Pages 41

advertisement

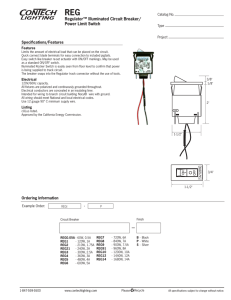

I n s u r a n c e L i t i g at i o n F o r u m 2 0 0 7 Demystifying fuses and circuit breakers By Richard van Leeuwen is an electrical fault in a device, the fuse or circuit breaker usually opens and removes the power from the circuit. It may protect the wiring to the device, but it’s too late to protect the device itself. If fuses and circuit breakers don’t protect electrical devices, why use them at all? I have answered this question for lawyers several times. The answer has three parts: to prevent human injury; to prevent further damage to the failed device and other equipment such as the wiring to the failed equipment; and to limit the extent of the service interruption, usually by isolating only one circuit of the system. If a device fails, and the fuse or circuit breaker opens, there is no injury or further damage. If any one of the three situations mentioned above has not occurred, the I t is a very common misconception that fuses and circuit breakers (and some variations of them) protect electrical devices. Fuses are electrical devices in which a filament of metal melts (fuses) when too much electrical current passes through it. The metal filament has a small amount of resistance which causes it to heat up with the current in accordance with Ohm’s law. Above a certain amount of electrical current or “overload,” the temperature of the filament will rise, then it will melt, open the circuit and stop the current. Time is required to melt the filament, Water gets into the area and starts forming an electrical path or arc across the insulation. but the greater the overload current, the faster it will open. In low temperature environments it will operate more slowly, or perhaps not at all. Once the fuse has opened or “blown,” it is usually replaced with another one to re-activate the circuit. Circuit breakers are similar to fuses in that they open (trip) the circuit when too much electrical current passes through it. But unlike fuses, they operate with a bimetal strip that heats with the current. When the bimetal strip bends with the heat, it opens a pair of contacts to interrupt the current. Often the opening of the contacts is assisted by a magnetic element which speeds the opening if there is a severe current overload. This type of operation means that the circuit breaker can be reset, saving money and the nuisance of replacement. So why do fuses and circuit breakers not protect electrical devices? It is because usually the device fails first and then causes the fuse or circuit breaker to open. If there www.insurancewest.ca November 2007 Insurancewest 41 I n s u r a n c e L i t i g at i o n F o r u m 2 0 0 7 fuse or circuit breaker has not done its intended job. There are many cases where the fuse or circuit breaker fails to operate as intended. An indication of this can be an injury, excessive electrical damage, damage to the wiring, or perhaps a fire. Occasionally the damage occurs at the fuse or circuit breaker itself. There are a variety of possible fuse or circuit breaker failures: water gets into the area and starts forming an electrical path or arc across the insulation; the fuse or circuit breaker has an ampere trip rating that is either too low or too high; the voltage rating of the fuse or circuit breaker has been exceeded; the interrupting rating of the fuse or circuit breaker has been exceeded; or something else that I haven’t thought of or experienced yet. Most of these situations are self-explanatory. But the interrupting rating is often overlooked, even by engineers who design electrical systems. If the electrical capacity of the supply exceeds the circuit breaker’s ability to open, an arc will form that does not extinguish. Within seconds or less, the arc does considerable damage and is usually more serious than the original fault. There are many cases where the fuse or circuit breaker fails to operate as intended. Now the protection is lost just when it was needed, and one is dependent on the next protective device upstream in the electrical system which, hopefully, does not have the same problem. The primary indicator of this type of problem is a fuse or circuit Harper Grey's litigation practice was founded upon our experience as insurance counsel. We know the twists and turns. breaker that exhibits massive damage. If this happens, cross your fingers – and hope the designer is well insured. IW F F F Richard van Leeuwen is an engineer and forensic investigator specializing in electrical failures. Today we serve clients in every insurance market