ASIO Building: The costs of poor contracting practices

advertisement

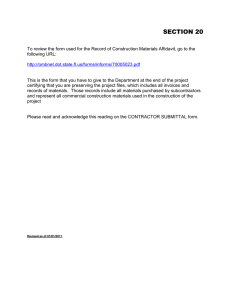

ASIO Building: The costs of poor contracting practices Report to the Minister for Small Business, the Hon Bruce Billson MP, on the small business concerns raised in the construction of the ASIO Building (Commonwealth New Building Project). ASBC Report │ January 2014 Contents Executive summary ................................................................................................................. 3 Role ............................................................................................................................................ 5 Background .............................................................................................................................. 5 The Ben Chifley Building........................................................................................................ 6 Purpose ..................................................................................................................................... 7 Issues ........................................................................................................................................ 8 Procurement/contracting process .......................................................................................... 8 Contracting and subcontracting practices ............................................................................. 9 Latent conditions in contracts ............................................................................................ 9 Imbalance of power .......................................................................................................... 11 Secondary subcontracting concerns................................................................................ 12 Security of payments............................................................................................................ 13 Misconceptions regarding government work ....................................................................... 13 Discretionary payment mechanisms .................................................................................... 14 Observations .......................................................................................................................... 15 External Administration of Urban Contractors ..................................................................... 16 Improving professional performance ................................................................................... 16 The Government’s role......................................................................................................... 17 Conclusions ............................................................................................................................ 19 Improved contract management by Commonwealth agencies ........................................... 19 Subcontracting documentation ........................................................................................ 19 Construction contracts ......................................................................................................... 20 Construction trust accounts ................................................................................................. 20 Review of regulatory approach ............................................................................................ 21 Scope for awarding contracts to companies in administrative actions in exceptional circumstances ...................................................................................................................... 21 Lessons for the future ........................................................................................................... 22 Recommendations ................................................................................................................. 23 Recommendation 1 – Improved Government contracting process and management ....... 23 Recommendation 2 – Better regulatory oversight ............................................................... 24 Recommendation 3 – Improving professional performance and standards ....................... 24 Recommendation 4 – Support the provision of information and education ........................ 24 Commonw ealth New Building Project 2 Executive summary In March 2013, the Australian Small Business Commissioner was contacted by a small business regarding underpayment and/or non-payment to small business contractors for external works carried out on the Commonwealth New Building Project (Ben Chifley Building) in Canberra. This is not an isolated incident. For various reasons, small businesses right across the country are continuing to be caught up in insolvencies and administrative actions on major building and construction projects. This is happening on projects commissioned by government agencies across all jurisdictions as well as private sector projects. There can be a perception within the business community that obtaining work on a large government project brings in more revenue, provides an opportunity to promote reputation and consequent profits. This can be very appealing to small business contractors, particularly those wanting to grow. However, while there can be benefits, a large project also brings with it a higher level of complexity and compliance issues, often resulting in more risk and higher levels of investment. The purpose of our enquiries leading to this report was to consider: 1. What led to the non-payment to the small business contractors on this particular project? 2. Whether there is any recourse available through the Government for the affected small businesses? 