WORLD COAL

®

JANUARY 2016

JANUARY 2016 - VOLUME 25 NUMBER 1

www.worldcoal.com

hero

hero friction

friction welded

welded chain

chain

Contents

Contents

03

Comment

05

Coal News

12

33

Industry View: Global Trends In Coal To 2020

Clifford Smee, Timetric, Australia.

14

Good Intentions

Despite industry reform and growing output from Coal India,

the Indian coal sector is beset by persistent problems that will

hamper growth. Mitchell Hugers, BMI Research, UK reports.

The Evolving Face Of Coal

The Clean Power Plan hit a US coal industry already struggling

with other regulatory challenges and competition from natural

gas. But despite the industry’s current woes, it’s not going away

anytime soon, as Andrew Moore, Platts, USA, reports.

Roof Bolting & Grouting

25

Keeping Things Running Smoothly

Bernhard Schust, Voith Turbo GmbH & Co. KG, Germany,

outlines how fluid couplings can help to ensure smooth

conveyor operation.

Shovels & Trucks

41

Special Report: The US

20

Conveyor Components

36

Regional Report: India

A Path To Development

Brian Thompson, Joy Global, explains how the company’s fleet

of miner bolters has helped mines to overcome bottlenecks and

improve reliability.

45

Suppliers Round-Up Special: No Tyring Out

Mike Brown, Kal Tire, UK, provides an overview of the

company’s True Tire Technology.

Setting A Platform

Frank Wickert, Flanders, USA, explains how the Freedom

Platform for shovels can enhance DC rope shovel performance,

while minimising the structural stresses inherent in mine

environments.

Screening & Sizing

Sheer Strength

Naj Aziz, Jan Nemcik and Ali Mirzaghorbanali,

University of Wollongong, Australia, discuss shear strength

properties of cable bolts.

49

Coal Crushing

Dr York Reichardt and Sven Heuer, Hazemag, Germany,

elaborate on the use of crushers in coal operations.

Special Report: Big Data and Mining

53

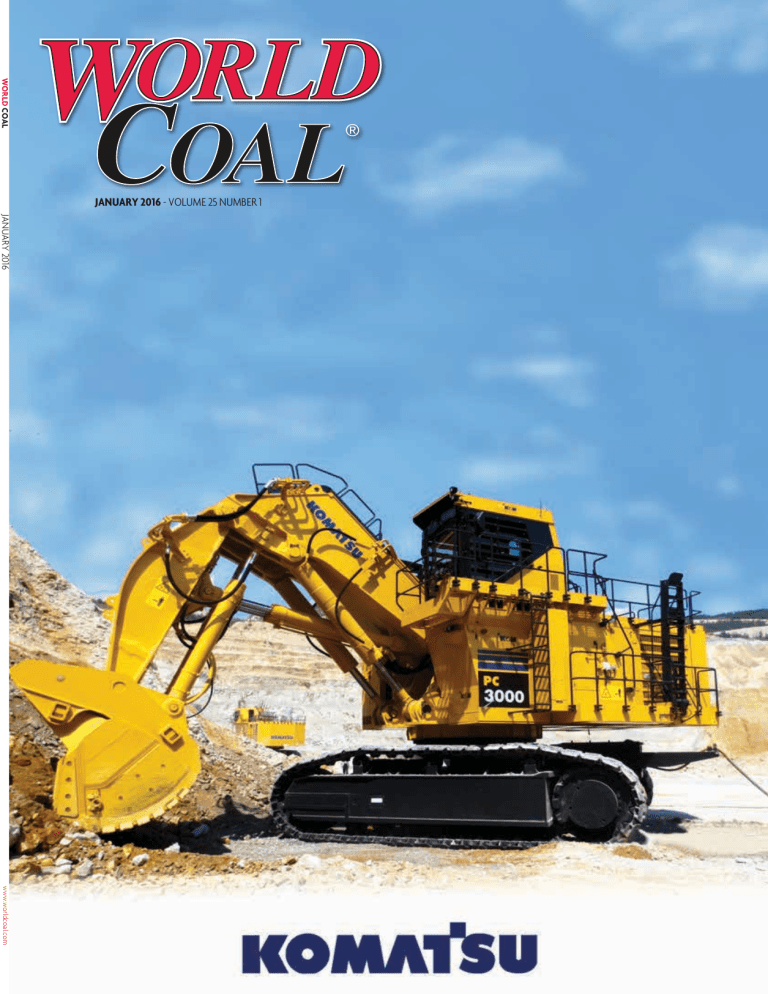

This month's

front cover

Small Steps To Big Results

Steve Bradbury, Dingo, USA, explains the Compound Effect

and illustrates how maximising on data to improve seemingly

small decisions can lead to big results.

Productive, profitable and powerful – three words that best describe the Komatsu

PC3000. Customers all around the globe value Komatsu’s hydraulic mining

shovels and excavators for their top availability, peak performance and highest

efficiency. Regardless of how tough mining conditions may become, the PC3000

achieves exceptional performance.

For more information: www.komatsu-mining.de

World Coal is a fully-audited member of the Audit Bureau of Circulations (ABC).

An audit certificate is available from our sales department on request.

Copyright © Palladian Publications Ltd 2016. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted

in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views

expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither does the publisher endorse any

of the claims made in the advertisements. Printed in the UK. Uncaptioned images courtesy of www.shutterstock.com

High angle, high volume productivity

The Joy brand HAC system is proven to be a versatile, cost-saving method for elevating

or lowering a variety of materials at extremely steep angles. It’s a system that lives up

to today’s industry demands for high-volume rates, adaptable conveyor profiles, and

ease of operation and maintenance. Joy’s HAC is versatile, adaptable and economical;

helping companies worldwide move material in a variety of markets.

JoyGlobal.com

Joy Global, Joy and HAC are trademarks of Joy Global Inc. or one of its affiliates.

© 2015 Joy Global Inc. or one of its affiliates.

Comment

Comment

P

Jonathan Rowland – Editor

jonathan.rowland@worldcoal.com

Managing Editor

James Little

james.little@worldcoal.com

Editorial Assistant

Harleigh Hobbs

harleigh.hobbs@worldcoal.com

Advertisement Director

Rod Hardy

rod.hardy@worldcoal.com

Advertisement Manager

Ryan Freeman

ryan.freeman@worldcoal.com

Production

Ben Munro

ben.munro@worldcoal.com

Subscriptions

Laura White

laura.white@worldcoal.com

Office Administrator

Jo Repton

jo.repton@worldcoal.com

Website Manager

Tom Fullerton

tom.fullerton@worldcoal.com

Website Editor

Callum O'Reilly

callum.oreilly@worldcoal.com

Digital Editorial Assistant

Angharad Lock

angharad.lock@worldcoal.com

Correspondents

Barry Baxter

Michael King

Anthony Fensom

Gordon Cope Ng Weng Hoong

Publisher

Nigel Hardy

Palladian Publications Ltd

15 South Street, Farnham,

Surrey, GU9 7QU, UK

t: +44 (0)1252 718999

f: +44 (0)1252 718992

w: www.worldcoal.com

World Coal (ISSN No: 0968-3224, USPS No: 020-997) is published

monthly by Palladian Publications Ltd, GBR, and distributed in the USA

by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals

postage paid New Brunswick, NJ, and additional mailing offices.

POSTMASTER: send address changes to World Coal, 701C Ashland Ave,

Folcroft PA 19032.

Annual subscription (monthly) £110 UK including postage, £125/E175

overseas (airmail), US$200 US/Canada (airmail). Two-year discounted

rate (monthly) £176 UK including postage, £200/E280 overseas (airmail),

US$320 US/Canada (airmail). Claims for non-receipt of issues must be

made within four months of publication of the issue or they will not be

honoured without charge.

erhaps the most headline-grabbing number contained in

Joy Global’s most recent quarterly result was US$1.343 billion.