and assist in managing all commonly-insured risks. We are the editor of the Quicklaw Insurance Netletter. We provide these summaries to our clients in our own free monthly email service. To sign up please contact the Chair of our Insurance Law Group, Peter Willcock, at pwillcock@harpergrey.com. www.harpergrey.com 42 Insurancewest November 2007 www.insurancewest.ca Electrical fire? Always ask how Don’t play the waiting game. By Sam Khashan E quipment failure is often cited as the reason for a fire, and certainly some TVs, toasters, baseboard heaters etc. can fail and can cause electrical fires. Get the right answers when you need them. But some don’t. 4RANSPORTATIONs)NJURYs0RODUCTs0ROPERTYAND0REMISESs!VIATION In most cases the equipment accused of instigating the fire is destroyed. And if the equipment is destroyed, the evidence proving its guilt is destroyed. British Columbia: 604.277.3040 800.565.3040 Without the alleged culprit, it is difOntario: 905.507.1844 866.507.1844 ficult, if not impossible, to determine for www.meaforensic.com Let the evidence speak® certain how the equipment caused the fire – the mechanism of the failure in the equipment. 10/19/07 6:23:33 AM Investigators often suspect electricalMEA Ad_1_3pg_BC_bw.indd 1 equipment caused a fire. But writing a report that says the electrical equipment probably caused the fire is merely a hypothesis. The cause should be scientifically determined. When a scene examination leads one to suspect that a particular piece of electrical equipment initiated a fire, and when that equipment has been damaged to an extent that investigators can’t determine the mechanism of the equipment failure, they should examine an exemplar – an identical, but undamaged piece of equipment. This exemplar can help investigators determine the probable mechanism failure and answer the question everyone wants answered: How did the fire start? Blaming a fire on a piece of equipment without scientifically identifying the probable mechanism failure can have serious consequences. Not only might the conclusion be inaccurate, it might also suggest that the problem has been solved. This can be a costly, even tragic mistake. IW F F F Syrian-born, Czechoslovakia-educated electrical engineer Sam Khashan has been a fire investigator for more than three decades. He has lectured extensively on the subject and testified on the cause of fires in B.C. courts. www.insurancewest.ca November 2007 Insurancewest 43 I n s u r a n c e L i t i g at i o n F o r u m 2 0 0 7 Rule changes create dilemma for insurance defence counsel By Neil MacLean and Kevin Gourlay C hanges to Rules 26 and 27 of the B.C. Rules of Court, effective July 1, 2007 and intended to promote earlier resolution of actions through disclosure of insurance information, create potential conflict problems for counsel retained by insurers to defend insureds against liability claims. Rule 26 now imposes a broad obligation on parties to disclose any insurance policy under which an insurer may be liable to satisfy the whole or any part of a judgment in the matter at hand. This includes disclosure 44 Insurancewest November 2007 of the declarations page, the policy wording and any endorsements, but does not include the insurance application. Rule 27 now requires a party being discovered to answer any question regarding the existence and contents of any relevant insurance policy, including the amount available under the policy and any communications from an insurer denying or limiting coverage under the policy. Although the change is silent on the discoverability of the factual basis for a denial or limitation on coverage, the potential for conflict arises even if the insured is only required to identify the basis for such a denial or limitation. In circumstances where there may ultimately be no indemnity or only partial indemnity under the policy, insurers may defend a claim but reserve rights to subsequently deny or limit coverage. There is also a duty imposed on insurers, where conflicts of interest arise, to instruct counsel to treat the interests of the insured equally with its own. The manner in which defence counsel defends a claim can affect whether indemnity is ultimately granted, so the conduct of the insurer and defence counsel can come under close scrutiny. Both insurers and defence counsel are at risk of liability for that conduct. To avoid bad-faith claims, insurers have generally developed a practice of not disclosing coverage issues to counsel. The changes to Rule 27 threaten the protection offered by this practice of non-disclosure: defence counsel