3. Can procurement and contracting practices on large Government projects such as this be improved to minimise the incidence rates of business failures in the future? On this project, the Australian taxpayers paid for a new building, which was built. The prime contractor and major subcontractors were paid to deliver the new building, which they delivered. However, a number of the small businesses that actually carried out the work did not get paid. While taxpayers should not have to effectively pay twice for this work, there is something fundamentally wrong with this scenario that leaves the smallest participants high and dry. The primary observation from our enquiries on this project is that a great deal of the issues can be attributed directly to poor contracting practices by subcontractors and secondary subcontractors, including the lack of appropriate professional advice. Commonw ealth New Building Project 3 What became apparent is that every player in the business community can get better at what they do. Government procurement practices and contract management can improve. Contract and management skills of business can get better and communication between all parties can also improve. In recent years there have been several inquiries and reports into insolvencies on building and construction projects. As a result, some state governments are heading down similar paths in regard to improving the operating environment for subcontractors. A number of measures to better protect subcontractors from the effects of insolvency have been or are in the process of being implemented. This presents the Government with an opportunity to monitor and review the impact of these measures with the possibility for wider implementation. Accordingly, the thrust of the recommendations of this report are directed to supporting the provision of information and education, improvements in Government practices and oversight, and improvements in contracting by all participants in the business community. If the Government is to consider any form of intervention on contracts for Government building and construction projects, we would encourage the Government to not unduly encroach on the freedom of contracting between businesses. Any form of intervention should be well thought through, succinct and have a clear purpose. It should strike the right balance between protections for small contractors from unlawful or unacceptable behaviour while not stifling innovation and competition, adding significant compliance costs for any party to the contract, or creating unintended ‘collateral damage’. The impact that this saga has had on families and the people behind the 180 small businesses involved is clearly unfortunate and highlights the need for small businesses to be hungry for information to improve their practices and for governments to work together to ensure that impacts of this kind are avoided in the future. Commonw ealth New Building Project 4 Role The role of the Australian Small Business Commissioner (ASBC) is to: provide information and assistance to small businesses, including referral to dispute resolution services; represent small business interests and concerns to the Australian Government; and work with industry and government to promote a consistent and coordinated approach to small business matters. At its core, our role is about improving the business environment by working with governments to ensure that small business needs are taken into account and helping small business (including navigating regulation and processes, assisting in the resolution of disputes and providing relevant information). Background In March 2013, the ASBC was contacted by the Director of Tread Lightly Earthmoving Pty Ltd regarding underpayment and/or non-payment to small business contractors for external works carried out on the Commonwealth New Building Project (Ben Chifley Building). Lend Lease Project Management & Construction (Australia) Pty Limited (Lend Lease) was engaged as Managing Contractor on the Project by the Department of Finance and Deregulation (Finance). Delivery of the Project has continued for approximately 5 years, and is nearing completion. Urban Contractors (UC) was engaged by Lend Lease in October 2011 under the terms of a duly executed Major Works Subcontract, following a competitive tender and evaluation process, to perform external civil and landscaping works on the Project. Due to the scale of the works, UC subsequently engaged the services of some 180 secondary subcontractors. During the Project, UC entered into voluntary administration, with BCR Advisory appointed as Administrators on 9 October 2012. This was a contributing factor in a number of secondary subcontractor insolvency issues, including the liquidation of Tread Lightly Earthmoving Pty Ltd. Commonw ealth New Building Project 5 The Ben Chifley Building ASIO’s new central office was officially opened on 23 July 2013. The building was named the ‘Ben Chifley Building’, after Australia’s sixteenth Prime Minister, Joseph Benedict ‘Ben’ Chifley. The Australian Cyber Security Centre (ACSC) will also be located in the new building. The Ben Chifley Building was constructed as a joint venture with Finance. This special purpose, high-security building has been designed with the capacity and flexibility to meet the long term national security needs now and in the future. The Ben Chifley Building is located at 70 Constitution Avenue, Parkes ACT, adjacent to the Department of Defence at Russell. It covers a 7 hectare site in Canberra’s Parliamentary Triangle and contains 40,000 square metres of office space. It has a life expectancy of 80 years and will accommodate up to 1800 staff. Lend Lease advise that more than 7000 workers were involved in its construction. Figure 1: The Ben Chifley Building during construction (source: www.asio.gov.au) Commonw ealth New Building Project 6 During construction, media reports suggested that the Project was plagued by delays, cost blowouts (reportedly in excess of $170M), insolvencies of subcontractors and an alleged cyber-attack by Chinese computer hackers resulting in the theft of blueprints of the building. However, nothing from our enquiries indicated that Lend Lease or other subcontractors were responsible for these reported issues. Purpose The purpose of our enquiries leading to this report was to consider: 1. What led to the non-payment of the small business contractors on this particular project? 2. Whether there is any recourse available through the Government for the affected small businesses? 