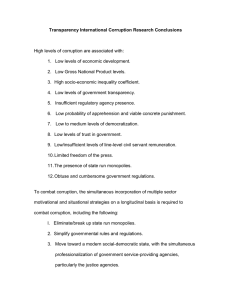

BUSINESS SOCIAL RESPONSIBILITY IN COMBATING CORRUPTION

advertisement