will now be present when coverage limitations are disclosed by the insured during an examination for discovery. As a result, defence counsel may choose to withdraw while coverage questions are www.insurancewest.ca I n s u r a n c e L i t i g at i o n F o r u m 2 0 0 7 explored to avoid future accusations of s. 24(1) of the Insurance Act for unsatisbiased conduct in favour of the insurer. fied judgments because plaintiffs will Also, an insured may be entitled to object know policy details; • Rule 26 only concerns the disclosure of to defence counsel being present during the “coverage” portion of the discovery. In policy information and does not impose each instance the parties must answer this a duty to disclose any documents respectquestion: who will represent the insured? ing coverage; • at discovery the plaintiff ’s Regardless of the outcome, it will require an analysis of counsel may ask coverage the tripartite relationship questions first and tailor between insurer, insured subsequent questions to and defence counsel. It will avoid eliciting any further likely take a decision of the evidence that may void B.C. courts to answer that coverage, and; • when issuing non-waivers question. Here are some other com- The conduct of the insurer or reservation-of-rights and defence counsel can ments about the changes to letters it may be wise to come under close scrutiny. Rule 26 and Rule 27: avoid including unnec• there may be an increase essary and potentially damaging information in any commuin settlement demands for policy limits by plaintiffs using an awareness of limits nications with an insured. IW to impose pressure on insurers; F F F • lawsuits commenced under Rule 68 Neil MacLean practises general insurance (expedited litigation) are not necessarily defence litigation with a specialty in professional subject to the rule changes. Rule 68(15) liability defence, coverage analysis and contract states: “Rule 26 does not apply to an review for Guild, Yule and Company LLP. Kevin expedited action”; Gourlay, a recent graduate of the University of B.C. • there may be an increase in actions under law school, is an articled student with the firm. michael O’meara & company Barristers Experienced Counsel Serving the Insurance Industry – Specializing in the Vancouver Island Region – • Motor Vehicle Litigation • Personal Injury Claims • Product Liability • Property Damage Claims • Coverage Opinions • Occupiers’ Liability Claims • Subrogated Claims • Mediation and Arbitration 202 - 45 Bastion Square, Victoria, BC V8W 1J1 Telephone: 250-475-6529 • Facsimile: 250-475-6528 Toll Free: 1-877-246-6529 Email: michael@omearalaw.net www.insurancewest.ca November 2007 Insurancewest 45 PROFILE Alfie’s story 46 Insurancewest November 2007 Following Japan’s attack on Pearl Harbour in December 1941, 23,000 people of Japanese ancestry living on the West Coast, more than half of them born in Canada, were deemed enemy aliens, stripped of their possessions and interned in remote camps. Alfie Kamitakahara, founder of the Vancouver brokerage Kami Insurance, was one of them. By Don McLellan T he unremarkable street-level entrance to Vancouver’s Kami Insurance, bookended as it is between a vacant retail property and a Dollar Store, belies the remarkable individual who founded the business almost half a century ago, Alfie Kamitakahara. The commonplace entrance also says nothing of what awaits a visitor on the second floor: an open, high-ceilinged marriage of natural light, glass and exposed beam punctuated by – from the agency’s balcony – a commanding view of the North Shore mountains. Though the business has been run by his son John for the past decade, Kamitakahara, now 78, still visits the office daily. He assigns himself sundry tasks like stamping the mail and visiting the bank, a duty slowed of late by the need for a walking stick. “My biggest decision of the day,” he says, “is what to have for lunch.” At home, when he has the energy, Kamitakahara likes to sing karaoke – enka, or Japanese folk songs. He’s also a voracious reader, methodically working his way through four newspapers a day and five magazines a week. He was born in a small Japanese fishing community on Sea Island, the present site of the Vancouver International Airport, in 1929. He had four brothers and three sisters. His parents, originally from Kagoshima, the southernmost prefecture of Japan, had been early pioneers on Sea Island. The senior Kamitakahara was a community leader who worked as a fish buyer. Young Alfie often accompanied him on business trips around Vancouver. “Before he was married