3. Can procurement and contracting practices on large Government projects such as this be improved to minimise the incidence rates of business failures in the future? In considering the issues, the ASBC engaged with a number of interested stakeholders, including: Mr David Tune PSM, Secretary, Department of Finance and Deregulation; Mr Steve McCann, Group Chief Executive Officer and Managing Director, Lend Lease; Mr David Saxelby, Chief Executive Officer, Construction & Infrastructure, Lend Lease; Mr John Morgan, Director NSW, BCR Advisory (appointed administrator for UC); Mr David Cocker, Supervisor, BCR Advisory; Senator the Hon Peter Whish-Wilson; and a number of secondary subcontractors. We also spoke to several other interested parties, including some with an intricate knowledge of procurement processes and dealing with disputes on large building projects. Commonw ealth New Building Project 7 Issues This is not an isolated incident. It appears that for a number of reasons, small businesses right across the country are continuing to be caught up in insolvencies and administrative actions on major building and construction projects. This is happening on projects commissioned by government agencies across all jurisdictions as well as private sector projects and our enquiries provided further evidence of this. In March 2013 the Western Australian Small Business Commissioner, Mr David Eaton, released a report on his investigation into the non-payment of subcontractors on construction projects administered by Building Management and Works (WA SBC Report).1 While Mr Eaton’s investigation and report focused on prime contractor insolvencies, the key issues from our preliminary enquiries, namely the impact on smaller subcontractors, appear to be very similar. In August 2012, the NSW Government commissioned Mr Bruce Collins QC to chair an Independent Inquiry into Construction Industry Insolvency (the Collins Inquiry), to assess the cause and extent of insolvency in the building and construction industry, and recommend measures to better protect subcontractors from the effects of insolvency. The NSW government announced its response to the inquiry’s recommendations on 18 April 2013.2 It is not our intent to duplicate or simply rehash previous inquiries. However we have drawn on the evidence and findings where they align with the purpose of our enquiries on the issues associated with this project. Procurement/contracting process At the Commonwealth level, all departments and agencies subject to the Financial Management and Accountability Act 1997 and relevant Commonwealth Authorities and Companies Act 1997 bodies are required to comply with the Commonwealth Procurement Rules (CPRs). The CPRs represent the Government Policy Framework under which agencies govern and undertake their own procurement and combine both Australia's international obligations and good practice. Together, these are intended to enable agencies to design processes that are robust, transparent and instill confidence in the Australian Government's procurement. 1 2 http://www.smallbusiness.wa.gov.au/report-on-the-construction-subcontractor-investigation/ http://www.finance.nsw.gov.au/updates/independent-inquiry-construction-industry-insolvency-response Commonw ealth New Building Project 8 The primary rules for all procurements include: 1. Value for money 2. Encouraging competition 3. Efficient, effective and ethical procurement 4. Accountability and transparency in procurement 5. Managing procurement risk 6. Procurement methods For this project, Lend Lease was engaged by Finance as the Managing Contractor (or prime contractor). For projects of this size and complexity, it is common practice for the Managing Contractor to engage subcontractors to carry out specific aspects of the project, who in turn often engage secondary subcontractors. In this scenario, the contracting department (Finance) does not have any direct contractual relationship with any of Lend Lease’s subcontractors or secondary subcontractors. Contracting and subcontracting practices Poor contracting and subcontracting practices can have a major impact on business cashflow and result in protracted and costly disputes. In 2010, the Department of Innovation, Industry, Science and Research (as it then was) conducted a survey of small businesses to better understand the nature of small business (business to business) disputes. This survey found that of the small businesses who indicated that they had experienced a serious disagreement, 65% indicated that it had been a disagreement over payment for goods or services; and 30% indicated that the dispute was over other contractual obligations (excluding payment, retail tenancy and franchising issues). 3 Latent Conditions in contracts During our enquiries, the issue of how Latent Conditions were dealt with in the contracting process was raised. In general terms, a Latent Condition arises when the conditions of the site are substantially different to the conditions which could reasonably have been expected by the contractor or subcontractor when the contract was executed. Some common examples of what might constitute Latent Conditions on construction projects could include underground utilities and site conditions affected by contamination, water courses and rock (not only its existence, but also key features such as quantity and type). 4 3 4 http://www.innovation.gov.au/SmallBusiness/Support/Documents/DisputeResolutionSurveyReport.pdf http://www.earthmover.com.au/news/2010/december/latent-conditions-dealing-with-the-unexpected Commonw ealth New Building Project 9 The term “Latent Condition” normally has a very explicit contractual term and what constitutes a contractual Latent Condition would need to be assessed on a case-by-case basis. Each project’s contractual arrangements may define and establish a different process to deal with Latent Conditions. Finance has emphasised that what is a contractual Latent Condition between the client (in this case Finance) and its Managing or Prime Contractor, may not be continued as a contractual Latent Condition in sub-contracting arrangements. The financial risk associated with a Latent Condition will normally reside with the client. The client will also normally wear the program risk associated with that Latent Condition. The Managing or Prime Contractor is expected to factor into its tender and price site conditions which were known (or could reasonably have been expected) when the contract was executed based on the information made available to it and, where permissible, additional investigations. This is because they are assumed to be better informed concerning the known site conditions. The knowledge of the conditions of the site are provided to subcontractors so they can then be factored into the subcontractor’s tender and priced accordingly. If the conditions are unknown, then the possible risk of these unknown variables can be assessed and dealt with prior to executing the contract. Accordingly, parties to the contract should seek to limit any ambiguity regarding how Latent Conditions will be dealt with by clarifying the terms of the contract. Professional legal advice should be obtained to ensure the best outcomes. An observation from Finance is that the big issue, and the one which is normally the main point of contention, is for the parties (client and contractor) to agree upon what is a Latent