G021 Microeconomics

advertisement

G021 Microeconomics

Problem Set 1

1. You wish to model the demands of a consumer with total budget y facing

prices p ∈ Rn+ for goods q ∈ Rn+ . What restrictions are necessary on the

parameters of the following demand systems in order for them to satisfy

(i) adding up (ii) homogeneity?

(a) pi qi = αi + βi y + γi y 2

i = 1, . . . , n

Answer For adding up we need Σi pi qi = y (for any y) hence Σi αi =

0, Σi βi = 1, Σi γi = 0. For homogeneity, we need αi = γi = 0

i=

1, . . . , n.

(b) pi qi /y = αi + βi ln y + Σj γij ln pj

i = 1, . . . , n

Answer For adding up we need Σi pi qi /y = 1 and therefore Σi αi = 1,

Σi βi = 0, Σi Σj γij = 0. For homogeneity, we require βi + Σj γij =

0

i = 1, . . . , n.

2. A typical pensioner has an income of £50 of which £10 is spent on fuel.

The government decides to instigate a reform cutting the pension to £45

but subsidising fuel for pensioners to the extent that the price is halved.

Will pensioner fuel consumption rise or fall? Is the typical pensioner

better or worse off? Will the cost of the subsidy exceed or fall short of the

reduction in pension expenditure? Make as few assumptions as you need

to answer these questions.

Answer The pensioner can still afford the initial bundle so this is a Slutsky

compensated price change. The pensioner cannot therefore decrease fuel

consumption by WARP. Since the initial bundle remains affordable the

pensioner cannot be worse off. The cost of the subsidy exactly equals the

fall in pension if there is no change in fuel consumption and will only be

higher if fuel consumption is increased.

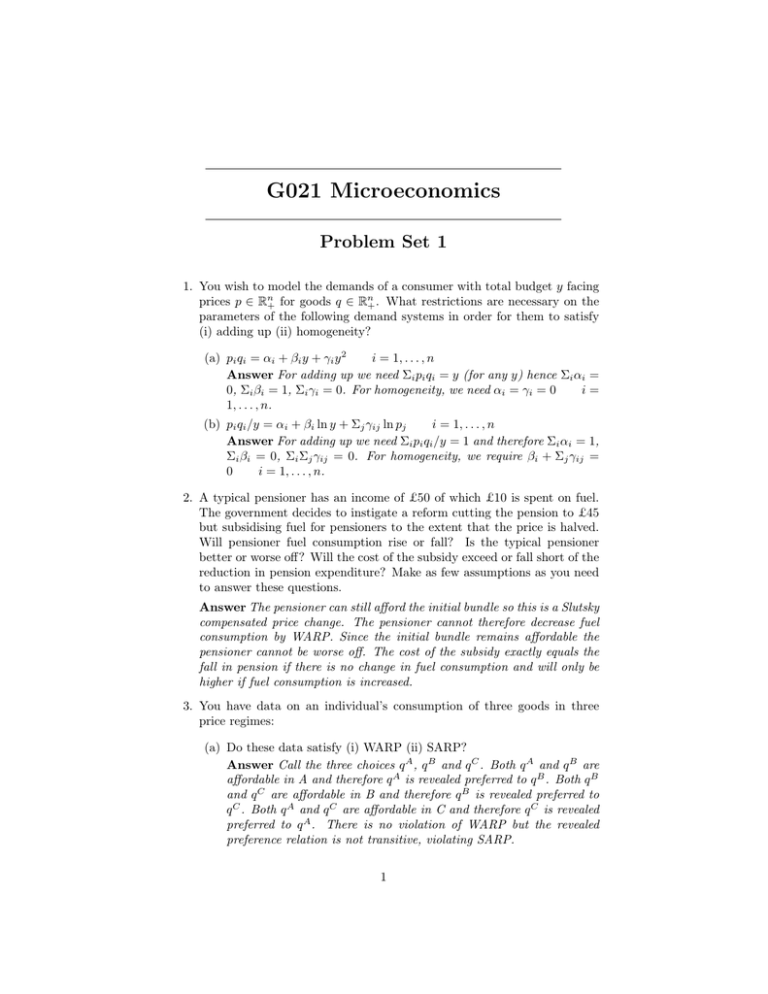

3. You have data on an individual’s consumption of three goods in three

price regimes:

(a) Do these data satisfy (i) WARP (ii) SARP?