my father worked as a bellhop at the Hotel Macdonald in Edmonton. His English was good, so he acted as an interpreter in the Japanese community.” Despite employment and other restrictions for Japanese, it was, he says, a good life, although Kamitakahara acknowledges that not everyone in the Japanese community felt likewise. After Dec. 7, 1941, however, the day Japan attacked Pearl Harbour, conditions drastically changed for the 23,000 Japanese living in the province’s Lower Mainland and on Vancouver Island, more than 60 per cent of whom were born in Canada. Events unfolded rapidly. Canada declared war on Japan. All Japanese on the West Coast were declared “enemy aliens” and “security risks.” Japanese schools and newspapers were closed. As the Japanese were heavily involved in the fishing industry, boats were impounded. “We were taken to Hastings Park (in East Vancouver, the site of the Pacific National Exhibition, then primarily an annual agricultural fair), where we lived for about four months in buildings designed for animals.” That fall, Alfie just 13, the family was shipped east to Slocan in the B.C. Kootenays. Each person was permitted to keep one suitcase of possessions. Everything else was sold at auction. “Nobody resisted. People followed instructions; they were resigned to the fact.” They stayed four years. The first winter the Kamitakaharas lived in a tent, eating communally and out of tins, army-style. They later lived in a tarpaper shack. Residents planted vegetable gardens and cleared trees. “I remember ladies teaching others how to bake bread,” Kamitakahara said. “We entertained ourselves with stage shows and singalongs.” A full year after the war ended, the Japanese remained interned. They were given a choice: repatriate back to Japan, a country many had never seen, or move east of the Rockies. The Kamitakaharas relocated to a sugar beet farm outside Lethbridge, Alta. “That was a terrible part of my life. We were like sharecroppers. It was hell.” After four years the family moved into Lethbridge. Kamitakahara worked in a www.insurancewest.ca furniture store. Taking classes when he could fit them in, it took him three years to complete Grade 12. He next worked in the office of a Ford dealership. He also became president of the southern Alberta chapter of a human rights organization called the Japanese Canadian Citizenship Association (JCCA), formed in 1947. He led the Vancouver chapter after moving west in 1956 to work at a Ford dealership in Steveston, another former Japanese fishing settlement not far from his childhood home. In 1958 he married Rosie, “an absolutely fantastic cook. In a period of 60 days, we Nash never have the same dish twice.” A few years later their first of two children was born. Alisa is a clinic coordinator at the B.C. Cancer Research Centre, which is near the brokerage. When the Ford dealership in Steveston closed down, people he had met in the Junior Chamber of Commerce recommended Kamitakahara try his hand at insurance. Lack of experience did not dissuade him from hanging a shingle near the Vancouver traffic court at Pender and Main, in the heart of the city’s Chinatown and a few blocks south of what was widely referred to as Japantown. When Japanese were caught up in legal disputes, the police sometimes asked him to interpret. Insurers that have offered encouragement over the years, Kamitakahara says, include Axa Pacific, Aviva, CNS and Continental – or their earlier incarnations. “When I first started out my clientele was 100 per cent Oriental. The Japanese had begun to trickle back to the coast. In my 48 years in insurance, I’ve never once knocked on a door. I was afraid people would slam it in my face. The agency grew because of referrals.” A younger brother also went into insurance. When he retired, Nobbi Kamitakahara was president of the Western Union Insurance Company, now part of ING. “Alfie’s down to earth, yet very worldly at the same time,” noted Robert Adams, an investment advisor with Berkshire Securities and part-owner of Vancouver’s F. Adams & Associates Insurance Services. “He’s goodhumoured, social, polished – and very loyal to his family. He also appears to be a very good businessman.” Don Nash, a stockbroker with National Bank Financial Services, has known Kamitakahara for 35 years. He said he’s never known anyone with more concern for his clients. “Money doesn’t come into it. People will www.insurancewest.ca travel for miles to see Alfie. I don’t know if it’s charisma or what, but he’s just one of those people whom everybody likes.” In 1988 the National Association of