Condition. To be a Latent Condition the contractor would need to clearly demonstrate that the contractor (being in a position of having, or having access to, certain experience and expertise) was not able to reasonably identify the Latent Condition (or the likelihood of such a Latent Condition) at the time of entering into the contract or establishing the project’s costs plan. If the issue is not clearly identified as a Latent Condition then the risk resides with the contractor. One such Latent Condition on this project was the discovery of asbestos contaminated material on the site. While variations to the contract were permissible for removal of the asbestos contaminated material (if considered outside the agreed Scope of Works), the costs associated with doing this work was disputed between the parties. This formed part of UC’s Security of Payment claim (discussed later). Commonw ealth New Building Project 10 Imbalance of power A recurring issue raised by stakeholders when discussing contracting and subcontracting practices (not specifically limited to this project) was that of prime contractors transferring the risk and responsibilities, particularly for contract variations 5, on to subcontractors. From a Commonwealth perspective, as a general principle, risks should be borne by the party best placed to manage them, that is, agencies should generally not accept risk which another party is better placed to manage. Where an agency is best placed to manage a particular risk, it should not seek to inappropriately transfer that risk to the supplier. 6 However, there is no directive within the Commonwealth Procurement Rules or policies for this principle to be adhered to by contractors or subcontractors. The primary concern raised by some stakeholders is that more sophisticated prime (or even subcontractors) can abuse the imbalance of power to transfer the responsibility, risk and cost for variations on to smaller subcontractors and secondary subcontractors that do not generally have access to the same level of professional skills to determine which party is obligated under the contract. An observation by Lend Lease is that risk transfer from a client to the Prime contractor, from the Prime contractor to subcontractors, and from subcontractors to secondary subcontractors is quite common and based on the principle that the contractor actually performing the work is best placed to manage the risk. Lend Lease suggests that subcontractors and secondary subcontractors usually run into difficulty because they don’t have the skills necessary to properly assess the risk, price tenders and/or administer their contracts during the delivery phase. The possession of market power of itself is not unlawful. In fact, it would be impossible to undertake projects of this size and complexity without the participation of significantly powerful players in the construction industry. During our enquiries we were not made aware of specific instances of misuse of power imbalance between Lend Lease and UC. BCR Advisory instructs that UC did not have the right people, skills or structures in place to adequately understand its contractual obligations or responsibilities or deal with these variations. We are of the view that this is not a misuse of power as it could be reasonably expected that for a contract of this size and complexity that UC should have the wherewithal to perform and manage any variations to the contract. 5 Building and construction contracts commonly contain a contract variation clause. In general terms, a variation in construction contracts means changes to the scope or character of the works. 6 http://www.finance.gov.au/procurement/procurement-policy-and-guidance/commonwealth-procurement-rules/cprsprocurement-risk.html Commonw ealth New Building Project 11 Secondary subcontracting concerns In addition to the contracting issues already discussed, there have been concerns raised in regard to the quality and adequacy of the contracts between UC and a number of the secondary subcontractors. UC had a strong track record in the Canberra region over a number of years on commercial projects. This is one of the significant aspects that led them to successfully tendering for this project. According to a number of the stakeholders we engaged with, the contracting practices primarily utilised on this project were “fairly informal”. A number of the parties had worked together previously on various projects and noted that “we had not had any problems before”. It was almost the case of a ‘hand-shake’ deal, with the spending of tens of thousands of dollars tooling up for the job prior to proper contracts being executed. One of the secondary subcontracts we reviewed consisted of a short letter that stated: “This letter, the back to back contract with our client, current drawings and other documents referred to, will constitute the contract document between us, for these works.” Lend Lease confirmed that it was usual practice for subcontracts to refer or mirror specific sections of the primary contract. This can occur by either providing a copy of the primary contract and referring to specific clauses that the subcontractor is obligated to abide by, or by replicating the applicable clauses in the subcontract. In this instance, a copy of the “back to back contract with our client (Lend Lease)” which constituted part of the subsequent contract was not provided by UC to the secondary subcontractor. Despite this, the secondary subcontractor signed the contract apparently without any legal advice and carried out the work. It could be speculated that circumstances requiring a small business operator to comply with the primary contract, without a full explanation of the specific clauses of the contract that are applicable to a subsequent subcontract could be unconscionable or constitute misleading or deceptive conduct. It would be unreasonable to assume that the small business operator would have the level of sophistication required to understand its contractual obligations of a ‘back to back’ contract in full. We are advised that this type of practice and use of ‘informal’ contracting practices is commonplace in the construction industry particularly among secondary subcontractors, often with a belief that a signed off quote is sufficient, even on larger projects. Commonw ealth New Building Project 12 Security of payments ‘Security of payment’ is a general term used to describe the entitlement of contractors, subcontractors, consultants or suppliers in the contractual chain, to receive payments due to them. Security