Exposure Draft | 1

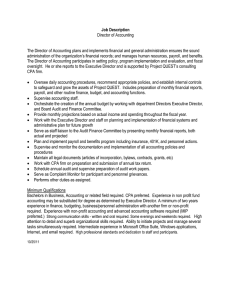

advertisement