PORR AG

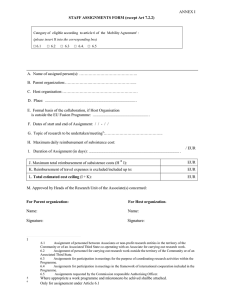

advertisement