic composition and preswith this capability comes increased criticality. As pitch sures from the fixtures used to separate the substrate.

placements move finer than .25 mm, trapezoidal packContinued on page 34

16 PASSIVE COMPONENT INDUSTRY NOVEMBER/DECEMBER 2001

FEATURE

Dry Stacking Opportunities in

Multila yer Inductor Production

H. Oostra (Sp), R. Höppener, Haiku Tech Europe BV,

Reijmerstok (NL);M. De Moya, Haiku Tech, Inc., Miami,

FL (USA); J. Stupar, Keko Equipment,Zuzemberk (SL)

T

wo technologies are currently used for the manufacture of multilayered ceramic devices. Besides

tape casting and subsequent stacking technology,

the so-called wet stacking technology builds the ceramic

in situ on a carrier in the desired multilayer configuration with optional via connections incorporated. The

wet stack technology, which nowadays accounts for the

majority of all multilayered SMD inductors produced

worldwide, offers considerable costs savings compared

to tape. In order to compare these technologies in the

manufacturing practice, an assessment of the technical

advantages and disadvantages has been made for different multilayer ceramic products. The technological

solutions for the manufacturing automation of both

technologies (as currently used) will be shown to support the final conclusions. We will present a ranking of

the investment and the cost of ownership to enable fur ther identification of the typical areas of application for

the tape and wet stacking technologies. Tape is clearly

the easier technology to use for most products, but it

cannot compete with the wet stack in certain massproduction niches.

Introduction

The wet and dry stacking processes are compared for

the inductor-making process, where wet stacking is a

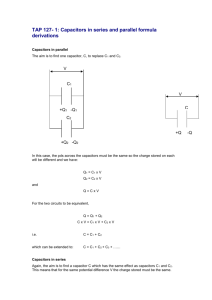

common practice. An inductor consists typically of a ferrite core and a conductor coil.The equivalent series circuit is schematically represented in Figure 1.

C

Ls

Rs

Figure 1: Schematic equivalent series circuit for

an inductor , in which C=capacitance;

Ls=induc tance; Rs=resistance.

18

PASSIVE COMPONENT INDUSTRY

Formula 1 calculates the Q-factor; this represents the

inductor quality. In general, a high Q is preferred, indicating the need for low resistance. Since too often high currents are applied, the low resistance can be achieved by

using thick, continuous Ag-electrodes, without thin spots.

Q = ω

Ls

Rs

•

Formula 1: Q-factor is dependent on frequency

inductance, and resistance.

,

The Inductor-Making Process

The multilayer inductor design described in this article can be manufactured by stacking ceramic layers, with

half-turn coil prints per layer, interconnected with vias.

Via Formation Processes

Vias can be formed in several ways. In dry stacking,

vias can be formed by either mechanical or laser punching. Mechanical punching is relatively more expensive

due to the unique set of tools required for each different

design, the cost of pin wear, and, in some cases, the low

process speed.The accuracy, however, is extremely high,

the holes have excellent shapes, and hole diameters of

125 mm can be achieved, with a continuous downward

trend to form less than 80 mm vias.

Laser punching is potentially inexpensive and flexible (because of software-based designs), and no tooling

and related wear costs are involved. In general, the

laser punching process is still slow and the quality of the

holes is inferior to that of mechanical punching (carbon,

debris, heat deformation, and energy distribution across

the beam can vary). Further development of the laser

punches will eventually eliminate these drawbacks.

In the wet stacking process, the vias are screenprinted. Alignment problems, after three 8-mm ceramic

layers are printed with the accompanying screen deformation, limit the via diameter to 200 mm. The quality of

via hole is lower than in a punched sheet due to the

resulting high edge roughness and poor shape

reproducibility.

NOVEMBER/DECEMBER 2001

Continued on page 20

ECA’s handbooks are essential for those in the electronic components

industry. Whether you’re a manufacturer, supplier, distributor or EMS,

these easy-to-understand guides are a handy reference for industry veterans and a great introduction for those new to the field.

Industry handbooks are a part of ECA’s mission to provide you with

the right information at the right time. To order any of the books

below, or to find out more about the full range of ECA services, visit

our web site or call us.

An Introduction to Passive Electronic Components

Resistive Devices Handbook

Connectors and Sockets Handbook

Integrated Passive Devices (scheduled 1st quarter 2002)

Each title has two volumes – an introduction, and annexes

with glossaries, standards and specifications.