Answer Call the three choices q A , q B and q C . Both q A and q B are

affordable in A and therefore q A is revealed preferred to q B . Both q B

and q C are affordable in B and therefore q B is revealed preferred to

q C . Both q A and q C are affordable in C and therefore q C is revealed

preferred to q A . There is no violation of WARP but the revealed

preference relation is not transitive, violating SARP.

1

Regime

p1

1

2

1

A

B

C

Price

p2

1

1

2

p3

2

1

1

Consumption

q1 q2

q3

1

0

0

0

1

0

0

0

1

(b) Should we expect to be able to fit a stable demand system consistent

with utility maximising behaviour to this data?

Answer No, since SARP is equivalent to compatibility with optimising behaviour

4. An individual has preferences over two goods, whisky w and gin g as

follows:

0

0

1

1

(w , g ) % (w , g )

w0 + g 0 > w1 + g 1

or

w0 + g 0 = w1 + g 1 and w0 ≥ w1

iff

Are these preferences (i) transitive (ii) monotonic (iii) continuous?

Answer They are certainly transitive and monotonic but not continuous.

Can you (i) draw an indifference map (ii) write down a utility function to

represent these preferences?

Answer You can draw an indifference map but indifference sets are all

single points. You could illustrate the weakly preferred set for some arbitrary bundle - it contains all bundles above a downward sloping 45o line

through the bundle and those bundles on that 45o line with more whisky.

You cannot write down a utility function because of the failure of continuity.

5. A family consumes three goods, q1 , q2 and q3 . The three family members

have preferences expressed in the following three utility functions:

A : uA

=

2q1 + q2

B : uB

=

2q2 + q3

C : uC

=

2q3 + q1

Say that the family prefers one consumption bundle to another iff a majority of family members prefer that consumption bundle to the other. Is

it possible to write down a family utility function to represent this family

preference relation? (Hint: Consider preferences over the bundles (1,0,0),

(0,1,0) and (0,0,1).)

Answer The preferences are not transitive. (1,0,0) is preferred by a majority to (0,1,0) which is preferred by a majority to (0,0,1) which is preferred by a majority to (1,0,0). The preference relation is therefore not

even a preference ordering and plainly no utility function can represent it.

2

Problem Set 2

1. John has a budget of £y which he spends on bread b and cheese c. The

current budget is just enough to buy one loaf of bread and one slab of

cheese. John is indifferent between this pattern of spending and any other

such that bc = 1. What is his MRS and what therefore must be the

relative price of bread and cheese for his choice to be optimal?

Answer The MRS is 1 which must also be the relative price.

Show that the information provided so far is compatible with any of the

following preferences:

u =

(u − b)(u − c)

=

ln b + ln c

1

u =

b − 1/c

u =

c − 1/b

Answer All have bc = 1 as an indifference curve for u = 0.

Which of these are (i) homothetic (ii) quasilinear? How would income

expansion paths and Engel curves differ depending upon which were the

case?

Answer The first utility function represents the unique set of homothetic

preferences with this as an indifference curve. Income expansion paths

would be rays through the origin and spending on either good proportional

to total budget. The last two utility functions represent the correspondingly

unique quasilinear preferences. Income expansion paths would be parallel

to axes and Engel curves would be flat for one good with all marginal

budget spent on the other good (except for extremely low budgets at which

all budget is spent on the first good). The second utility function is neither

homothetic nor quasilinear. Indifference curves are 45o translations of

each other and income expansion paths therefore all have a 45o slope.