That was the size of the loss the company booked in the three months

to the end of October on the back of a US$1.199 billion writedown of its

underground reporting unit.

Similarly gloomy headlines (and eye-watering numbers) are not hard to

find in the mining industry at the moment. Caterpillar is expecting a 5%

fall in its revenues in 2016 on the back of a 10% fall in its mining‑related

revenues. That will mark the first time in its history that the company has

reported four consecutive years of falling sales. Since peaking in 4Q12,

Caterpillar’s Resource Industries business segment has seen sales fall from

US$5.776 billion in 4Q12 to just US$1.796 billion in 3Q15.

Looking at mining CAPEX numbers and it’s not hard to see why

mining equipment manufacturers are taking a hit. Global mining CAPEX

fell by 26% in 2015 and is expected to keep heading down this year (-19%)

and in 2017 (-6%), according to a recent Susquehanna Financial Group

research note. Meanwhile the US coal industry is now in its fifth

consecutive year of belt tightening with the cuts averaging around 30% per

year since 2013.

Is it all gloom then? Well not entirely. Although impressively large,

Joy’s fall into the red was non-cash: its underlying business is stronger

than that headline figure suggests. As Ted Grace, Research Analyst at

Susquehanna Financial Group, told World Coal, Joy’s management have

done an “excellent job” of managing through the downturn – cutting costs,

strengthening the balance sheet and restructuring debt, and developing

new products that take the company out of its traditional markets. These

efforts will leave Joy in a relatively strong position when the turnaround

comes. Indeed, the company may return to growth sooner than most on

the back of its new product lines and cost‑cutting measures.

The slowdown in the commodity market is not yet over and this year is

looking like another difficult one for anyone involved in digging things

out of the ground. But the mining industry has always been cyclical and it

always swings back around – because ultimately people will always need

mined commodities. And yes, that includes coal.

Nor does the current market mean an end to opportunity. Joy hasn’t

stopped developing new product lines despite its falling revenues; it looks

well set to take advantage of that investment. Murray Energy saw an

opportunity when it bought two Colombian mines, as did Bowie

Resources more recently when it agreed to buy Peabody Energy’s

New Mexico and Colorado mines. In Australia, Stanmore Coal’s plans to

re-open the Isaac Plains mine, bought from Vale and Sumitomo last year,

shows a smaller company smelling profit where a major couldn’t.

Not every risk will pay off; the downturn will surely claim more

victims before it has run its course. But the old maxim still holds true:

fortune favours the bold. While it may be easy to be blinded by the doom

and gloom that dominates reports on the industry, there’s always some

light to be found for those with the vision and gumption to find it.

ADVANCED

COAL SIZING

SOLUTIONS

MMD have been at the forefront of Mineral Sizing and In-Pit

Sizing & Conveying solutions for over 35 years, providing

systems that maximise production, improve safety,

and increase efficiencies.

Coal processing remains at the core of our business.

MMD has developed a range of machines from high

capacity Sizers that reduce ROM to a conveyable size, to

segmented tooth machines designed for a specific product

size in the coal preparation plant.

Discover how we can deliver the complete sizing solution for

your mining needs.

For more information please visit

WWW.MMDSIZERS.COM

Coal News

Coal News

INTERNATIONAL Majors continue to wrestle with impact of commodities downturn

L

ast month saw two of the world’s

biggest mining companies,

Anglo American and Glencore, announce

significant measures to counter the

downturn in the mining industry.

Anglo American has put forward

proposals that could lead to the company

losing about two-thirds of its workforce and

assets as mines are sold or closed.

“We are setting out an accelerated and

more aggressive restructuring of the

portfolio to focus around our ‘Priority 1’

[assets],” Mark Cutifani, CEO of Anglo said

at a recent investors day.

The company will also aim for

US$3.7 billion of cost and productivity

improvements by 2017, while CAPEX will

be cut by a further US$1 billion to the end of

2016 with a US$2.9 billion aggregate CAPEX

reduction for 2015 – 2017 compared to

original guidance.

“As we redefine our operational

footprint, we are aligning our organisation

to ensure optimal efficiency and

effectiveness,” continued Cutifani.

Meanwhile, Glencore will reduce its 2016

coal production by 22 – 27 million t

compared to its original guidance, the

company said in an investor presentation.

This comes on top of the 20 million t of

managed production cuts in coal output in

2015. The company’s coal production

guidance for 2016 now stands at

127 – 133 million t.

The cuts to coal output form part of a

swath of production cuts that will reduce the

mining and trading giant’s copper, zinc,

lead, nickel, ferrochrome and oil production.

Glencore also said that it was increasing its

debt reduction target to US$13 billion from

US$10.2 billion by the end of 2016, having

already achieved US$8.7 billion of savings.

As well as production, the company is

taking an axe to its CAPEX, reducing it from

US$11 billion to US$9.5 billion over 2015 and

2016 with cuts coming to coal projects in

Australia and South Africa.

“We want to have the balance sheet in a

position where the ‘what ifs’ don’t affect us,”

Glencore CEO, Ivan Glasenberg told

investors, referring to an incident last year

when hedge funds questioned whether the

company’s equity would retain any value if

the copper prices fell to under US$4000/t.

INTERNATIONAL Thiess announces contract wins in Australia and Mongolia

O

ver the past month, CIMIC

Group’s global mining contractor

business, Thiess, has been extending,

winning and securing mine operation

contracts worth over AUS$2.5 billion

across Australia and Mongolia.

First, the company was awarded a

contract to operate Glencore’s Mt Owen

coal mine in the Hunter Valley of New

South Wales. The contract is expected to

generate AUS$760 million in revenue for

Thiess and builds on the contract miner’s

longstanding relationship with the

mine.“Our ongoing work at this

geologically complex mine is testament to

the relationship with Thiess and Glencore

and the expertise within our organisation,”

said Thiess’ Managing Director,

Michael Wright.

Meanwhile, in Queensland, Thiess

announced contracts with Jellinbah Group,

QCoal Group and Anglo American.

The Australian mining contractor was

awarded a contract extension worth

AUS$1.3 billion by Jellinbah Group to

continue its operations at Lake Vermont coal

mine in the Bowen Basin in Central

Queensland, Australia. The three-year

contract extension continues Thiess’ turnkey

mining operations at the opencast mine

until December 2021, continuing a working

relationship that goes back to 2007 when

Thiess was contracted to build the mine

infrastructure, including coal handling

preparation plant, site office and workshop.

Also in Queensland, Thiess won an

AUS$250 million contract from QCoal

Group to operate the QCoal Northern Hub

mines, in Queensland’s Bowen Basin. The

contract will run for three years with an

option for a one-year extension and covers

the continuation of operation at the Sonoma

and Drake coal mines.

Additionally Thiess gained an

AUS$115 million contract to continue

operating the southern pits of the Dawson

coal mine in Central Queensland. According

to the company, the new two-year

agreement with mine owner Anglo

American builds on a long‑standing

involvement at the mine. Under the new

contract, Thiess will provide mining

services including the removal of

overburden and coal mining.

Away from its home market and Thiess

signed a four-year contract extension with

Mongolian coal miner, Energy Resources, to

operate the Ukhaa Khudag (UHG) coal

mine, in southern Mongolia. The contract

extension follows the current eight year

agreement signed in 2008 and results in

Thiess continuing mine operations and

maintenance delivery until 2022.

Thiess is responsible for mining services

at the UHG mine, including fleet operation

and maintenance for overburden stripping,

coal mining and blast drilling under an

alliance structure, with involvement also in

mine planning and health, safety and

environmental management. This extension

is set to deliver up to AUS$1 billion of

revenue during the next seven years.