Quartz Crystals for Electrical Circuits –

Their Design and Manufacture

A historical perspective on design and manufacturing methods.

Engineers Relay Handbook

(5th Edition)

The complete handbook from the

source – the National Association

of Relay Manufacturers (NARM), an

ECA affiliate.

Electronic Components, Assemblies

& Materials Association

The electronic components sector of the

Electronic Industries Alliance

2500 Wilson Blvd., Arlington, VA 22201

Tel: 703-907-7070 Fax: 703-907-7549

www.ec-central.org

ECA MEMBERS: Customized handbooks with your name and company logo make great promotional items.

Contact ECA to find out about bulk printing discounts.

Dry Stacking

Continued from page 18

Circuit Printing

The screen-printed electrode found in inductors is

typically 4–10 mm thick and 125–200 mm wide. Two

trends can be seen nowadays: thick, high-current applications (with a high Q) and thin, good quality lines for

miniaturization. The via filling is done by stencil printing.

Comparison of the Dry Stacking and the

Wet

Stacking Technologies

The multilayer processes differ significantly from

each other. The wet stacking only involves screen printing of covers, ceramics layers, and circuits. The dry

process, on the other hand, requires tape production.

Wet stacking requires multiple prints (three 8-mm

prints) for an acceptable ceramic layer quality, tape

casting results in higher quality, and potentially thinner films down to 5 mm. The print quality, and conse quently the active layer thickness of the wet stacking,

cannot be controlled as accurately. The homogeneity

and the desired thickness can be fully controlled on the

tape casting process; therefore, this method offers great

advantages in today’s industry, given the miniaturization and reproducibility trends. The printing quality on

each punched sheet with accurate hole size and positioning can also be fully controlled, resulting in better

and more reliable parts.

Schematically, the traditional dry stacking processes

especially used for thick ceramic layers (also used for

LTCCs) can be presented as shown in Figure 2.

Figure 2:Typical traditional dry-stack process for

inductors or LTCCs/HTCCs.

For thick, but also very thin ceramic layers, the new

20

PASSIVE COMPONENT INDUSTRY

Mylar alignment lamination method is available, as

shown in Figure 3.

Figure 3. Schematic of new , fast dry-stack process

for inductors or LTCCs/HTCCs.

The unique peeling process results in very fast cycle

times because of easier peeling. The application of thinner ceramic sheets becomes possible because of the

presence of the carrier film in the process that is

removed after the positioning and lamination process.

Because each different step in the process involves a

dedicated machine, most of the manufacturing processes

are parallel, therefore the process time is short.

Processing on independent machines is done simultaneously, requiring well-trained operators. The manufacturing is not batch-size related, which means high

batch-size flexibility. High-speed punching of up to

10,000 holes in 6″ x 6″ sheets in 5 seconds is achieved.

The stencil via filling, the coil-printing, alignmentstacking, and Mylar-removal cycle times are typically

5 seconds each. Up to 50 stacks can be isostatically

laminated in 6 minutes. Finally, cutting is done with

high-accuracy, fast-guillotine cutting machines.

In the wet stacking, however, the ceramic and metal

are printed on a multiple printer machine operated by

one operator, with average cycle times of about 6 seconds/print. If the application requires typically 2–5

prints per layer of ceramic and 30 turns have to be produced, approximately 360 prints will be done. For an

efficient batch size, typically 100–200 plates are

processed in one machine with a printing area of at least

8″ x 8″. Every print must be perfect, but wet stacking

has the disadvantage of the formation of the so-called

dog bone stack structure, thus limiting the number of

layers and accuracy. The dicing is done by diamond saw,

which is a slow and relatively high-cost process.

NOVEMBER/DECEMBER 2001

Dry Stacking

Conclusion

Wet stacking is a low-cost, high-volume, large batchsize process for the production of multilayer inductors.

This process is highly preferable when lower accuracy

or simple designs are involved.

Dry stacking is preferred for higher Q,

DRY

lower resistivities, and miniaturization with

Mylar

higher throughput and much more flexibility. Punching costs must be lowered to

0.1 hr.

become competitive with the wet stacking

10 stacks/hr.

process. Due to the better control in each

100,000

step of the process, the final products will

have better performances and narrower

45,000

tolerances, compared to wet stacking.

Table 1 summarizes the typical issues for wet and

dry technologies.

Table 1: Typical production data.

ASPECT

WET

Materials

No Mylar

15-turn run

60 hrs.

Capacity for 15 turns

3 stacks/hr.

Capacity 0402 in pieces/hr.