Engel curves are upward sloping straight lines.

2. Suppose an individual’s utility function takes the form:

u (q1 , q2 ) = [q1ρ1 + q2ρ2 ]1/ρ1

where q1 , q2 ≥ 0 and ρ 6= 0. For what values of ρ1 , ρ2 are preferences

(a) (strongly) monotonic

Answer Marginal utility is

1

ρi

∂u

= qiρi −1 [q1ρ1 + q2ρ2 ] ρ1 −1

∂qi

ρ1

which is positive if ρi /ρ1 is. Hence the marginal utility of q1 is always

positive and that of q2 is positive if ρ2 has the same sign as ρ1 which

is therefore the required condition.

3

(b) homothetic

Answer The MRS is given by minus the ratio of the MUs and is

therefore

!

ρ1 q1ρ1 −1

.

M RS = −

ρ2 q2ρ2 −1

Preferences are homothetic if this depends only upon the ratio of q2

and q1 which is so iff ρ1 = ρ2 .

(c) quasilinear

Answer The MRS needs to be independent of q1 or q2 so either

ρ1 = 1 or ρ2 = 1.

(d) convex?

Answer This is the trickiest. We need to differentiate the MRS along

an indifference curve:

!

q

M

RS

ρ

−

1

ρ

−

1

1

2

.

. 2 M RS

=

−

q.1 q1

q2 q.1 u

u

ρ1 − 1 −ρ1 ρ2 − 1 −ρ2

=

q

+

q

ρ1 q1ρ1 −1 M RS

ρ1 1

ρ2 2

For this to be positive at all q1 , q2 requires ρ1 , ρ2 < 1.

Suppose ρ1 = ρ2 = ρ. Show that

(a) when ρ = 1 the goods are perfect substitutes

Answer If ρ1 = ρ2 = ρ then M RS = −(q1 /q2 )ρ−1 . Thus if ρ = 1

the MRS is constant (in fact equal to -1) which is the characteristic

property of perfect substitutes.

(b) as ρ → −∞ goods tend to perfect complements

Answer As ρ → −∞ the MRS goes either to −∞ or 0 depending

upon whether q2 > q1 or the reverse. Hence indifference curves are

L-shaped (with the angle on the 45o line) as characteristic of perfect

complements.

(c) as ρ → 0 preferences tend to Cobb-Douglas with equal budget shares.

Answer If ρ = 0 then M RS = −q2 /q1 which is the special case of

Cobb Douglas preferences stated.

Continuing to assume ρ1 = ρ2 = ρ, find the Marshallian demands and

hence the indirect utility function, expenditure function and Hicksian demands.

Answer These are CES preferences. Marshallian demands follow from

equating MRS to the price ratio: (q1 /q2 )ρ−1 = p1 /p2 . Hence p1 q1 =

h

i

ρ

−1

ρ

q2 p1ρ−1 p2ρ−1 and by substitution into the budget constraint y = p2 q2 (p1 /p2 ) ρ−1 + 1 .

4

h ρ

ρ i

1

Marshallian demands are fi (y, p) = ypiρ−1 / p1ρ−1 + p2ρ−1 . To find the

indirect utility function substitute these into the direct utility function

1−ρ

h ρ

ρ i

ρ

to get v(y, p) = y p1ρ−1 + p2ρ−1

. To get the expenditure function

ρ−1

h ρ

ρ i

ρ

invert in y to get e(u, p) = u p1ρ−1 + p2ρ−1

. Finally to get Hicksian demands replace y with e(u, p) in the Marshallian demands to get

h ρ

ρ i−1/ρ

1

gi (u, p) = upiρ−1 p1ρ−1 + p2ρ−1

.

3. Suppose preferences take the form:

u (q1 , q2 , q3 ) = min[q1 + q2 , q3 ].