5 | World Coal | January 2016

Coal News

DIARY DATES

Coaltrans USA

28 – 29 January 2016

Miami, USA

www.coaltrans.com/usa

SME Annual Meeting and Expo

21 – 24 February 2016

Phoenix, USA

www.smeannualconference.com

Coaltrans India

3 – 4 March 2016

Goa, India

www.coaltrans.com/India

PDAC Convention

6 – 9 March 2016

Toronto, Canada

www.pdac.ca/convention

ACPS Annual Conference

13 – 17 March 2016

Wollongong, Australia

www.acps.com.au/conference-2016

bauma 2016

11 – 17 April 2016

Munich, Germany

www.bauma.de

Coaltrans China

14 – 16 April 2016

Beijing, China

www.coaltrans.com/china

ELECTRIC POWER

18 – 21 April 2016

Louisiana, USA

www.electricpowerexpo.com

Coal Prep 2016

25 – 27 April 2016

Louisville, USA

www.coalprepshow.com

AIMS 2016

18 – 19 May 2016

Aachen, Germany

www.aims.rwth-aachen.de

XVIII International Coal Preparation Congress

28 June – 1 July 2016

St. Petersburg, USA

icpc-2016.com

MINExpo 2016

26 – 28 September 2016

Las Vegas, US

www.minexpo.com

6 | World Coal | January 2016

CEO INTERVIEW Glenn Kellow, Peabody Energy

W

ith the global coal industry

facing unprecidented

market conditions, World Coal spoke

to Glenn Kellow, President and CEO

of Peabody Energy, the world’s

largest private-sector coal company,

about its business, recent changes

in the company’s leadership and his

view on the long-term prospects for

coal.

Peabody is the world’s

largest private-sector coal

company. Tell us about

your platform.

Peabody serves metallurgical and

thermal coal customers in more than

25 countries on six continents. We

have more than 7 billion short t of

reserves and ownership interests in

ports and generation projects in

multiple countries.

Our portfolio is shaped around

core regions, including the

Powder River Basin (PRB) and

Illinois Basin in the US, as well as the

Bowen Basin, Hunter Valley and

Illawarra region in Australia. These

regions have the best market access

and lowest costs. Our flagship

operation in the PRB, the North

Antelope Rochelle mine, is the world’s

largest and most productive coal

mine, shipping more coal each year

than most nations.

Safety is a top priority

for the industry. How is

Peabody’s performance in

this area?

Safety is our first value and core to our

mission. Peabody is on track for

another record year of safety

performance in 2015, marked by a

double digit improvement in

Australia’s results as of 3Q15. We

continue working toward a goal of

operating incident free.

Our Wambo underground mine in

New South Wales, Australia, also

brought home unique safety honours,

earning the highest national honour in

the Australian Mines Rescue

competition. The team is set to

represent Australia at the

international championships in

Canada in 2016.

Even though Peabody

is a 130-plus yr old

company, it appears to

be reinventing itself with

the appointment of a

new management team.

Tell us about the recent

changes.

All of our executive leadership has

joined the team since 2013,

representing a mix from both within

and outside of Peabody, which

includes more than 150 yr of

industry experience and 60 yr of

Peabody service combined. Amy

Schwetz, who held a number of key

financial roles across the

corporation, was promoted within

Peabody and took the helm as

Executive Vice President and

Chief Financial Officer this past year.

Verona Dorch was recruited as

Executive Vice President,

Chief Legal Officer, Government

Affairs and Corporate Secretary

late last summer. Both Amy and

Verona are skilled, hands-on leaders.

In addition, Robert Malone has

been named Chairman of the Board,

succeeding Greg Boyce who

retired at the end of December last

year. Bob is a valued and

well‑regarded energy and mining

veteran.

Coal News

The coal industry continues

to navigate turbulent

times. What is your view of

long‑term energy markets?

In recognising the importance of coal

to long-term energy demand, we

have to start with the premise that

access to affordable energy is a basic

necessity and essential for quality of

life. Over the past century, access to

electricity has brought an

extraordinary transformation to our

lives, and coal’s contribution has been

far reaching.

Coal has been the world’s

fastest‑growing major fuel this decade,

underpinning urbanisation and lifting

billions to better, longer lives. Today

we are seeing more than 75 million

people added to cities each year,

which creates greater demand for

modern conveniences and

infrastructure that require steel to make

and energy to use. And this ultimately

points to use of coal. All forms of

energy are needed to meet these

demands. Coal is unique in its scale,

cost and reliability.

Peabody, along with others, believes

in favourable long-term demand trends

for coal, which is approaching oil in

terms of use. In a recent analysis, Wood

Mackenzie projected that coal would

surpass oil as the world’s largest

energy source in coming years.

What measures is Peabody

taking to help the company

weather the storm in global

markets?

Peabody’s new management team is

taking aggressive steps to improve the

business with an intense focus on the

operational, organisational, portfolio

and financial areas of our business. Let

me run through our progress:

nn The business lowered costs while

often lowering production in line

with market factors. We have an

unmatched portfolio of assets,

geographic diversity and operations

in some of the best mining regions

in the US and Australia.

nn We created a leaner organisation

structure at the management and

administrative level and had the

lowest overhead costs in a decade,

down 29% from the prior year.

nn Our asset base provides option

value to hold for development,

transfer into joint venture

opportunities or to monetise.

We’re currently advancing

multiple processes, including

the sale of our New Mexico and

Colorado assets to Bowie Resource

Partners in a transaction that is

expected to close during the first

quarter of 2016.

nn Our dual financial objectives

are optimising our liquidity and

reducing debt. Opportunities

for deleveraging could include

proceeds from assets sales,

reduced cash outlays for cost or

capital management, rising cash

flows from any eventual market

improvements, or buybacks and

exchanges of debt.

Beyond the planned sale

of your New Mexico and

Colorado assets, are any

further mine sales planned?

Our criteria for evaluating

opportunities for potential sale of

certain mines or non-core assets

includes strategic fit, value

considerations, potential growth and

capital or cash requirements. Making

the right deal is as important as the

timing.

What is your longer‑term

view of US coal markets?

While natural gas prices were lower in

2015, we expect prices to increase over

time from new industrial demand,

LNG export capacity, Mexico pipelines

and slower production growth. The

PRB and Illinois Basin are

best‑positioned and will benefit

from higher utilisation and basin

switching.

Energy policy is a

major topic for global

leaders. What are your

views on the steps needed

for a low‑carbon energy

future?

We all share the goals of affordable

energy, strong economies and a clean

environment. We believe use of

advanced coal technologies presents a

ready-today solution toward

low‑carbon energy systems for

policymakers worldwide.

Deployment of high-efficiency

low-emissions technologies, which can

achieve a 25% reduction in the carbon

dioxide (CO2) emissions rate, will

play an increasingly significant role

in meeting greenhouse gas

commitments. As an example, moving

the current average global efficiency

rate of coal-fueled power to

supercritical levels could deliver the

equivalent environmental benefit of

reducing India’s annual CO2 emissions

to zero.

Longer term, world leaders

recognise that policy measures are

urgently needed to accelerate

development of carbon capture

utilisation and storage technologies,

which will drive toward the

ultimate goal of near-zero emissions

from coal.

7 | World Coal | January 2016

Coal News

Coal News

AUSTRALIA Tinkler’s Australian Pacific Coal acquires Dartbrook coal mine

A

nglo American and Australian

Pacific Coal (AQC) have reached a

binding agreement for AQC to purchase

Anglo’s 83.33% interest in the Dartbrook

coal mine in the Hunter Valley, New

South Wales, for up to AUS$50 million

(approximately US$36 million). The sale is

expected to be completed by mid-2016.

There will be an upfront cash payment of

AUS$25 million and the grant of a royalty

equal to AUS$3.0 for each tonne of coal

produced by the operation in the future and

AUS$0.25 for each tonne of coal sourced

from other sites and processed using

Dartbrook’s processing infrastructure.