Japanese Canadians, the heir organization of the JCCA, convinced Brian Mulroney’s Conservative government to apologize and offer redress to victims of the wartime discrimination. As a Canadian-born survivor of the injustice, Kamitakahara received $21,000. “Although I made a speech against redress, I decided I’d rather be a hypocrite than a fool for not accepting the money. I was also very proud of the young people who negotiated it. But I don’t think we should be a cry baby. Canada is a different place now; there are no restrictions. We Japanese have bounced back, we’ve done well. In some countries, we would be dead. I think we should appreciate what we have.” Indeed, life has since been good to the Kamitakaharas. The brokerage thrives; so, too, have Alfie’s siblings and their families. It’s a beautiful summer day on the West Coast and the North Shore mountains shimmer in the distance. Rosie and daughter Alisa are waiting for the interview to end. It’s time for lunch, you see. Alfie Kamitakahara has a big decision to make. IW r' s o t c a r Cont bilit y Lia Professional Liability/E&O • • • • • • • • • • • • Agricultural Risks - Greenhouses - Farm Packages & Participation Amusement Parks Arenas Association Business Aviation - Airport Premises Liability - Aviation Products Liability - Hull & Liability coverage for Private & Commercial Aircraft - Hangars Builders’ Risk - C.O.C. (Residential & Commercial) Boiler & Machinery Churches & Religious Institutions Cargo / Transportation Commercial & Mercantile Packages Contractors’ Equipment & Liability Contractors’ Equipment • • • • • • • • • • • • • • & Liability Convenience Store Packages Director’s & Officer’s Liability E&O - Including Manufacturers’ Design Entertainment - Pubs - Night Clubs - Hotels & Motels Environmental Liability - First & Third Party Film/Motion Picture Furs/Furrier Glass Contracts Hazardous Materials High Hazard Property / Crime Hole-In-One Homeowners, Tenants & Condo Packages Host Liquor Liability (incl. Forcible Ejection) Jewellers’ Block l Commerctiya Proper Call Special Risk for all your wholesale needs. Tel 604-541-9799 or 1-800-663-9066 Fax 604-541-9769 Visit our website at www.srib.ca Special Risk I N S U R A N C E B R O K E R S LT D 15573 Marine Drive, White Rock, B.C. V4B 1C9 E-mail: specialrisk@yahoo.com To receive a package containing applications & products available, please call! Lloyd’s, London, Correspondents “For Fast, Friendly Service” Yachts & Pleasurecraft T he next time you need a fresh quotation for your client’s sailboat or power yacht, give Pacific Marine a call. Or if it’s a dayboat, sportboat or runabout, trailerable or tied up, we’ll surprise you on these too. We’re independent, service-oriented and tuned in to broker needs because we are broker-owned — have been for more than 30 years. And with stable rates, great claims service and flexible underwriting rules, we could just become the marine market you might get used to! Pacific Marine writes other risks too: Marine liability • Cargo • Commercial marine Yacht clubs, Marinas • Boatbuilders • Repair yards For a fast quote please call underwriters Dan Kim in Vancouver, B.C., or Laura Beth Maracle in Midland, ON… or online quotes available at www.pacificmarine.ca Vancouver: 310 - 2800 E.1st Ave. V5M 4P3 Tel 604-251-7447 or toll-free 1-877-433-2628 Fax 604-251-7449 Email: dkim@pacificmarine.ca Midland: Unit 3 - 349 King St. L4R 3M7 Tel 416-607-7087 or toll-free 1-866-619-1605 Fax 705-528-1148 Email: lbmaracle@pacificmarine.ca Underwritten by Pacific Marine; secured by CNA, Canada’s largest marine insurer. November 2007 Insurancewest 47 yourstorefront Please e-mail Storefront suggestions to editor@insurancewest.ca in Vancouver or to our Prairies editor at rshorvoyce@insurancewest.ca The brokerage recently moved into this 4,000-squarefoot office on Grimshaw’s main drag. Last winter the snow was piled so high you couldn’t see across the street. D in the blood anielle McKenzie and her husband Ken are relatively new to the business of owning an insurance brokerage. They purchased Grimshaw Agencies only three years ago. But Danielle has been a broker for 12 years. The McKenzies’ agency is located in Grimshaw, Alta., about 510 kilometres northwest of Edmonton, in an area known as the Peace River region. It’s farm and cattle country, with forestry, oil and gas also contributing to the local economy. With a population of 2,600, the town is named after Dr. M.E. Grimshaw, a native of Kingston, Ont., who established a medical practice in the area in 1914. Grimshaw’s location was chosen by the Central