Find the indirect utility function and expenditure function.

Answer At the optimum q1 + q2 = q3 and the consumer consumes only

the cheaper of q1 and q2 . Hence e(u, p) = y/ [min(p1 , p2 ) + p3 ] and by

inversion v(y, p) = u [min(p1 , p2 ) + p3 ]

4. You are studying demand for a low quality staple food in a low income

country. You find that consumers’ demand for the good is well captured

empirically by a double log equation

ln q = A + α ln y + β ln p

where q is quantity purchased, y is income, p is price and A, α and β are

constants. However your estimates suggest that α is negative and β is

positive. Use the Slutsky equation to show that this is compatible with

optimising behaviour by consumers only if the budget share of the good

is greater than −β/α. Explain.

Answer By the Slutsky equation the substitution effect is

∂q/∂p + q∂q/∂y = βq/p + q(αq/y) = (q/p)(β + αpq/y)

which is negative only if β + αpq/y < 0 and therefore pq/y > −β/α

(remembering α < 0). The good appears to be a Giffen good. It must be

inferior, which it is since β < 0, and it must have a large share of the

consumer’s budget to generate a strong enough income effect for this to

arise from optimising behaviour.

5

Problem Set 3

1. An individual living for T periods consumes goods qt = (q1t , q2t ) in period

t. The individual receives lifetime income Y , prices in period t are pt =

(p1t , p2t ) and the interest rate is constant at r. Lifetime utility

T

u=

1X

ρ t

1

1+δ

t h

iρ

α (1−α)

q1t

q2t

is therefore maximised subject to a lifetime budget constraint

t

T X

1

p0t qt = Y

1

+

r

t

Suppose the optimal choice involves spending yt = p0t qt in period t. Explain

(a) why knowledge of yt and of prices pt is sufficient information to infer

within period quantity choices qt

Answer Preferences are weakly separable (in fact, strongly separable).

(b) why the allocation of spending across periods involves solving

T

max u =

c

1X

ρ t

1

1+δ

t

cρt

s.t.

T

X

a(pt )ct

=Y

(1

+ r)t

t

for some a(pt ). Derive and interpret a(pt ).

Answer Within period preferences are homothetic so there exists a

within period price index a(pt ). In fact within period prefs are Cobb

Douglas so demands are q1t = αyt /p1t , q2t = (1 − α)yt /p2t and

(1−α)

α (1−α)

therefore q1t

q2t

is proportional to yt /pα

so we can choose

1t p2t

α (1−α)

a(pt ) = p1t p2t

. Homothetic separability means there is two stage

budgeting and the form of the top stage budgeting problem follows

from substituting the lower stage demands.

Show that

ct

=

cs

"

1+δ

1+r

t−s

a(pt )

a(ps )

1

# ρ−1

and use this to interpret ρ.

t

a(pt )

1

Answer First order conditions require 1+δ

cρ−1

= λ (1+r)

t for Lat

grange multiplier λ. The expression then follows by taking ratios. The

exponent 1/(ρ − 1) is the elasticity of intertemporal substitution ie the

elasticity of the quantity ratio to the price ratio and indicates responsiveness of intertemporal choice to intertemporal economic incentives.

6

2. A farmer with budget of Y invests an amount z in a new crop. IF weather

is good then he will get back (B + 1)z and if not then he loses the investment. Income in the case of good weather is therefore y0 = Y + Bz and

in the case of bad weather is y1 = Y − z.

(a) Write down the budget constraint and Slutsky equation for y1 and

explain why income and substitution effects of an increase in B on z

are opposed if income in each state is a normal good.