Placed into care and maintenance in

2006 on the back of gas drainage,

geotechnical and water issues, as well as a

number of fatalities, Dartbrook was a

multiseam longwall operation with a

resource base of just over 400 million t of

low rank bituminous coal. It was also a

reasonably high‑cost operation, requiring

production of about 3.5 million tpy in order

to be profitable with the cost of gas

drainage adding significantly to costs. “As

the production declined and it was

considered unlikely to improve, the mine

was placed into care and maintenance,

where it has remained, even in the height of

the mining boom,” Lloyd Hain, Senior

Consultant at CRU, explained to

World Coal.

AQC now plans to rejuvinate the site

with a 5 million tpy opencast mine north of

the current underground workings. “The

Dartbrook JV presents a unique

opportunity to acquire a tier 1 asset that is

not only strategically located but also

well-equipped with existing infrastructure

and facilities,” said Nathan Tinkler, CEO

and Managing Director of AQC.

Despite its troubled past, Hain is

positive on the economics of AQC’s

proposal: “Based on the stated plan to

produce 5 million tpa, previous opencast

studies done on the deposit and current

industry cost structures, we estimate that

the FOB cost to the Port of Newcastle for

the opencast coal to be approximately

US$48/t in 2016 dollars, which compared

to the current Newcastle price of US$52/t

would provide a small return. However,

when taking into account the purchase

price of AUS$50 million, as well as the cost

to develop and construct the opencast

operation and connect it to the existing coal

handling and preparation plant and train

loadout infrastructure, we estimate that a

price of US$64/t would be required to

make an economic return on this

investment.“

“Considering a typical 3 – 5 yr time

frame to conduct environmental and

engineering studies and navigate the

approvals process, we believe that growing

demand for thermal coal in Asia, outside of

China, and a limited pipeline of low capital

projects, we forecast the coal price

recovering to this level within the timeframe

required to make this project economic, and

it would place this project in the second

quartile of the cost curve,” Hain concluded.

Yet developing the proposed mine may

not be an easy process – particularly when

it comes to permitting. Recent campaigns

by the thoroughbred horse industry in the

region have already seen Anglo American’s

Drayton South expansion project blocked; it

is unlikely to approve of opencast mining at

Dartbrook. The local council is also

opposed to opencast mining. This “makes

the task of navigating the approvals process

by far the riskiest part of this purchase,”

said Hain.

But Tinkler is no stranger to risk, having

already made (and lost) a fortune betting

on coal – a fuel he remains committed to

despite its current troubles: “Thermal coal

will remain one of the core sources of

energy production and if we can position

this asset to be in the lowest cost quartile

we are well placed to ride on that demand.”

AUSTRALIA Third berth at Hay Point Coal Terminal officially opened

Q

ueensland Premier,

Annastaci Palaszczuk, has

officially opened the new third berth

at BHP Billiton Mitsubishi Alliance’s

(BMA) Hay Point Coal Terminal. This

move increases the export capacity from

44 million tpy to 55 million tpy. The

premier was joined by the President

of BHP Billiton’s Coal Business,

Mike Henry, and Chief Operating

8 | World Coal | January 2016

Officer of Mitsubishi Corp.’s Mineral

Resources Investment Division,

Rick Tanaka, at the official ceremony.

The US$3 billion project, near Mackay

in Central Queensland, comprised the

construction of a new berth and

shiploader alongside the existing two

berths. It also included the replacement

of the existing jetty, trestle conveyors

and surge bins and linking conveyors.

“I want to thank BHP Billiton and

Mitsubishi for their confidence in the

Queensland coal export market and their

contribution to the Queensland economy,

despite coal prices having declined

markedly in recent years,” said

Palaszczuk. Queensland is one of the

world’s major exporters of coal with

shipments hitting a record of 219 million t

in the financial year to June 2015.

WHEN

WHENPRODUCTIVITY

PRODUCTIVITY

&

&SAFETY

SAFETYCOUNTS.

COUNTS.

With

WithKal

KalTire’s

Tire’sTTT

TTT(True

(TrueTire

TireTechnology)

Technology)temperature

temperature&&pressure

pressuremonitoring

monitoringsystem,

system,

mining

miningcustomers

customershave

haveaccurate,

accurate,real-time

real-timetire

tiretemperature

temperatureand

andpressure

pressuredata

dataacross

across

their

theirfleet

fleetatattheir

theirfingertips,

fingertips,helping

helpingminimizing

minimizingdowntime,

downtime,saving

savingtire

tirewear,

wear,improving

improving

safety

safetyand

andincreasing

increasingmine

mineproductivity.

productivity.

Helps

Helps

trucks

trucks

run

run

atat

peak

peak

Show

Show

real-time

real-time

data

data

in in

Wifi,

Wifi,

3G3G

oror

radio

radio

frequency

frequency

efficiency,

safely

safely

- know

- know

when

when the

the

cab,

cab,

and

and

view/report

view/report

connectivity

connectivity

options

options

toto

suit

suit efficiency,

tires

tires

are

are

reaching

reaching

potentially

potentially

anywhere

anywhere

globally,

globally,

allall

mines

mines

unsafe

unsafe

limits

limits

online

online

Minimize

Minimize

tire-related

tire-related

Improve

Improve

fuel

fuel

efficiency

efficiency

with

with TTT

TTT

pays

pays

forfor

itself

itself

with

with

downtime

downtime

and

and

maximize

maximize

optimal

optimal

tire

tire

pressures

pressures

just

just

one

one

tire

tire

saved

saved

productivity

productivity

Providing

Providingtire

tireservice

serviceon

onover

over130

130mine

minesites

siteson

on5 5continents,

continents,Kal

KalTire

Tire

helps

helpscustomers

customersmaximize

maximizethe

thevalue

valueofoftheir

theirtire

tireinvestment

investmentand

and

optimize

optimizemining

miningproductivity.

productivity.

info@kaltire.com

info@kaltire.com

www.kaltiremining.com

www.kaltiremining.com

Coal News

Coal News

INTERNATIONAL Exploration and mine development news

A

round-up of news from coal

projects around the world.

Australia

Glencore

Glencore has announced that its

proposed Blakefield North underground

coal project has been placed on hold in

response to continuing low prices in the

global thermal and metallurgical coal

markets. “We have to ensure that the

volumes and qualities of coal we

produce are aligned with market

requirements. We will not push

incremental tonnes into markets that

don’t want them or need them,” the

company said. The project, located near

Bulga, was expected to start in 2017.

Leigh Creek Energy

Leigh Creek Energy Ltd (LCK) has

carried out inferred resource and

exploration target estimations, and

reported an initial JORC inferred coal

resource of 377 million t at its

Leigh Creek Energy project (LCEP).

This result is within the company’s

previously announced target range of

220 – 530 million t. LCK intends to

commence additional drilling, coal

quality test work and seismic surveys

during 2016 in order to extend

confidence in coal quality and to

upgrade deposit certainty and

commerciality. The LCEP aims to

develop the area’s deep coal reserves,

using an underground coal gasification

process to turn the coal into gas for

supply into Australia’s east coast

gas network.

Stanmore Coal

Stanmore Coal has announced it is to

restart operations at Isaac Plains in

10 | World Coal | January 2016

1H16 after it acquired the shuttered

metallurgical coal mine from Vale and

Sumitomo Corp. in August. The

company said that the recommencement

of mining at Isaac Plains would create

about 150 new jobs in the Moranbah

region of Queensland, as well as paying

AUS$7 million in annual royalties to the

state government. First coal is expected

to be shipped in April 2016.

Wollongong Coal

Wollongong Coal is to restart operations

at its Wongawilli coal mine in New

South Wales after placing the mine into

care and maintenance last year. The

decision comes after the New South

Wales Planning Assessment

Commission (PAC) last month

approved a five-year extension to the

Wongawilli mining licence. The

company has signed a two-year contract

with Delta SBD, one of the largest

contract mining companies in the

Australian underground coal mining

industry, to oversee and manage the

recommencement of the operations.