–*

Capacity 0603 in pieces/hr.

22,000

Thickness control

–

Punch cost

++

– (++ for laser)

Minimum via diameter

200 microns

100 microns

Miniaturization

–

++

Dicing

Slow

Fast

*Only simple staircase design (maximum 10 turns) is possible.

++

References

1. Murray, C., J. Flannery, S. Mathúna. “A

Planar Inductor Fabricated Using Co-Fired

Wet Stack Ferrite Processing,” CARTS

Europe 1996 Proceedings. East Sussex, UK:

ECII, 1996. 215.

Continued on page 30

PASSIVECOMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

21

FEATURE

What Ha ve We Learned?

DeAnn Sanders, Director of Sales

Inductors, Inc.

(888) 812-0288

I

t goes without saying that this year has been one

of remarkable change in the inductor market, as

well as the rest of the passive component market.

We went from a severe allocation situation where we

couldn’t keep parts on the shelf to falling off a cliff into

an unprecedented excess inventory glut.

Forecasts for recovery? What forecasts? That was

another issue that became painfully obvious in the

last year: All members of the supply chain must improve their ability to forecast. There were so many different players in the channel that it was nearly impossible to get an accurate forecast for usage. In 1999

and 2000, many demands were double (triple?) count ed

when manufacturers and suppliers were forecasting. What a mess. It became a firestorm of cancellations and returns. Factories, franchised distributors,

independent distributors, and end-users were all

sitting on more inventory than they knew what to do

with.

Most of the excess inventory is expected to move

through the channel by spring of 2002. Recovery,

right? Yes, but with some major changes in the industry. Even for inductors.

Inductors, chokes, and coils have always been

viewed as the “stepchild” of the passive component industry. They are thought of as low-tech, noninnovative,

and noncritical products. That simply is not the case.

Inductors are a specialized market. The technology

changes rapidly, with components getting smaller and

more efficient. There are over 25 major manufacturers

of inductors, and they are continually releasing new

products into the market. But the point to keep in

mind is that an inductor shortage can stop your production line as quickly as a capacitor or resistor shortage can.

My advice is to start thinking about the recovery

and start planning for it. You need to partner with inductor suppliers who are strong and have learned

some valuable lessons in the last 12 months, so as to

benefit from those lessons.

Due to the uniqueness of the inductor market, you

will need someone who knows his stuff. Companies

22

PASSIVECOMPONENT INDUSTRY

that specialize in passive components and inductors

are rare, especially distributors. But building and

maintaining a strong relationship with a specialized

distributor is critical.

Factories and broad line distributors are limited in

the solutions they can offer, either by production capability or their line card. Distributors, particularly

specialized and independent ones, offer a great deal of

product knowledge about the components you are buying. They have the experience and technology to offer

alternatives. This becomes especially helpful when

buyers and project managers are searching for a critical part they are experiencing shortages on. Many also

offer in-house engineering support to assist customers

in making alternative component selections.

A strong, specialized distributor can also offer you

more flexibility and quicker turnaround time than

most factories. Right now, everyone has stock on the

shelves, but is it the right stock? We are finding that a

lot of the fast-moving product series are out of the

glut. End-users, however, still have a perception of

overstock, so they are not placing orders with any lead

time. It is important that your suppliers have the ability to offer alternatives and the strength to hold parts

in stock for your demand. Factories and some broad

line distributors have become less flexible about taking any inventory risks. They are requiring NCNR on

a wider variety of products. Your inductor partner

should have the flexibility and infrastructure to satisfy the demands of your particular business.

We are at a critical time in the current business

cycle. The length of this excess inventory situation is

beginning to create some spot shortages in certain

sizes and values of inductors. However, demand has

not yet reversed the price erosion that has occurred. In

the last month or so, savvy buyers have placed scheduled

p u r chase orders or issued Letters of Intent. T h i s

a llows them to take advantage of the attractive prices

while assuring that they have all the product they

need when the lines start to produce at full capacity

again. The suppliers you want to partner with will

accept and encourage these types of order with little or

no restrictions. They want to support your recovery

because they know that they will benefit also.

Start looking toward the upturn and let what we

have learned work for your benefit.

NOVEMBER/DECEMBER 2001

E-MAIL

Y

ou were feeling pretty good a year ago when your

factories could not keep up with the phenomenal

demand we all experienced. Expediting looks pretty good now, huh? Better shut off the alarm buzzer and

wake up, it’s a new day. Today’s “savvy” buyers are back

to business as usual with a new twist, not just asking for

pricing that predates the 2000 craze, try this on “what

can you offer me over X besides local inventory, buffer

stock and price reduction?” Memories of double-digit

price erosion are back in the news thanks to those folks

that seek alternative solutions to their deficiencies in the

art of selling.