Answer Budget constraint is y0 + By1 = Y (1 + B). Marshallian

demand is therefore Y − z = y1 = f1 (Y (1 + B), B) and Hicksian

demand Y − z = y1 = g1 (u, B). Slutsky equation is

∂g1

∂B

∂z =⇒

∂B Y

∂f1

∂f1

+ f1

∂B

∂Y (1 + B)

∂f1

∂f1

= −

−Y

∂B

∂Y (1 + B)

∂g1

∂f1

= −

+ (f1 − Y )

∂B

∂Y (1 + B)

∂g1

∂f1

= −

−z

∂B

∂Y (1 + B)

=

The substitution effect −∂g1 /∂B is positive whereas the income effect

−z∂f1 /∂Y (1 + B) is negative. Viewed as a conventional demand

problem with endowments, the farmer has an endowment of Y in

each state and is a net seller of income in the bad state hence income

and substitution effects are opposed under normality.

(b) Suppose the farmer maximises expected utility

u = πv(y0 ) + (1 − π)v(y1 )

where π is probability of good weather and v(Y ) is a concave function.

What is the smallest value of B which will persuade the farmer to

invest a positive amount?

Answer The farmer is risk averse since v(Y ) is concave. He therefore invests only if the expected monetary return is positive which

requires B > (1 − π)/π

(c) Assuming this condition is satisfied use the first order condition for

optimum choice of z to show that z is increasing in B if and only

if wR/(1 + w) < 1 where w = Bz/Y and R = −(Y + Bz)v 00 (Y +

Bz)/v 0 (Y + Bz). How do you interpret the role of R?

Answer The first order condition is

πBv 0 (Y + Bz) − (1 − π)v 0 (Y − z) = 0.

Differentiating wrt B

[πv 0 (Y +Bz)+zBπv 00 (Y +Bz)]+[B 2 πv 00 (Y +Bz)+(1−π)v 00 (Y −z)]

7

∂z

=0

∂B

Since the farmer is risk averse [B 2 πv 00 (Y +Bz)+(1−π)v 00 (Y −z)] < 0

(which also ensures satisfaction of the second order condition) and

∂z

therefore ∂B

> 0 iff πv 0 (Y + Bz) + zBπv 00 (Y + Bz) > 0. Rearranging

gives 1 > −Bzv 00 (Y + Bz)/v 0 (Y + Bz) from which the condition

follows. R is of course the coefficient of relative risk aversion - the

higher it is the more risk averse the farmer is and the less willing to

gamble in response to good odds.

(d) Suppose v(Y ) = ln Y . Establish an expression for z and show that

z is increasing in B, assuming the farmer invests at all, but that the

share of Y invested never exceeds π. What is R in this case?

Answer The first order condition (assuming z ≥ 0) is πB/(Y +

Bz) = (1 − π)/(Y − z) from which z = max([π − (1 − π)/B]Y, 0).

The amount invested is unambiguously increasing in B for z ≥ 0

and approaches πY as B → ∞. For these preferences R = 1 so the

condition derived in the previous part is always satisfied.

8

Problem Set 4

1. Suppose a firm has technology represented by production set

Y = {q, z ∈ R+ | q ≤ max(ln z, 0)}

where q is output and z is input.

(a) Illustrate the production set.

Answer Quantity is zero for z < 1 and a concave function of z for

higher values.

(b) Find the values of q and z which maximise profit given output price

p and input price w.

Answer The producer problem is

max p max(ln z, 0) − wz.

z

First order condition for an interior solution is p/z = w so at an

interior solution z = p/w, q = ln(p/w). The interior solution holds

if the firm can make positive profits which requires ln(p/w) > 1,

otherwise z = q = 0.

(c) Derive the profit function and confirm Hotelling’s Lemma

Answer The profit function is found by substituting the supply functions in to the expression for profit: π(p, w) = p ln(p/w)−p. Hotelling’s

lemma tells us that the supply functions should follow by differentiation as they do: ∂π/∂p = ln(p/w) + p/p − 1 = p ln(p/w) = q and

∂π/∂w = −(p/w) = −z.