Delta SBD will provide technical

expertise, personnel and equipment

services at the mine, as well as

managing day-to-day operations.

Mongolia

Aspire Mining

Aspire Mining subsidiary Northern

Railways has received its construction

licence for the Erdenet-to-Ovoot

Railway from the Mongolian

government. The licence allows

negotiations to start for the grant of a

long-term lease for the land on which

the railway will be built, as well as

enabling Northern Railways to enter

into land use agreements with local

communities along the line’s route. It

also allows for the establishment of a

commission to agree traffic management

protocols and the point at which the

Erdenet-to-Ovoot line will connect to

the existing network. The 574 km rail

project forms part of Mongolia’s Rail

Policy to provide rail access to its

northern provinces through the

extension of the existing rail network

from Erdenet to the Russian-Mongolian

border at Arts Suuri.

Additionally, Aspire has announced

that its Ekhgoviin Chuluu Joint Venture

(ECJV) with the Noble Group has

received proximate analysis from core

samples taken from the 2015 exploration

programme at the Nuurstei coal project.

Washability test work on samples from

the first four holes show moderate

yields of a high‑quality coking coal.

South Africa

Baobab Mining & Exploration

Chinese industrial conglomerate,

Qingdao Hengshun Zhongsheng Group

(Hengshun), could acquire a 34% stake

in Baobab Mining & Exploration, the

owner of the Makhado hard coking coal

project in South Africa, for

US$113.95 million, following the signing

of a non-binding memorandum of

understanding (MoU) with Baobab’s

parent company, Coal of Africa (CoAL).

The deal remains subject to CoAL

shareholder and regulatory approval, as

well as subject to Hengshun being

awarded the engineering, procurement

and construction contract for the project.

The Makhado project contains

344.8 million t of mineable coal and

forms part of the Greater Soutpansberg

project in the Soutpansberg Coalfield in

Limpopo Province.

Lubricants: ASSETS or

CONSUMABLES?

ARE YOU DISCARDING

PERFECTLY GOOD OIL?

If you think oil is oil and grease is grease, you might be taking your lubricants for

granted and missing an opportunity for improved uptime and profits. Viewing lubes

as assets is the first step in extending the life of the lubricant as well as the

equipment. With our proven Lubrication Reliability Program, Lubrication Engineers

can set you up with the right high-performance lubricant for the application and show

you how to keep it clean and dry with our reliability products and services.

To learn more about LE’s Lubes as Assets philosophy and how it can

help your organization, visit www.theLEdifference.com today to

watch a brief video and request a complimentary onsite consultation.

Industry View

Industry View

GLOBAL TRENDS IN COAL TO 2020 Clifford Smee, Timetric, Australia

O

ver the next five years, the global

coal industry is expected to

witness a fundamental structural change

to the seaborne market: a move away

from Chinese led demand growth. The

last 10 yr have seen significant growth

in the global seaborne market. But with

global production seeming to have peaked

in 2014, serious issues remain as to its

sustainability.

The majority of global coal reserves are

located in the US, followed by Russia,

China, Australia, India and Germany,

which collectively account for 76.9% of the

global total. The major producers are China,

the US, India, Australia, Indonesia and

Russia, collectively accounting for 81.1% of

global production in 2014. Logically, this

means that a country, such as Indonesia, is

rather rapidly depleting its reserves. Over

the forecast period, these rankings will

remain the same, with little movement in

position, as had happened with the rapid

rise of Indonesia over the previous decade

when production increased from

154 million t in 2005 to 458 million t in 2014.

Other developed countries, such as

Australia and the US, may never find an

economic need to exploit their reserves.

For the two largest consumers of coal,

China and the US, serious efforts are now

being made to curtail coal use, which

contributed to global consumption

decreasing in 2014. Consumption in 2014

fell by 62 million t compared to 2013, and it

will likely decrease again in 2015. This

would be the first fall in consecutive years

in recent history. Efforts to curtail

consumption include increased

environmental protection regulations and

the US government’s plans to decrease

overall coal consumption by 180.4 million t

and by 2.2% in electricity generation in 2015

over 2014. The Chinese government has

also initiated an ambitious campaign to

diversify its energy sources, consolidate its

12 | World Coal | January 2016

coal mines and cap consumption,

announcing various coal quality restrictions

and a ban on new developments of

coal-fired plants.

Delving deeper into Chinese coal

production, over the last decade global

production has continuously increased,

mainly due to increased production in

China. Yet, Chinese coal production

decreased to an estimated 3.59 billion t in

2014: the first fall registered since 2000.

Most Chinese coal mines are located in

Inner Mongolia, Shanxi, Shaanxi and

Xinjiang. In 2014, coal output in Inner

Mongolia fell by 12% to 123 million t, while

production in Shanxi was relatively flat

increasing by just 1.5% over 2013. Since the

state-owned enterprises account for

approximately 62% of total domestic coal

production, both provincial and central

governments have initiated measures to

support domestic industry, including a

reduction in provincial-level mining fees

and royalties, the imposition of an import

tax of 3% and 6% on metallurgical and

thermal coal respectively and a reduction in

export tax from 10% to 3%.

Without robust demand growth from

China and the developed economies, there

is likely to be little support for prices.

Hence, the world is unlikely to see a return

of US$100/t prices for thermal coal over

the forecast period; prices are instead

expected to stay around US$60/t FOB

(Newcastle 6700 GAD) to 2020. The net

effect of prices at these levels will be that

export-oriented countries, such as

Australia, Indonesia and Colombia, will

have to focus on reducing operating costs

to stay competitive in the seaborne market.

These countries will increasingly close their

higher-cost smaller coal mines, with large

expanding opencast mines taking their

place.

Over the forecast period, global coal

mine production is projected to grow

moderately at a CAGR of 1.6% to

8.6 billion t in 2020. This very moderate

growth will be mainly driven by

developing Asian countries,

predominately India. In India, the

government plans to quickly increase coal

production and allow private investment

in the industry. The government’s decision

to reallocate all 204 coal blocks, which

were earlier declared illegal by the

Supreme Court of India in December 2014,

is projected to increase coal production to

over 1 billion t in 2020. Coal is a major

source of energy in the country; it has the

largest share as a raw material for energy

production and an increase in population

is expected to drive growth in demand for

energy.

Other potential growth countries are

Russia and the former Soviet Union

countries. Recently, the Russian

government announced plans to increase

the use of coal as one of its primary energy

sources from 25% in 2014 to 27% in 2020. In

contrast, very few new large-scale projects

in the US, Australia and Indonesia,

announced in the boom era, are likely to be

developed over the next five years.

By 2020, the global coal market will

likely have shifted from its reliance on

China, with export-based countries having

stagnating production and a shift away

from the seaborne market for many coal

consumers, such as China. The one

exception to this will be India, which will

continue to increase in coal consumption

driving both domestic production and

import demand growth.

Note

This article is based on the report ‘Global Coal

Mining to 2020’ (Timetric; August 2015).

About the author

Clifford Smee is Lead Analyst – Mining at

Timetric.

World Coal Online

The home for the

latest coal industry

news, analysis,

comment and events

Visit our website today:

www.worldcoal.com

®

Despite industry reform and growing output from

Coal India, the Indian coal sector is beset by persistent

problems that will hamper growth. Mitchell Hugers,

BMI Research, UK, reports.

GOOD

A

lthough India possesses one of the world’s

largest coal reserves and has significant

production growth potential, the country will

continue to suffer from a persistent coal deficit

over the coming years. The Indian government has made

great progress in improving coal mine production and coal

offtake in recent quarters. As a result, BMI has raised its

production forecast, with India’s coal output to grow from

753 million t in 2016 to 935 million t in 2019, posting average

annual growth of 7.4% during 2016 – 2019, a sizeable

acceleration from an average growth of 4.4% annually

during 2011 – 2015.

