The Hidden Daytime Price Of Electricity

advertisement

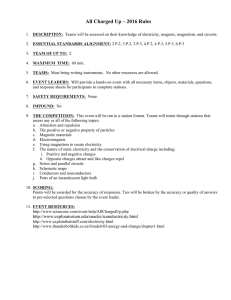

TECHNICAL FEATURE This article was published in ASHRAE Journal, April 2015. Copyright 2015 ASHRAE. Reprinted here by permission from ASHRAE at www.calmac.com. This article may not be copied nor distributed in either paper or digital form by other parties without ASHRAE’s permission. For more information about ASHRAE, visit www.ashrae.org. The Hidden Daytime Price Of Electricity BY EVAN BERGER Whether or not you know it, if you manage an office building, school, university, mall, or hospital and are in a region that has a demand charge over $10 per kilowatt each month, the price you pay for electricity is likely more than twice as much during the day than it is at night. Even customers who receive “flat rates” from their utility or third-party supplier pay a much higher rate during daytime hours, due to the effects of demand charges. In a sense, demand charges serve as a peak-time adder for a typical nonresidential customer with a bell-shaped load curve, making energy twice as expensive during the day – or, looking at it from another perspective, half-off at night. Yet despite the outsized effect that demand charges have on commercial, industrial, and institutional customers, these costs are poorly understood by the entities who pay them. This article provides an overview of various “demand” charges, such as utility demand, grid demand, and rate structure-related costs. Further, this article demonstrates how reducing peak demand and managing one’s load curve can provide customers with opportunities to cut costs dramatically, and also potentially benefit from revenue-generating programs such as demand response. Utility Demand Charges The utility is, broadly speaking, the company that delivers power to your home and business. It is the “poles and wires company” that provides the last-mile distribution to the end-user; in regulated states, it may also be the company that owns the generators who make your power as well. The most commonly understood demand charges are those levied by the utility. Many, but not all, utilities use demand charges to earn revenue; in deregulated regions, which include 16 states plus the District of Columbia in the United States, demand charges are a principal means by which investor-owned utilities profit from commercial and industrial customers. Utility demand charges are typically denoted in dollars per kilowatt ($/kW) monthly, and set through a ratemaking process between the utility and its public Evan Berger is director of energy solutions for CALMAC Manufacturing Corp., in Fair Lawn, N.J. 64 A S H R A E J O U R N A L ashrae.org APRI L 2015 TECHNICAL FEATURE utility commission. Typically, the amount of kW assessed on each monthly bill is based on the highest 15- or 30-minute kW interval within that billing period. Utility demand charges are the most widely understood among commercial customers because they are easiest to intellectually comprehend, and also very often the most transparent form of demand charge on a customer bill. There are several complexities to navigate when deciphering utility demand charges, however. The first is time-of-use or seasonal adders. Many summerpeaking utilities have summer adders: in New Jersey, the utility PSE&G levies an annual demand charge for commercial customers year-round; in the months June through September there is an adder that effectively triples the total utility demand charge. Another demand charge adder is based on time-of-use. For example, Southern California Edison (SCE) has one rate with a summertime on-peak demand charge adder during the weekday hours of 12 to 6 p.m. of $26.01/kW, as well as a mid-peak adder of $7.17/kW, for the site’s peak during weekday hours of 8 a.m. to 12 p.m. and 6 to 11 p.m. These two charges are in addition to SCE’s year-round off-peak demand charge of $14.32/ kW.1 All of the California investor-owned utilities have rates that model this format. Another source of complexity in utility demand charges is the use of ratchets. Many utilities use ratchets to assess a higher kW number to commercial customers. Oncor, one of Texas’s largest utilities, imposes an 80% ratchet for large users. In Oncor’s case, the ratchet works as follows: a customer’s assessed kW is the greater of a) its monthly peak kW draw, or b) 80% of the peak kW draw over the course of the previous 11 billing months.2 This penalizes customers who hit a particularly high kW peak in any given month, as that peak can affect their electricity expenditure for the next year. For example, if a customer has a typical monthly peak kW of 2,500 kW, but happens to hit a peak of 5,000 kW in the month of August, its energy costs will be affected for the following year: even if the customer never exceeds 2,500 kW in any 15-minute interval again, its assessed demand for the next 11 months will be a minimum of 80% of its August peak, or 4,000 kW. A final, and perhaps most confusing, source of complexity in utility demand charges is pricing based on load factor. Load