of payment laws are in place for the building and construction industry in every state and territory and are administered by the state and territory governments. These laws are aimed at avoiding costly project delays and stopping some principals and contractors holding-up or reducing payments owed, in order to inflate their positive cash flow. 7 During the Project, disputes arose between the parties as to UC’s payment entitlements. Between October 2012 and January 2013, UC served two separate claims on Lend Lease under the Building & Construction Industry (Security of Payment) Act (ACT) totalling approximately $10m, and proceeded to adjudication under the Act in respect of both claims. Both adjudications (by separate adjudicators) were determined entirely in Lend Lease’s favour, with $Nil being determined payable by Lend Lease. The secondary subcontractors could have made a claim under the Security of Payment Act against UC. However given UC were placed into voluntary administration, the ability of the debtor to pay was effectively dealt with by the Administrator and it appears to have been considered unfruitful to pursue this avenue. While Security of Payments gives a claimant great leverage to recover money, it is reliant on there being funds available to pay a claim. Some stakeholders have also suggested that Security of Payments legislation would be more effective is it was uniform across the states and territories. Misconceptions regarding government work There can be a perception within the business community that obtaining work on a large government project brings in more revenue, provides an opportunity to promote reputation and consequent profits. This can be very appealing to small business contractors , particularly those wanting to grow. However, while there can be benefits, a large project also brings with it a higher level of complexity and red tape, often resulting in more risk and higher levels of investment. A greater level of project management, risk management and contract management is required. Financial management also becomes even more critical. Overdrafts or borrowings may need to be bigger to cover the increased investment or to manage cash flow as progress payments trickle down the supply chain. This increased complexity and broader skill set needs to be factored into the tender process. 7 http://www.fwbc.gov.au/security -payment Commonw ealth New Building Project 13 It was put to Lend Lease to comment on whether subcontracting on large government projects is more rigorous or has different levels of complexity and red tape compared to large private sector projects. In Lend Lease’s view, there is no difference. Another common view amongst smaller secondary subcontractors on large projects such as this is that “this is a government job, so I’m eventually going to get paid”. This seems to be the case on this project where some secondary subcontractors continued working and running up significant costs for several months without getting paid, believing that because it was a “government job” that they would eventually receive their payment. Whereas on a nongovernment project they may have stopped work until payment was received. There were also heavy penalties (as per the prime contract) to be passed on to the secondary subcontractors for delays affecting the completion dates. This had a domino effect resulting in some secondary subcontractors being owed hundreds of thousands for many months work. These consequences led to calls from a number of stakeholders and the media for the Government to step in and bail them out, even though there was no contractual relationship between the Government and the subcontractor (UC) or the secondary subcontractors. The capacity for the Government to do this is covered below. Discretionary payment mechanisms As advised by Finance, there are three discretionary payment mechanisms which are available to government: 1. waiver of debt, under s34(1)(a) the Financial Management and Accountability Act 1997 (FMA Act); 2. act of grace under s33 of the FMA Act; and 3. the Scheme for Compensation for Detriment Caused by Defective Administration (CDDA Scheme). We are advised by Finance that none of the three discretionary options available to the Commonwealth are applicable under the particular set of circumstances surrounding UC’s voluntary administration. The application and UC’s subcontractors’ eligibility for the three discretionary mechanisms available to the Commonwealth are discussed below: a) Waiver of Debt – as there are no amounts owing to the Commonwealth in this situation, s34(1)(a) of the FMA Act is not applicable. Commonw ealth New Building Project 14 b) Act of Grace – s33 of the FMA Act allows the Finance Minister (or delegate) to authorise payment if he or she considers it appropriate to do so “because of special circumstances”, and where there is no other viable avenue of redress. “Special circumstances” are not defined but are considered to include matters relating to agencies governed by the FMA Act, the application of Commonwealth legislation or policy and broader policy implications. There is no automatic entitlement to an act of grace payment, which is at the discretion of the decision maker, and the mechanism is generally one of last resort. The actions of and/or contractual arrangements between third parties, independent of the Australian Government, do not fall within the parameters of the act of grace mechanism. c) CDDA Scheme – This scheme, in effect, enables the payment of compensation for detriment caused by government administration. Based on the circumstances, there does not appear to be any causal link between the administration of the Australian Government and the non-payment under an independent contractual arrangement between parties independent to the Australian Government. Observations Tough economic environments create more competitive markets and tighter margins, sometimes tending to result in more businesses getting into financial stress, requiring tighter contracting processes. What has become apparent from our enquiries into this matter is that every player in the business community can get better at what they do. Government procurement practices and contract management can be improved. Contract and management skills of business can get better, and communication between all parties can also improve. On this project, the Australian taxpayers paid for a new building, which was built. Lend Lease was paid to deliver a new building, which it delivered. Urban Contractors was contracted to deliver external