While impressive, these growth rates will fall short of the

government’s ambitious target. Despite passing the Coal

Mines (Special Provisions) Bill, two key challenges will limit

the sector’s growth. Firstly, attracting foreign players will be

hampered by coal unions. The strike in January 2015 by coal

14 | World Coal | January 2016

unions highlighted the need to address the union’s concerns

before making any changes to the current policies. Secondly,

low coal prices will limit investment from entering the

sector. BMI forecast thermal coal prices to average US$62.0/t

during 2016 – 2019, significantly lower than US$85/t during

2006 – 2015. Moreover, the lack of infrastructure

modernisation and the government’s inability to push

through the land acquisition bill will limit the development

of coal infrastructure, which will impede coal output growth

over the coming years.

Government reforms taking shape

In March 2015, the Indian government passed the Coal Mines

(Special Provisions) Bill. BMI believes that this bill will help

boost domestic production as it has removed the state

monopoly held by Coal India. Under the new law, private

mining companies are allowed to enter the domestic coal

High altitude pastures in Ladakh, India.

INTENTIONS

market – a previously state-monopolised sector – to sell and

produce coal. Although the removal of Coal India’s

monopoly has caused disruptions in its operations as union

members walked off the job in January 2015, the government

has managed to end these strikes in an expedient manner,

highlighting that reforms are indeed possible if the

government manages to address the concerns of the miners.

The ability to pass the special provisions bill has aided

India’s government’s efforts to auction off the 214 coal

blocks whose licences were cancelled by the Supreme Court

on 24 September 2014. As of mid-April 2015, it had

successfully auctioned off 66 coal blocks for more than

Indian Rupee 3.5 trillion.

Overly ambitious

Coal India’s target coal production of 925 million t of coal

output by 2019 – 2020 will not be achieved. For the company

to meet this production target, it would have to sustain an

average annual growth of 13.4% y/y from 2015 – 2020.

Under the direction of the current Minister of State for

Power, Coal and New & Renewable Energy, Piyush Goyal,

Coal India’s production increased 8.9% over

April – September 2015, compared to the same period the

previous year, signalling that some progress has been made

in improving productivity. Given that the institutional

portion of Coal India’s equity sale in January 2015 was 1.2

times oversubscribed, BMI believes that Coal India would

be able to attract capital from equity markets if it manages

to deal properly with its unions. This would allow it to

purchase foreign machinery to further sustain

improvements in productivity in order to meet its

production targets.

Coal India’s productivity is indeed starting from a low

base. In the 2013 – 2014 fiscal year, it produced 12.2 t and 0.8 t

January 2016 | World Coal | 15

of coal per man-shift in opencast and

underground mines, respectively,

which pales in comparison to Australia

where opencast coal and underground

mining production per man-shift

amounted to 74 t and 40 t, respectively.

Coal India’s machines also work

15 hr/day, compared with 22 hr/day in

Australia.

forecasts of annual average growth of

7.4% in 2016 – 2019.

Although it is possible for

Coal India to hit its production targets

by sustaining annual average

production growth of 13.4% during

2016 – 2020, four key obstacles remain,

besides improving productivity and

production:

Brakes on growth to

remain

nn The opening of new mines could

remain hampered if environmental

clearances are not made in

an expedient manner. As of

August 2014, Coal India had 48

mines awaiting environmental

Barring any announcements of capital

injections and major increases in

CAPEX, BMI is reluctant to further

upgrade its already optimistic

Prices to remain relatively low: Newcastle thermal coal (US$/t).

Source: BMI, Bloomberg.

clearances. It currently has close to

500 mines in operation.

nn Coal India might not be able

to construct sufficient railway

infrastructure by 2020 to

improve offtake, which would

limit efforts to open mines that

could add about 300 milion tpa

of coal production from the

states of Odisha, Jharkhand and

Chhattisgarh.

nn Given India’s insistence on not

exceeding its targeted budget

deficit, the government will need

to come up with an innovative

workaround to finance the

purchase of new freight trains

by India Railways in order to

transport the coal, other than

raising railway fares, as the cost

of railway travel is an extremely

sensitive issue to the public.

nn The threat of strikes by mining

unions could derail efforts to

improve productivity. Given that

Coal India produces approximately

80% of India’s coal, by going

on strike the coal unions could

plunge the entire country into

darkness. Given the opposition

faced by the government when it

wanted to privatise a small stake

of Coal India in the past year,

the threat of renewed strikes by

union workers poses downside

risks on Coal India’s ability to

raise further capital from equity

markets to fund major upgrades

in equipment. India’s efforts to

introduce competition to the

de facto monopoly by allowing

foreign private players might

result in long-lasting strikes, which

could significantly reduce the

company’s operating performance

and stymie its efforts to raise

productive capacity by acquiring

more modern equipment.

Imports to remain strong

– for now

Coal imports to remain elevated: India – thermal and metallurgical coal imports

(million t).

Source: BMI, Bloomberg.

16 | World Coal | January 2016

Coal imports will remain strong over

the coming quarters as India will

continue to be unable to meet domestic

coal consumption. Even though

domestic coal production is rising

faster than domestic consumption,

seaborne coal demand from power

Endorsed by

MINISTRY OF COAL

GOVERNMENT OF INDIA

15th

India

2 – 4 March, 2016 I Grand Hyatt Goa

India’s largest coal industry gathering

Register by 22 January for the early bird discount

Email enquiry@coaltrans.com for more details

coaltrans.com/india

@CoaltransEvents | #CoaltransIndia

plants along the coast will remain

strong due to a lack of transport

infrastructure and low coal prices. As a

result of new capacity additions, coal

consumption in the country remains

higher than production, with a

structural deficit of 129 million t in

2015. In the long term, as India

attempts to hit its ambitious plans of

doubling production by 2020 and

production from its auctioned coal

mines finally comes online, imports

are expected to fall. For instance,

during the first eight months of 2015

India’s thermal coal imports grew by

27.7% y/y. Meanwhile, Indian

metallurgical coal imports grew by

17.3% during the first eight months of

2015.

Growth to ramp up: India – coal mine production (million t) and growth y/y (%).

Source: EIA, BMI.

Port bottlenecks to cause

a problem

Indian steelmakers will struggle to

operate at full capacity due to coal

supply constraints. The rush to secure

more seaborne coal in India will

continue to cause heavy congestion at

one of the country’s busiest ports,

which now has twice the number of

vessels waiting than its available

berths. The Paradip port in Odisha is

buckling under the weight of heavy

traffic, with many ships reportedly

taking up to six days to offload their

goods once berthed. According to the

Indian Ports Association, Paradip port

shipments rose 20.2% y/y in 2014 –

with the port handling 16% more coal

during the same period.

Port throughput to grow: Port of Paradip throughput ('000 t) and growth y/y (%).

Source: IPA, BMI.

Coal to remain dominant

source for electricity

generation

BMI expects coal to retain its primacy

in India over the coming years as

energy poverty remains a key concern.

The fuel will remain the only realistic

option for providing cheap and

abundant energy for the local

population over the BMI forecast

period to 2024. The country’s heavy

reliance and strong appetite for

coal-fired power generation is in

contrast to the other major power

markets around the world. Coal has

been a diminishing fuel in the US and

EU power sectors over the last five

years, driven by a combination of

18 | World Coal | January 2016

Coal to dominate: India electricity generation by type (2015 – 2024).

Source: EIA, BMI.

policy implementation and changing

pricing dynamics – particularly in the

US where cheaper natural gas has

undermined coal’s competitiveness.1

Conversely, pricing and policy

dynamics often favour the use of coal

in Asian countries.

BMI forecast the share of coal in

India’s overall electricity mix to

remain steady over the coming years

as the majority of its natural gas

reserves are deemed uneconomical

given the current extraction costs.