factor is defined as the average kW draw divided by the peak interval. FIGURE 1 Nine ISO/RTOs in North America. Source: FERC. 138.8 kW Average 500 kW Maximum = 27.7 Load Factor Other utilities use a more tortuous method referred to as hours use of demand (HUD). A simple glance at an HUDbased bill might give most customers no idea that they are sensitive to peak demand fluctuations; but HUD actually serves as a very expensive form of demand charge. For its large C&I customers, Georgia Power’s PLL-9 rate has no $/kW demand charge, but rather has an hours use of demand structure that, if understood, functions as an incentive for buildings to shave their daytime peak.3 The best way to explain Georgia Power’s rate is by example. Suppose you had a very small building – perhaps a large doghouse or a toolshed – which has a steady 1 kW load all month. At the end a 30-day month you would have used 720 kWh. With Georgia Power’s PLL-9 rate and a 1 kW peak load, the first 200 “Hours Use of Demand” would charge you 12.7 cents for the first 200 kWh and the remaining 520 kWh would be at a little more than a penny per kWh.4 Using the same example – with the exception being that for 1 hour of the month the load went up to 2 kW and for one hour the load was zero – the total kWh would be the same 720, however now the first 400 kWh (2 kW x 200 HUD) would be at 12.7 cents, and the balance at 1.3 cents. Therefore, the one single hour of increased demand doubles the amount of electricity charged at the higher rate. After surcharges and taxes, Georgia Power’s effective demand charge for PLL-9 customers is in excess of $20/ kW monthly – and it is 95% ratcheted. Grid Demand Charges Independent System Operators (ISOs) and Regional Transmission Operators (RTOs) are both terms to APRI L 2015 ashrae.org A S H R A E J O U R N A L 65 $/kW 25 20 15 10 5 0 Jan FebMar Apr MayJun Jul AugSepOct Nov Dec 2014 PSE&G Annual Demand PJM Capacity Demand PSE&G Summer Demand PJM Network Transmission Demand FIGURE 2 Cost of cooling per kW in New Jersey’s PSE&G utility. Sources: PJM, PSE&G; General Power & Lighting Rate. Note: C&I customers continue to pay for cooling during winter due to PJM’s grid demand charges, which are 100% ratcheted. Advertisement formerly in this space. 66 describe the coordinators of the bulk grid, the non-profit entities that manage the dispatch of wholesale electricity in their respective footprints. ISO/RTOs’ role in demand charges are poorly understood, in large part because few consumers know of their existence, and because their demand charges are often collected indirectly, through a retail electricity provider, and thus often buried in C&I bills. There are nine ISO/RTOs across North America, including ISOs in the three largest U.S. states, California, Texas, and New York, and regional grid operators across the country as seen in Figure 2. The largest bulk grid in terms of MW managed is PJM Interconnection, which covers the mid-Atlantic, DC Metro area, Virginia, Ohio, and Chicago. One of the most important functions of the ISOs/RTOs is to ensure that its territory has adequate generation to meet its worst-case contingency – the grid’s equivalent to a design day. Each ISO or RTO meets this function differently, but many do so by procuring so-called “capacity” A S H R A E J O U R N A L ashrae.org APRI L 2015 through an auction process for generators. Once the generators’ proceeds are determined, the costs for capacity are levied on consumers. Most ISO/RTOs charge end-users for their share of capacity costs through a peak load contribution (PLC), also referred to as a customer’s ICAP, capacity tag, or “captag” for short. A customer’s PLC is not based on its own peak kW draw; rather, it is based on the customer’s kW consumption during the grid’s peak kW draw. In PJM, for example, each customer’s PLC is based on the average of the customer’s load during the grid operator’s five highest hours of grid demand during the year. These hours are known as the five coincident peaks (5CPs), and it should be noted that no more than one of the 5CPs can be assessed on any single day. In contrast, NYISO determines each customer’s captag based on the customer’s consumption during the New York State grid’s single highest hour of demand each year. In both PJM and NYISO, the peak hours of demand fall almost exclusively on the hottest weekday afternoons of the summer. Advertisement formerly in this space. TECHNICAL FEATURE 12 p.m. 11 p.m. 10 p.m. 9 p.m. 8 p.m. 7 p.m. 6 p.m. 5 p.m. 4 p.m. 3 p.m. 2 p.m. 1 p.m. 12 p.m. 11 a.m. 10 a.m. 9 a.m. 8 a.m. 7 a.m. 6 a.m. 5 a.m. 4 a.m. 3 a.m. 2 a.m. 1 a.m. $0.120 ISO/RTOs’ operation and maintenance $0.100 costs are determined through a regulatory procedure, not an auction, but they are typi$0.080 cally also charged to the customer through a $0.060 PLC-type process. This is the case in ERCOT, $0.040 which uses a “4CP” calculation to determine $0.020 its transmission cost recovery charges. In $0.000 ERCOT, the customer’s assessed kW is based on the average of its consumption during the highest demand hour in