works for the new building and was paid as per the contract (prior to its termination with 85% complete). However, the small businesses that actually carried out the work did not get paid. While taxpayers should not have to effectively pay twice for this work, there is something fundamentally wrong with this scenario that leaves the smallest players to deliver and not get paid. Commonw ealth New Building Project 15 External Administration of Urban Contractors Based on its investigations, BCR Advisory has informed us that the key reason for UC’s failure (which lead to the numerous small business contractors not being paid or being under paid) was UC’s poor management and contracting practices. This primarily involved: Being under-prepared and not having the structures and management skills in place to deal with a contract of this size and complexity; Not receiving sufficient professional advice in relation to the contract with Lend Lease; and Deficient finance facilities and structures to cope with a contract of this size and complexity. There has been some suggestion that Lend Lease were in a position of power and should have taken more responsibility to ensure that contractual obligations were understood by the other parties down the supply chain. It is reasonable to assume that all contractors involved in the delivery of the Project entered into it with the intent of making a profit. Lend Lease, by anyone’s definition, is a big business that has excelled commercially. The contract between Lend Lease and UC is complex and would require a high level of professional advice and ongoing professional contract management. The contract between Lend Lease and UC was a multi-million dollar contract. In what is essentially a private commercial arrangement, it is beyond commercial expectation or practice to impose a responsibility on Lend Lease (or the Government for that matter) to confirm the validity or thoroughness of the professional advice obtained by UC or the secondary subcontractors. What is clear is that Lend Lease was well aware of the rights and obligations of each party to the prime contract and managed the Project accordingly. The outcome may have been significantly improved for the small business subcontractors if this was the case with UC. However, in the ordinary course it is reasonable for Lend Lease, having undertaken its due diligence, to assume UC had the requisite commercial wherewithal to perform the contract. Improving professional performance The primary observation from our enquiries on this project is that a great deal of the issues experienced can be attributed to poor contracting practices by subcontractors and secondary subcontractors, including the lack of appropriate professional advice. Commonw ealth New Building Project 16 Some sections of the building and construction industry have recognised the importance of professional performance of the individuals in the sector. The Professional Performance Innovation and Risk Protocol (PPIR Protocol), developed by the Warren Centre for Advanced Engineering, defines the standard of performance of an engineering task which can be expected by employers, clients and other stakeholders. 8 The PPIR Protocol is a holistic professional performance suite that informs and guides: the professional engineer acting individually or as a team member on the essentials of performance in undertaking an engineering task; and all parties to, and stakeholders in, an engineering task on the role and obligations of the professional engineer and the effective use of such services. The PPIR Protocol was developed partly in response to rising insurance costs on large projects. It was developed as an integrated risk management process that helped to contain costs and limit the impact of the more fragmented approach to risk assessment that was typical of Australian projects. To make the professional performance process robust, the PPIR Protocol ensures there is an appropriate trigger for dealing with supplier disputes at an early stage. If parties on the project follow the guidelines, this results in fewer protracted disputes and can help to ensure that small business suppliers on big projects don’t fall through the cracks. This process provides a win for large engineering and construction firms by improving their professional performance and cost profile, and benefits small suppliers by ensuring they are properly contracted, appropriate risk allocated and included in the professional performance process. This is all about transparency up front in the contracting relationship. Roll-out of the PPIR Protocol in Australian engineering offices is currently being undertaken with the support of a number of organisations in both public and private sectors, as well as industry associations. The Government’s role It is our view that no small business should fail through a lack of access to information. A core responsibility of government is to provide information to small businesses to educate them about government laws and help them to understand what it is they’ve got to do. It is a matter of their own personal responsibility how they use the information, but it should be available to them. 8 http://thewarrencentre.org.au/ppir/ Commonw ealth New Building Project 17 There is a view by government agencies that the most efficient use of taxpayer funds when it comes to large projects is to appoint a managing contractor, who is subsequently responsible for the tendering of all trade packages on the project. As there is not a contractual relationship with the subcontractors, the agency takes an "arm's length" approach in respect of the relationship with, and payment of, the subcontractors. Any disputes between the contractor and subcontractors then become a “commercial contractual matter” and not the responsibility of the agency. While on most accounts engaging a private sector contractor would be the most appropriate and efficient approach to manage large projects, we do not believe that this should completely absolve the agency of all responsibility for robust project management. When government agencies are behaving as a business, it is the view of this office that they have an obligation to act as a “model business” to influence industry behaviour positively, setting best practice standards, being a good corporate citizen and demanding similar behaviour from its suppliers, even when this may come at an additional cost. One simple practical example of best practice arises in the Statutory Declaration process. While Finance was able to confirm that invoices