Coal generation will account for

66.5% of total energy generation

during 2016 – 2024, slightly lower

than the average of 67.8% over

2006 – 2015. Coal consumption in

India will continue to grow in

absolute terms and the country will

see increased coal demand on the

seaborne market.

Power sector to face

challenges

Investment in India’s power grid

infrastructure will need to increase if

Prime Minister Modi’s ambitious

power plans are to be realised. Some

W E

progress has been made, but the

transmission and distribution network

remains highly inefficient, posing a

significant risk to the expansion of the

power and renewables sector in India.

BMI has long-highlighted the shortfalls

in India’s grid infrastructure, notably

the high transmission and distribution

losses, restricted network coverage

and the widespread lack of investment

into the sector. These factors have

meant that the grid infrastructure has

not kept pace with the growth in

electricity generation capacity.2

Miners to increasingly

look abroad

Despite reforms to domestic coal

production, projects in southern Africa

are expected to continue to receive

interest from Indian companies

seeking to plug its domestic shortfall

in coal production. The portfolio of

coal reserves in South Africa has

attracted an increasing number of

Indian companies, looking to establish

a foothold in the country’s mining

sector. South Africa has been cited by

Indian mining and industrial

C O N V E Y

companies as the obvious supplier,

since Indonesia’s coal is of poor

quality and extraction costs in

Australia are high. Jindal and

Atha Group have already invested in

South African coal, while companies,

including Dalmia Cement, are

considering entering the sector.

Besides South Africa, Mozambique is

gaining interest. For instance, in July

2014, Rio Tinto sold the firm’s coal

assets to Indian firm, International

Coal Ventures. International Coal

Ventures joins India’s state mining

company, Coal India, and Jindal,

another major Indian iron and steel

concern, in taking control of some of

Mozambique’s largest coal mines. The

Jindal mining concession covers an

area of 17 600 ha. and, by the time the

mine is in full production, the

company’s total investment will have

reached US$10 billion.

References

1.

2.

‘Coal Power: No Escape From

Irreversible Decline,’ 26 May 2015 (BMI

Research).

‘Modi's Power Plans One Year On,’

7 May 2015 (BMI Research).

Q U A L I T Y

Stockyard Equipment

SCHADE Lagertechnik GmbH • Bruchstraße 1 • 45883 Gelsenkirchen • Germany

sales@schade-lagertechnik.com • www.schade-lagertechnik.com

The Clean Power Plan hit a US coal industry already struggling with other regulatory

challenges and competition from natural gas. But despite the industry's current

woes, it's not going away anytime soon, as Andrew Moore, Platts, USA, reports.

THE EVOLVING

FACE OF

COAL

Aerial view of The White House, Wahington DC, USA.

20 | World Coal | January 2016

T

he US Environmental Protection Agencyʼs (EPA) Clean Power

Plan (CPP) could not have come at a worse time for a US coal

industry already looking vulnerable in the face of low natural

gas prices and other regulatory challenges. While it is too early

to say what the impact of the CPP will be – and whether it will

withstand legal challenges – the long-term outlook looks fairly bleak for

coal. Still, it looks set to remain a major energy source for the US and the

world for decades to come.

January 2016 | World Coal | 21

Last July, Minnesota Power said it

would idle and eventually close its

coal-fired Taconite Harbor power

plant on the shore of Lake Superior.

It followed up the announcement

in September with an integrated

resource plan filed with the state of

Minnesota, noting the closure

would be accompanied by plans to

increase natural gas generation and

add renewable power – all of

which would help the utility “to

position itself for compliance with”

the CPP.

At 150 MW, the relatively small

plant burned only 684 000 short t of

coal in 2014 – a drop in the ocean

compared with the

999.7 million short t of coal mined in

the US last year. But it was enough to

catch the attention of Peabody Energy,

the largest US coal producer, which

cited the closure in an August filing

with the US Court of Appeals for the

District of Columbia in support of an

emergency stay petition brought

against the EPA by 15 states opposing

the CPP.

“EPA tries to brush off the Taconite

shutdown as ‘likely part of the

general shift away from coal,’ but the

unrebutted evidence is that the [CPP]

was a precipitating factor,” said the

Peabody filing. “Indeed, a sector

already weakened by market forces

and pre-existing environmental

regulations is even more vulnerable to

draconian regulatory measures like

the [CPP].”

Vulnerable seems an apt

description for the US coal industry.

While it is too early to tell what

impact the CPP might have, it could

not have come at a worst time. Low

natural gas prices have made coal

uneconomical to burn in many parts

of the country. Meanwhile, in markets

where coal can compete, producers

are often pitted against each other.

The outlook could look even

gloomier if utilities begin to view

carbon dioxide as a risk regardless of

what happens with the CPP.

“Generally speaking, utilities are

obviously looking at the CPP, and you

know, there is some pretty clear

handwriting on the wall here, and

some are starting to take some

22 | World Coal | January 2016

action,” said one utility official who

did not want to be identified.

What seems clear is the US coal

industry faces an uncertain future,

though by no means is it going away.

US coal production

In 2008, US coal production peaked at

1172 million short t, with roughly 94%

consumed by industry and the electric

power sector, where coal‑fired

generation made up 48.2% of the US

power market.

That same year, prices reached an

all-time high for the physical coal

underlying the two Central Appalachia

futures contracts: the 12 500 Btu/lb

CAPP rail (CSX) contract, which hit

US$160.60/short t, and the

12 000 Btu/lb CAPP barge contract,

which hit US$143.25/short t.

Seven years later, it is a much

different picture. According to the US

Energy Information Administration

(EIA), US coal production is estimated

to total 914 million short t in 2015 – a

22% drop from the recent peak and

the lowest annual total since 1986.

Coal generation is expected to

make up 35% of the US power market

in 2015, with the most share lost to

natural gas, which made up 21.4% of

US generation in 2008 but is expected

to make up 31.6% in 2015.

And prices for the physical coal

underlying two of the three major coal

futures contracts are at multi‑year

lows: in early October, the CAPP rail

contract fell to US$35.40/short t, a

78% drop from its 2008 peak, while

the CAPP barge contract dropped to

US$40.75/short t, down 72% from its

2008 peak.

All this has happened before the

CPP has been made official and

despite it facing an uncertain future.

Already, 26 states and a number of

industry groups have filed legal

challenges to the plan, which would

take effect in 2022.

Clean Power Plan impact

But the EPA’s projections do not bode

well for the coal industry. According

to the agency’s regulatory impact

analysis for the plan, US thermal coal

production could drop to

729 million short t by 2025 in its base

case review. The figure could drop as

low as 606 million short t under a

more stringent scenario.

“The [CPP] turned out to be worse

than we thought it would be,” said

Paul Bailey, Senior Vice President for

policy and affairs at the American

Coalition for Clean Coal Electricity.

“Coal is down a lot, and the EPA likes

to claim that’s because of natural gas

prices, and some is due to that, but a

great deal of it from the analysis

we’ve done is due to EPA

regulations.”

In 2008, the net summer capacity of

US coal-fired generation totalled

roughly 313 GW, according to the

EIA. As of October, Platts-unit

Bentek Energy estimated net summer

capacity for US coal-fired generation

at roughly 300 GW, with another

24 GW of announced retirements by

2025.

Bailey and much of the industry

attribute the recent closures to the

EPA’s Mercury and Air Toxics

Standards Rule, which mandated

certain emissions controls be installed

by April 2015. Even though the

Supreme Court remanded the rule in

June, utilities had already made the

decision to close roughly 13 GW of

coal-fired generation that was not

economical to retrofit.

With the CPP, Bailey believes

utilities could possibly shutter

40 – 50 GW of coal-fired generation,

resulting in the closure of roughly a

quarter of the US coal fleet compared

with 2008.

“I think it’s a little premature to

say how it will really impact the

industry, and whether it will be

actually implemented,” said

Betsy Monseu, the CEO of the

American Coal Council. “We know

there is opposition to it far beyond

just coal; there are utilities

concerned states concerned […] and

there is going to be a great deal of

push back.”