each of the four FIGURE 3 PEPCO Washington D.C. prices, average July Weekday. Source: PJM Interconnection. Average weekday Locational Marginal Price of electricity in PEPCO (Washington, D.C. area) in July 2013. Prices reached their summer months, from June to September. highest at 2 p.m., at 9.7 cents per kWh; the highest hour during the month was 2 p.m. on July 17th, when prices Two additional notes are warranted on grid reached 40.1 cents/kWh. Prices were at their lowest at 4 a.m., when they averaged 2.1 cents/kWh. demand charges. First, they are frequently ratcheted: the peak load contribution that a customer sets in the summer will affect its grid thermal storage is a cost-effective plan. As the graphic demand charges for a full year. Second, there is often a of summertime real-time locational marginal prices in lag between when a customer’s peak load contribution Washington, D.C.-area PEPCO shows, nighttime elecis assessed, and when it is levied. In PJM, NYISO, and tricity on the real-time market tends to be much less ERCOT, the grid demand charges that a customer must expensive and less volatile. pay are based on its PLC from the year before. Therefore, It is important to note that regardless of whether a in these regions, customers who set high PLCs in the customer is on real-time pricing or a fixed rate, it is still summer of 2014 will begin paying higher grid demand likely to pay demand charges. charges beginning in the summer of 2015. Special Rate Structures Since grid demand charges are frequently obscured in Some utilities offer special rate structures for customthe customer bill, it is typically a subject worth inquiring about with one’s utility or third-party provider, or with a bill- ers who have particularly high load factors. For example, ing expert. These charges can be substantial, and are very Potomac Edison in West Virginia offers a special High often blended into other charges within the electric bill. Load Factor schedule for large customers; these customCustomers that would like to identify their grid demand ers pay a slightly higher demand charge than normal charges and find solutions to reduce those costs can often ask users, but they are compensated with a lower cents per and receive for the ISO/RTO demand charges to be separated kWh usage charge.5 This benefits industrial customers with 24x7 operations and a flat load curve: the increase and listed on their bill in an itemized, line-by-line format. in demand charges is offset many times over by the Real-Time Pricing: Following the Market decrease in cents/kWh. Real-time pricing, also known as “indexed” or “floatOther special rate structures are given to customers ing” rates, allow end-users to buy energy at the prewith specific technologies, such as thermal energy storvailing market price, rather than at a fixed cents per age (TES). Austin Energy in Texas offers a special rate to kilowatt-hour price. Over the long run, this tends to be end-users with thermal storage onsite.6 In exchange for a slightly higher demand charge, customers in the speless expensive: fixed pricing is an insurance mechacial TES Rate pay lower cents/kWh for most of the year, nism, and insurance typically comes at a premium. However, employing real-time pricing leaves customers particularly during nighttime hours; in the summer months (June through September), TES rate customers more exposed to the vagaries of the open market: if the weather is unexpectedly hot or cold, or a large generator pay only 2.7 cents/kWh between 10 p.m. and 6 a.m., in contrast to the typical user’s 6.4 cents/kWh. Since TES fails, prices can spike dramatically. users consume a significant amount of electricity at For customers willing to manage the risk of cheaper night, when they are charging up their thermal storage but spikier real-time pricing, shifting load from day systems, the TES rate provides immense savings. to night with smart building technologies such as 68 A S H R A E J O U R N A L ashrae.org APRI L 2015 Advertisement formerly in this space. TECHNICAL FEATURE Demand Response: Turning the Paradigm Upside Down Most of this article focuses on how demand costs consumers money; with demand response, consumers can use their load flexibility to earn money from revenuegenerating programs run at the ISO/RTO or utility level. An example of this is PJM’s capacity market: users with flexible load can bid demand reduction (known as demand response) into the capacity market and receive the same value for their flexibility as a generator does. In return for the revenue they receive, demand response participants must respond to grid or utility “events” – calls to curtail – by reducing their electricity load, typically for a period lasting four or six hours. Such programs can be found throughout the country, and can be very lucrative: in New York City, combining ConEdison’s and NYISO’s Demand Response programs can earn a customer as much as $250,000 per curtailable megawatt, annually. There are other demand response-related programs available to end-users aside from the traditional