Canada Railway in 1917. The hamlet became a village in 1930 and a town in 1953. “It’s a very friendly, close-knit community,” Danielle McKenzie says. “We have a very active chamber of commerce and a lot of recreational clubs. Hockey is big here: there’s minor hockey, old-timers hockey Danielle and women’s hockey.” McKenzie The area has always had a reputation for unpredictable weather, with early frosts, lots of snow and chilling temperatures in the winter. “Last year the snow was piled up so high you couldn’t see across the street,” says Danielle, who grew up in Grimshaw and graduated high school there. The McKenzies bought the brokerage from Danielle’s mother and father, Annette and Nels Nelson, in September 2004. The Nelsons had been running the agency, which will be celebrating its 50th anniversary Ken next spring, since 1989. McKenzie Last December the McKenzies moved the business out of a 900-square-foot facility into a 4,000-square-foot office on Grimshaw’s main street. Insurance was not Danielle’s first choice for a career. She wanted to become a teacher, and had been studying towards that goal when her father asked her to replace a departing employee in 1994. “It was supposed to be a temporary thing. I was supposed to take a year off. But that’s when I got sucked in and ended up 48 Insurancewest November 2007 staying. At first I wasn’t attracted to the business at all. But once I got into it, I started to enjoy it, and now it’s just part of me. It’s in your blood.” Before the couple bought the agency, Ken McKenzie was working at the local pulp mill and farming at nearby Brownvale, a village of 300, where he grew up and where he and Danielle have their home – a log house on a large lot. They have two boys – Joshua, 13, and Cory, 9. Ken worked part time for the agency for a couple of years before the McKenzies purchased the business, so he got to know a bit about insurance before becoming an owner. Grimshaw Agencies has a staff of five, including Ken and Danielle. Except for the receptionist, all are licensed. “We have a fabulous and loyal staff,” Danielle says. “We work well as a team.” The agency is a full-service brokerage with personal lines accounting for the majority of business. It offers farm, oil and gas, commercial, home and auto coverage. The McKenzies are pleased with their lifestyle and with everything that Grimshaw has to offer. But the town could be in for a big change if a Calgary-based company, Energy Alberta, has its way. It wants to build a nuclear power plant in the area and has filed an application for a site preparation licence with the Canadian Nuclear Safety Commission. Energy Alberta hopes to start building in 2017, at a cost of more than $6 billion. The company says it selected the Peace River region as its preferred site because of “demonstrated” community support as well as the existence of infrastructure, support services and technical feasibility. “Right now there’s a lot of hoopla over it,” says Ken. “The word is the company intends to use water for the plant from a nearby lake, eight miles from town. The power would be used for the oil sands at Fort McMurray.” The project still has to go through a lot of stages in the approval process and may never get off the ground. “I haven’t made up my mind on it,” Ken says. “I’m sitting right on the fence. There are lots of issues to sort out.” IW www.insurancewest.ca streetTalk Continued from page 9 auction bids, more than 460 were sold through the fundraiser this year. “The net proceeds of this event support projects here at our cancer clinics,” MacKenzie says. “That’s something that touched my heart because I was only 14 when my mom was diagnosed. She died when I was 16. I know how confusing and scary it is for kids.” Canadian Northern Shield Insurance stepped up with a $500 donation and a number of industry suppliers chipped in. “One of our local adjusters bought a table for the auction.” The Quilt auctions, which have been running for a decade, have allowed the group to donate over $890,000 to the Canadian Cancer Society. The art is sent on a travelling road show from Halifax to Vancouver and displayed in La-Z-Boy Furniture stores in advance of each auction. To participate with an online bid, visit www.thequilt.com. CRAWFORD CASH FOR WICC Crawford Cares, the community relations program of Crawford & Company Canada, raised $10,000 in September for the Women in Insurance Cancer Crusade (WICC) at the adjuster’s 13th annual charity golf tournament held at Toronto’s Royal Anderson Ontario Golf Club. “We’re very proud to be affiliated with an organization