Coal is not going away

Regardless of the outcome, Monseu

rightly points out that coal generation

is not going away. The surviving

plants will likely run at higher

capacity factors, “but I don’t believe

we’ll resign to a smaller market,” she

said.

“We’re existing in a smaller market

because of regulation in large part,

and changes in energy markets, and

we’re adapting to that,” Monseu said.

“You’re seeing lots of restructuring on

the coal side and with efforts to

improve balance sheets and

restructure as a leaner, more efficient,

segment for the future.”

Robert Moore, President and CEO

of Foresight Energy LP, a major

producer of Illinois Basin coal, wrote

in response to emailed questions from

Platts that he believes the US thermal

coal market might drop to

600 – 650 million short tpy if the CPP

is implemented.

“It is too early to tell what the

coming restructuring of the coal

industry will do to overall production

levels in each region, but it is evident

that the CPP encourages using higher

Btu thermal coal from the Illinois

Basin,” wrote Moore. “The

8400 Btu/lb and lower production in

the Powder River Basin will likely be

negatively impacted.”

In the base case review of the EPA’s

regulatory impact analysis for the

CPP, the agency projects coal

production from the US’s Interior

region, which includes the Illinois

Basin, would total 250 million short t

in 2025. In 2014, Interior production

totalled 188.7 million short t.

And in the Powder River Basin, the

nation’s largest coal-producing

region, the EPA forecasts 2025

production to total 379 million short t

– down from 430.4 million short t in

2014.

Without the CPP, Moore noted that

US coal production will likely remain

robust, referring to the EIA’s most

recent long-term projections.

In its 2015 Annual Energy Outlook

issued earlier this year, the EIA

forecast in its base case review that

US coal production would total

1105 million short t in 2025 and

1118 million short t by 2030, though it

did not include the CPP in its

modelling.

The EIA’s forecast points to the fact

that coal-fired generation historically

has been an inexpensive baseload

24 | World Coal | January 2016

power source and will likely remain

so in the future, especially as natural

gas prices are forecast to increase due

to greater industrial and power

demand as well as increasing LNG

exports.

In 2008, when coal production

peaked, the average price for

the NYMEX Henry Hub natural

gas futures contract was

US$8.891/million Btu. As of

15 October, the 2015 contract price

averaged US$2.744/million Btu, and

the average price for the 2020

contract was US$3.224/million Btu.

In the base case review in its annual

forecast, the EIA put spot natural gas

price at US$4.88/million Btu by 2020

and US$7.85/million Btu by 2040, in

2013 dollars.

Technology solutions

needed

Even if states and utilities work to

eliminate carbon emissions, coal

remains integral to the reliability of

the power grid.

Minnesota Power made headlines

with its plan to close Taconite Harbor,

but the utility will still have more

than 11 GW of net summer coal-fired

generation capacity in its fleet by

2020, according to its recent

integrated resource plan.

“Even though gas prices are still

low, coal is still very economical in

many places,” said Joe Nipper, Senior

Vice President of Regulatory Affairs

and Communications for the

American Public Power Association.

“It’s available to run. Some are not

running because of gas prices, but it is

available. So we have lots more

capacity to generate electricity from

coal-fired plants, but utilities are often

choosing to generate or dispatch from

other sources, but may be keeping

coal capacity maintained and up to

date, and running those units some of

the time.”

There is also the possibility that

commercial-scale carbon capture

could become economically viable,

enabling coal-fired power plants to

reduce their carbon emissions. At the

moment, however, carbon capture is

generally confined to areas of the

country that contain oil fields. The

captured CO2 is pumped into existing

oil wells to help increase production,

a process known as enhanced oil

recovery (EOR). But the costs of

capturing and transporting the CO2

are high.

Further down the road, the coal

industry faces a daunting reality. The

last US coal plant entered service in

2012 and, while there are several coal

plants in various stages of planning,

only one is under construction:

Southern Co.’s Kemper plant in

Mississippi, which gasifies

locally‑mined lignite to fire an

integrated gasification

combined‑cycle power plant.

Despite the addition of carbon

capture technology, the plant is likely

to serve more as a warning than a

sign of progress, as it is more than

US$4.7 billion over its initial

US$2.2 billion budget.

Furthermore, in 2014 the EPA

issued stringent carbon emissions

guidelines for new power plants that

essentially rule out the construction of

any new coal-fired plants, given that

coal would be physically unable to

come under the emissions limits.

That means that by 2040, most of

the plants in the existing US coal‑fired

fleet will have reached the end of their

useful lives of 70‑plus yr. While plants

can be maintained and their lives

extended, costs go up, while

efficiencies go down, making it a less

attractive option.

Exports also remain an option, but

not in the current environment. A

global oversupply of coal has pushed

down prices worldwide, and new

demand from Asia is not likely to

materialise for several years.

“Looking at this strategically, and

for the longer term, one thing that is

very important is technology and

continuing to advance [carbon

capture] and support for that at the

federal level,” said the American Coal

Council’s Monseu. “There is a

recognition that coal is going to be

a major fuel source for the US and the

world for decades and, if that’s the

case, then if there are goals for

emissions reductions, there needs to

be commitment to technological

solutions to making that happen.”

Naj Aziz, Jan Nemcik and Ali Mirzaghorbanali, University of Wollongong,

Australia, discuss shear strength properties of cable bolts.

C

able bolt usage in

Australian coal mines is

on the increase, because it

is mostly used as a

secondary support to supplement the

primary support system for strata

reinforcement. Several factors have

contributed to the increase in cable bolt

usage in mines. The most prominent of

these are a better understanding of the

principals of rock mechanics and strata

control, as well as better management of

difficult ground conditions. As a

consequence, the reliance on short

encapsulation pull testing (SEPT) of

cable bolts cannot be considered by

itself as an adequate means of providing

realistic answers to the credibility of

installation in given ground conditions.

The unwinding/unscrewing of the

cable bolts from their anchorage

medium, as well as shear behaviour

across the stratified formation, both

represent important challenges that

must be addressed. A number of papers

have been reported on studies

examining the load transfer and

unscrewing characteristics of cable bolts

and there have been significant

variations in the design to include both

plain and indented cable bolts of

different sizes and combinations.1,2,3

The increased variations in cable bolt

configurations and designs have also

generated deep interest in shear failure

of tendons. In-situ studies in cable bolt

shear are difficult to conduct, but can be

carried out in laboratory-simulated

conditions. Goris et al. carried out shear

testing of cable bolts using pairs of

0.025 m3 concrete blocks made from fine

sand-concrete mix, with an average

28 days compressive strength of

69 MPa.4 The concrete mixture was

poured into steel moulds that contained

January 2016 | World Coal | 25

Figure 1a. Hilti 19 wire HTT-UXG

indented strand cable bolt.

Figure 1b. Hilti 19 wire HTT-IXG plain

strand cable bolt.

aluminium‑cast joint surface prints. The

tested cable was installed across two

concrete blocks with the desired shear

surface roughness produced as off

prints of aluminium joint surface

moulds. The study reported that a cable

bolt placed across a joint more than

doubled shear resistance of shear blocks

with both smooth and rough joints.

Testing of the cable bolt in shear

using the double embedment assembly,

as recommended by the British

Standard (BS 7861-2:2009),5 is an

unrealistic approach. Guillotining of the

cable tendon, leading to true shearing

of the metal elements is not what occurs

when a cable bolt is sheared across a

rock joint. In reality, past laboratory

experiences have shown that the failure

of the cable bolt in rock or composite

material is a combination of both tensile

and shear failure, manifested with

crushing of the rock or concrete

surrounding the zone of the sheared

plains.6,7 These findings were also

demonstrated by numerical simulations

in both rock bolts.8 Accordingly, the

application of the double shear system