curtailment programs. One such program garnering attention is behind-the-meter frequency regulation, whereby assets follow an ongoing grid signal to maintain the grid at its desired frequency of 60 Hertz. Traditionally, only natural gas and hydroelectric generators were dispatched to regulate grid frequency; but now, smaller customer-sided assets such as electrical and thermal storage as well as variable frequency drives (VFDs) are engaging in this lucrative program as well. Part of this change has been spurred by policy: FERC’s Order 755 in 2011 mandated that faster-acting devices, such as storage and VFDs, should be paid an additional “performance” payment for responding to grid signals more quickly than large generators can. Conclusion Whether their energy managers know it or not, most C&I buildings pay a large percentage of their electricity costs in the form of demand charges. Nonresidential customers with bell-shaped load curves, including office buildings, hospitals, schools, universities, and many industrial plants, pay substantially more during the daytime than they do at night, because of the effect of demand charges. Advertisement formerly in this space. 70 A S H R A E J O U R N A L ashrae.org APRI L 2015 Advertisement formerly in this space. TECHNICAL FEATURE If you could fill your car up with gasoline at noon for $2.50 per gallon, or at 9 p.m. for $1.25 per gallon, which would you choose? Many electricity customers face this same choice – and because of the complexities of the electricity bill, they have no idea they ever had a choice in the first place. Smart building technologies allow commercial, industrial, and institutional customers to buy electricity at night, when it is vastly cheaper. Thermal energy storage, such as ice storage and chilled water storage, allow endusers to build up cooling at night, when electricity is “on sale,” and dispatch that cooling during the daytime to displace the on-peak usage of their chillers and HVAC equipment. Other demand-limiting technology, such as battery storage or smart building controls, offer the same opportunity to shift loads from daytime to nighttime, when electricity can be procured at a discount. Because of the great but latent sensitivity of end-users to demand, such load-shifting can result in electricity savings of 10% to 20% off of the total bill. Advertisement formerly in this space. To save money, end-users and their energy advisors must be able to understand the effects of demand charges – and yet, many energy procurers do not understand that, unlike a residential bill, most C&I bills have demand charges of one form or another. While this knowledge gap cannot be bridged with a single article, perhaps a few final points will be useful to professionals looking to lower their demand charges or those of their customers. First, all else being equal, reducing daytime peaks lowers demand costs, and thus lowers electricity bills. Smart building technologies such as thermal energy storage help to reduce peaks and flatten the load curve; they should be considered in all new construction and retrofit designs. Second, it always helps to look closely at the electricity bill. Specifically, it is of great value to add up the demand charges (the per-kW line items) and compare them to the usage charges (the per-kWh line items). This gives one a sense of a site’s sensitivity to demand. When looking at electricity bills, be sure to review at least one bill from the summer (July or August) and one from the winter (December, January, or February). Comparing these two will determine whether there are seasonal adders, and those can be a very substantial portion of a user’s bill. However, make sure to be wary of thirdparty suppliers’ “flat rate” or “blended rate”: these terms can obscure the effect of demand, and give the wrong impression that electricity is equally expensive during day and night. Rarely is this true. Finally, when in doubt, ask for help. Non-residential customers have access to utility representatives who can guide them through the process of understanding their bills; additionally, third-party electricity suppliers can be a valuable resource as well. References and Notes 1. Southern California Edison. 2013. Schedule TOU-8, Time-OfUse – General Service – Large. 2.Oncor Electric Delivery Company. 2014. Tariff for Retail Delivery Service, Secondary Service Greater than 10 kW. 3.Georgia Power. 2014. Electric Service Tariff, Power and Light Large Schedule: “PLL-8.” 4.This does not include the Fuel Cost Recovery surcharge (FCR23), nor other Riders such as Environmental Compliance and Nuclear Construction Cost Recovery. Also note that PLL-9 covers loads 500 kW or greater; this highly simplified 1 kW site example is for expository purposes. 5.The Potomac Edison Company. 2014. Rates and Rules & Regulations for Electric Service in Certain Counties in West Virginia, Light and Power Service (High Load Factor) Schedule “PH.” 6.Austin Energy. 2014. City of Austin Electric Rate Schedules, Thermal Energy Storage. 72 A S H R A E J O U R N A L ashrae.org APRI L 2015