submitted by UC to Lend Lease were accompanied by a Statutory Declaration that all subcontractors had been paid for monies due, a further check, such as a mere phone call from a project manager within Finance to the secondary subcontractors to verify this would have alerted the parties that this was in fact not the case. Commonw ealth New Building Project 18 Conclusions If the Government is to consider any form of intervention on contracts for Government building and construction projects, we would encourage the Government to not unduly encroach on the freedom of contracting between businesses. Any form of intervention should be well thought through, succinct and have a clear purpose. It should strike the right balance between protections for small contractors from unlawful or unacceptable behaviour while not stifling innovation and competition, adding significant compliance costs for any party to the contract or creating unintended ‘collateral damage’. Improved contract management by Commonwealth agencies Based on our enquiries, it generally appears that the contracting process (carried out in accordance with the CPR’s) for the primary contract on large construction projects is quite robust—particularly by those agencies which are regular large procurers. However, procuring agencies can improve the contract management and project management throughout the supply chain on large projects. Taking a hands-on approach to checking the validity of Statutory Declarations as mentioned is one possible approach. Subcontracting documentation One of the key messages of our office when engaging with small business is to stress the importance of seeking professional advice from an accountant, business advisor or a lawyer, particularly in relation to contracts and leases, as these have obligations which need to be fully understood. For example, taking a lease or contract to a lawyer and asking them to explain it whilst highlighting in one colour all the business owners rights and obligations and in another colour all the rights and obligations of the other party will improve understanding and leave the business owner with an easy to reference resource. In our experience, this can significantly reduce contract related disputes and bring about improvements in the contracting practices of both parties. The Department of Finance has recently developed a new suite of standard procurement documents for low risk procurement under $200,000. As a result of discussions with our office, to clearly highlight the rights and responsibilities of each of the contracting parties, a colour-coded version of the contract has been included. It is expected that the small business sector will be a major beneficiary of this initiative. Commonw ealth New Building Project 19 If colour coding of contracts proves to be successful on contracts under $200,000, this could potentially be rolled out to all Commonwealth contracts and include all subcontracts within the supply chain on Commonwealth projects. Construction contracts While the Government currently has a Standard Contract Document Suite which provides standard templates, standard form contracts and related guidance to agencies and their suppliers, it could also consider a specific standard contract suite for general conditions for construction contracts. This approach is used for information and communications technology (ICT) procurement, recognising that a tailored approach is required to achieve the objectives of the Government’s ICT strategy. It was indicated as part of our enquiries that the NSW government’s GC21 construction contracts have proved to be effective in emphasising co-operative contracting and enhanced communication between the parties. Edition 2 of GC21 provides a short list of mandatory requirements to give the contractor and subcontractors flexibility in their commercial arrangements. One stakeholder interviewed suggested that the defects free completion approach in GC21, ensuring that all commercial arrangements are finalised before the practical completion of the project, helps to promote a consultative approach between the contractor and subcontractor. Construction trust accounts One of the potential remedies proposed to assist in reducing small business insolvencies on large construction projects such as this was the introduction of construction trusts or retention sums. This effectively retains the funds in a trust account to ensure that the money is only used for the intended purpose throughout the supply chain. Trusts of this type have been used, and are reported to be effective, for a number of years in Canada and the United States. One of the recommendations of the Collins Inquiry was to establish a statutory Construction Trust for the purposes of paying the subcontractors and suppliers on all building projects valued at $1,000,000 or more. In its response to the Inquiry, the NSW Government announced it will establish a Retention Trust Scheme for subcontractors to be administered by the NSW Small Business Commissioner. While there is some vocal opposition within the construction industry, believing that it will add additional layers of red tape and slow down the payment process, or that corralling the Commonw ealth New Building Project 20 money will not fix having poor systems and people in place, construction or retention trusts have support amongst other stakeholders. There appears to be sufficient evidence to suggest that the NSW scheme should be closely monitored with a view to a potential trial at the Commonwealth level. Review of regulatory approach The Collins Inquiry considered that much more could be done by the Australian Securities and Investment Commission (ASIC) to check the health of businesses in the construction industry. This appears to be worth exploring further and perhaps consideration could be given to re-establishing the National Insolvent Trading Program or similar. Our enquiries also revealed that while Statutory Declarations are required to prove that subcontractors have been paid, this process is not being taken seriously and treated as just part of the paperwork. This is reiterated in the WA SBC Report where Mr Eaton noted that the Statutory Declaration process is a poor tool that has failed to ensure security of payment. One of the reasons suggested for this was limited prosecutions relating to falsely signed Statutory Declarations. Scope for awarding contracts to companies in administrative actions in exceptional circumstances Prior to this project, UC were successful at completing medium sized projects, often