(d) Derive the supply substitution matrix and use it to show that the

profit function is convex

Answer The supply substitution matrix is

! ∂2π

∂2π

− ∂p∂w

1

1/p 1/w

1

∂p2

1 p/w

=

=

2

∂2π

∂2π

1/w p/w

p/w

p

− ∂p∂w

∂w2

which is clearly positive definite.

(e) Establish the form of the firm’s total cost, average cost and marginal

cost functions.

Answer The conditional factor demand is found by inverting the

production function: z = exp q. Hence total cost is C(q) = w exp q,

q

average cost is C(q)/q = w exp

and marginal cost is C 0 (q) = w exp q.

q

MC is increasing and AC is U-shaped.

(f) What is the firm’s minimum efficient scale?

Answer MES is where AC reaches a minimum which is where AC=MC.

q

Equating the expressions above: C(q)/q = C 0 (q) if exp

= exp q

q

which implies q = 1.

9

2. A firm produces two outputs, q1 and q2 , using two inputs, z1 and z2 .

Suppose its technology is represented by production set

Y = {q1 , q2 , z1 , z2 ∈ R+ | q1 + q2 ≤ (z1 z2 )α }

(a) Let Q denote total output Q = q1 + q2 . Find an expression for the

minimum cost of producing Q given input prices w1 and w2 .

Answer The cost minimisation problem is

min w1 z1 + w2 z2 s.t. z1 z2 = Q1/α .

Equating MRTS to the factor price ratio implies w1 z1 = w2 z2 and

substituting this into the production condition gives z12 (w1 /w2 ) =

Q1/α . Thus conditional factor demands are z1 = Q1/2α (w2 /w1 )1/2

and z2 = Q1/2α (w2 /w1 )−1/2 . Costing these gives cost function

√

c(Q, w1 , w2 ) = 2Q1/2α w1 w2

.

(b) How are returns to scale related to α? For what values of α will the

firm show decreasing returns to scale?

Answer Higher α corresponds to greater returns to scale. Specifically

there are decreasing returns to scale if α < 1/2, constant returns to

scale if α = 1/2 and increasing returns to scale if α > 1/2.

(c) Explain why at most one of the two outputs is supplied unless their

prices are equal.

Answer The two outputs are perfect substitutes in production with

MRT=1 so the firm will produce solely the one with higher price.

(d) Derive the profit function, assuming decreasing returns to scale.

Answer The firm’s profit maximisation problem is

max P Q − c(Q, w1 , w2 )

Q

where P = max(p1 , p2 ). First order condition is P − α1 Q

0 and therefore

2α

1−2α

αP

Q= √

.

w1 w2

1−2α

2α

√

w1 w2 =

Substituting back into the expression for profit gives

max(p1 , p2 )

π(p1 , p2 , w1 , w2 ) =

(w1 w2 )α

10

1

1−2α

2α

α 1−2α (1 − 2α) .

3. The Weak Axiom of Cost Minimisation says that the cost of a chosen input

combination should never exceed the cost of any other input combination

which can produce at least as much output. Use this axiom to prove that

conditional input demand functions slope down.

Answer The WACM says that if z0 is chosen to produce q at w0 and z1

0

0

0

0

is chosen to produce q at w0 then w0 z0 ≤ w0 z1 and w1 z0 ≥ w1 z1 .

0

Subtracting gives ∆w ∆z ≤ 0. If only the ith factor price changes then

∆wi ∆zi ≤ 0.

11

Problem Set 5

1. Alex and Bob each consume apples q1 and pears q2 . Alex has preferences

represented by utility function

uA = q1A + α ln q2A

and Bob has preferences represented by

uB = q1B + β ln q2B .

Initial endowments are (ω1A , ω2A ) and (ω1B , ω2B ). Assume that they trade

as perfect competitors and that p apples exchange for one pear.

(a) Find expressions for their demands for pears, assuming endowments

are such that both choose to consume positive quantities of apples.