The “Cracker Jack” generation has decided that they

will show management how they can reduce the BOM at

any cost, “there’s always someone out there that will lower price or give away the farm”. Well for those of us that

did not take advantage of last year’s windfall and go for

price and decided to support our “Strategic Accounts”,

surprise!, nobody cares, it makes no difference, it has all

been but forgotten, not to mention most of the folks you

dealt with last year right up through the ranks is no

longer there.

OK enough of the reality stuff, what can we do in this

market to improve the overall outcome of our collective

futures? Customers need to be educated on the effects of

the demands that they request. Negotiations are just

that, a time to discuss the customers needs and for what

price that you can full fill the need. Today we all think inside a bottle “how low do I have to go to get the business”.

As long as we continue to operate in this mode we all

have to suffer the consequences, that of course being lower prices, longer terms and higher inventories.

A year ago the customer acted like a customer, he or

she saw value in what we had to offer, or was it “how can

I convince these people to give me enough share at the

lowest possible increase to keep my lines running, when

allocation is over we can gain the loss back and then

some?” Seems like the later is what really happened, but

it was a nice thought when you were treated like a real

supplier that meant something to your customer.

Passive suppliers need to act like that have a valuable product and service worthy of fair market prices,

when that happens it will demonstrate to our customers

that we have finally hit the bottom and no longer will

tolerate the excessive price erosion that permeates the

passives marketplace.

— Name Withheld by Request

PASSIVE COMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

23

FEATURE

The Value of Distribution

Victor Meijers

Technology Marketing Director,

Passive Products

Avnet Kent

O

riginal equipment manufacturers (OEMs) procure electronic components through

distribution for two primary reasons: Either their volumes are too

low to meet the criteria for buying

directly from a component manufacturer, or they need greater flexibility in delivery schedules or credit

terms than a component manufacturer is able to offer. The profit

margin that a distributor earns on

a component sale is directly proportionate to the return value OEMs

place on this flexibility. But over

time, with increased pressure on

both OEMs and component manufacturers to reduce costs, the role of

distribution has grown beyond simply providing flexibility to adding

increasing value in facilitating

demand creation and fulfillment,

and becoming a vital link in most

OEMs’ supply chain management

strategies.

Component specification is becoming increasingly more complex,

often involving the evaluation of

features beyond core functionality

and taking into account product life

cycles (long-term availability),

packaging trends, manufacturability, and, of course, cost. For any

given design, the sheer volume of

functionally equivalent solutions

from competing technologies, as

well as the shrinking life cycles of

many products, can be overwhelming,

leaving many engineers scrambling

to keep up.

24

PASSIVECOMPONENT INDUSTRY

Although component manufacturers and their representatives

focus primarily on educating engineers about their products, they are

now turning to distributors to help

get their message out. Many distributors have field application engineers (FAEs) on staff to provide

technical support. Avnet Electronics Marketing, one of the world’s

largest electronics components distributors, gives its customers access

to a variety of FAEs at both the

l ocal and regional levels; these

FAEs provide valuable information

on all types of electronics products,

including FPGAs, RF applications,

and power supplies. In addition to

using FAEs, Avnet has expanded

distribution even further by creating Avnet Design Services (ADS).

While Avnet and its FAEs help with

product selection, ADS reaches further to create circuit design and

simulation. ADS, staffed by engineers who are experts in the latest

technologies, gives OEMs access to

engineering expertise they may

lack in-house, allowing customers

to direct resources to their own core

competencies.

In response to OEMs’ need for information in real time, many distributors are relying on the Internet to provide 24/7 data to their

customers. Avnet’s IP&E division,

Avnet Kent, provides comprehensive 24/7 information and services

to its customers. By going online to

www.avnet.com, customers have instant access to component price and

availability, data sheets, product

news, and technical help. There is

also access to Avnet PartBuilder,

the industry’s first parametric

selection tool that helps customers

NOVEMBER/DECEMBER 2001

choose the best solution for their

design needs. By entering key parameters and choosing from a list of

parts that meet those parameters, a

side-by-side comparison can be

made, allowing a user to quickly

identify the best solution. Searches

can be performed for commodities,

including capacitors, resistors, inductors, and circuit protection, as

well as power supplies, interconnect, and electromechanical produ c t s. PartBuilder also provides

access to semiconductor and RF

selection tools, providing complete

support to design engineers.

