printmgr file - ArcelorMittal

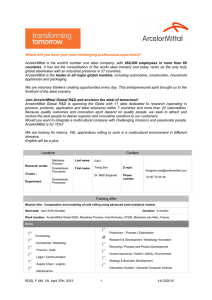

advertisement