for the ACT government. Prior to being placed into Voluntary Administration, UC met ACT Government Shared Services pre-qualification for contracts to the value of $10 million. Once entering into an External Administration, this removed UC’s pre-qualification. This affected the ability of UC to continue to trade, and appears to be inconsistent with the intent of the Voluntary Administration regime under the Corporations Act 2001. We raised this issue with the ACT Deputy Chief Minister, the Hon Andrew Barr MLA. Noting that while there could be risks with awarding contracts to a company in an External Administration, UC had a strong track record on ACT government projects and may have been in a better position to trade out of its situation if there were ongoing and future contract opportunities. We discussed with Minister Barr the potential scope for awarding contracts for exceptional circumstances where it was in the public interest. In this case, it could have led to better outcomes for UC’s 180 local small business contractors if UC had been permitted to retain its pre-qualification status under the ACT system. If a test of “exceptional circumstances” had been in place, it is strongly arguable that the circumstances UC found itself in were Commonw ealth New Building Project 21 exceptional, particularly if access to ACT Government work resulted in UC trading out of its difficulties and enabled it to meet its obligations to the 180 unpaid small business contractors. Lessons for the future The impact that this saga has had on families and the people behind the 180 small businesses that were either not paid or underpaid is clearly unfortunate. It is important that measures are put in place to avoid this situation occurring in the future. Educative opportunities should be explored and pursued so that the lessons learned from this matter benefit future projects and contractors. It highlights the need for small businesses to learn of the potential pitfalls of contracting on large building and construction projects and to ensure that impacts of this kind are avoided in the future. Commonw ealth New Building Project 22 Recommendations In light of the concerns raised on this project, and based on the observations and conclusions from our enquiries, we pose the following recommendations for the Government’s consideration to assist in improving the outcomes for small business subcontractors on large Government building and construction projects. Recommendation 1 – Improved Government contracting process and management 1.1. We recommend that options for improved contract and project management on large Commonwealth construction projects be considered by the Government’s Procurement Consultation Committee (or similar). 1.2. We recommend that the Government considers the introduction of specific construction contracts for Commonwealth projects. This would follow consultation with the NSW government and building and construction stakeholders in NSW on whether any aspects of GC21 could be adapted to suit the Commonwealth’s current standard contracting suite. 1.3. We recommend that the Government considers amending the Commonwealth Procurement Rules to ensure that the principle of risks being borne by the party best placed to manage them are applied to subcontracts and secondary subcontracts. The same standards should be applied throughout the supply chain, with terms no less favourable than the prime contract. 1.4. We recommend the wider use of colour-coded contracts to explain the rights and obligations of each party to the contract. This would follow feedback received on the trial of colour-coded documents for low risk procurements under $200,000. 1.5. We recommend that the Government should closely monitor the outcomes of the NSW Retention Trust Scheme with the view to a potential trial at the Commonwealth level. This could be in the form of a pilot on a specific project. 1.6. We recommend that governments across jurisdictions consider exceptional circumstances prior to removing businesses in external administration from procurement panels. Commonw ealth New Building Project 23 Recommendation 2 – Better regulatory oversight 2.1. We recommend that as part of the Financial System Inquiry announced by the Treasurer on 16 October 2013, that the Government considers a more proactive role for ASIC in regular and ongoing health checks of companies in the building and construction industry. 2.2. We also recommend that consideration be given to a review of the way Statutory Declarations are treated within the industry. We would be supportive of an educative approach where directors of companies found to be in breach are forced to undertake training on the proper use of Statutory Declarations. This approach has had a positive impact on changing behaviours in other areas of business regulation.9 Prosecutions would remain for serious and repeated breaches. It is the view of this office that, as a regulator, there is an opportunity for ASIC to have a more prominent role, through better education activities as well as clamping down on serial offenders, to ensure the Statutory Declaration process is more robust and taken seriously by the industry. Recommendation 3 – Improving professional performance and standards 3.1. We recommend that the Government considers working with the Warren Centre, the major building and construction companies, and industry associations (such as Consult Australia) on the suitability of expanding the take-up of the PPIR Protocol throughout the industry. Recommendation 4 – Support the provision of information and education 4.1. In addition to recommendation 2.2 to review the way Statutory Declarations are treated, we recommend that the Government support the provision of education and information on tools to assist small businesses avoid insolvencies. There are a number of potential avenues for the delivery of targeted education and information, such as the provision of specific funding through the Small Business Advisory Service (SBAS) program (for private sector initiatives), online mechanisms (such as www.business.gov.au) and through the Small Business Commissioners. 9 For example, the ACCC often uses enforceable undertakings with education as an alternative measure to prosecution. Another example is in the liquor industry in Victoria, where mandatory training on the responsibilities of company directors of licensed premises (whose establishments had liquor license breaches), improved compliance and standards of staff within these establishments. Commonw ealth New Building Project 24