In conjunction with determining

which components to design in,

OEMs face the challenge of managing the cost of those components.

The definition of component cost

has expanded to include more than

just the purchase price. Component

cost now takes into consideration

the total cost of acquisition; the entire expense of the procurement

cycle, as well as shipping, handling,

quality control and inventory management, are included in this equation. Inventory management practices are coming under scrutiny and

are being evaluated not strictly by

the number of turns achieved but

more by the return on the dollars

invested. Through this analysis,

OEMs are discovering that the purchase price is only a portion of the

total acquisition cost, and furthermore, for certain commodities, it is

the smallest cost.As a result, many

OEMs are looking to streamline

their business practices to eliminate duplication, reduce waste, and

increase productivity, thereby increasing profits.

Continued on page 34

Circuit Protection

Continued from page 12

tronic component manufacturers need to be diligent

when interpreting these trends, as they impact various

developmental and business strategies.

As electronic devices evolve to the higher data speed

protocols, denser boards, more device interconnectivity,

and greater plug-and-play capability, the overall need for

ESD protection will significantly increase. The ESD

Association states that approximately 30% of all field

failures of electronic devices are due to ESD. As this fact

is more clearly understood by the electronics engineering

community and the reliability issues associated with

these failures become apparent, the realization of the

need for ESD protection will increase significantly.

Not only is ESD immunity mandated by international

standards, it is also a significant warranty and reliability

concern for end-product manufacturers. ESD protection

is usually accomplished via three technological alternatives: multilayer varistors, diode arrays, and polymer

suppressors. The marketplace needs a broad product

portfolio to address the wide-ranging ESD issues as well

as the expert design and testing capabilities to ensure

proper ESD protection.

A Look at

Ceramic P assiv e

Components

If interested in submitting

an article, contact

Sam Corey at

sales@paumanokgroup.com

or call (919) 468-0384

ADVANCED CERAMIC SOLUTIONS . . .

Switchmode

Capacitors

Mini-Switchmode

Capacitors

High Capacitance

MLCCs

Radial Leaded

HV Capacitors

High Voltage

Large Size MLCCs

High Temperature

MLCCs

MIL-PRF-49470

Capacitors

Application Specific

Capacitors

San Diego California 619.266.0762 www.johansondielectrics.com

PASSIVECOMPONENT INDUSTRY

NOVEMBER/DECEMBER 2001

25

FEATURE

ECA Membership: Privileges,

Rewards, and, Abo ve All, Pro ven

Business V alue

by Glyndwr Smith

Assistant to the CEO/Senior Vice President

Vishay Intertechnology

Y

ou’ve no doubt seen the credit card commercials

touting that membership has its privileges . . .

membership has its rewards . . . membership can

help you get something that’s priceless.

Few people totally buy into these feel-good credit card

commercials, but there is an intangible feeling of worth

being a member of an exclusive club. As a business person, you’re probably bombarded with membership pitches

for clubs and organizations. In the business world—

especially in these tight fiscal times—you probably

select your memberships based less on status and more

on real business value to you and your organization.

Investing for the Comeback

At Vishay, there’s one membership that we know

delivers great value: our corporate membership in the

Electronic Components, Assemblies & Materials Association (ECA). It’s the one organization that delivers the

information, resources, and personal contacts that help

us tackle our biggest challenges: Issues such as industry consolidation, price erosion, e-business, emerging

markets, supply-chain management, and how to maintain leadership in turbulent times, such as those we are

now facing.

Marketing activities and memberships are under

intense scrutiny right now as companies are looking to

cut costs any way they can. Certainly, it’s wise to be

frugal, but not to mortgage your company’s future.

There’s no doubt that this country will get through

these economic, political, and social upheavals. We always

have. And when we start the upturn, the companies

that took advantage of cost-effective marketing, information, and networking opportunities will be way

ahead of those that went into limbo.

That’s where ECA comes in. ECA members get

timely information, cost-effective marketing opportunities,

and the chance to forge strong industry relationships

26

PASSIVE COMPONENT INDUSTRY

that have a positive impact on their business.

Data Worth the Cost of Admission

ECA’s marketing data alone goes well beyond the

cost of membership. It is simply the largest collection of

timely electronic component data anywhere in the

world. The ECA monthly market reports provide a

detailed, graphical look at every major factor that affects

manufacturers, suppliers, and distributors of electronic

components and assemblies. The reports give members

the power to spot trends and to plan proactively, rather

than simply react to market forces.