Answer MRS is α/q2A for Alex and β/q2B for Bob. Equating to price

under the assumption of an interior solution gives demands f2A = α/p

and f2B = β/p.

(b) Hence find the price p that clears the pear market. Does this price

also clear the apple market?

Answer Aggregate demand for pears is (α + β)/p. the market clears

if these equals aggregate endowment ω2A + ω2B hence equilibrium price

is p = (α + β)/(ω2A + ω2B ). This price also clears the apples market

by Walras’ law.

(c) Explain why the equilibrium price depends only on aggregate endowment of pears. What does the contract curve look like?

Answer Quasilinear preferences ensure demands for pears are independent of the value of endowments (assuming interior solutions).

Alex’s equilibrium consumption of pears is α(ω2A + ω2B )/(α + β) and

Bob’s is β(ω2A + ω2B )/(α + β), both of which are independent of the

distribution of the endowment of pears. The contract curve is a horizontal line where it lies in the interior of the Edgeworth box (assuming

pears on the vertical axis).

(d) Show that the condition on endowments that ensures that neither

ceases to consume apples is

ω1A ≥

αω2B − βω2A

≥ ω1B .

ω2A + ω2B

What happens if this doesn’t hold?

Answer At interior solutions Alex spends α and Bob spends β on

pears. Alex ceases to consume apples if the value of his endowment

is insufficient to cover this amount α which is so if ω1A + pω2A ≤ α.

Substituting the expression for equilibrium price and rearranging gives

12

αω B −βω A

ω1A < ω2A +ωB2 . Similar reasoning for Bob gives the other inequality

2

2

condition.

It is sufficient to work through the case where Alex ceases to consume

apples. In this case all budget is spent on pears so f2A = ω2A + ω1A /p.

Bob’s demand is β/p as derived earlier so aggregate demand is ω2A +

(β + ω1A )/p. Equating to aggregate endowment ω2A + ω2B and solving

for p gives p = (β + ω1A )/ω2B . It is worth checking that the two

expressions for equilibrium price do indeed coincide if the condition

holds with equality.

2. Asif and Bilal farm neighbouring plots in a highly uncertain world. There

are two possible states of the world. In state 0, Asif’s plot yields z units

of wheat while Bilal’s yields none. In state 1 Asif’s plot yields none and

Bilal’s yields z units. Asif and Bilal agree that the probability of state 0

occurring is π.

Their only means of insurance is to agree in advance to share their yields.

Suppose they agree that for every unit given by Asif to Bilal in state 0

Bilal will give p units to Asif in state 1.

Both are expected utility maximisers and both have an expected utility

function

π ln c0 + (1 − π) ln c1

where c0 is consumption of wheat in state 0 and c1 is consumption of

wheat in state 1.

(a) Explain why Asif chooses consumption cA

0 = πz for state 0 and Bilal

chooses consumption cA

0 = πz/p for the same state.

Answer Solve maxx π ln(z − x) + (1 − π) ln(px) and maxx π ln(x) +

(1 − π) ln(z − px). Alternatively note that the problems are effectively

Cobb-Douglas and solutions have budget shares π for state 0.

(b) Show that the competitive equilibrium price is p = π/(1 − π).

Answer Competitive equilibrium price requires market clearing in

state 0: z − πz = πz/p.

(c) Do they insure fully? Explain why.

Answer Yes - the equilibrium price is actuarially fair. Asif consumes

πz in both states and Bilal consumes (1 − π)z in both states.

(d) Are they equally well off? If not, who is better off?

Answer They are not equally well off unless π = 1/2. The one whose

land is most likely to be productive is better off.

(e) Describe carefully in what sense, if any, the outcome is Pareto efficient.

13

Answer It is ex ante efficient by the First Fundamental Theorem of

Welfare Economics ie it is not possible to raise the expected utility of

both by any different contract available before the weather is known.

14