such as WICC,” said Stephen Anderson, Crawford’s senior VP, corporate markets and administration. “It’s a sad fact of life that cancer has affected nearly all of us. We all have co-workers, friends or family members who have battled this disease.” To date, Crawford Canada employees have raised more than $155,000 for WICC and have donated hundreds of volunteer hours on behalf of the charity. ICBC APPOINTMENTS The Insurance Corporation of B.C. recently appointed Paul Haggis and T. Michael Porter to its board of directors. Haggis, the former presiHaggis dent and CEO of Ontario’s Municipal Employees Retirement System, has 28 years’ experience in the financial, insurance and real estate industries. Porter Porter has 38 years’ experience in www.insurancewest.ca the insurance and credit union sectors. He was most recently president, CEO and a board member with The Cumis Group. Withenshaw From 1973 to 1985 Porter held several management positions at ICBC. Elsewhere at the corp, Mark Withenshaw Brown Carle has been appointed VP driver services, Sue Carle has been named VP claims servicing and Cindy Brown is ICBC’s new VP communications. RANGER ACQUIRES FLANDERS Ranger Insurance of Winnipeg has purchased the Prairie city’s century-old Flanders Insurance Services, making it one of the three or four leading independent brokerages in Manitoba. Nick Leitch, president and CEO of Flanders, which had considerable risk management expertise, has taken a shareholder position in Ranger and has been appointed first VP. “The insurance industry continues to evolve and Leitch change and we had to look at how we service our clients,”he said.“To service our clients better, it becomes obvious that you’ve got to get bigger.” With the acquisition, Ranger now has a staff of about 75. FRIENDS IN HIGH PLACES Canada’s new foreign affairs minister has an insurance background. Maxime Bernier is a former VP corporate affairs and communications exec for Standard Life of Canada. He assumed the prestigious government posting when Peter Bernier MacKay moved to defence. Named the Best Dressed MP this year by Ottawa’s The Hill Times, the 44-year-old Bernier represents the rural Quebec riding of Beauce, where he was born, a riding once held by his politician father, Gilles Bernier. THE PROFESSOR Highly regarded B.C. broker and educator David Gairns passed away recently from pancreatic cancer. “He was still looking after some major accounts for us,” said former employer Garry Gairns Robinson , himself semi- retired from Schill Robinson Insurance Brokers in Coquitlam, east of Vancouver. Gairns was known throughout the West Coast insurance industry as “the professor” because of his many lectures and seminars. “He was a fountain of knowledge, particularly in the field of liability law,” recalled Peter Wright of the Insurance Dispute Resolution Services of B.C. “I don’t think many people knew more about the subject. I had great admiration for him.” Gairns’ daughter Monique said, “He was a very caring parent and teacher, and I’m sure he will be missed by many of his former students. Being one of those students, as well as his daughter, I can attest to his belief in ‘know what you’re doing, or know who to ask.’ It was his way at home, too.” Besides daughter Monique and her spouse Brett, immediate survivors include wife Shirley, son Lloyd (Sue) and four grandchildren. Professor Gairns was 68. BACK TO WORK Brian Tascona has joined Horizon In- surance of Winnipeg, one of Manitoba’s largest brokerages, as managing director, commercial insurance operations. He has more than 30 years’ experience in insurance management and sales leadership. Commercial lines make up about a quarter of the Tascona agency’s business. “Of the 100 people who work for Horizon, about 20 are in the commercial area.” Prior to his appointment, Tascona, 54, worked with Aon for 30 years, in Ottawa and Winnipeg, before retiring recently from that company. “I had an opportunity for a second career and I’m absolutely delighted to be part of Horizon.” CHANGES AT AVIVA Change continues to be the theme at Aviva Canada following the spring announcement that Robin Spencer, formerly the insurer’s CFO and executive VP, would succeed president Igal Mayer, now the top executive at Aviva plc’s Norwich Union General Insurance in the U.K. More recent appointments include the naming of Jim Falle as Aviva Canada’s CFO and executive VP. Falle Formerly filling the same roles at Aegon Canada and Zurich Canada, Falle will oversee the finance, actuarial, November 2007 Insurancewest 49 50 Insurancewest November 2007 www.insurancewest.ca