The Power of the Alliance

The ECA market reports are provided in cooperation

with the Consumer Electronics Association (CEA),

which brings up another major membership benefit.

With your ECA membership, your company becomes

part of the Electronic Industries Alliance (EIA), which

comprises 2,100 members who represent 80% of the

$550 billion U.S. electronics industry. How important is

EIA? Speakers at its spring meeting this year included

President Bush, Senators John Kerry and Bob Bennett,

and leading journalists from CBS News, CNN, and

Newsweek.

The Alliance gives ECA members added power on

Capitol Hill, including direct lines to influential lawmakers and Senate and House committees.

Greater Depth of Services

Valuable market reports and high-level representation are enough to justify any industry association’s

existence. But, as part of its ECA 2000+ program, ECA

has gone well beyond those services to provide benefits

in the following areas:

• Cost-effective marketing opportunities and a major

Web presence through ECA Resource Central, the only

comprehensive Web site covering news, market analysis,

and business trends affecting the electronic components

industry.

NOVEMBER/DECEMBER 2001

Continued on page 34

FEATURE

Sons of Gwalia Clarifies T antalum

Supply-and-Demand Issues

Peter Lalor, Executive Chairman

Sons of Gwalia Ltd.

T

he perceived shortage of tantalum

raw materials and the sharp price

rise for tantalum products during

the second half of 2000 has been well publicized and much debated. Since December

2000, when several tenders for tantalum

concentrate reportedly sold for well in

excess of US$200 per pound, discussion

has focused on who was responsible for the

sharp price rises. The reality is that

overzealous growth expectations and lack

of supply chain communication and management were built into the tantalum supply chain. The demand increases experienced during 1999 and 2000 were seriously

compounded by several members of the

supply chain who purchased tantalum raw

material rather than the actual tantalum

product required in their respective businesses. That activity exacerbated the tightness of the

raw material supply and contributed to the price rises

seen in 2000. However, these tenders should be viewed in

the context of the significant quantities of raw materials

delivered by Sons of Gwalia, the world’s largest supplier

of tantalum raw materials, at previously contracted fixed

prices. In fact, Gwalia supplied approximately 1.6 million

pounds of tantalum concentrates for the year ended June

30, 2001, at prices significantly below the very high spotsales prices referenced above.

Sons of Gwalia Ltd. is a Western Australia-based company that presently controls approximately 75% of the

globally defined tantalum reserve base (U.S. Geological

28

PASSIVE COMPONENT INDUSTRY

Society, January 2001).

As far back as 1990, Gwalia began negotiations with

its two largest customers, Cabot Corporation and H.C.

Starck (the world’s two largest tantalum powder and

metal producers), which would see a structural shift in

the tantalum raw material supply system. The longterm contracts negotiated at that time enabled Gwalia

to invest in the development of long-term tantalum

resources.

The long-term, fixed-price-and-volume, take-orpay evergreen contracts are still in place

t o d ay, with a current expiration date of

December 2005. In the 11 years since the

c o ntracts were first established, all parties

have honored their obligations under those

contracts. In fact, during 2000—the time of

the sharp price rises—Gwalia delivered all

contract quantities, at contract prices significantly below the “spot” prices.

Gwalia’s strategy has always been to provide sustainable levels of raw materials at

reasonable prices to ensure the ongoing growth of the

tantalum industry, generally.

NOVEMBER/DECEMBER 2001

Continued on page 30

Tantalum

Continued from page 28

Late in 2000, as a result of the perceived raw material shortage, Cabot and Starck approached Gwalia

about producing additional material. Gwalia reviewed

its mine plans and production schedules and was able

to deliver more product, albeit at increased production

costs, resulting in marginally increased average contract prices. However, Gwalia did not seek to renegotiate its existing contracts or to raise prices, despite the

ongoing perceived shortage of supply for 2001/2002.

Over the last decade—and what is evident today—

Gwalia has consistently invested significant capital in

the development of tantalum resources in Western Australia. The company’s two mines, Greenbushes and

Wodgina,are the world’s largest and second largest tantalum producers, with combined resources of 157 million pounds of tantalum, or over 30 years supply at current annual consumption rates of approximately 5

million pounds per annum.

Film

Continued from page 35

have several limitations in its use in many of today’s

new high-performance applications.

Stacked metallized film capacitor construction is the